up to date!Wang Guobin, Fu Pengbo, Zheng Youwei ... Star Fund Manager's position exposure!

Author:Broker China Time:2022.09.12

Since mid -August, the market has been in a shock, and the fund manager has also taken the opportunity to start positioning stocks to pick up chips for the next round of market.

Recently, a number of listed companies have disclosed announcements such as fixed increase and repurchase, and the latest position adjustment of a group of star fund managers has also been exposed.

Among them, Wang Guobin's Quanguo Fund, Castrol Fund, JPMORGAN and other well -known investment institutions appeared on Plaid's Dingzi List. The veterinary drug industry attracted more and more investors' attention at the industry's low point; Zheng Youwei of the Fund added a position on the double -shares of this year's Guanghui energy. In addition, Feng Mingyuan, the star fund manager of the Cinda Austrian Fund, participated in the decision -making increase in the electronic company Kexiang.

Wang Guobin participated

On September 10, Plaid announced that the issuance of non -public offering of A -share shares in 2021. The issue price of non -public issuance shares was 28.58 yuan/share, and the final raised funds were about 898 million yuan, and the number of issuance shares issued issues was about 898 million yuan. It was 3142.05.73 million shares.

It is worth noting that the Quanguo Fund founded by Wang Guobin appeared on the list. Specifically, the Quanguo Fund participated in the fixed increase through 53 asset management plans, and eventually received approximately 5.3884 million shares for 28.58 yuan/share, with a total amount of about 154 million yuan.

The Fund Industry Association's filing information shows that the Quanguo Fund has filed a total of 51 asset management plans, all of which are Wang Guobin's special account product Quanguo Fund Taoyuan Phase I in August, which also means that Wang Guobin personally participated in Plekko. The fixed increase. Assuming that based on the above -mentioned shareholding, regardless of other situations, after the issuance of new shares issued this time, the Quanguo Fund will ranks the fifth largest shareholder of Prako, with a shareholding ratio of 1.53%.

In addition to the Spring Fruit Fund, for this fixed increase, the well -known investment institutions such as Castrol Fund and JPMORGAN also participated in it. Among them, the 3 public fundraising funds and 21 private equity asset management plans of Castrol Fund have been provided with 40.588 million shares, with a amount of 116 million yuan. It was 32 million yuan; JPMORGAN Chase Bank received 1.6795 million shares, with a amount of 48 million yuan.

Prako is a well -known domestic veterinary pharmaceutical company. The company was established in 2002 and was listed on the main board of the Shanghai Stock Exchange in 2015. It is mainly engaged in the development, production, sales and related technologies of veterinary drugs, chemicals and Chinese veterinary drugs. This fixed increase is mainly used to build an active vaccine production project, biological product workshop and supporting facilities, the product quality inspection workshop project, and supplementary funds. The diseased bird flu vaccine production line will help break through the bottleneck of existing capacity and enhance the company's highly pathogenic avian influenza vaccine domestic and international market share.

The semi -annual report shows that the company's operating income and net profit attributable to the mother in the first half of the year were 513 million yuan and 80.259 million yuan, respectively, a decrease of 11.48%and 50.94%from the same period of the previous year. Regarding the decline in revenue and net profit attributable to mother, the company said that there are mainly the following three major reasons:

First, in the first half of 2022, the breeding industry was under great pressure, which had a greater impact on the veterinary drug industry. In the first half of 2022, affected by factors such as the high level of feed prices and the overall price of pigs, the breeding industry was under great pressure. The veterinary drug industry mainly served the downstream breeding industry. From the perspective of demand, the demand for veterinary drug products was higher than that During the same period of the same year, the sensitivity to product prices has improved to a certain extent; from the perspective of supply, due to market demand, the production of veterinary drug production enterprises has decreased, the fixed costs of the unit products have increased, and the gross profit margin of the product has increased. It must have an impact.

The second is that the new veterinary drug GMP reconstruction acceptance has a certain impact on the company's profit level in the short term. According to the requirements of the 293rd announcement of the Ministry of Agriculture and Rural Affairs, all veterinary drug manufacturers should meet the new version of veterinary drug GMP requirements by June 1, 2022. In order to meet the above -mentioned new veterinary drug GMP requirements, the company and some subsidiaries have successively carried out short -term production and transformation of some production workshops in the third quarter of 2021. In the first half of 2022, the company has completed GMP transformation and acceptance work. The level has a certain impact.

