The inquiry letter extended 19 times has ended.

Author:Daily Economic News Time:2022.09.14

Due to the weak operation of the*ST Garden City (SH600766, the stock price of 10.31 yuan, and a market value of 2.312 billion yuan), it was finally waiting until the day of picking the hat.

Today (September 14),*ST Garden City announced that the company's stock will be suspended on September 14 and will resume trading on September 15. On the day of resumption, the company's shares revoke the risk of delisting, referred to as "*ST Garden City" to "Garden City Gold".

While issuing the above announcement, Garden City Gold also responded to the Shanghai Stock Exchange's "Regulatory Questions on the Information Disclosure of the Company's 2021 Annual Report". However, since I received the inquiry letter on April 22 this year, the reply of Garden City Gold has been postponed 19 times.

Regarding the direct connection between the response to inquiry letter and the company's star picking hat, on the morning of September 14, the Golden Golden person in the garden told the reporter of the Daily Economic News that the two must have a connection. In the future, the Shanghai Stock Exchange considers whether to lift the risk of delisting of the company's stock.

It is worth noting that before the announcement was released, the company's stock price had responded in advance: the "Di Cainea" was out of the day on September 13, the stock price was closed at 10.31 yuan/share, and the previous three trading days continued to fall.

19 extension of the response to the question after the inquiry

For Garden City Gold, the termination of the stock delisting risk is very important for financial reporting data in 2021.

Because the net profit attributable to shareholders of listed companies in 2020 is negative and operating income is lower than RMB 100 million. On the 26th, the company's shares were warned by delisting risk and turned into*ST Garden City.

Financial data shows that in 2020, Garden City Gold realized revenue of 26.2278 million yuan, and its net profit loss attributable to shareholders of listed companies was 15.4257 million yuan. At that time, the company that landed on the capital market in 1996 mainly involved trade business, steel, coal and other trade business, and the company's total assets were only 138 million yuan.

"Daily Economic News" reporter noticed that in the eight years from 2013 to 2020, the management of Garden City Gold has not improved, and its operating income has been under 100 million yuan for 8 consecutive years.

After disclosed the company's 2020 performance trailer on January 30, 2021, Garden City Gold made risk reminders: The company's stock may be issued a delisting risk warning after disclosure of the 2020 annual report.

Against the above background, the performance of Garden City Gold in 2021 is particularly important. From the perspective of financial data, Garden City Gold achieved operating income of 225 million yuan in 2021, an increase of 757.99%year -on -year. Among them, the construction materials trade revenue was 166 million yuan, an increase of 968%year -on -year; coal trade revenue was 56 million yuan, an increase of 657%year -on -year.

Although the main financial data has reversed a huge reversal from the previous year, this has not allowed Garden City to directly go ashore. Before the "picking the star and taking off the hat", Garden City Gold can still stand the inquiry of the exchange.

In fact, the regulatory layer was "vigilant" for Garden City Gold's 2021 annual report. Once disclosed, the Shanghai Stock Exchange issued a supervisory inquiry letter.

On April 22, Garden City Gold received a letter of inquiries from the Stock Exchange. The exchange required the company to further supplement the disclosure information on the five major issues from the aspects of industry characteristics, financial accounting, and information disclosure. Reasonable inquiries.

However, since I received the inquiry letter on April 22 this year, the Garden City Gold had only been replied for nearly 5 months, and a total of 19 times was postponed.

It is worth noting that the situation of Garden City Gold Express is not the first time. For example, on July 19 last year, Garden City Gold received the "Inquiry about the Issuance of the Shares for the Issuance of the Shares for the Issuance of the Shares for the Issuance of the Shares for the Issuance of the Shares to Yantai City Gold Co., Ltd. and the payment of supporting funds and the related transaction plan for related transaction plans". The company issued more than ten post -postponed replies.

However, after many extensions, the company finally responded to the annual report inquiry letter, which also made the company's stock "picking the star hats" finally landed. During the response to inquiry, Garden City Gold also disclosed at the same time that the company's shares have been revoked to the delisting risk warning from September 15.

When communicating with the reporter of the Daily Economic News, the company said that "lifting the risk of delisting" and the reply inquiry must be related. Risk warning.

In the first half of the year, the operating conditions were still under pressure

From the current point of view, Garden City Gold Stocks have been approved to terminate the risk of delisting, which is related to the company's response letter on the exchange. In the reply, the company also explained the multiple "0" in its 2021 financial report.

"Daily Economic News" reporter noticed that in the inventory subjects in 2021, the balance of the inventory commodity in Garden City was 0, and the balance of the receivable period was 842,000 yuan.

Garden City Gold said that the company's batch of coal business from procurement to settlement payments is usually not more than one month. The company usually develops coal business in the middle of the year, which leads to 0 inventory goods at the end of the early stage of the coal business period. The balance of the receipt is rational. At the same time, in order to ensure the security of funds, the company usually requires the first payment when cooperating with small steel traders.

