Fulde IPO: The growth rate of performance is declining and the gross profit margin fluctuations are closely related to the controlling shareholder

Author:Discovery net Time:2022.09.13

Fulaid was launched in five years, but the net profit growth rate of revenue declined both. The main business proportion was adjusted, and the gross profit margin also changed. The company has a close relationship with the controlling shareholder, with both sales and purchases.

On May 6, 2022, Anhui Fulaid Technology Development Co., Ltd. (hereinafter referred to as Fulde) passed on the GEM of the Shenzhen Stock Exchange. On June 17, the company has submitted registration.

The prospectus shows that Fulde's issuance of no more than 84.6 million shares this time, accounting for not less than 25.00%after the company's total share capital. It is expected to raise 414 million yuan, of which 156 million yuan are used for ceramic thermal spray product maintenance projects, 120 million yuan for ceramic melt and research and development center projects, 58 million yuan for the expansion project of R & D and analysis and testing centers, and supplementary mobile funds of 0.80 100 million yuan.

After reading the prospectus, it was found that Fulde was listed in five years, but the growth rate of revenue was both declined. The proportion of the main business was adjusted, and the gross profit margin also changed. The company has a close relationship with the controlling shareholder, with both sales and purchases. In response to the above situation, it was found that the network sent an interview letter to Fulde's public mailbox to request a question. As of press time, Fulde did not give a reasonable explanation.

Performance growth rate declines gross profit margin fluctuation

Public information shows that Forade was founded in 2017. It is a precision cleaning service provider in the pan -semiconductor field. Focusing on the two major areas of semiconductors and display panels, focusing on providing one -stop equipment precision for semiconductor and display panel manufacturers Washing service provides integrated washing and regeneration solutions for customers' pollution control.

It is found that Fulde has been listed in five years, but in recent years, the net profit growth rate of revenue has both declined. From 2019 to 2021, Fulde achieved revenue of 322 million yuan, 483 million yuan and 569 million yuan, respectively, with a year-on-year growth rate of 138.49%, 49.96%, and 17.94%. , 773 million yuan and 088 million yuan, a year -on -year growth rate of 71.77%, 66.73%, and 19.68%, respectively.

Source: Wind (Fulde)

