One week's solidarity research | The yield of solidarity investment is recovered, and the annualized level of the annual yield of the traditional cargo base is as low as below 1%, and the bank interest margin is passively decreased

Author:Daily Economic News Time:2022.09.13

Last week, the market stocks and debt markets were weak, but the macro -funded side still maintained a loose trend. The interest rate deposit interest rate has declined slightly. Affected by this, in the field of solid income investment, pure debt funds and rights containing debt -based investment instruments are compared with the weekly yields compared with the weekly yields compared Last week, it fell, especially a lot of traditional currency funds in the weekly yield level as low as below 1%. Some people in the investment community told reporters that the current bank interest margin is passively lowered, compressed ticket integration and income space, and the future in the future. In the future, in the future With the further relaxation of monetary policy, or it will continue to open the arbitrage space, it is also expected to further relieve the pressure of the institution's debt.

Photo source: Photo Network-500470853

Agreement in the bond market

Last week (9.5-9.11), the bond market market was relatively dull. From Monday to Tuesday, the capital surface was relatively loose, and the liquidity continued to support more emotions; There is a weakening; on Thursday, because of concerns about social finance data exceeding expectations, the market sentiment is more cautious; on Friday, the inflation data released in the early trading is lower than expected, but the benefits for the debt market are limited. As well as the relaxation of real estate policies, the yield has been significantly recovered, and the yield after the post -release of the social merger has turned down.

According to the statistics of Xingye Securities' solidarity income, last week issued 281.7 billion yuan in government bonds, 156.1 billion yuan in government bonds, and 44.2 billion yuan in local bonds. The circulation volume of each voucher increased month -on -month, which led to a recovery of net interest rate bonds. On September 7, the Ministry of Finance successfully issued 3 billion yuan in Treasury bonds in Macau, with a subscription multiple of 2.04 times. This is also the second time the Ministry of Finance issued Treasury bonds in Macau after 2019.

In terms of the secondary market, according to statistics from Xingye Securities, the daily fluctuations of the long end of the four trading days last week were less than 1bp. When the message lacks a catalyst, it is difficult to find sufficient reasons for more or short; Last week and Tuesday, the market was strong, and the T2212 successfully stood on the 101.7 mark. In terms of positioning, the T2212 contract rose sharply on Wednesday and Friday. In combination with the price trend, it may be caused by the short positioning. The technical form of the "shoulders" gives the short gas to the short. From the perspective of transactions, the enthusiasm of the market has risen, and emotional heights appear on Friday.

