Does "0 yuan purchase" harm the interests of small and medium shareholders?Analysis of the employee holding plan of Tianqi Lithium: The production capacity assessment or "precision" meet the standard

Author:Daily Economic News Time:2022.09.12

On September 9, the Shenzhen Stock Exchange issued a attention letter to Tianqi Lithium (SZ002466, the stock price was 110.35 yuan, and the total market value was 174.9 billion yuan). The Shenzhen Stock Exchange requires listed companies to the performance assessment indicators involved in the "2022 Employee Holding Plan (Draft)" (hereinafter referred to as the "Draft") Be explained.

According to the unlocking conditions of the employee holding plan, the company's level assessment indicator is "As of the end of 2024, the company's lithium chemical product production capacity has reached 90,000 tons of lithium carbonate (equivalent)." Regarding why there is no revenue and net profit index, the reporter of "Daily Economic News" calls Tianqi Lithium Industry Directors' call today as an investor. If settings are set to revenue targets, too many influencing factors are controlled by the company. "

According to the above -mentioned staff, the current production capacity under construction is "Suining Anju's annual output of 20,000 tons of lithium carbonate projects", and there is a "2,000 -ton metal lithium project" in Chongqing Tongliang.

The reporter noticed that the capacity of 22,000 tons of construction and planned planning was 22,000 tons. If there is currently 68,800 tons of lithium carbonate, in the future, the "90,000 tons" lithium carbonate performance assessment target can be "accurately" achieved in the future.

Shenzhen Stock Exchange send a letter of attention

According to the announcement, the board of directors of Tianqi Lithium held a meeting on August 30 to review and approve the (including) A -share repurchase plan, and agreed that the company's own funds with no less than 136 million yuan and no more than 200 million yuan were agreed. Concentrated bidding transactions repurchase the company's A -share shares for implementing employee holding plans.

Regarding the repurchase price, the average company's stock transactions of the company's shares on the first 30 trading days of the board of directors were 116.88 yuan/share. The total number of shares can be repurchased between 90.67 million shares and 1.333 million shares. According to the "Draft", the transfer price of the employee's shareholding plan is 0 yuan/share, and the 36 -month lock -up period has been set up. The assessment year is from the three accounting years from 2022 to 2024.

In the "Following Letter" of the Shenzhen Communication Institute, the employee holding plan is to be conducive to establishing and improving the interest sharing mechanism of employees and the company, and whether the employee sharing mechanism is in line with The basic principles of "profit and loss at their own risk and self -blessed" in the Guidance Opinions are conducive to improving the competitiveness of the company and the benefit of listed companies and small and medium shareholders. Explain the pricing method, basis and rationality of the employee shareholding plan.

There are also settings for assessment indicators that trigger the dispute between the employee shareholding plan. According to the "Draft", the requirements of the "Company performance assessment" are: "As of the end of 2024, the company's lithium chemical product production capacity reached 90,000 tons of lithium carbonate (equivalent)."

For whether other income and net profit performance assessment indicators can reach the "establish and improve core backbone employees, companies, shareholders '" risk sharing, interest sharing' mechanisms "mentioned in the" Draft ", the Shenzhen Stock Exchange requires Tianqi to Qi Qi The lithium industry explains how to ensure that the employee shareholding plan is effectively produced through the incentive effect.