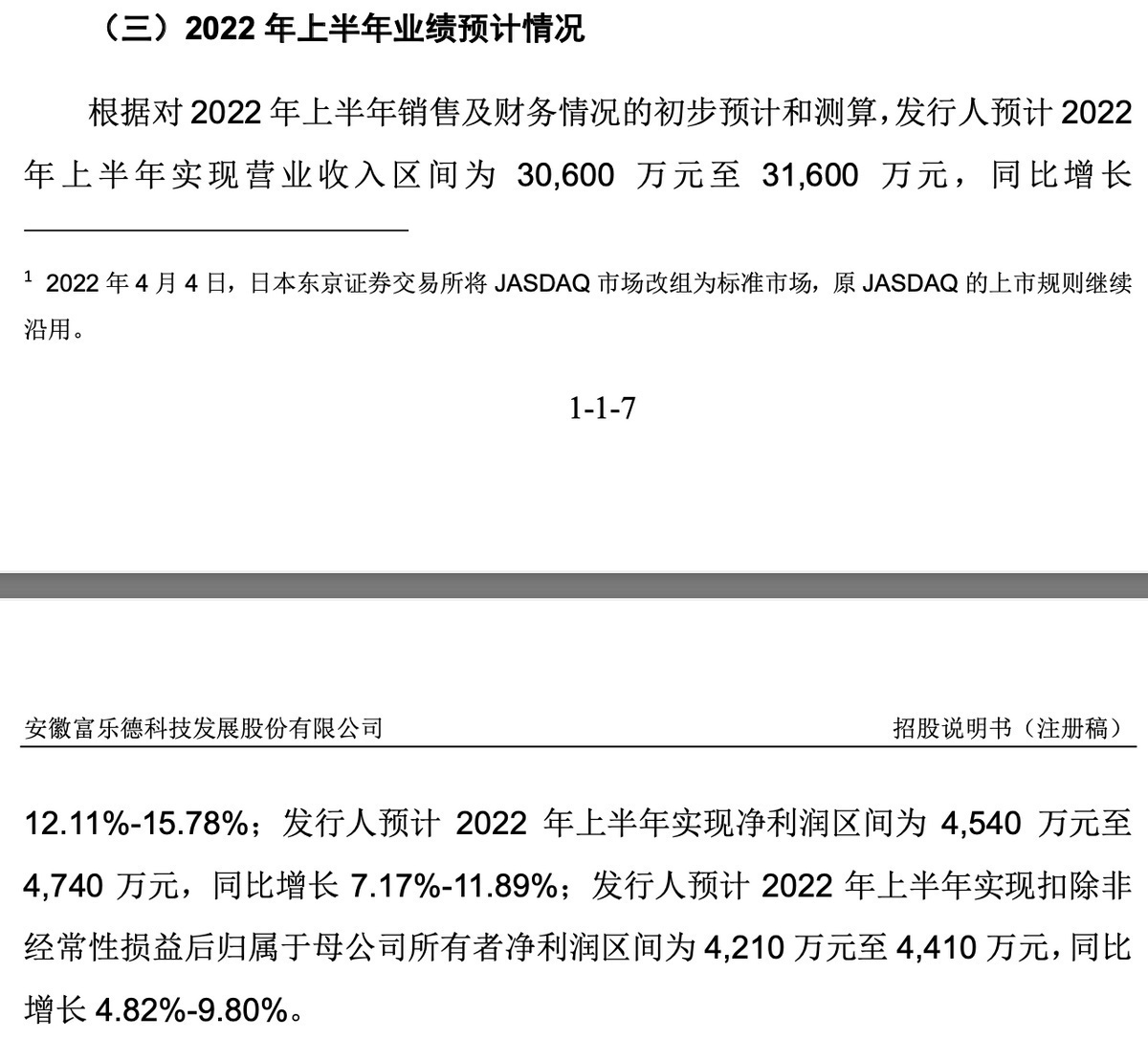

At the same time, according to Fulde's performance in the first half of 2022 disclosed in the prospectus: It is expected that the operating income range is expected to achieve 306 million yuan to 316 million yuan, an increase of 12.11%-15.78%year-on-year; From the yuan to 47.4 million yuan, a year-on-year increase of 7.17%-11.89%.

Source: prospectus (Fulde)

From the expected performance, Fulde's performance growth rate in the first half of this year cannot achieve a large rise. The growth rate of performance has declined year by year, or the company's main business proportion and gross profit margin change in recent years.

Fulaid's main business is mainly three types of services: semiconductor equipment washing service, display panel equipment cleaning service and HS renovation service. From 2019 to 2021, the semiconductor equipment washing service achieved revenue of 93 million yuan, 156 million yuan, and 232 million yuan, respectively, accounting for 30.13%, 33.23%, and 41.35%of the main business revenue; the display panel equipment was cleaned. The service revenue realized revenue was 175 million yuan, 207 million yuan and 196 million yuan, respectively, accounting for 56.64%, 43.92%, and 34.91%of the main business revenue. Yuanhe 13 billion yuan, accounting for 12.73%, 20.67%, and 21.33%of the main business income, respectively.

Source: prospectus (Fulde)

It can be seen that Fulde's display panel equipment cleaning service in 2019 has contributed more than half of revenue, and by 2021, the proportion has fallen by 20 percentage points; the semiconductor equipment washing service has become the largest revenue business in 2021. In addition The scale of renovation service income has also increased rapidly.

Correspondingly, Fulde's main business gross profit margin. From 2019 to 2021, the gross profit margin of semiconductor equipment washing services was 32.88%, 41.70%, and 47.39%, respectively, and 8.82%and 5.69%in 2020 and 2021 respectively. 42.76%and 34.86%, in 2020 and 2021, the change of -5.02%and -7.90%respectively; the gross profit margin of HS renovation services was 32.46%, 21.40%, and 22.25%, respectively. In 2020 and 2021 0.86%. On the whole, Fulde's main business gross profit margin was 41.41%, 42.21%, and 42.02%, respectively, with certain fluctuations.

