Lepu Medical "Formation": What is the frequent financing of financing?

Author:Radar finance Time:2022.09.14

Radar finance produce | Li Yihui edited | Deep Sea

The subsidiaries of Lepu Medical spin -off are being listed on financing.

On September 9th, according to the Hong Kong Stock Exchange, Lephutai Medical Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Lepu Xintai") submitted a prospectus at the Hong Kong Stock Exchange and planned to be listed on the main board of Hong Kong. This is another hand delivery after it expires after June 25, 2021 and January 14, 2022.

Counting the Lepu creatures who were listed in Hong Kong in February this year and planned to have recently landed on the science and technology board, and Lepu diagnosis that was withdrawn from the science and technology board last year, and the issuing GDR was approved by the CSRC, the "Lepu Department" was approved by the CSRC. There are 4 companies that intend to list or make a secondary financing.

The Lephutai prospectus shows that the company's net profit in 2021 declined, and the net interest rate continued to decline. Lepu creatures focusing on the field of tumor therapy have multiple tumor product pipeline layouts, but they are still in a loss. In the first half of the year, the net loss of the parent company was 344 million yuan. Lepu Medical itself continued the decline in performance last year in the first half of the year, and the net profit of revenue increased.

Some investors in the pharmaceutical industry believe that under normalization, Lepu medical performance is under pressure, while innovative drugs and innovative equipment research and development funds have invested heavily. In order to obtain more funds, Lepu Medical adopted the development of its business listing financing methods to obtain development funds.

Lepu Xintai increasing income does not increase profit

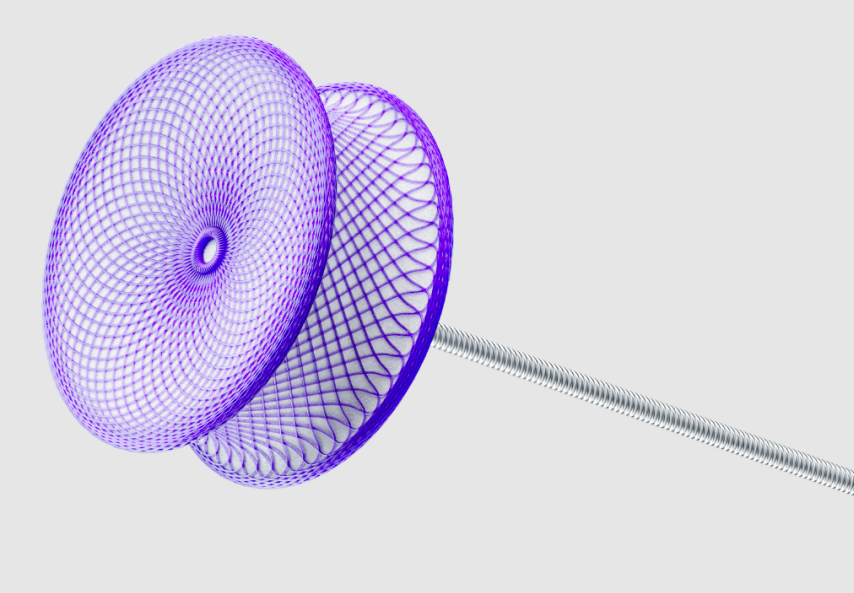

According to the prospectus, Lepu Xintai was established in 1994 and is committed to the research and development, production and commercialization of interventional medical devices dedicated to structural heart disease.

According to the Fifrrishalvan report, Lepu Xintai is China's largest congenital heart disease blocking product and related surgical supporting product manufacturers. Essence

At present, the company has 13 products in the domestic market to realize commercialization. Among them, the ovaries are not closed ("PFO") blocking device products and Zuoxin Er ("LAA") blocking device products Symptoms are one of the few commercial products.

However, at present, the company's commercialization is mainly concentrated in the blocking device products. As many as 21 cardiac valve products are under research, it mainly includes aortic valve and mitral valve research products.