Garden City Gold also said that during December, on the one hand, due to the demand for steel entering the off -season, the company's business was relatively small. On the other hand, in order to ensure the timely return of funds, the company focuses on the settlement procedures for the delivery of steel and actively collect. Therefore, the inventory goods at the beginning of the initial period of the steel trade business period are 0, and the balance of receivables at the end of the period is small. In response to the existence of related business entities mentioned in the inquiry letter, the existence of the company's related business entities also become the company's customers and suppliers. Garden City Gold said that the situation has commercial rationality and necessity. They are completed independently and eventually sent to different terminal addresses. It is not a number of cycles for the same batch of goods. This type of transaction has a commercial essence.

Although the issues that pay attention to the exchange have responded one by one, after the rise of related financial data in 2021, how this old listed company continued the situation of last year and faced a lot of pressure.

In fact, in the first half of this year, Garden City's gold performance was not optimistic. According to the financial report, in the first quarter, Garden City's gold revenue was 110.75 million yuan, a decrease of 76.76%year -on -year, and net profit attributable to shareholders of listed companies was 142,800 yuan, a decrease of 106.28%year -on -year. Although the revenue in the second quarter increased 9 times the month -on -month revenue to 92.31 million yuan, the net profit attributable to shareholders of listed companies was only 272,800 yuan.

Based on the results of the first half of the year, the company's revenue was about 103 million yuan, an increase of 5.55%year -on -year; the net profit attributable to shareholders of listed companies was about 130,000 yuan, a year -on -year decrease of 95.24%.

Regarding the changes in performance, Garden City Gold said that the main reason for the significant decline in sales revenue in the first quarter was affected by the local epidemic, and the construction industry started less and the demand for steel decreased. In addition, the company and Xiaoshong Mining Co., Ltd. of Benxi Manchu Autonomous County lifted the custody contract, and the custody income decreased by 1.5 million yuan (including tax). According to the gross profit margin of the custody business in 2021 Whether the small set of mining custody business continues to carry out uncertainty.

It is worth noting that when the company's development strategy was mentioned in the 2021 financial report, Garden City Gold said that in the future, the company will strengthen the construction of professional teams, introduce professional and technical talents, and better serve the existing trading business, optimize the industrial structure, and optimize the industrial structure. Promote technology transformation. Complete industrial upgrading and find new profit points.

However, it is interesting that Garden City Gold's 2021 annual report shows that as of the end of the reporting period, there are only 12 employees in the company. Among them, there are 10 employees of the parent company and 2 main subsidiaries. The 12 employees include 4 salesperson, 3 finance personnel and 5 administrators.

Daily Economic News

- END -

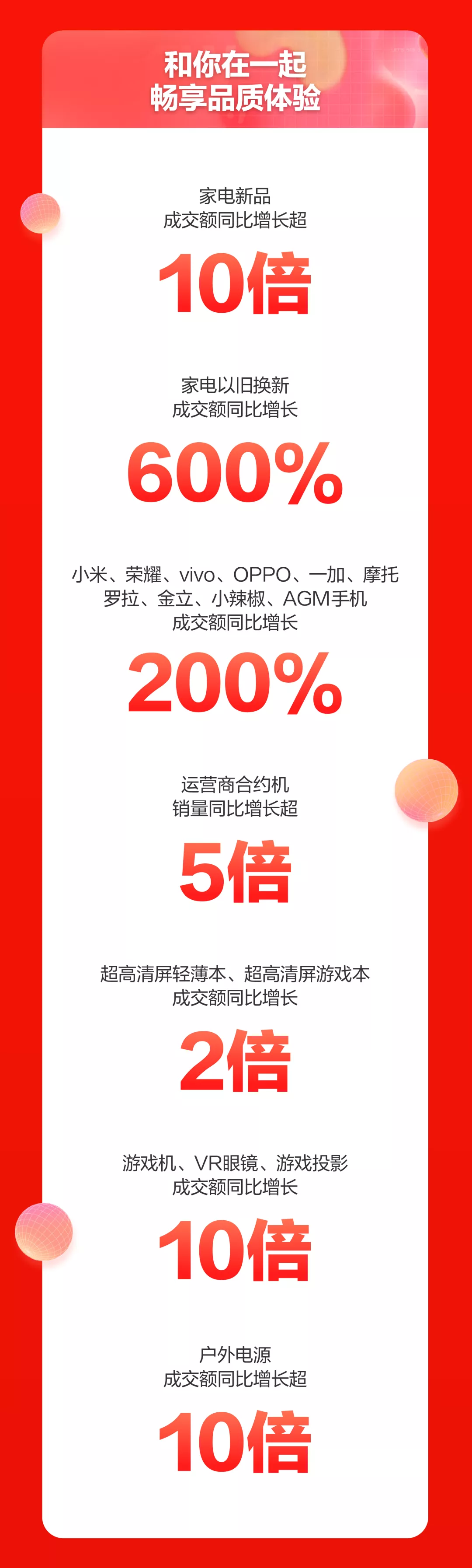

618 Battle Report | Trendy and entertainment products are sought after, new energy vehicle orders have increased significantly year -on -year

Cover Journalist Fu WenchaoAt 8 pm on June 17, 618 in 2022 ushered in a climax, an...

Shi Jingshan highlights the new vitality of the city.

AnnualChina International Services Trade FairIt's about to come as schedule,Shi Ji...