The 30th year of Fosun: Capital Teng Nuo Layout shrinkage

Author:Red Star News Time:2022.09.13

Since entering September, the Fuming system at the helm of Guo Guangchang has frequently moved in the capital market.

The Red Star Capital Bureau noticed that this year is the 30th year since the founding of Fosuna. It is also in this year that the Fosun has changed the hive that has opened up territory in the past and is constantly shrinking its territory.

↑ Data Matching Figure Figure according to visual China

Ask to sort out cooperation

Fosun: daily work, no pertinence

According to some network documents, in response to the recent selling situation of Fosun Group stocks, the Beijing State -owned Assets Supervision and Administration Commission requested the municipal management enterprise to sort out the cooperation with Fosun Group, which is not limited to holding stocks, equity investment and engineering contracting, etc. Cooperation risk.

On September 13, the Red Star Capital Bureau contacted the Beijing State SASAC, and the other party said "inconvenient to respond."

Fosun responded to the Red Star Capital Bureau that it had noticed the notice of the Internet and asked the Beijing State -owned Assets Supervision and Administration Commission. They also issued relevant investigations notice on relevant companies. At the same time, Fosun said that its business development in Beijing was normal.

On the afternoon of September 13, Guo Guangchang, who was certified as "Chairman of Fosun Group", posted on Weibo:

"I just ended a few months of overseas travel schedule. Fortunately, I returned to Shanghai before the typhoon 'plum blossoms'. These two days are being isolated according to epidemic prevention requirements. Half of the industry and employees are overseas, so this time I stayed more time overseas, ran more than 20 countries, nearly 40 cities, and had a detailed communication with the overseas Fosun students who had never seen them for a long time. I am very happy that I have seen that many overseas companies have returned to a better level than before the epidemic, and some companies have achieved high -speed growth during the epidemic. In the process, many overseas friends have been visited. Please drink our willingness to drink, while trying to taste the wisdom of China, and convey Chinese confidence to overseas.

I always believe that globalization is the common interest of all humanity, and Fosun's competitiveness lies in the global vision and ability. More importantly, as an enterprise rooted in China, China is always the most important base for Fosun. Whether overseas or isolation, I always care about domestic business. In the future, it is hoped that Fosun can achieve mutual empowerment and high -speed growth in the global ecology while deeply cultivating China. "

