The Nasda Index ETF (513100) closed down 4.68%, and the turnover exceeded 400 million yuan

Author:Capital state Time:2022.09.14

The United States has increased by 8.3%year -on -year CPI in August, which is higher than market expectations. The market is concerned that the United States will radiate rate hikes for a longer period of time. Affected by this, the three major indexes of the US stocks fell collectively overnight, and the Nasda Index fell more than 5%. On Wednesday (September 14), the Naqi ETF (513100) closed down 4.68%and the turnover exceeded 400 million yuan.

Analysis of the cause of the decline: The US CPI super expectation in August, the radical interest rate hike expectations of the US -related institutions

The US CPI data disclosed before the opening of the US stock market on September 13 exceeded expectations. The US -quarter CPI was transferred to 8.3%in August, 8.1%expected, and 8.5%before; %. From the data point of view, the CPI in August was only slightly higher than expected, and it was still declining continuously, but the market response was fierce. Not only did US stocks fall fiercely, but US debt, gold and other commodities were under pressure.

The reason behind this is two aspects. First, the core CPI of energy and food increased by 0.6%month -on -month, an increase of 6.3%year -on -year. Among them, the residential items rose sharply from 5.7%in July to 6.3%, which has a long -term impact on the overall CPI. In addition, the price of new cars and traffic services is still rising. Except for air tickets, other out -of -event activities still have demand. Structure structure. It is not optimistic.

Second, the relevant U.S. departments in September were in front of them, and they were about to be held on September 22, and the expectations of interest rate hikes were heating up sharply. Especially last month's CPI data showed that the deceleration was more than expected. The market once believed that as the CPI decreased smoothly, the probability of raising 50bp in the United States slowly and interest rate hikes in September was greater.

However, on August 26, relevant US departments and relevant personnel reiterated at the annual meeting of relevant financial institutions to continue to tighten monetary policy to achieve relevant goals. Subsequently, the market continued to bet on the relevant U.S. departments more aggressively interest rate hikes. The probability of raising 75bp in September once rose to 91%; after the announcement of the CPI data in August, even 34%of the probability of raising interest rates of 100bp, and rate hike 50bp 50bp 50bp The possibility has been completely denied. Audit rate hike expects to fluctuate the stock market, especially the Nasdaq 100 index on behalf of the technology stock market.

Outlook on the market:

Judging from the US CPI base last year, it was relatively stable before September last year, and the CPI decline in the third quarter of this year was also very difficult. From the beginning of the fourth quarter, the obvious rise of the base is still expected to drive the CPI rapidly. In addition, from the recent high -frequency indicators, US rent and CPI expectations have also signs of weakening, such as investigating the rent, and the Federal Reserve's CPI expectations and house prices expected data, which may gradually be reflected in the price trend of the future.

Looking back, employment may become the core contradiction at the policy level. In August, the U.S. unemployment rate rebound and high -frequency indicators such as the initial invitation and continued requests have stated that the employment market has begun to change. At the same time, the US midterm elections are approaching, and the relevant US departments may also take into account asset prices and market risk preferences. Therefore, after the interest rate hike in September, the probability of slowing rate hike rhythm in the fourth quarter will increase.

As of September 13, the Nasdaq 100 Index has fallen 26.26%this year. From the perspective of the index valuation, it is currently 25.57 times PE, which is located at 52.85%in the past ten years. Compared with 40 times last year's high point, the high valuation risk has been released to a large degree. The valuation adjustment may be limited. Taken together, as the CPI continues to decline in the fourth quarter, the US interest rate hike slows down, and it can gradually pay attention to the opportunity of the Naqi ETF (513100).

The Nasdaq 100 index covers the top 100 non -financial companies in the US stock market. It is the "green" technology index of the American index. "Innovation" is the keyword of its ingredients companies, representing the future development direction and trend of the world economy. In the middle and long term, the Naqi ETF (513100) is still a better investment tool for sharing American scientific and technological innovation growth.

- END -

Agricultural technicians in Pingyuan County go deep into the field "Kailiang Fang", and the corn is harvested and harvested

Qilu.com · Lightning News September 5th. At present, corn has entered the grouti...

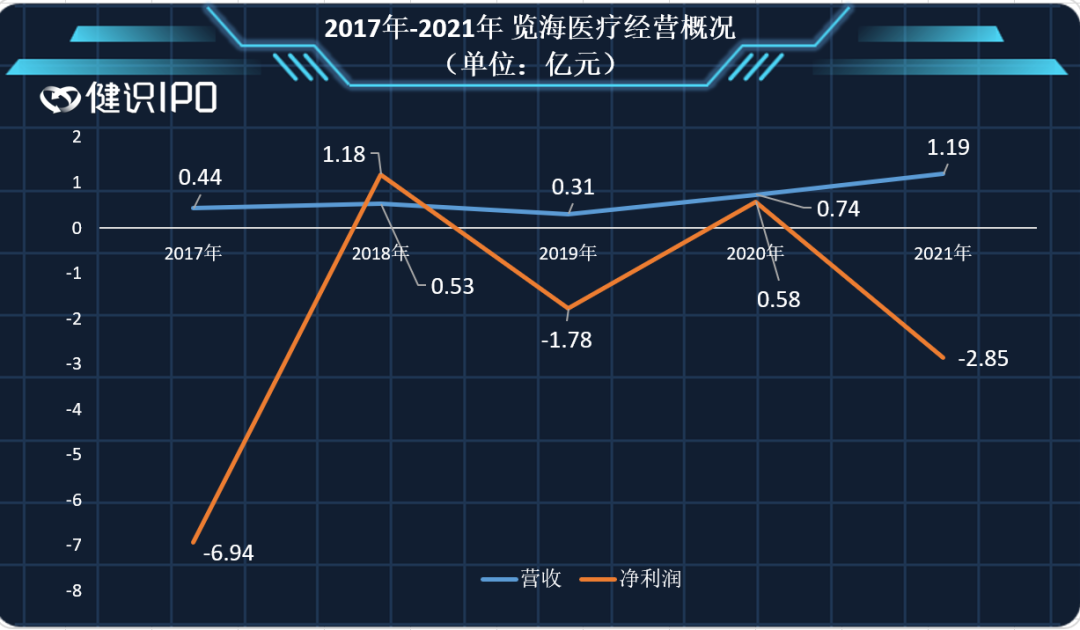

The period of Lanhai Medical delisting is officially ended: It is difficult for the road to high -end medical treatment to go in China

On July 18, the delisting period of Lanhai Medical was officially ended. According...