In the second quarter, the "transcript" of the enterprise annuity was released: management assets exceeded 2.7 trillion yuan, and the weighted average income was 2.13%

Author:Daily Economic News Time:2022.09.13

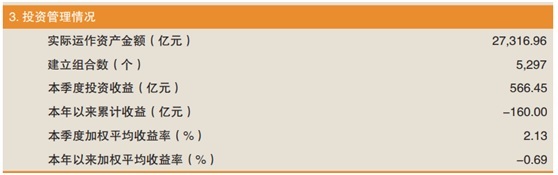

Recently, the Social Insurance Fund Supervision Bureau of the Ministry of Human Resources and Social Security disclosed the business data of the National Enterprise Enterprise Fund in the second quarter of 2022. The data shows that the actual operating assets in the second quarter of this year exceeded 2.7 trillion yuan, and the investment income was 56.645 billion yuan. 2.13%, which has caused the weighted average yield of corporate annuity since -2.75%in the first quarter to -0.69%.

Picture source: Photo Network-401765781

In addition, the relevant data of the classification of pension products in the second quarter of pension products were disclosed with annuity data. The data showed that in equity assets, ordinary stock products achieved investment in positive investment in the second quarter, with a yield of 8.44%. The good performance in the quarter, the weighted average rate of return this year has changed from -15.77%in the first quarter to -8.72%of the first half of the year.

Management assets exceeded 2.7 trillion yuan, and the average weighted income was 2.13%

According to the recent disclosure of the Social Insurance Fund Supervision Bureau of the Ministry of Human Resources and Social Security in the second quarter of 2022 National Enterprise Annual Fund Business data, the actual amount of actual assets in the second quarter reached 2.73 trillion yuan, a total of 5,297 combinations, and a total of 5666.45 investment income in the second quarter achieved a total of 5666.45 100 million yuan, a weighted average yield of 2.13%.

However, from the perspective of this year's performance, the cumulative returns and weighted average returns since this year are still negative. The two are -16 billion yuan and -0.69%, but compared with -72.645 billion yuan and the first quarter, -2.75%, the loss has narrowed significantly.

From the perspective of the combination type, in a single plan, the fixed income and equity combinations have achieved positive returns in the second quarter. The weighted average yields are 1.19%and 2.25%, respectively. One positive and one negative, the average rate of return of weighted was 1.68%and -0.99%, respectively.

In the collection plan, the combination of fixed income and equity classes also achieved positive income in the second quarter, with a weighted average yield of 1.36%and 2.32%, respectively. The average rate of return of weighted was 1.09%and -1.03%, respectively.

Then to the specifically the product's income range, of the 4684 sample combinations, the yield of only 299 combinations in the first half of the year reached or exceeded 2%, and the yield of 648 combinations declined or exceeded 2%.

Most combined products are concentrated between -2%and 1%, of which the number of products between -2%and -1%is the largest, reaching 1239.

The management scale of 4 companies exceeds 100 billion yuan, and 1 has exceeded 200 billion yuan

In terms of the company, 11 public fund companies with an annuity investment management qualification have also changed in the second quarter.

First of all, as a whole, thanks to the rebound in the second quarter, the overall management scale of these fund companies has picked up.

Secondly, a fund company with a management scale of more than 200 billion yuan appeared. Specifically, the management scale of ICBC Creditses exceeded 200 billion yuan, which was increased compared to 195 billion yuan at the end of the first quarter.

Secondly, the other three fund companies with a scale of over 100 billion yuan have also increased the management scale in the second quarter compared to the end of the first quarter. Among them, the changes in Yifangda not only risen from about 165.3 billion yuan at the end of the first quarter to two to two. About 182.2 billion yuan at the end of the quarter, and the increase in the number of products was also obvious, from 273 at the end of the first quarter to 299.

In addition, the number of products of some companies has remained unchanged, while some have decreased. For example, Haifutong Fund, the number of product portfolios is still 93, and the number of combinations of Castrol Fund decreased from 92 in the first quarter to 90.

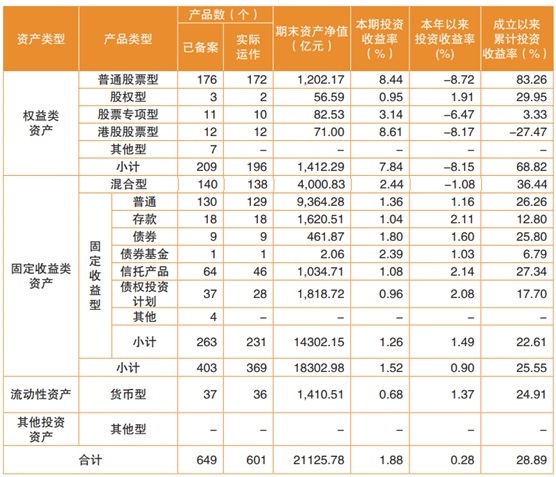

Pension product income is turned to positive

Discovered with annuity data, there are relevant data of the classification of pension products in the second quarter. The data shows that 649 pension products in the second quarter achieved investment yields of 1.88%, which made the overall yield of this year's overall return to positive. Remember that the yield in the first quarter was -1.61%, and now the overall investment yield of 0.28%has been achieved in the first half of the year.

In terms of product types, in the equity assets, ordinary stock products achieved investment positive income in the second quarter, with a yield of 8.44%. Thanks to the good performance in the second quarter, the weighted average yield of this year has been from the first quarter- 15.77%became -8.72%in the first half of the year.

In terms of fixed income assets, the yield of mixed products in the second quarter also reached 2.44%, which also caused investment yields this year to rise from -3.60%in the first quarter to -1.08%in the first half of the year.

Daily Economic News

- END -

The longest wooden arcade bridge in China is burned, and the fire prevention regulations cannot be empty.

Xu Hanxiong, a polar news commentatorOn the evening of August 6, Wan'an Bridge in ...

China Listed Companies Association: 4825 listed companies' net profit of 3.25 trillion yuan in the first half of the year, the second quarter performance is generally better than market expectations

On August 31, the China Listed Companies Association released the statistical statistics of the semi -annual report of listed companies in the first half of 2022. Data show that as of August 31, a tot