Being "black hands" again?Yao Mao evaporates 50 billion yuan a day!The Ministry of Foreign Affairs responded!What does the market understand?This new energy car is soaring after the performance

Author:China Fund News Time:2022.09.14

China Fund reporter Yao Bo

The peripheral market has a warm emotion. After the holiday, the Hong Kong stocks maintain a low shock, and the HSI fell 35 points.

Today's plates are severely divided. Consumption leads the market, new energy vehicles, gambling stocks and tourism travel performed well. BYD continued to rebound. Huazhu Group rose nearly 5%, Wynn Macau and Australia Holdings all rose more than 6%; , Ali rose 1.56%, Tencent fell 0.72%, Shang Tang and JD.com both fell nearly 5%, and Meitu and Heartbeat Company rose more than 7%.

Among the large -cap stocks, the weights of the Chinese characters performed brightly, and the three barrels of oil and China Shenhua have risen. The three major operators of China Mobile, Telecom and Unicom have risen by more than 1%, driving the state -owned enterprise index to turn red.

Apple concept stocks have risen, and BYD Electronics and Gao Wei Electronics have risen by more than 5%. Recently, the "Fosun" performance that has been reduced in a large reduction has performed sluggish, and Fosun International has fallen by more than 4%, a new low in the year.

Weilai will soar after his performance

Ideal was reduced by shareholders

After digestion the content of the second quarter, Weilai led the new energy vehicle out of a wave of rebound.

Weilai Hong Kong stocks rose nearly 17%

Low bomb more than 20%

Compared with BYD's Gao Gao's progress, Weilai's second quarter report is good and empty.

Affected by factors such as epidemic and raw materials rising, Weilai net losses in the second quarter were RMB 2.758 billion.

The cost of lithium batteries has risen and reached a high point in April. The company's gross profit margin is still declining. In the second quarter of this year, the gross profit margin was 16.7%, which was far lower than 18.1%in the previous quarter and 20.3%in the same period last year. The company guided the car delivery volume in the third quarter of 3.1 to 33,000 units, and it was not seen.

However, the market has seen Weilai's next growth potential.

Weilai pointed out that the company's orders are still sufficient, mainly due to the repeated supply of the supply chain due to the repeated supply side of the supply side. ET7, ET5, ES7, etc. The production capacity of new vehicles that began to be delivered this year is gradually climbing.

When asked if he could complete the sales target of 100,000 vehicles in the second half of the year, Weilai CEO Li Bin also stated at the performance exchange meeting that it is expected to completely solve the problem of the industrial chain and yield in October. confidence. He said that although the pressure is great, he still has confidence in the recovery of the industrial chain and the market demand. I believe that it can break the record every month and continue to create a new delivery record.

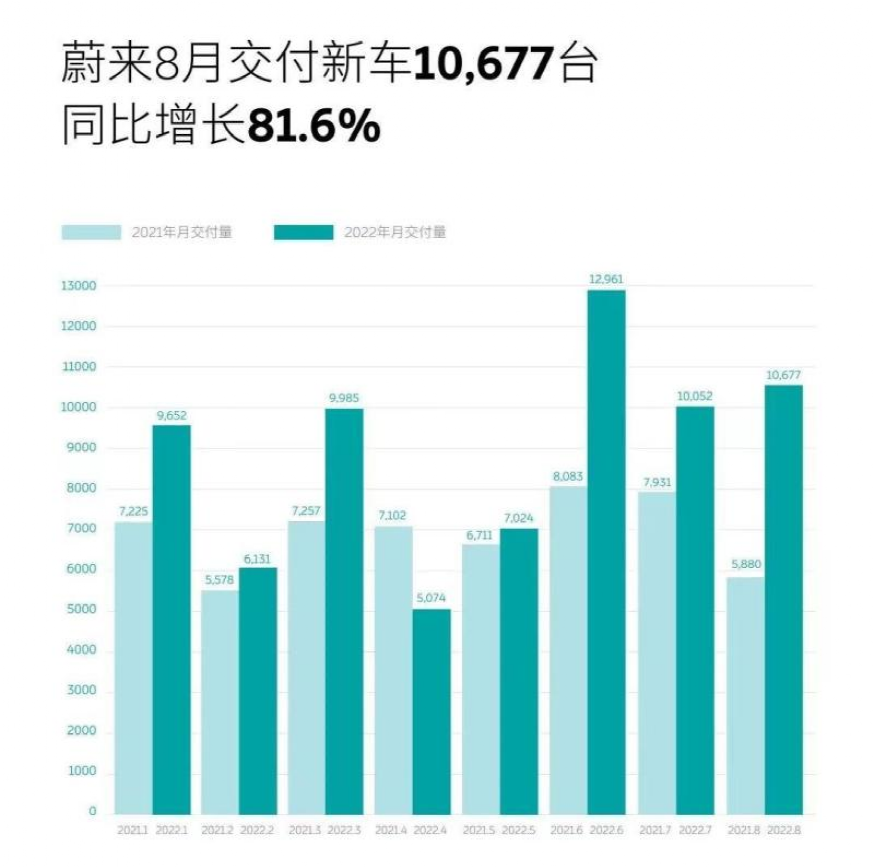

Data show that from January to August this year, Weilai Automobile delivered a total of 71,556 new cars, an increase of 28.3%. The delivery volume in August reached 10,677 units, an increase of 81.6%year -on -year. The agency expects that with the listing of new cars and some models increase, Wei's gross profit margin will also rise from the third quarter of this year.

