The increase in CPI in August exceeded expectations!The Dow once fell more than 660 points, and the US dollar index rose by 109, and the market began to bet on 100 basis interest rates.

Author:Daily Economic News Time:2022.09.13

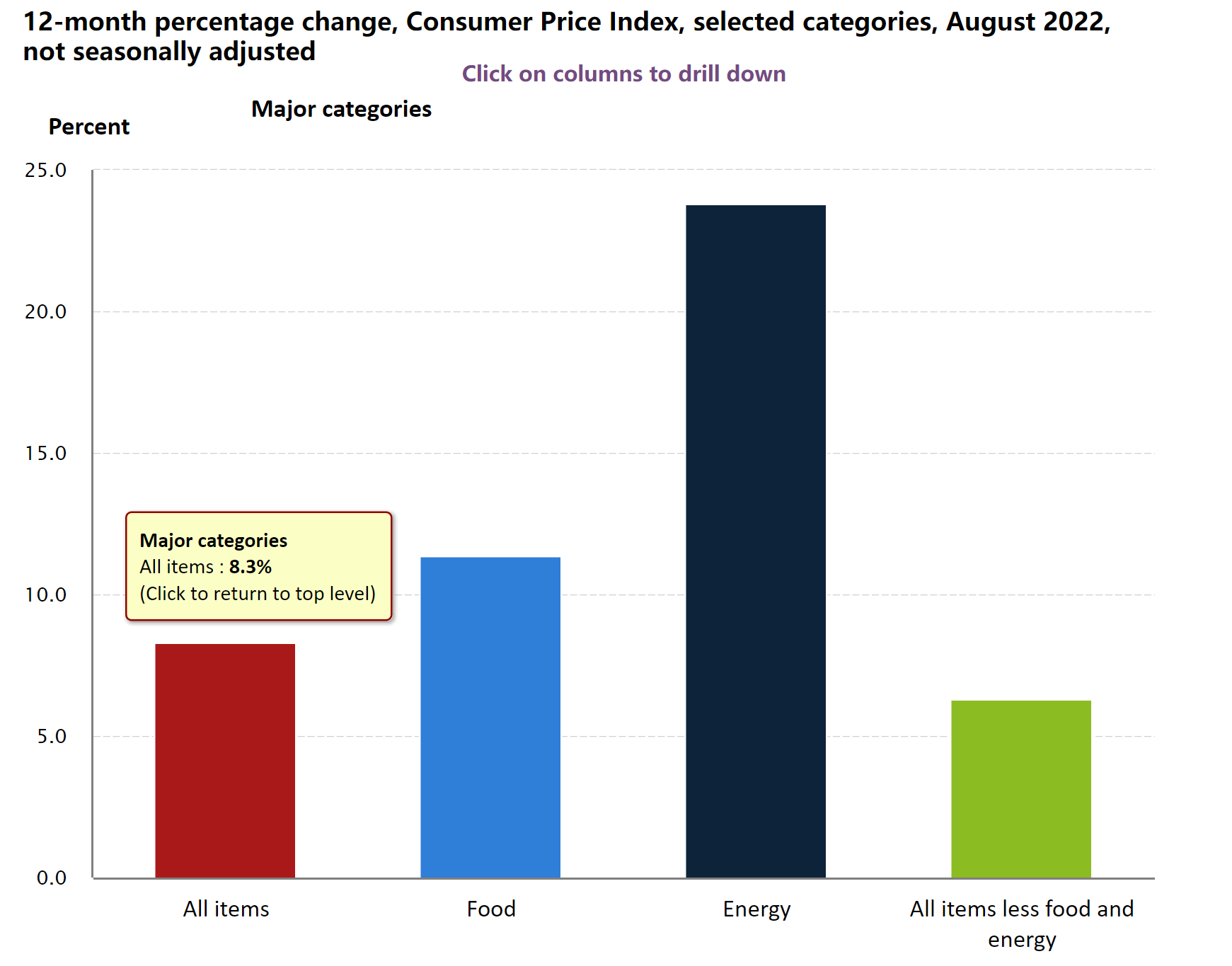

On September 13, local time, data released by the U.S. Labor Statistics showed that the US August CPI increased by 8.3%year -on -year, higher than the market expectations of 8.1%, and 8.5%below July; the month -on -month increased by 0.1%, which was higher than the market expectations -0.1%, a recovery from 0%last month.