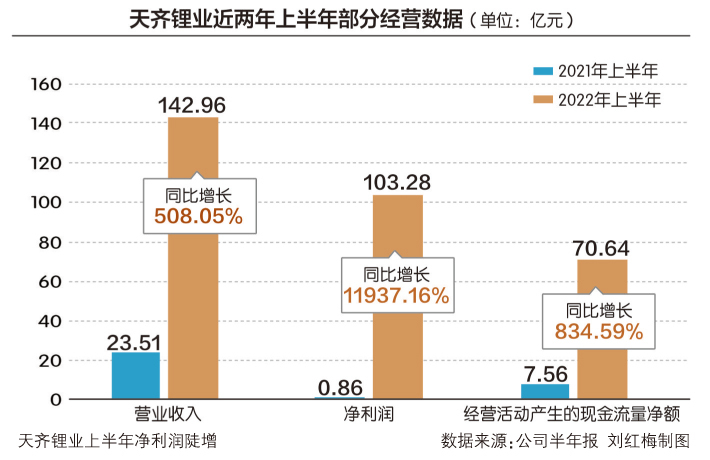

"Daily Economic News" reporter noticed that on the evening of August 30, Tianqi Lithium revealed the semi -annual report. According to data from the semi -annual report, the company achieved operating income of 14.296 billion yuan in the first half of 2022, an increase of 508.05%year -on -year; net profit attributable to shareholders of listed companies was 10.328 billion yuan, an increase of 11937.16%year -on -year. Among similar A -share companies, Tianqi Lithium has the highest net profit and is a veritable "lithium king".

Who will benefit "0 yuan purchase"?

The "Draft" shows that the total number of employees participating in the employee holding plan of the employee's shareholding plan does not exceed 240 (excluding the number of employees reserved), which is mainly directed at the company's overall performance and medium- and long -term development. The company or the director of the holding subsidiary (excluding independent directors), supervisors, middle and senior managers, and core business/technical personnel, including nine directors, supervisors, and senior managers.

According to the employee shareholding plan, the total number of shares corresponding to the shareholding plan of a single employee shares do not exceed 1%of the company's total share capital. Among them, the highest limit of employees' shareholding plan is Xia Juncheng, the president of Tianqi Lithium, with a share limit of 1.9 million copies.

According to the staff of Tianqi Lithium, completing the performance of the company's level of assessment, the human resources department will judge according to multiple indicators such as personal comprehensive KPI completion.

Will "precise" production capacity assessment?

According to the "Draft", in the Tianqi Lithium Employee's shareholding plan, the company's performance assessment indicators at the company's level are "as of the end of 2024, the company's lithium chemical product capacity has a total of 90,000 tons of lithium carbonate (equivalent)."

According to the staff of the director office of the listed company, as of the first half of this year, the company has achieved an annual production capacity of lithium chemical products of 68,800 tons. In other words, as long as the end of 2024, the company can complete the estimated assessment target of 212,000 tons of production capacity.

The above -mentioned staff said that the current production capacity of construction is "Suining Anju's annual output of 20,000 tons of lithium carbonate projects", and Chongqing Tongliang's "2000 -ton metal lithium project" is in the planning and construction stage. The reporter noticed that the company's current/planned production capacity is 22,000 tons. If the plan is completed, it can "accurately" achieve the expected assessment goals in the employee shareholding plan. It can be seen that the "Suining Anju annual output of 20,000 tons of lithium carbonate project" plays a pivotal role in the performance assessment of the company's employee shareholding plan. The staff told reporters that the project is expected to enter the debugging stage in the second half of 2023.

According to public information, the "Suining Anju annual output of 20,000 tons of lithium carbonate project" was launched in 2018, and it is expected to be put into production in May 2020. It is expected to invest more than 1.4 billion yuan. However, by the first half of 2022, the project's cumulative investment was only 83.883 million yuan, and the project progress was only 5.65%.

Regarding whether the capacity of the expansion can be absorbed by the market, the staff said: "This must be combined with the future market conditions, and now there is no way to judge."

As for the slow progress of the project, the company explained in the semi -annual report of this year: "Affected by various factors, the company's operating performance in 2019 has dropped sharply, especially after entering February 2020, the company's liquidity pressure has further increased. Therefore In order to ensure the normal progress of production and operation, the management combined with the company's financial capital status at that time, and decided to adjust the construction progress and capital investment plan of the settlement project to slow down the overall rhythm of the project construction. "

Daily Economic News

- END -

The scale of science and technology awards in Shandong Province has reached 57.6 million yuan, an average annual increase of 28.7% in the past 5 years

Recently, Shandong Provincial Finance has implemented 57.6 million yuan through sc...

Glory X series global users exceed 100 million!Amoy Searchs for the first pit to cancel the bidding, zero advertising recruitment

1. iPhone14 Pre -sale price: New PLUS model starting from 6699 yuanNews on Septemb...