Third, the company has increased the construction of direct sales channels, and sales costs have increased. With the rapid development of the downstream breeding industry towards scale, intensive, and standardized, the company established a strategic customer department in July 2021 to coordinate the company's product resources, customer resources, and technical resources to form a "medicine seedlings linkage" mechanism and continue to continue Promote the construction of direct sales channels. From January to June 2022, the company's direct sales revenue accounted for 55.75%of the main business revenue, an increase of 3.25 percentage points from the same period last year; the sales cost was 145.4136 million yuan, an increase of 6.29%over the same period last year. It is to develop and maintain direct sales customers. The sales expenses paid increased compared to the same period last year.

From the perspective of the stock price trend, Plako has rebounded by about 54%from the low point on April 29 to September 9th. Among them, the stock price on August 9 once reached a height of 34.9 yuan, but then recovered about 12%. As of the closing of September 9, Prako's latest stock price was 28.54 yuan/share, an increase of 30.14%during the year.

Fu Pengbo, Zheng Youwei Jiacang Guanghui Energy

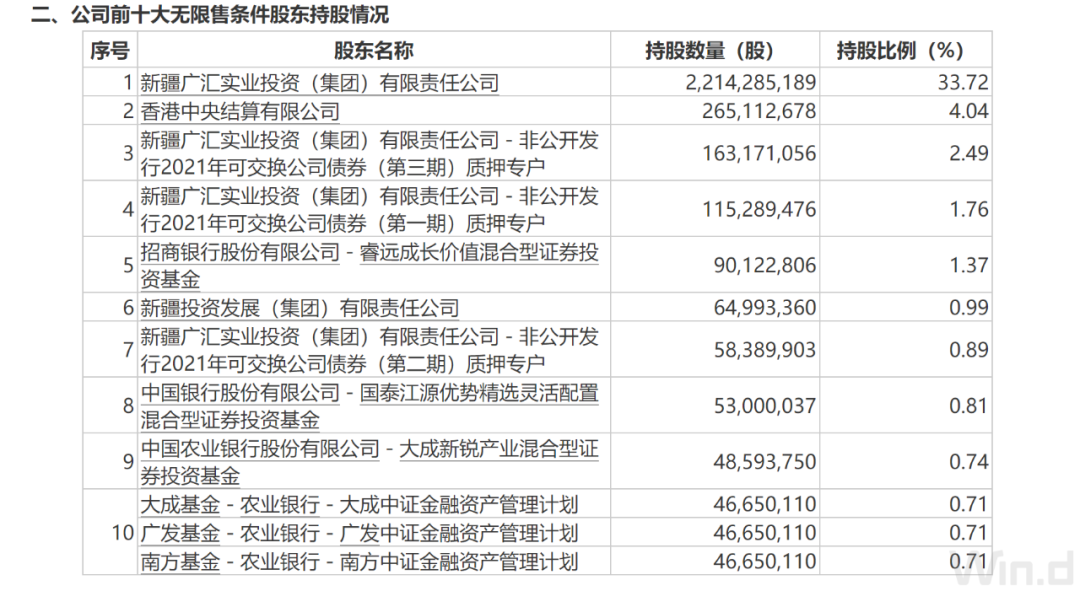

On September 8th, Guanghui Energy announced the latest top ten circulation shareholders due to the repurchase of the controlling shareholder, Fu Pengbo's Ruiyuan growth value, Zheng Youwei's Guotaijiang source advantage, Han Chuang's Dacheng industry and many other star funds Manager's products appeared in the top ten circulation shareholders. It is worth noting that compared with the end of the second quarter and the third quarter, Fu Pengbo and Zheng Youwei have added positions on Guanghui Energy.

Specifically, as of September 2, Fu Pengbo's growth value held 90.228 million shares of Guanghui Energy, an increase of 25.059 million shares compared to the end of the second quarter, which is currently ranked fifth in circulation. Guotaijiangyuan's advantage holds 5.304 million shares of Guanghui Energy, and has entered the top ten shareholders of the top ten circulation shareholders.

Guanghui Energy was founded in 1994 and was listed on the Shanghai Stock Exchange in May 2000. It is currently a private enterprise that currently owns three resources of "coal, oil, and gas" at home and abroad. Relying on rich natural gas, coal and petroleum resources, the company has built a comprehensive energy of liquefied natural gas (LNG), methanol, coal, coal tar, and ethylene glycol. The industrial system has formed four major business segments: natural gas liquefaction, coal mining, coal chemical industry, oil and gas exploration and development. Energy listed company.

