It spent 1.3 million to buy "bank financial management" and did not pay for 3 years.

Author:First financial Time:2022.09.12

12.09.2022

Number of this text: 1950, reading time for about 5 minutes

Guide: When private equity funds have not been included in the supervision in the early years, similar cases are not uncommon.

Author | First Finance Android

Investors think that they have purchased the wealth management products of Guangfa Bank, and the product "compound yields reach 60%~ 70%, and 90%of the compulsory dividends are made each year. Limited partners. After the product "expired", it was unable to pay. The investor brought Guangfa Bank to court in a furious.

Recently, the China Magistrate Book Network announced such a financial entrusted financial contract dispute. The news appeared on Baidu Hot Search. Although the first trial and second trial judgment, investors requested that the lawsuit request for compensation for the principal and income did not get the court from the court. support.

In fact, when private equity funds have not been included in the supervision in the early years, similar cases are not uncommon.

Is it a bank financial management or a private equity fund?

According to the civil judgment of the Shanghai Financial Court published by the referee document network, Cao Cao claimed it. In mid -2012, Zhou Mou, the staff of the Jinshan Sub -branch of Guangfa Bank, informed that there was a wealth management product specifically for VIP customers inside the Jinshan Sub -branch. When he came to Zhou's counter, Zhou introduced the product to Cao's wife, saying that "the compound yield of this product reaches 60%~ 70%, 90%of the compulsory dividends each year, returning to the book in three years, and returning to the entire income in seven years." Essence

Under the guidance of Zhou, Cao opened the card on the spot on the spot, and bought a wealth management product of 1.1 million yuan in principal, and signed on several blank A4 paper in accordance with Zhou's requirements, but did not fill in the date. Since then, Cao has purchased 200,000 yuan of wealth management products at the previous process.

Cao said that in the process, bank staff never informed the product department of private equity funds. He originally believed that the product was a wealth management product issued by the Kingshan Sub -branch of Guangfa Bank. In August 2019, when the product expires, it cannot be redeemed. Cao Mou sued the Guangfa Bank Jinshan Sub -branch to the court.

In the first instance lawsuit, Cao asked Guangfa Bank Shanghai Jinshan Sub -branch to compensate 1.3 million yuan in principal, and lost 6.461 million yuan in compensation yields at an annual compound yield of 71%, but did not be supported by the first instance court. In the second trial, Cao appealed that the bank was sentenced to 1.3 million yuan to pay the principal of the bank and compensated the loss at 15%of the annualized interest rate.

In fact, the so -called "financial product" purchased by Cao is actually the Zhongjin Luhe Fund managed by CICC Innovation Company.

Tianyancha shows that CICC is a limited partnership. The registration time is March 21, 2012, and the business period is from March 21, 2012 to March 20, 2032. The company, Cao Mou is a limited partner, which contributed 1.3 million yuan and the capital contribution was 1.84%.

The dispute is not only Cao, but also a number of investors. According to the facts, more than a dozen people including Cai, Wu, Qian, Cao, Liang, etc. have repeatedly complained to regulatory complaints, and while, they have repeatedly complained to regulatory complaints. The regulatory response restored the original committee of the incident.

On November 19, 2019, the Consumer Protection Bureau of the Banking Insurance Regulatory Commission issued a reply letter saying: After investigation, in May 2012, according to the relevant documents and approval processes in the bank, Guangfa Bank of Jinshan Sub -branch enrolled CICC Innovation Capital, and promoted the inside of the bank to promote the promotion of this in the bank. The fund managed by CICC Innovation Company under the institution. At the same time, Guangfa Bank signed an agreement with Party B with China Jin Runhe, CICC, CICC, and CICC Stable Entrepreneurship Investment Center (Limited Partnership) as their consultants and custody banks.

On November 6, 2019, the Consumer Protection Bureau of the Banking Insurance Regulatory Commission issued the "Notice on the Case of Emperor Insurance and the Cases of Consumer Rights", which states that in 2012, Guangfa Bank was promoted to cooperate products on behalf of its internal "Private Equity Fund (PE)). "Plan", in the bank to promote private equity funds for private equity funds. Fund expired in August 2019, with a debt -floating loss, and the failure of investing in investment in capital and income, which caused consumers to complain.

The focus of the three major controversies is solved one by one

The Shanghai Financial Court believes that the case is a dispute caused by individual investors to subscribe to private equity funds at the bank outlets.

There are three disputed focus: first, the product involved in the product is the wealth management product issued by Guangfa Bank or the establishment of the CICC Private Equity Equity Fund initiated by CICC; the other is the product involved in the case. If there is any fault in the above links; the third is whether Cao has the right to request compensation for all investments and benefits.