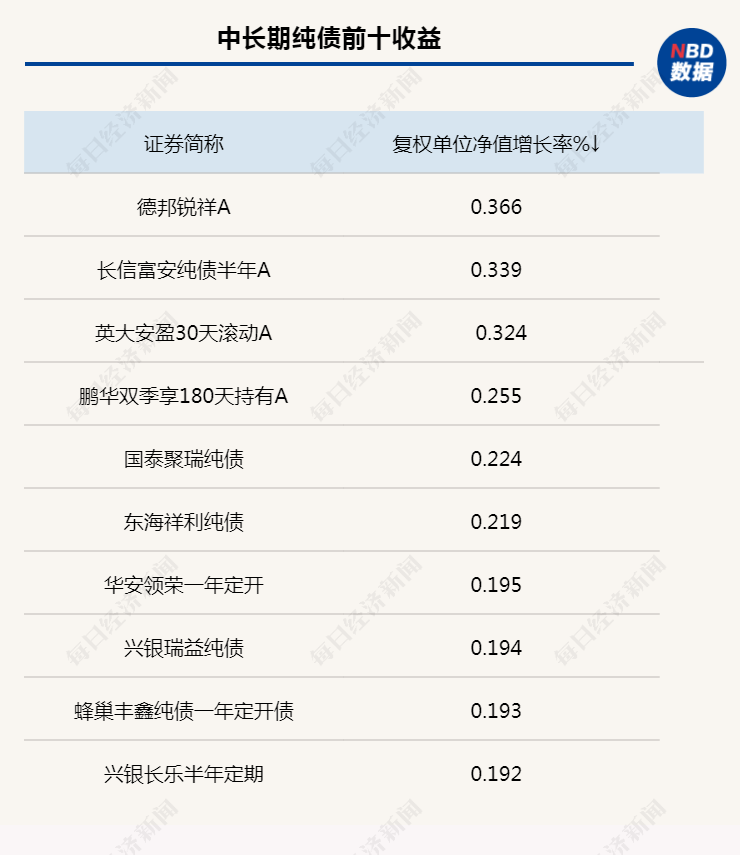

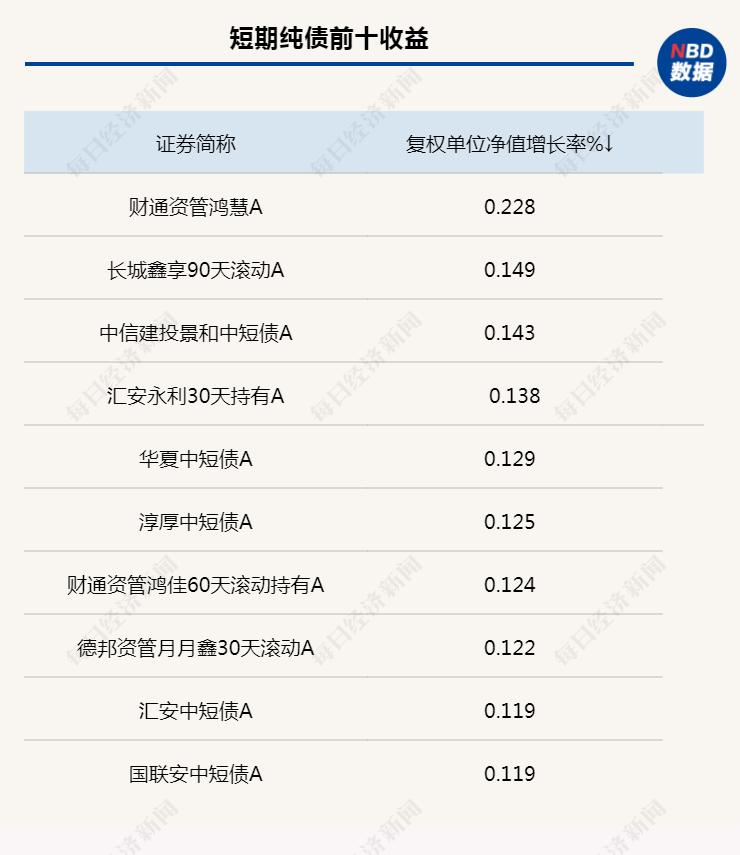

The yield rate of solidarity investment declines from the previous month

The yield rate of solidarity investment declined in the week -on -month decline. Taking the short -term pure debt index fund as an example, Wind statistics showed that the weekly increased by 0.05%, a decrease of 0.03 percentage points from the previous week; 0.07%last week, a significant decrease from 0.14%the previous week.

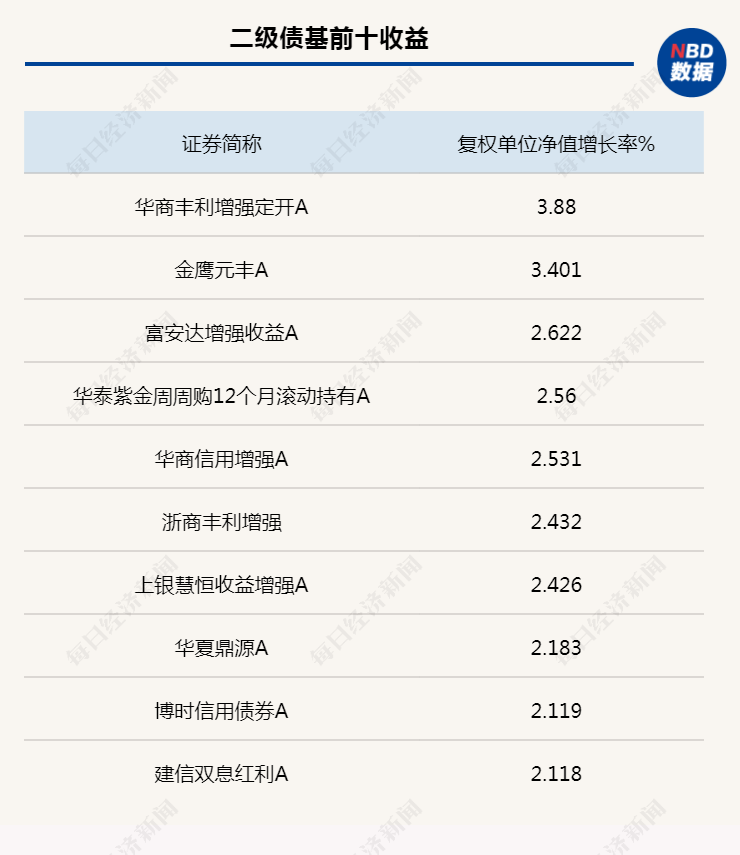

In addition, from the perspective of other rights -containing debt -based performance, the yield level of mixed bond type secondary funds rose last week. Wind statistics showed that last week's mixed bond second -level fund index closed up by 0.59%, and the previous week closed down the decline in the previous week. 0.55%.