Photo source: official website of the US Labor Statistics Bureau

After eliminating the price of food and energy, the core CPI in August rose 6.3%year -on -year, higher than the market expectations of 6.1%, and the previous value was 5.9%. 0.3%.

Affected by this, the three major US stock indexes fell collectively after the opening of the market. The Dow has dropped by more than 660 points, and the NASC market fell more than 380 points. As of press time, the two major indexes have risen slightly.

Picture source: Futu Niu Niu Screenshot

The spot gold fell short -term, and now reported at $ 1714.95/ounce. The US dollar index rose short -term, and now reported at 109.42.

From the specific data of CPI, US energy prices fell 5%in August and the gasoline index fell 10.6%. According to data from the American Automobile Association (AAA), the price of unparalleled gallon of lead gasoline fell from $ 4.22 at the end of July to US $ 3.84 at the end of August, a decrease of 9%. The price of food prices rose 0.8%, which accounted for about one -third of the housing cost of CPI, which rose by 0.7%, an increase of 6.2%compared to the same period last year.

This inflation data reflects the current contradictory of the US price. Last month, the price of gasoline fell sharply after reaching the peak of more than $ 5 per gallon this summer. However, other key living cost indicators such as food and housing continue to rise.

Questing strategist QUINCY KROSBY, the chief stock strategist of the securities firms, said that the price of food, transportation and rental is the reason why inflation is still high. In particular, the cost of renting has been rising, which is currently the most stubborn inflation factor facing the Fed.