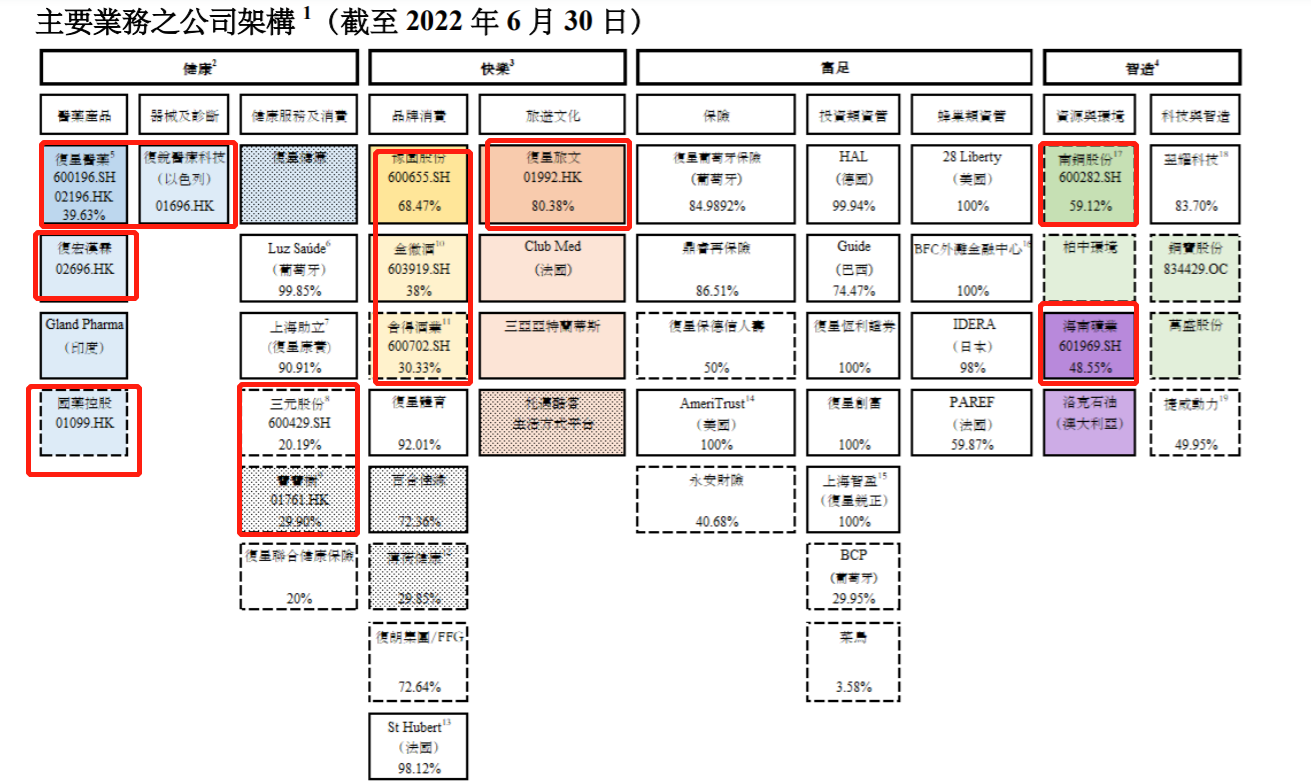

The Hongxing Capital Bureau sorted out and found that the core of the "Fosun" was Fosun International (00656.HK). As of June 30 this year, 12 A -share and Hong Kong stock holders were included in the company's framework. Its health, happiness and intellectual manufacturing: three major businesses.

Among them, in the health sector, the listed companies held by Fosun International include Fosun Pharmaceutical (600196.SH; 02196.HK), Fuhong Hanlin (02696.HK), Sinopharm Holdings (01099.HK), Fusui Medicalcare Technology (01696.HK), Sanyuan (600429.SH) and Babyshop Group (01761.HK).

In the happy sector, the listed companies participating in the shareholding of Fosun International include Yuyuan (600655.SH), Jinhui wine (603919.SH), willing wine industry (600702.SH) and Fosun Tourism Culture (01992.HK) ; In addition, there are Nangang Steel (600282.SH) and Hainan Mining (601969.SH).

Screenshot from Fosun International Financial Report

In addition to the three major sectors of health, happiness and intelligent manufacturing, Fosun's official website shows that it also has a rich sector and honeycomb cities. The former mainly involves insurance and finance, investment, honeycomb real estate, etc. The latter refers "Outlets" solution.

The capital market continues

Involved in listed companies such as Hainan Mining, Fosun Pharmaceutical and Gold Huijiu

Since this year, the Founder has carried out a series of capital. The Hongxing Capital Bureau sorted out the announcement of the listed company according to the time:

· In mid -February this year, Hainan Mining issued an announcement saying that Shanghai Fosun Industrial Investment Co., Ltd. (hereinafter referred to as "Fosun Property Investment") cumulatively reduced its holdings of 20.217 million shares, accounting for 1%of the total share capital. It is 32.24%.

Calculated at the median number/share calculation of the median number of the holding price range, the amount involved was about 267 million yuan.

· In March, Taihe Technology (300801.SZ) issued an announcement saying that its shareholder Shanghai Fosun Chuanghong Equity Investment Fund Partnership (Limited Partnership) plans to reduce its holdings of not more than 16.2148 million shares, accounting for about 7.51%of the total share capital; The implementation of this reduction is completed.