Source: Wind statistics

Not long ago, the reporter learned from a number of public fund companies that it has received the guidance of the regulatory window, and in the future, the proportion of "solidaries+" product equity investment will be further restricted. In the guidance of the new regulatory window, products with more than 30%of equity investment will not be defined as "solidaries+".

With the implementation of the new regulations, the equity allocation of the second -level funds of the mixed bond type in the future, and the investment portfolio of the so -called "solid income+" fund may be further adjusted. From the situation of the existing reporters, there are indeed many funds. The proportion of equity allocation among the company's "solidaries+" products is significantly higher than 30 %.

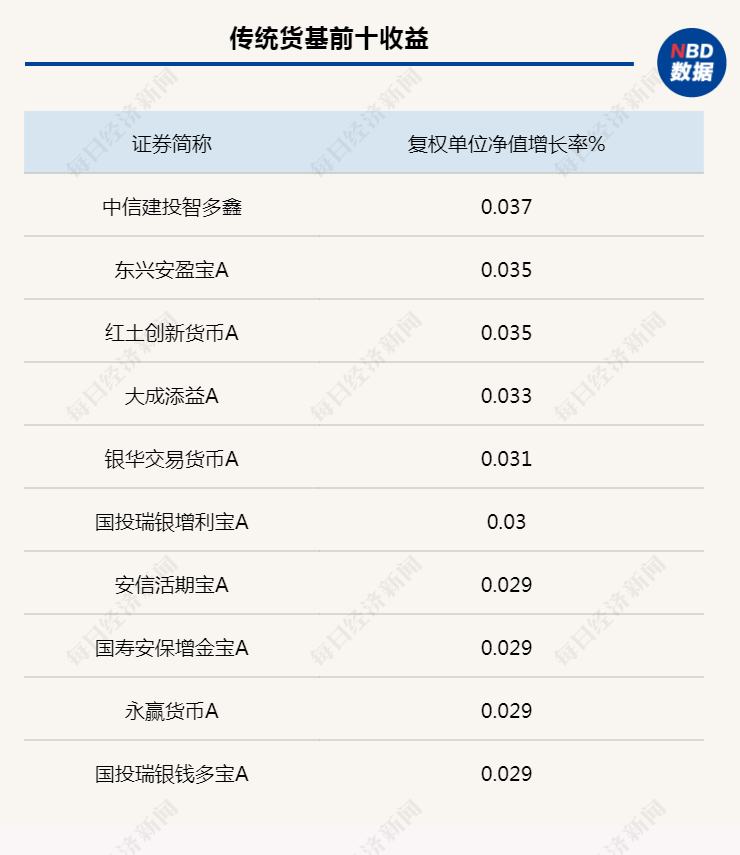

In addition, in the field of solid income investment, the low yield of traditional currency funds has attracted much attention from the industry. Last week, of the 356 traditional currency funds (statistical initial share) of Wind statistics, the average yield was as low as 1.04%, and the attractiveness was significant. Weaken. In terms of quantity, 139 funds have annualized rates as low as within 1%, accounting for nearly 40%.

In addition, the interest rate interest rate also declined slightly last week. According to the statistics of Xingye Securities, last week, the three -month deposit interest rate declined 2BP to 1.53%. Division. The trend of the interest rate deposit interest rate means that the market has not changed its liquidity to maintain liquidity, and it also means that the pressure of the financial system to find assets is far greater than the pressure of liabilities.

Polysis decreased, compressed ticket blending and income space

The market conditions of the aforementioned solidarium investment are generally the case, but referring to the current fund's fundamentals, or it is not difficult to discover the cause, mainly the financial institution's bills represented by banks passively decreased, which has compressed its space for integration.