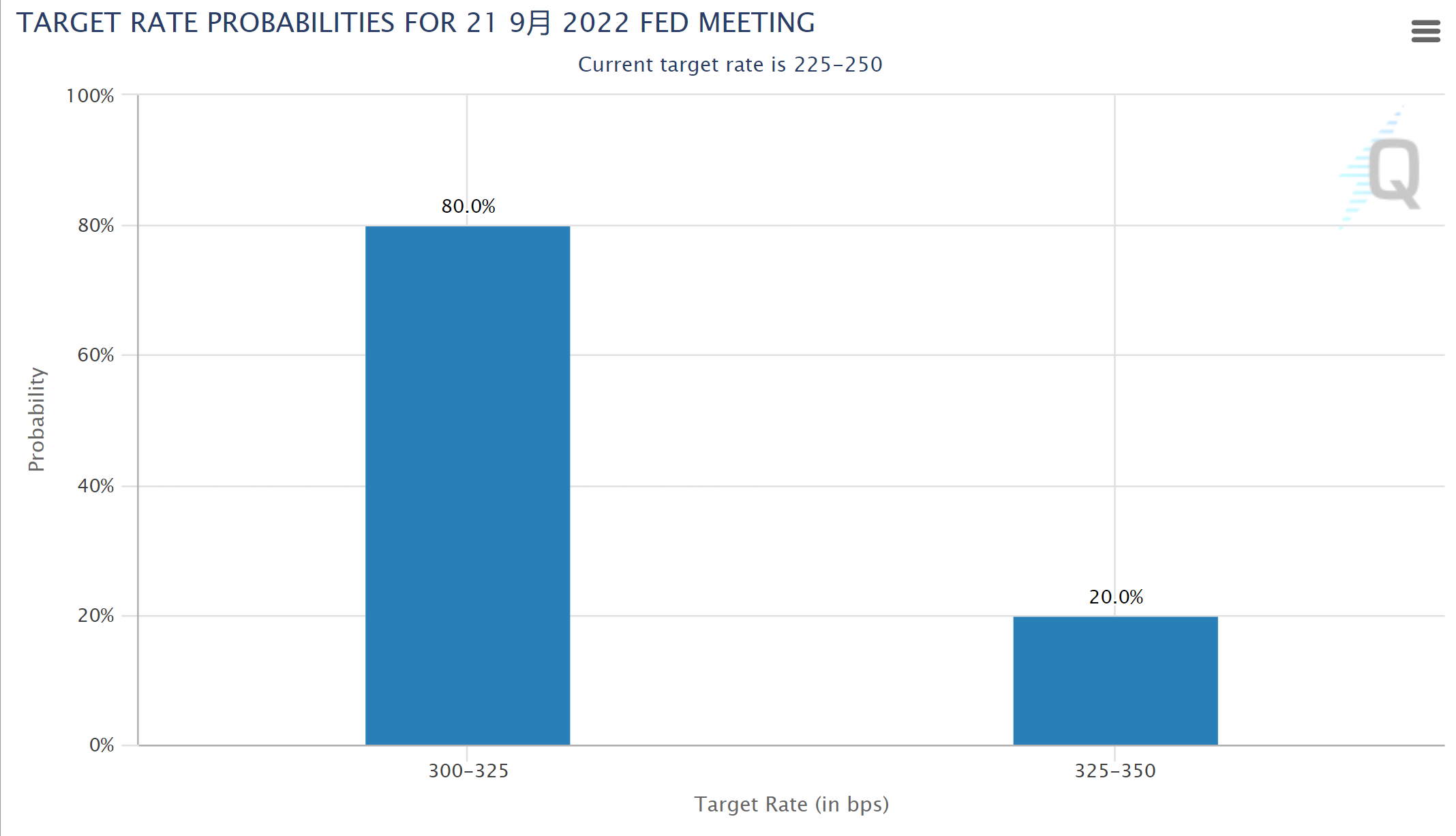

It is worth noting that the time for this announcement of CPI data is only one week before the Fed's new interest rate meeting.

From September 20th to 21st, the Fed will hold a monetary policy meeting. At the Jackson Hall meeting held last month, Fed Chairman Powell has released a strong "eagle" signal. He emphasized that in order to resist inflation, the Fed may continue to raise interest rates and maintain it for a period of time. Powell also supplemented in the case of Walker's era that "historical records strongly warned not to relax the policy prematurely."

Some analysts believe that the inflation that exceeds expected in August may promote the Federal Reserve to maintain a significant interest rate hike. After the data was announced, the Fedwatch tool of Zhishang Institute showed that the probability of the Fed's 75 -basis point in September was 80%, and the probability of 100 base points increased to 20%.

Rick Rieder, the chief investment officer of Bellaide's global fixed income department, previously issued a report predicting that the Fed may raise interest rates rapidly this year, but next year, the Fed should wait and see for a period of time to avoid excessive policy risks.

RIEDER believes that although "the Fed's current high inflation rate is definitely necessary, we are worried that the Fed may over -tighten the policy and destroy most of the progress of the US economy from the impact of the epidemic."

Since the beginning of this year, the US economy is generally struggling. According to CNBC, data from the Egent Federal Reserve Bank of Atlanta show that the total domestic product (GDP) in the first two quarters has contracted, which has conforms to the definition of universal acceptance, and the annual growth rate of the third quarter is only 1.3%.

Daily Economic News

- END -

"Integration of production and city" in Yuanbao Mountain District, Chifeng City to build chemical, logistics, and seedling bases

The crane machine roars, the logistics vehicles shuttle, and the seedlings are full of seedlings. In recent years, the strategic goal of the Yuanbao Mountain District of Chifeng City has been like a p

The 3rd multinational company leader Qingdao Summit ended a total of 99 foreign -funded projects of 99 total investment of 15.6 billion US dollars

Qilu.com · Lightning News, June 21st News On the afternoon of June 21, the 3rd m...