At the end of May, Fosun International issued an announcement saying that it intends to sell Tsingtao Beer's Hong Kong shares at a price of HK $ 62/share.

· In mid -June, Zhongshan Public (000685.SZ) issued an announcement saying that its shareholder Shanghai Fosun High Technology (Group) Co., Ltd. (hereinafter referred to as "Fosun High Technology") intends to be on the day of disclosure Reduced your holdings within a month, not more than 6%of the total share capital.

· August, Hainan Mining issued another announcement, disclosed the reduction plan of Fosun's production investment, and plans to reduce their holdings from September 20th to December 17th, not more than 610.349 million shares, and the total reduction ratio does not exceed the total share capital. %.

It was also this month, and the rating agency Moody's rating of Fosun International's corporate family rating to B1 and rating outlook were negative. After entering September, the movement of the Refractive System became faster.

After the market on September 2, Fosun Pharmaceutical issued an announcement that the controlling shareholder Fosun High -tech plans to reduce its holdings of A shares with a total share capital of 3%, which is calculated based on the closing price of the same day, and approximately 3.220 billion yuan.

According to the securities firm China report, the High -tech reduction of Fosun is the first initiative to reduce its holdings as the controlling shareholder since its listing in 1998. After the announcement was released, Fosun Pharmaceutical's stock price continued to decline.

· On the same day (September 2), Yuyuan and Jinhui Jiufa announced that Yuyuan and its wholly -owned subsidiaries intend to sell 13%of the shares of Jinhui wine, with a total transaction price of 1.937 billion yuan, transaction transaction, and transaction. Later, it still holds 25%, but it is planned to continue to reduce the stock of more than 5%of the golden wine wine in the next six months.

· On September 6, Fosun Tourism Culture announced that the controlling shareholder Fosun International sold 28 million shares to independent third parties after receiving the market at a price of HK $ 8.57/share on September 5, a total of HK $ 240 million, and About RMB 122 million.

· On the evening of September 9, COFCO (301058.SZ) issued an announcement saying that its shareholders Shanghai Fosun Weishi Phase 1 equity investment fund partnership (limited partnership) intends 6%) shares.

The Red Star Capital Bureau roughly estimates (the partial reduction plan has not yet been implemented). In this round of capital, the Fosuna will cash out about 10 billion yuan.

The Red Star Capital Bureau noticed that as of the end of the first half of 2022, Fosun International's non -current assets were approximately 470.903 billion yuan, mobile assets were 378.782 billion yuan, and total assets were 849.685 billion yuan. The liabilities were 375.395 billion yuan, and the total liabilities were 6511.56 billion yuan. Fosun International's asset -liability ratio is 76.63%. On December 31, 2021, its asset -liability ratio was 74.8%.

As of September 13, the closing price of Fosun Pharmaceutical in A shares was reported at 34.44 yuan/share, down 1.6%, and A -share listed companies such as Yuyuan, Jinhui wine, willing to wine, Nangang and Hainan Mining fell 0.34 on the same day %To 3.01%. The closing price of only Sanyuan shares rose 0.41%.

In addition, the Putsuit listed companies have also declined in Hong Kong stocks. Among them, Fusui Medical Technology fell nearly 8%, Fosun International fell more than 4%, and Fosun Pharmaceuticals and Baby Tree Group fell more than 1%. Fu Hong Hanlin and Sinopharm Holdings closed up by about 0.4%-0.5%.

Red Star News reporter Yang Peiwen Wang Tian Qiangya Mill

Responsible editor Wei Kongming editor Yang Cheng

- END -

Jining: The Capital of the Canal Tongjiang Dahai

Planning: Ge Tenglong Design: Li Nan Photography: Yang Guoqing Chen Shuo Tian Chun...

"Huilai Five Treasures" (prefabricated) International Network Festival+Cloud Exhibition will eat Huimin waiting for you

In the summer solstice, the mountains and sea in the prefecture of the east of Gua...