In May 2021, Lepu Medical Board and the shareholders' meeting successively approved the issue of spinning Lepu Xintai to go public in Hong Kong. On June 25, 2021, and January 14, 2022, Lephutai submitted the prospectus to the Hong Kong Stock Exchange twice. At present, both of the prospectus have been invalidated.

Prior to this IPO, Lepu Medical and his wholly -owned subsidiary Tianyi and Herohevil held 86.34%of Lepu Xintai's equity, of which Lepu Medical and Heaven and Earth and Xiejie directly held 85.48%and 0.86%of the equity equity. In addition, Sequoia Capital holds 1.92%; Shanghai Biomedical holds 0.97%; Dinghui Capital holds 0.96%; Huaihua Haozhi holds 0.48%.

In terms of finance, in the past 2019 to 2021, Lepu Xintai's operating income was 116 million, 148 million, and 223 million, respectively, and the growth rates were 27.3%and 50.1%. 68.772 million and 58.97 million, the growth rates were 32.5%and -14.6%, respectively.

In the first half of 2022, the company's revenue was 125 million yuan, an increase of 12.5%compared to the 111 million yuan in the first half of last year; the company's net profit at the same time was 24.255 million yuan, which was 41.93 from 41.767 million yuan in the first half of last year, a year -on -year decrease of 41.93 %.

The prospectus explained that the growth rate of revenue growth in the first half of this year was mainly due to the impact of the epidemic, which limited the implantation and related sales of the left -hearted ear seal blocking device, which led to the failure of the ovaries and the left -hearted ear blocking device products. The income income decreased by 75.4%year -on -year.

As for the decline in net profit last year and the first half of this year, the company said that it was mainly due to the comprehensive impact of the decrease in gross profit margin and general administrative expenditure and the increase in total income, and the net foreign exchange loss in the first half of this year was 26.9 million yuan. (It is mainly related to re -converting the redemption liabilities caused by exchange rate fluctuations).

In terms of gross profit margin, from 2019 to 2021, Lepu Xintai's gross profit margin was 88.3%, 89.8%, and 88.8%, respectively, remained stable. As of June 30, 2022, the gross profit margin was 87.7%, a year -on -year decrease of 1.6 percentage points. This is mainly due to the increase in the cost of raw materials and consumables of the company's related products under the epidemic.

In contrast, the company's net interest rate fell all the way. According to the prospectus, the company's net interest rates from 2019 to 2021 are 44.6%, 46.4%, and 26.4%from 2019. As of the 30th of 2022, the net interest rate fell to 19.4%. The company's reduction of net profit attributes to the net foreign exchange loss generated by it.

It is worth noting that Lephutai's inventory amount increased by. As of December 31, 2019, 2020 and 2021, and June 30, 2022, the company's inventory was 11.1 million yuan, 23.3 million yuan, 33.4 million yuan and 40.3 million yuan. It is 277, 414, 413 and 435.

Regarding the significant increase in inventory in the first half of 2022, the company said that the company's production and sales activities in the Shanghai region in the first half of the year were temporarily interrupted, resulting in delayed raw material consumption; and the company's procurement of raw materials to support the recurring production after the epidemic was controlled. Activity. It is understood that the company's inventory mainly includes raw materials, products and finished products. Its inventory level usually maintains the product sales volume of 3 months and raw materials for 6 to 12 months. The shelf life of the product is usually 3 years.

Lepu Xintai said that the company had not encountered any major supply of supply or excess inventory during the past. However, the company also prompts that some raw materials may expire. At the same time, excessive inventory levels will increase the company's inventory cost, slow -selling risk or potential impairment loss.

Lepu Biological Detailing Board Listing

Tianyancha shows that Lep biology was established in 2018 and is a biopharmaceutical company focusing on the field of tumor therapy. It is also split from Lepu Medical.

On February 23, 2022, the Lepu creatures who were hindered by the market for the third time successfully launched the official listing on the Hong Kong Stock Exchange for the third time, issuing about 127 million shares, with a net fundraising of 804 million Hong Kong dollars.