Source: prospectus (Fulde)

In this regard, Fulde also stated in the prospectus that "if the issuer adjusts the service structure according to his own development strategy and customer needs, or various types of cleaning and derivative value -added services have fluctuated significantly, the company's comprehensive gross profit margin will still exist. Continue the risk of fluctuations. "

And the controlling shareholder is purchasing and sales

The precision cleaning service industry of Fulde's pan -semiconductor equipment is mainly serving customers in the pan -semiconductor industry, so that there is a higher concentration of customers.

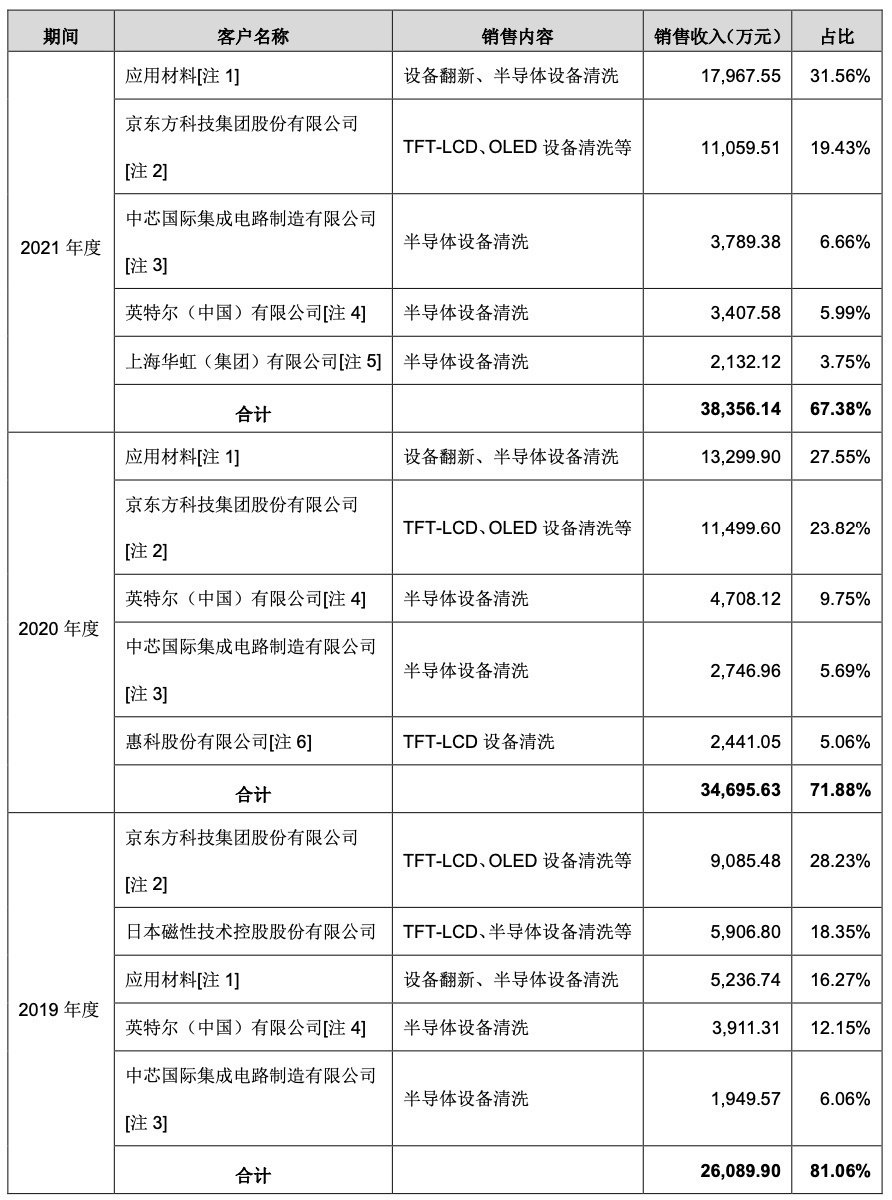

From 2019 to 2021, Fulde's revenue from the top five customers was 261 million yuan, 347 million yuan, and 384 million yuan, respectively, accounting for 81.06%, 71.88%, and 67.38%of the main business revenue, respectively. Among them, Fulde's sales of BOE and application materials accounted for more than 30%of the annual sales, and the proportion of sales of related parties Japan's 2019 annual sales also reached 18.35%. Source: prospectus (Fulde)

The revenue of the top five customers in Fulde accounted for a relatively high income, but it was declining year by year. In this regard, Fulde said, "Although the company's customers and the revenue structure are becoming increasingly diversified, in the foreseeable future, a few large customers' income will still occupy a higher proportion of the company's operating income."

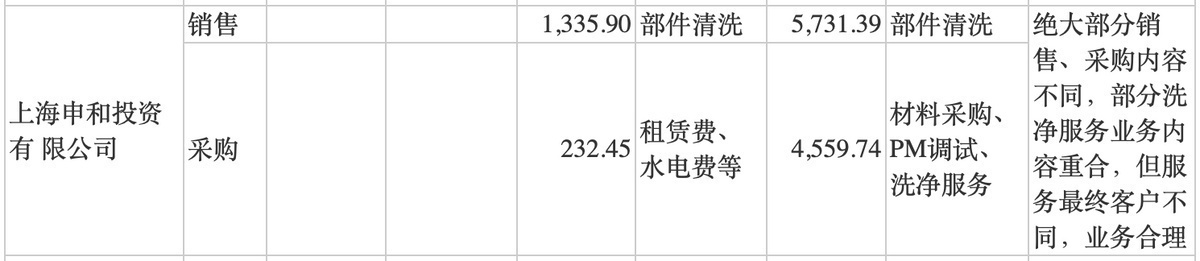

It is worth noting that the company and affiliated parties Shanghai Shenhe Investment Co., Ltd. (hereinafter referred to as: Shanghai Shenhe) exists in the case of both sales and purchasing and washing services. In 2019 and 2020, Fulaid's sales income from Shanghai Shenhe was 57.3139 million yuan and 13.359 million yuan, respectively. 23.245 million yuan.

