8.3%, super expectation!The most critical data before the Federal Reserve resolution was released!The US dollar index rose straight, the Dow fell 500 points, and gold and crude oil dived one after another

Author:Daily Economic News Time:2022.09.13

According to CCTV news reports, on the 13th local time, the latest data released by the US Department of Labor showed that the August consumer price index (CPI) in the United States increased by 0.1%month -on -month, an increase of 8.3%year -on -year, and estimated to 8.1%. In the month, after excluding large fluctuations and energy prices, the core CPI rose 0.6%month -on -month and 6.3%year -on -year.

After the CPI data of the United States was announced in August, the US stocks opened sharply, the Dow fell 1.68%, the Nasda Index fell 2.14%, and the S & P 500 index fell 2.13%.

In addition, the US dollar index rose 1.08%to 109.50. The gold short -term fell over $ 28 and fell to $ 1712.5/ounce. WTI crude oil futures fell 0.59%, and now reported to $ 87.26/barrel. Brent crude oil futures fell 0.66%to $ 92.32/barrel.

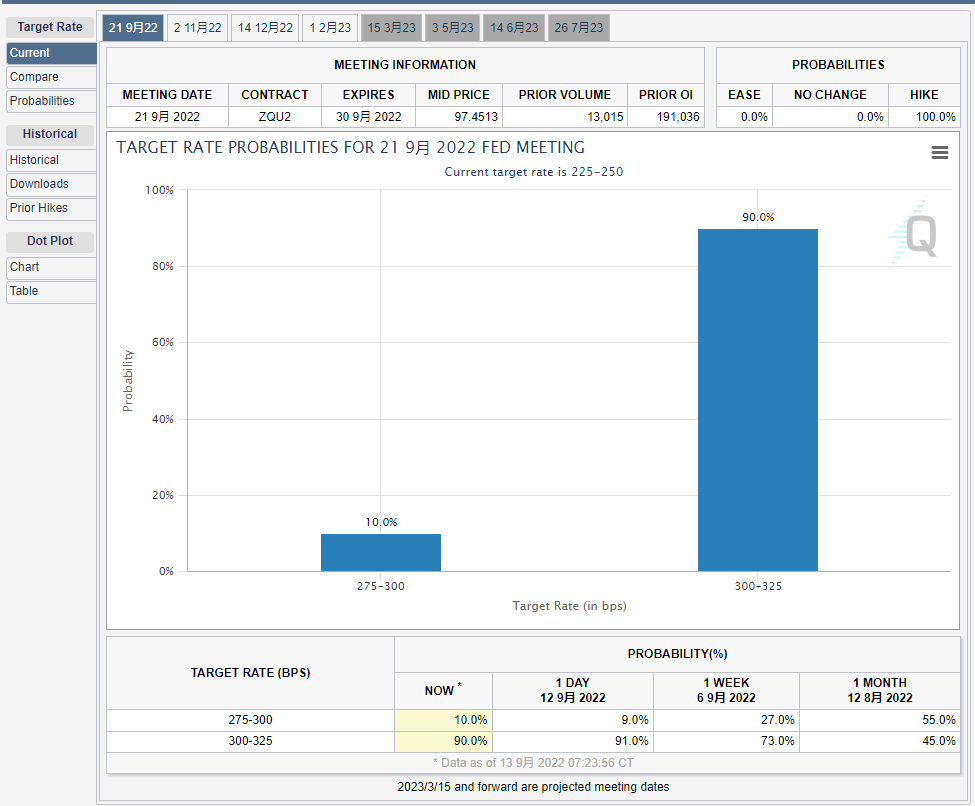

Data show that 95 % of the possibility of 75 basis points in September!

The release date of the CPI data in the United States in August can be described as quite sensitive, because in just one week, the Fed will hold a September interest rate meeting, which means that the data tonight will be the last heavy economy before the Fed's resolution. index. At present, the Federal Reserve is in the "cricket period" before the conference.

Earlier, according to CCTV News reported on September 9, Fed Chairman Powell said at the 40th annual currency conference at Cato Institute that in order to suppress inflation, tough measures will continue to take tough measures to curb the pressure on prices.

Powell's remarks suggest that the Fed will likely continue to raise interest rates sharply. Most investors expect the Federal Reserve to raise 75 basis points at the policy -making meeting at the policy formulation meeting this month.

