100, 4.4 billion yuan!Products of Star Fund Managers such as Fu Pengbo and Liu Gezhang are favored

Author:Dahe Cai Cube Time:2022.09.14

Statistics show that since this year, 100 fund companies have purchased their fund products for their own pockets, and the purchase amount has exceeded 4.4 billion yuan.

Funds that have been combed by the "own family" can be found that the products of star fund managers such as Fu Pengbo, Liu Gezheng, Qiu Dongrong and other star fund managers are very popular.

Self -purchase has exceeded 4.4 billion yuan during the year

This year's fund company's self -purchase rhythm is faster.

Choice data shows that as of the Mid -Autumn Festival, the number of fund companies that have initiated their own purchase has reached 100 this year, with a total purchase amount of 4.429 billion yuan, which is more than 600 million yuan more than the same period last year.

A total of 11 fund companies have a net purchase amount of more than 100 million yuan. Huatai Securities (Shanghai) Asset Management Co., Ltd. has the highest amount of net subscriptions, reaching 340 million yuan, and a total of 5 products have been purchased. The net purchase amount of Huitianfu Fund, Southern Fund, and Changjiang Securities (Shanghai) Asset Management Co., Ltd. also exceeded 200 million yuan.

From the perspective of product, this year, the fund company has purchased 307 funds, with 38 net purchases of more than 20 million yuan, and 7 products exceeding 100 million yuan. On the whole, half of the repurchase amount is invested to equity funds.

"This year's market fluctuates greatly. On the one hand, fund products are not easy to sell, some fund companies are supported by their own purchase, and on the other hand, self -purchase behavior may also have considerations of the current market investment value. Higher. "Some fund companies said.

"Family" heavy warehouse star fund

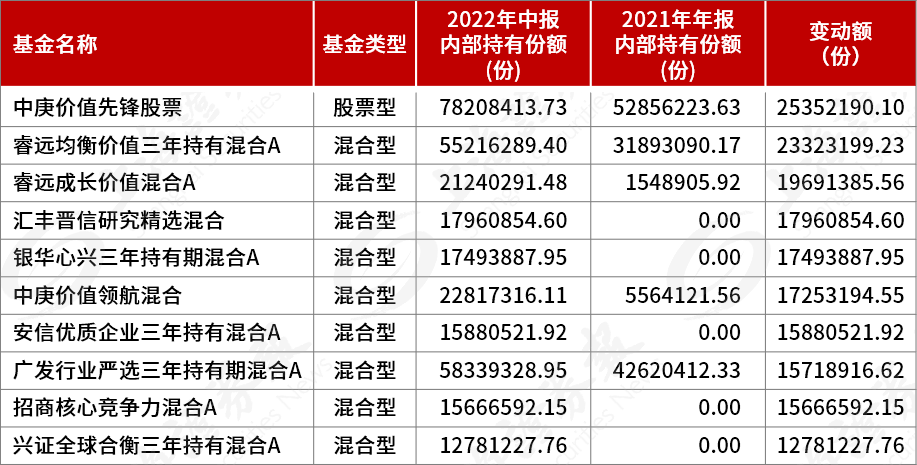

According to statistics from the Ji'an Jinxin Fund Evaluation Center, from the data from the Fund Half -annual Report, as of June 30, this year has been purchased by the fund company's "own family" net purchase share (mixed, ordinary stock type) Most of them are products managed by star fund managers.

Some of the equity funds with a lot of equity funds with a large share of the fund company this year

For example, Zhao Feng managed Ruiyuan's equilibrium value of three years holding a hybrid and a mixed growth value managed by Fu Pengbo. Calculation of shares); Liu Gehi's management of Guangfa industry was mixed for three years. In the first half of the year, 15.75 million copies were added by the company's employees.

Under the market fluctuations, many fund companies "their own people" have no confidence in the company's "old" fund manager and frequently increase. Products such as the new trend mixing of China and Europe and the management of Xie Zhiyu managed by Zhou Weiwen are favored by internal funds.

Some outstanding star funds have also been added by the "own family" in the first half of the year. For example, a mixed value of Zhong Geng managed by Qiu Dongrong, the "own family" increased more than 17.25 million copies in the first half of this year.

Follow -up fund self -purchased products need to be cautious

This year, many fund companies such as Huaxia Fund, CCB Fund, and Bodao Fund have initiated the self -purchased operation of the fund manager group of the fixed investment of the fund manager.

From the perspective of historical data, the fund manager's self -purchased product income is relatively good as the fund company "self -knowledge". According to the statistics of China Merchants Securities, from 2011 to 2021, in most years, the overall yield of active equity funds purchased by employees' own self -purchased was better than the active equity funds that were not purchased by employees, and the excess revenue was more obvious. At the same time, the fund's self -purchased proportion of the fund's first phase also has a positive impact on the product performance of the next issue.

"The self -purchased behavior itself conveys the information of interest sharing and risks, and it is easy to get closer to the distance from investors." Zhang Huairuo, the product manager of Ge Shangfu, said that investors should not invest in a single factor. "Net purchase may also be just a fund company's marketing strategy.

On the contrary, Zhang Huairu reminded that if the fund's internal funds are reduced, you need to observe whether the fund is at a high net worth, whether the fund manager has replaced, and whether the fund investment style has emerged in the near future. Investors need to judge more.

Responsible editor: Gao Shuai | Review: Li Zhen | Director: Wan Junwei

- END -

Answer reporters 丨 In the first half of this year, consumer goods imports in Shandong Province imported 49.1 billion yuan, an increase of 3.7% year -on -year

This morning, the Provincial Government News Office held a press conference to int...

The main venue of the Chinese Farmers Harvest Festival in 2022 will be held in Chengdu in September

Recently, the reporter learned from the first plenary meeting of the Chengdu Execu...