However, according to media reports, the listing of Lep biology this time made round C investors "lose money". Specifically, the issuance price of Lepu Biology is HK $ 7.13 (RMB 5.78) is far lower than the 6.7 yuan/share cost in round C financing. Valentine's biopharmaceutical company.

Lepu biology said that the company is the number one ADC development company in the number of candidates in the clinical phase of ADC (antibody couplet drugs) in China.

Like many biomedical companies, Lepu Biological has not obtained the operating income from the product before listing, and it is in the stage of burning money. In the prospectus, Lep biological stated that according to its preset cash consumption rate, its existing funds can be maintained for 4.9 months, and if it can be listed in financing, it is expected to increase to 17.4 months.

The performance data of the company's before listing shows that in 2019, 2020 and 2021, Lepu Bio has obtained other income of 5.553 million yuan, 7.964 million yuan, and 4.601 million yuan, respectively. During the same period, Lep biological losses were 515 million yuan, 613 million yuan, and 668 million yuan, respectively, with a cumulative loss of more than 1.7 billion yuan in less than three years.

On July 22 this year, the Pitley monoclonal anti-anti-anti-anti-resistance of Lep biological was officially approved for high micro-satellite instability (MSI-H) or mismatch repair defect (DMMR) that previously received the failure of the first and above system treatment (MSI-H) Treatment of patients with advanced physical tumors. As a result, Pitley monoclonal resistance became the 8th PD-1 monoclonal anti-resistance.

As of now, Pitley Midopers are the only product in the commercialization stage of Lepu Bio. However, according to the Science and Technology Board Daily, the competition in the domestic PD-1 monoclonal anti-anti-anti-anti-anti-anti-anti-anti-anti-anti-anti-anti-anti-anti-resistance market has become fierce. PD-1 products of PD-1 products such as Baiji Shenzhou, Junshi Biological, Kangfang Pharmaceutical, Fuhong Hanlin and other companies have already been approved to be listed.

The industry expects that with more products to be listed in the future, if you want to enter medical insurance, domestic PD-1 may be caught in a price war. In terms of entering the overseas market, the PD-1 monoclonal anti-resistance of Baiji Shenzhou, Junshi and Cinda creatures is obstructive. In this case, whether the Lep biology can get a considerable return in the PD-1 market, it remains to be tested by time.

It is understood that, as a powerful anti-cancer drug, ADC drugs have become another popular research direction after PD-1. This is also a key lane for Lepu biological layout. The company's current product pipeline covers 7 clinical stage candidate drugs ( Five of them are ADC products).

According to the statistics of Medicine Rubik's Cube, as of June 2022, there were more than 400 ADCs worldwide researching drugs, of which more than 200 have entered the clinical stage. There are more than 170 ADCs in China who are studying drugs, of which nearly 60 have entered the clinical stage.

Whether Lepu creatures can be discouraged in this popular field are not easy to judge. Prior to this, the company needs more financial support.

Lepu Biological announced on September 1 that the company suggested applying for the distribution and issuance of not more than 415 million A shares to the relevant regulatory agencies in China, and the recommendation to the Shanghai Stock Exchange for approval of the A -share listing and buying and selling on the science and technology board. It is expected that the net fundraising will not exceed 2.5 billion yuan, which is mainly used for new drug research and development, production base construction, marketing network construction and operating funds.

According to the performance data announced earlier, in the first half of this year, Lepu Bio achieved revenue of 5.162 million yuan, an increase of 25.5%year -on -year; R & D expenditure was 231 million yuan, a year -on -year decrease of 44.09%; the net loss attributable to the parent company was 344 million yuan, a year -on -year decrease of 32.75 32.75 %.

At the end of the period, the company's cash and cash equivalents were about 814 million yuan. At the current speed of R & D expenditure, coupled with the company's plan to establish a commercial team of 50 to 100 people. Obviously, these funds are "stretched", which is not enough to support multiple approaches to approaching multiple approaches. The commercial ADC pipeline continues to advance.

Lepu medical revenue profit double drops

In addition to the two companies mentioned above, the "Lepu Department" also has more subsidiaries for listing, and its capital map is rapidly expanding.

