"Little White Milk" originally applied for bankruptcy and reorganization after delisting, and once wanted to become a "central milk carrier"

Author:Chengdu Business Daily Red Sta Time:2022.09.12

Remember the transparent packaging net red white milk? Today, the company behind it has been forced to delist and bankruptcy.

In 2016, Kody Dairy launched net red white milk, which was hot. The founder of the company Zhang Qinghai has publicly shouted, to build Cydi's dairy industry as a "central dairy carrier" that is Banomo and Yili.

Data chart according to IC Photo

However, after 2018, Cepy Dairy deducted non -net profit for 4 years, and was trapped in the storm and financial fake storms of "milk farmers." The market for 10 years is banned ... it can be called "one place".

In May of this year, Kody Dairy, who returned to heaven, was terminated and listed by the Shenzhen Stock Exchange, and more than three months later, it was ruled by the court for bankruptcy and reorganization. The "little white milk" originator, who was once the limelight, is now noisy.

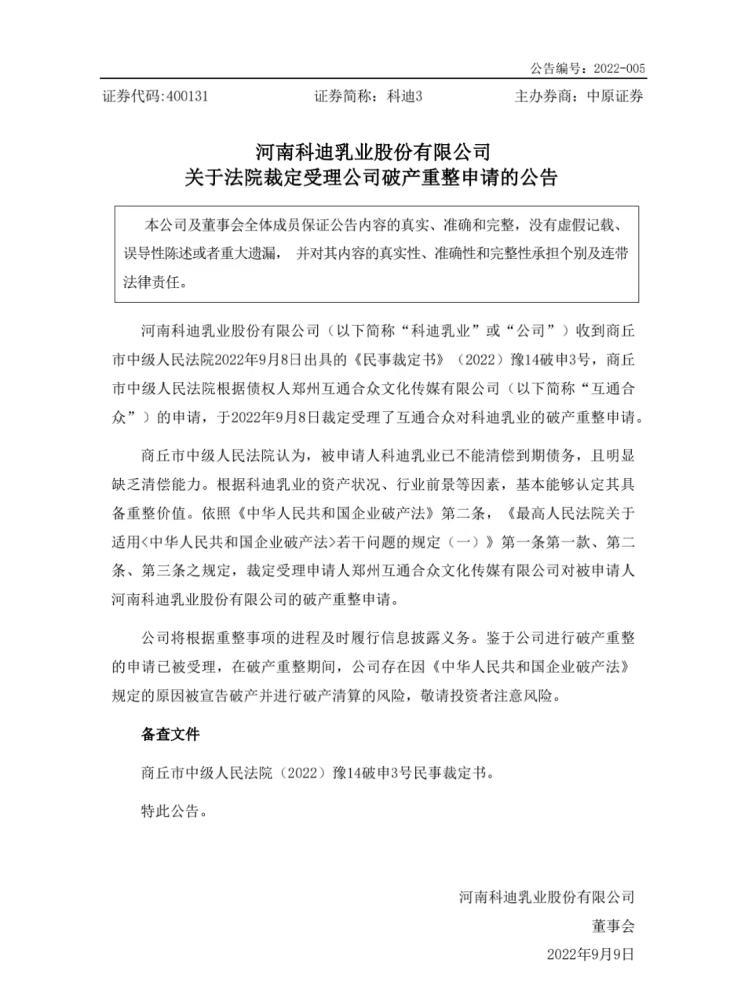

Kody Dairy is applying for bankruptcy and reorganization

According to the Red Star Capital Bureau, on September 9, Cydie Dairy issued an announcement that the company received the "Civil Ruling Book" issued by the Shangqiu Intermediate People's Court. Congress Culture Communication Co., Ltd.'s application for bankruptcy reorganization of Kody Dairy.

Screenshot of Cody Dairy Announcement

The Shangqiu Intermediate People's Court believes that the respondent Cody Dairy has not been able to pay off the debt due, and it is obviously lacking the ability to settle. According to factors such as Kudy Dairy's asset status and industry prospects, it can basically determine its reorganization value. In accordance with relevant regulations, the applicant's application for the applicant's bankruptcy and reorganization of the applicant's applicant Cody Dairy.

Kydai Dairy said that the company will timely fulfill the information disclosure obligation in a timely manner according to the process of reorganization. Given that the company's application for bankruptcy and reorganization has been accepted, during the bankruptcy reorganization, the company has the risk of being declared bankrupt and bankruptcy.