Picture source: Visual China-VCG31N1395389197

It is reported that the Fed will hold a meeting meeting from September 20th to 21st. Data from the CME Fedwatch tool show that the possibility of raising 75 basis points in September was 90%on September 13, higher than 73%of the previous week.

Image source: CME Fedwatch

In addition, according to CCTV News, on September 8th, local time, US Finance Minister Yellen said that the decline in gasoline prices may alleviate the overall consumer price inflation in August, but the inflation prospects still have great uncertainty.

Yellen said that due to the deepening of European energy and economic crisis, she was worried about global prospects. She said that the United States was taking action to increase the supply of liquefied natural gas in Europe.

Expert: The impact of the Federal Reserve interest rate conference on US stocks in September depends on the interest rate hike

According to the 21st Financial Report, Hu Yi, an associate professor and doctoral instructor of the U.S. Economics Research Institute of Wuhan University, pointed out in an interview with the 21st Century Business Herald that the impact of the Federal Reserve interest rate conference on US stocks depends on the interest rate hike. At that time, if 75 basis points are raised, considering the general expectations of the market, the impact of interest rate hikes has been reflected in the current price, so the impact on U.S. stocks has a small impact. Since then, if the U.S. high inflation has not been significantly cool down, the Fed may adopt a more radical interest rate hikes, which may cause economic recession, then US stocks will have a high probability of further reduction. And if the United States is balanced between the two goals of inflation and employment, U.S. stocks will maintain a stable performance.

Zhang Yugui, Dean of the School of International Finance and Trade, Shanghai University of Foreign Languages, told the 21st Century Business Herald that US stocks are expected to maintain a stable trend as a whole in the future. For trillions of dollars, its economic recovery is normal. At the same time, the improvement of US energy -consignment rate ensures its security in the energy supply chain, but it actually supports the stable US economy and capital markets.

Brokerage: The downward pressure of short -term US stocks continues to highlight, and the low point in the fourth quarter may usher in a low point.

According to a report on September 13th of the China Securities Journal, in the opinion of Xue Wei, a senior strategy analyst at Ping An Securities, the market had previously expected the Federal Reserve to raise interest rates or slowed down. After Powell's eagle spokesman in late August, the market expected to reverse. Although non -agricultural data at the beginning of this month showed that the pressure of employment in the United States has eased, the sliding level of the US inflation is not enough to slow down the rhythm of the Federal Reserve's interest rate hike, which has led to the continued highlight of the downward pressure on the short -term US stocks.

Morgan Stanley strategist Wilson believes that the biggest concern at the current US stock market may be due to the slowdown of the US economy, rather than a higher inflation and a more eagle Federal Reserve. He predicts that even if the US economy has not declined, the performance of US listed companies in 2023 will decrease by 3%.

"U.S. stocks may usher in the low point of this adjustment in the fourth quarter." Wilson predicts that the S & P 500 Index may fall to 3400 points in the fourth quarter, which is about 15%lower than the current level. The index does not rule out the possibility of falling to 3000 points.

Daily Economic News Comprehensive CCTV News, CME Fedwatch, Finance News Agency, 21 Finance, China Securities News

Daily Economic News

- END -

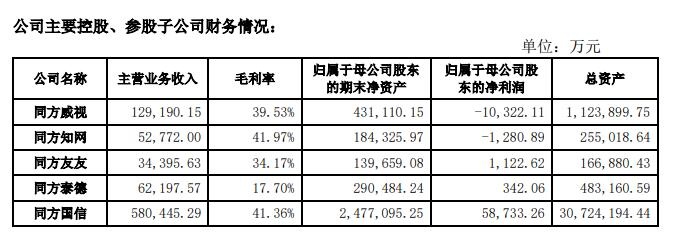

Report disclosure: Tongfangzhi.com's gross profit margin of 41.97% in the last half year

The Yangtze River Daily Da Wuhan Client September 1st (Reporter Zhang Weina) Recen...

The eighth "Mayor Cup" SME Innovation and Entrepreneurship Competition ended, and the "specialized new" enterprise emerged

Fengkou Finance Reporter Bai JuOn September 8th, the 7th Maker China (Qingdao Divi...