Source: prospectus (Fulde)

Fulde further explained in the prospectus: In 2019, due to the limited conditions and configuration equipment conditions of the company and some subsidiaries, there was no oxidation processing business, and the purchase of cleaning and oxidation processing services from Shanghai Shenhe. After the reorganization was completed in 2019, Shanghai Shenhe washing business had been transferred to Fulde, Anhui, and no longer engaged in the washing business. In 2020, the company did not have a related transaction to Shanghai Shenhe's purchase and processing services.

And Shanghai Shenhe is just the controlling shareholder of Fulde. As of the prospectus day, Shanghai Shenhe Direct and indirectly controlled 78.806%of the voting rights, while Shanghai Shenhe was also a full -time subsidiary of Ferrotec, a listed company in Japan. As of the end of 2021, Ferrotec did not have a shareholder's shareholding ratio of more than 5%. Therefore, Ferrotec's equity was scattered, and there was no controlling shareholder and actual controller, which also made Fulde no actual controller.

This also means that after the issuance and listing, the current shareholders of Fulde's existing shareholders will be further diluted, and the proportion of FERROTEC's indirectly holding company shares in Japan will also be further reduced. The changes in personnel may cause Fulde's normal business activities.

(Reporter Luo Xuefeng Financial Researcher Chen Kangli)

- END -

[Point stone into gold] "Ice Cream Assassin" is not the long -term way for the company

Dianshi Jinjin is collected by the financial and taxation big data and policy research center of Zhejiang University, and invites experts to commented in depth to present you with attitude and valua

In the past five years, the "Made in Shanghai" brand has continued to make efforts

On May 14, 2022, the first flight test of the first C919 large aircraft of COMAC w...