Data show that at the end of the 2021 annual report period, the balance of liabilities of Cody Dairy was 1.967 billion yuan, of which the short -term borrowing of 560 million yuan was overdue, and the asset -liability ratio was as high as 96.43%. Due to the tight funds of the company and subsidiaries, at present facing more judicial lawsuits, related lawsuits have caused some of the company's account to be frozen, the company has been included in the list of dishonesty executives, and the frozen of major bank accounts has a significant impact on the company's production and operation activities on the company's production and operation activities. Essence

Due to the failure to issue a standard opinion report

The Red Star Capital Bureau noticed that as early as the bankruptcy and reorganization, in May of this year, Kody Dairy was issued by the accounting firm that the accounting firm could not express an opinion on the 2021 financial report, and the relevant stocks related to the Shenzhen Stock Exchange terminated the listing situation. The Shenzhen Stock Exchange was terminated.

Screenshot of the Pentilities of Kody Dairy

Back to the announcement that due to the audit report issued by the 2020 financial report, Kody Dairy Stocks were issued by the delisting risk warning from May 6, 2021, and the stock abbreviation became "*ST Cody". In order to avoid being delisted,*ST Kody needs to meet the net assets of 2021, and the 2021 annual report as a standard opinion report to keep the listing status.

But*ST Cody only completed the previous indicator. The financial report in 2021 shows that*ST Ce Ci achieved operating income of 591 million yuan, an increase of 24.22%year -on -year; net profit was 69.048 million yuan, an increase of 105.69%year -on -year. However, since 2018,*ST Coddie's non -net profit has been lost for 4 consecutive years. From 2018 to 2021, the non-net profit of*ST Kody was -010 million yuan, -175 million yuan, -34 billion yuan, and -139 million yuan, respectively.

And another indicator of the standard report,*ST Cody cannot complete. As the type of opinions issued by the accounting firm in 2021, the type of opinion issued by the 2021 is still unable to express their opinions. Touching the termination of the relevant stocks of the Shenzhen Stock Exchange, the Shenzhen Stock Exchange decided to terminate the listing of Kody Dairy stocks.

On June 23, 2022, Kody Dairy, who was listed for 7 years, was delisted by the Shenzhen Stock Exchange. On August 24, the company's shares began to be listed on the New Third Board.

Once in the storm of "milk farmers' arrears" and financial fraud storms

Once upon a time, Kody Dairy was also the Internet celebrity milk brand. The founder of the company Zhang Qinghai has publicly shouted, to build Cydi's dairy industry as a "central dairy carrier" that is Banomo and Yili.

In 2016, Kody Dairy launched a transparent packaging "Internet Red White Milk", which quickly swept the entire Henan market and moved towards the country. Kody Dairy was also known as the "little white milk" originator. However, the Red Star Capital Bureau noticed that today's major milk brands, such as Yili, Mengniu, Sanyuan, Tianrun, Western Central Chun, etc. have launched their own "small white milk". Again.

In addition, Kody Dairy has also been trapped in the storm and financial fraud storms of "milk farmers", which has greatly damaged the company's reputation and performance.

In April 2019, Kody Dairy was exposed to lack of milk agricultural goods and dealers continued to be crushed. It involved thousands of dairy farmers in Henan, Hebei, Shandong, Shanxi, Jiangsu and other places, with a amount of 140 million yuan. Subsequently, the Shenzhen Stock Exchange issued a letter of inquiry on the arrears. Affected by this, Kody Dairy's revenue was 813 million yuan in 2019, a year -on -year decrease of 36.77%, and the net profit of returning to the mother was 49.6245 million yuan, a year -on -year decrease of 138.43%.

Subsequently, Kody Dairy encountered financial fraud.In September 2021, it was verified by the Henan Securities Regulatory Bureau, and Kody Dairy's total revenue increased by more than 840 million yuan in 2016-2018 and 300 million yuan in profits.100 million yuan, 2.5 billion yuan, 3.4 billion yuan, and 6.8 billion yuan, controlling listed companies to provide a cumulative guarantee of 500 million yuan for its violations.The Henan Securities Regulatory Bureau decided to fined 600,000 yuan in Kody Dairy. The former chairman Zhang Qinghai was fined 900,000 yuan and took a 10 -year securities market forbidden measures.At the same time, the company's controlling shareholder Cody Group also broke out of the debt crisis and was in trouble.In September 2021, 10 companies including Kody Group were ruled to enter the reorganization process.On April 22, 2022, Cordi Group and other companies merged the reorganization plan approved by the court.

Red Star News reporter Xie Yutong

Edit Yu Dongmei Pengjiang

- END -

Shandong Consumers Association reminds: Consumers are opposed to excessive packaging and returning to food itself when buying moon cakes

In order to actively respond to the consumer supervision of the Chinese Consumer Association and the China Bakery Foods and Sugar Industry Association, the concept of the promotion of moon cakes such

The production and sales data of the five major pig companies turned in July. How to get the price of pigs in the future?

As of now, the five major listed pig companies have disclosed a briefing of the sa...