Earlier, Lepu Medical also plans to split the holding subsidiary Lepu to the listing of the Science and Technology Board. In June 2021, in view of the possible competition between the same industry, Lepu Medical withdrawing the application for the launch of Lepu diagnosed to the science and technology board. In addition, Lephs was listed on the New Third Board in February 2016, and was terminated in January 2019.

It can be seen from public reports that Lepu Medical frequently spin -up and listing or the pressure of responding to national collection and decentralization.

The company has stated that since the first participation in the collection of drug collection on December 6, 2018, the management has realized that the collection policy will be normalized. Therefore, in early 2019, Lepu Medical proposed a long -term strategy to respond to collection, in which the tactical strategy was "integration, efficiency, and stable development."

According to the company's response to the Shenzhen Stock Exchange in February 2021, in the "integration" section, the company integrates all ECG artificial intelligence -related enterprises, involving the artificial intelligence ECG cloud cloud system and various equipment related to cloud systems related to the cloud system. The system, which is called the Ministry of Artificial Intelligence internally, is called Lepu Yunzhi.

Integrating the business used by surgery and operating room, including the matchmaker business, anesthesiomy business, and ultrasonic knife business. In the future, the Lepu Surgery Division is formed.

At that time, Le Pun Yunzhi was in the formulation of the joint -based. Therefore, the market estimates that maybe Lepu Yunzhi and Lepu Surgery will also embark on the road to listing.

And Lepu Medical itself, with the instrument business mainly based on coronary brackets in 2020, entered the collection of collection, and the company's performance began to undergo pressure.

The same flowers of the same flowers show that in 2020 Lepop Medical achieved revenue of 8.039 billion yuan, an increase of 3.12%year -on -year. This is the first time that the company has fallen into a single digit range since its listing; 4.44%.

In 2021, the company achieved revenue of 10.659 billion yuan, an increase of 32.61%year -on -year; net profit of returning shares was 1.719 billion yuan, a decrease of 4.58%year -on -year. This performance was still related to the country's volume procurement.

"2022 is a year after the company's three -year collection of dilemma, from scratch." Facing the pressure of collection, Lepu Medical will transfer the growth opportunities to innovative products such as degradable brackets, drug ball pockets and cutting ball pockets Essence

However, the short -term products of innovation products have not improved the company's performance. In the first half of 2022, the company's operating income was about 5.334 billion yuan, a year -on -year decrease of 18.2%; net profit attributable to shareholders of listed companies was about 1.268 billion yuan, a year -on -year decrease of 26.53%.

Lepu Medical said that in the first half of this year, the revenue of the new crown testing related business decreased by 80%year -on -year, and the gross profit margin decreased significantly, affecting the company's performance.

Faced with the uncertainty of the needs of Ji Cai and New Crown Products, in addition to the increase in innovation business of Lepu Medical, it also invested attention to the field of dental medicine. In August 2021, the company acquired for 255 million yuan and increased its capital. Rights and interests.

After multiple mergers and acquisitions, as of the end of June 2022, the company's goodwill has been shown to 3.327 billion yuan.

Right now, Lepin Medical has also embarked on the road to overseas equity financing. The company announced on September 2 that GDR was issued and was listed on the Swiss Stock Exchange.

An investment bank person in East China said that A -share listed companies go to Europe to issue GDRs, which will help them with the help of domestic and international market allocation resources, complete financing, and expand their brand influence. Lepu Medical believes that the issuance of GDR can meet the needs of the company's international business development and broaden international financing channels.

After the "creation" of Lepu Medical spin -up, can it usher in a leap -up development? Radar Finance will continue to pay attention.

- END -

Social finance data in July was lower than expected, and the five major central enterprises withdrew from US stocks ... Guoxin Securities: Secondary disturbance not to change the logic of the rebound of Hong Kong stocks

There are two major events on the weekend. One is that the social integration data...

Dang Xiaolong: Create the most attractive youth future community successful model

On the morning of August 29, Dang Xiaolong, Secretary of the Municipal Party Commi...