For the first point, the Shanghai Financial Court believed that Cao insisted that he purchased wealth management products issued by Guangfa Bank, but failed to provide corresponding written vouchers, nor could it explain what specific products purchased. Proposal does not accept letters.

For the second point, Cao advocated that due to the introduction of the staff of the Kingshan Sub -branch of Guangfa Bank and subscribed to the product involved in the case, the Kingshan Sub -branch of Guangfa Bank should bear the liability for its losses. The Kingshan Sub -branch of Guangfa Bank denied the section of "Promotion and Sales" but failed to provide the dual records of the time.

In the end, the Shanghai Financial Court identified the fact that the "agency sales agency" involved in the product "agency" of the Kingshan Sub -branch of Guangfa Bank, combined with the relevant "Answers" and "Reply Letter" issued by the regulatory authorities. There is a fault to conduct risk tolerance assessment and not properly keep business information. For the third point, Cao advocated that the product expired in August 2019, but the Kingshan Sub -branch of Guangfa Bank has not been paid so far, and its loss has actually occurred. Guangfa Bank Jinshan Sub -branch believes that the case involved in the private equity fund is still continued normally, and the operation of the fund involved in the case is good. Without liquidation, whether Cao has lost the loss and the amount of losses has not been determined. Income loss.

In this regard, the Shanghai Financial Court held that the case involving private equity investment funds expired on August 8, 2019. However, from the perspective of the underlying assets invested by the fund, two of them intend to list on the motherboard and the New Third Board, and the future development prospects are better. In summary, Cao's investment loss has not yet been presented.

In summary, the Shanghai Financial Court made a judgment that Cao's appeal request could not be established, rejected the appeal, and maintained the original sentence.

- END -

Helping the "Gazette Enterprise" jumped into the capital market, Huangpu held a special training meeting for the "Peking Stock Exchange Policy Interpretation"

Recently, the Huangpu Gazette's Peking Stock Exchange Policy Interpretation specia...

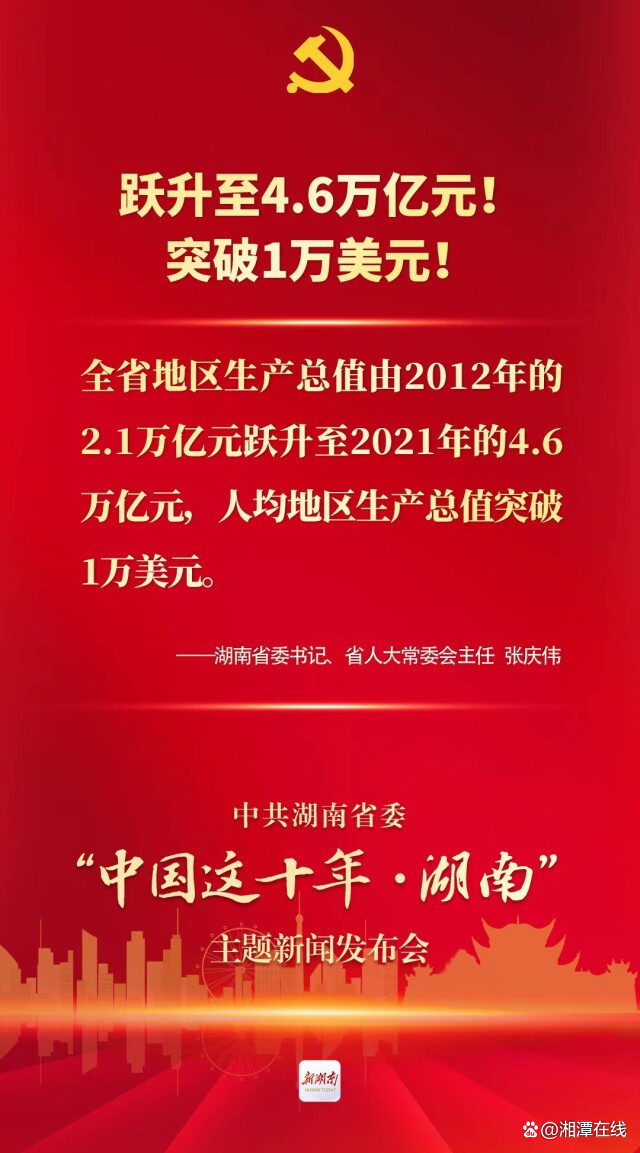

China's ten years · Hunan 丨 GDP jumped to 4.6 trillion yuan!Per capita GDP exceeds $ 10,000!

Hunan Daily August 5th (All Media Reporter Deng Jingzheng) At 10:00 on August 5th,...