On the other side, the trend of reducing holdings of new energy vehicles continued. Since Buffett's initiative to reduce its holdings for many years, the ideal car has also been reduced by shareholders' holdings of nearly 100 million yuan.

According to the Hong Kong Stock Exchange website documents, Shen Yanan, an ideal car executive director and president, sold 600,000 Hong Kong stocks of the ideal car on September 6, cash out 7.875 million US dollars, about RMB 54.52 million, and the shareholding ratio dropped from 1.71%to 1.68% Essence

On September 2nd, Shen Yannan reduced its holdings of 400,000 shares of the ideal automobile Hong Kong. The average transaction price was US $ 13.2221, and the shareholding ratio decreased from 1.74%to 1.71%.

Through these two selling, Shen Yanan reduced its holdings of 1 million shares, cash out 13.1638 million US dollars, or about 91.13 million yuan.

The ideal car retracted nearly 40%from the high point in June, and today fell slightly by 0.1%.

Pharmaceutical stocks: I am worried while rejoicing

Medicine biology is half -mixed today.

What I like is that there is money to be optimistic about the company's stock price.

As a B -line ending company, it means that the biotechnology stocks in Hong Kong stocks have not yet been profitable, and funding changes often reflect the changes in fundamental expectations. Yongtai Biological-B, as a company specializing in cell immune technology products,

Today, the company's opening of funds was fried, and the stock price rose by more than 150%, and the closing increase fell to 39%.

On the news, recently, Yaoming Junuo's CAR-T product Ruki Olun Sai was included in the medical insurance list, and Yongtai Biological also pointed out that there was a clinical trial application involving CART-T products. The company also announced in June to cooperate with the company's company to develop tumor treatment and diagnosis business.

What is worried is medicine and creatures or "black hands" in the United States.

According to news, US President Biden has signed an administrative order to expand American biological manufacturing to reduce dependence on foreign countries. After Biden signed an administrative order and speeches, the White House will convene a summit for further discussion details on Wednesday.

This blow may include many biotechnology giants in my country. They specifically provide drug research, development, and generation services for pharmaceutical companies. Leading company at the top of the pharmaceutical biology list.

Affected by the news, Yaoming Bio fell nearly 20%today, and the market value evaporated at HK $ 56.7 billion (about 50 billion yuan); the same Department of Yao Ming Kant also fell nearly 17%, and Kang Long turned into nearly 15%.

Chinese Foreign Ministry spokesman Mao Ning hosted a regular press conference today. When responding to related issues, he pointed out that economic globalization is an objective fact and a historical trend. Scientific and technological exchanges and trade exchanges.

Many foreign investment banks believe that it still needs to be further clarified the scope of the impact of this policy, and now it seems that the impact may be less than the chip bill. Credit Suisse believes that this policy has a clear threat to the Chinese industry. It requires multiple regulatory agencies to identify a threat to the American biological economic circle within 180 days and put forward policy suggestions.

However, the biggest difference between CITIC analysis is that the biggest difference between the chip bill is that the administrative order did not clearly target Chinese peers, mainly focusing on the sustainable development of American biotechnology and maintaining a global leading position. The command is more neutral than the media starts to report, and the impact on the Chinese medical industry is far less than the chip bills that have been passed earlier, but it is expected that the news will trouble the Chinese CXO industry in a short period of time.

Morgan Stanley issued a report that related administrative orders are unlikely to directly restrict US biopharmaceutical companies using Chinese trusted research institutions. The key issue is how the bill involves the degree of resource budget, and what is the size of the relevant investment in major Chinese participants such as Yaoming Bio.

Damo believes that although the United States has not announced the details of the new policy that promotes American biomedicine manufacturing, in view of the long period of construction cycle of biological factories, and the risk of commission development and manufacture and commissioned production services for biological agents, the bank believes that drugs are considered to drugs for medicines. The mid -term impact of Ming creatures may be limited.

Edit: Captain

- END -

Realize 100%green power supply in Xiong'an New Area first new 500 kV transformation power stations for operation

On June 27, Xiong'an New District's first 500 kV substation -Xiongdong Station was completed and put into operation. This project is an important node for the main channel of power transportation in t...

The interest rate of the medium and long -term deposit of commercial banks is upside down?What time is the longer the interest rate?

On the banking market, basically everyone will be familiar with a trend. This is t...