According to a bank insider, the interest margin of financial institutions is getting smaller and smaller, and it is particularly vigilant for the investment community. In the WeChat exchange with the "Daily Economic News" on September 12, the person said that in general, the continuous easing of monetary policy can easily stimulate the willingness of financial institutions to be widely credit, but there will be a certain stagnation in timeliness, and then bring it. Give the bills for bank bills that are relatively abundant arbitrage space, but the current situation is very different.

"For example, the interest rate of our project loan was above 4%before. Now because of the central bank's interest rate, we have passively reduced the interest rate to 2%. For large financing institutions, the bank will ask the bank to sign an agreement interest rate The purpose is to fall to the end. "Not only that, the person added that it must be reduced to the same as other banks." And the four major bank interest rates are now falling, from four o'clock to more than two o'clock. The company's loan item is the interest rate of the project loan. Therefore, from this perspective, the interest difference between banks is getting smaller and smaller. In fact, it is not a good thing for banks. "

It can be seen that at present, the interest difference between banks is passively low, and the compressed ticket integration of the income space. In the future, with the further relaxation of monetary policy, it will continue to open the arbitrage space, which is also expected to further alleviate the pressure on the liability of the institution.

In fact, from 2019 to the present, the bond market has entered the industry that the industry is said to be a short pattern, and the key to supporting this logic is that the interest difference between the continuous broad credit environment is opened. According to the analysis of the China Golden Harvest Revenue, as the real estate and infrastructure stimulus economic models have shifted to rely on new special essence and green investment manufacturing models, for financial institutions, high -interest assets are scarce and high interest rates have gradually declined. Under the circumstances of the monetary market interest rate and interest rates and bond interest rates, the liabilities of financial institutions have a slow downward interest rate down, causing interest differences in financial institutions to compress.

Therefore, the research and analysis of China Golden Harvest states that monetary policy needs to relax and guide low interest rates such as the interest rates of currency markets to decline, thereby reducing the debt costs of financial institutions to open up interest margins and stimulate the willingness of financial institutions to wide credit. We expect that the central bank's monetary policy will be relaxed, and the length of the relaxation time will be extended compared with the past, resulting in the extension of the bond bull market.

The yield of the bond market may show a trend of shock upward trend

The China -EU Fund publicly stated that for the bond market, the stable growth policy increased, and its strength was not significantly exceeded. The social merit in August was better but the sustainability remains to be observed, and the economy has maintained a long time at the bottom. The market expectations of the market in January and May are more optimistic than they are now. Therefore, after the interest rate is bottomed out, it has caused greater adjustments due to broad -credit concerns. The current expectations have changed significantly, and the interest rate adjustment is expected to be smaller. The capital side has recently paid a high degree of attention, and the center may rise. At present, it is judged to return to the level in June. In the middle of the interest rate, it will still fall down, and the densely promulgated construction period of the construction period may disturb the interest rate. It is recommended to wait and see temporarily. If there is a significant adjustment, you can choose to buy it, and the leverage level maintains neutrality.

Huang Haifeng, Boshi Fund, publicly stated that if there are no special government bonds in the second half of the year, more wide fiscal policies such as special government bonds and the reduction of deficit rates have been introduced, and the economic short -term action is insufficient, and it will be gradually repaired and moved closer to the epidemic. Monetary policy is necessary to maintain a certain amount of easing to take care of the economic recovery.

Generally speaking, the fundamentals do not support the significant upward rate of yields, and monetary policy will not take the initiative to tighten, which restricts the adjustment of the bond market adjustment. If there is a significant adjustment of the market over expectations, it provides us with better configuration and trading opportunities, and we can actively participate in the band market.

Wang Shiqian, the Penghua Fund, publicly stated that in terms of the bond market, in the second half of 2022, the economic fundamentals gradually improved, and the bond market yield may show a trend of shocks. In terms of rhythm, short -term economic restoration may be relatively slow, monetary policy will still maintain a relatively loose tone, and the yield of the bond market may maintain a narrow range of shocks. As the economic upward trend gradually clarifies, the loose monetary policy may converge margin, and the bond market revenue may be converged. Rate may also go up.

Daily Economic News

- END -

Wood Blind Kazakh Autonomous County: Xiaodou Big Industry

Pomegranate/Xinjiang Daily reporter Li Rui reportedOn June 19th, Tianshan Qi Dou B...

Hengyi Petrochemical: Cumulative repurchase of about 42.72 million shares, accounting for 1.17%

Every time AI News, Hengyi Petrochemical (SZ 000703, closing price: 10.51 yuan) is...