In the context of global energy supply and demand mismatch, in the first half of this year, Guanghui Energy achieved a net profit of 5.131 billion yuan, an increase of 264.62%year -on -year, of which Q2 achieved a net profit of 2.9 billion yuan, an increase of 382.8%year -on -year, which was a single single, which was a single single, which was a single single, which was a single single, which was a single single. The quarterly performance history is recorded. Guanghui Energy's stock price has also made great progress all the way. Since this year, it has doubled. As of September 9, it has increased by about 125%.

The repurchase is the operation of the company's controlling shareholder Guanghui Group based on the confidence of the company's future development prospects and the recognition of internal investment value. Effectively combine the interests of shareholders, the interests of the company, and the core team of core teams, so that all parties will pay attention to the company's long -term development.

In contrast, Han Chuang of Dacheng Fund stopped the profit operation of Guanghui Energy. As of September 2nd, Han Chuang's Dacheng Emerging Industry held 48.5938 million shares of Guanghui Energy, a decrease of 15.7292 million shares compared to the 64.323 million shares at the end of the second quarter, and currently ranked ninth.

Feng Mingyuan's layout of Kexiang shares

At the end of August, Cinda Australia and Asian Fund announced that funds such as Xin'ao and New Energy Industry, Xin'ao Advanced Intelligent Manufacturing, Core Australia Core Technology and other funds participated in the subscription of non -public offering shares of Kexiang. Feng Mingyuan.

The announcement shows that Feng Mingyuan's fund managed a total of 2.56 million shares of Kexiang. Among them, Xin'ao and New Energy Industry subscribed for over 1.014 million shares, and Xin'ao's leading Smart Selection subscribed for more than 280,000 shares. In total, the total cost of these 7 funds participated in the fixed increase was 27 million yuan. As of the announcement, the book value has risen to nearly 28.09 million yuan.

In addition to Feng Mingyuan of the Cinda Australia Fund, the report of the issuance of shares issued by a recently issued by Kexiang shares showed that the company's fixed increase issue price was 13.13 yuan per share, and the number of issued shares was 11.424 million shares. In the end There are 3 fixed -income institutions. In addition to the Cinda Australia Fund, Caitong Fund also subscribed for nearly 33 million yuan among public funds.

Public information shows that Kexiang Co., Ltd. is a national high -tech enterprise that specializes in research and development, production and sales of electronic circuits. In the investigation, the company said that it currently has a group of well -known customers such as BYD, Sunshine Power, Dahua Technology, and Starnet Ruijie. It is one of the top PCB (printed circuit board) companies in China. Market Competitiveness. It is reported that the fundraising will be used for the company's MINI LED construction project for MINI LED.

In terms of stock price, Kexiang's shares rebounded from April 12, and rose by more than 45%on August 15th, but its stock price fell sharply since mid -August, a decline of nearly 20%. As of September 9, the closing price of Kexiang shares was 12.86 yuan, which was lower than the fixed increase price of 13.13 yuan.

Editor: Lin Gen

School pair: Wang Wei

- END -

Altay: Focus on the "five major industries" to focus on the key industry chain investment promotion

Pomegranate/Xinjiang Daily reporter Zhang Ting correspondent Hu JunxiuOn July 8th,...

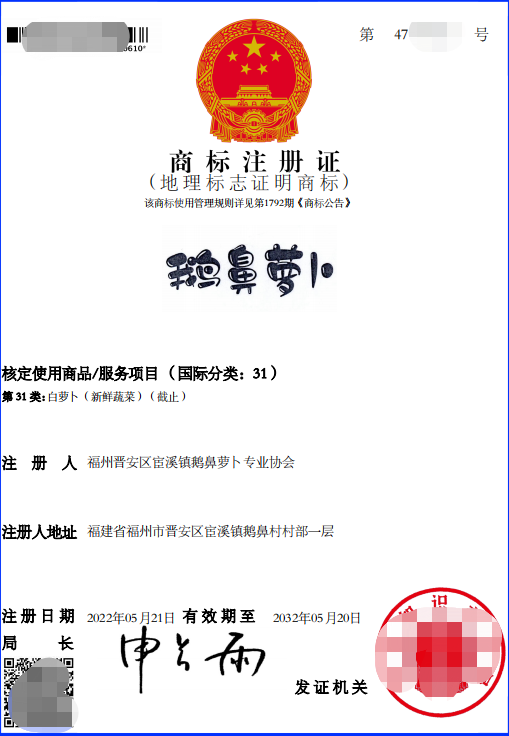

awesome!The country is latest!It's Jin'an again!

Following Shoushan stone carving and bergamotNational Geographic Symbol Certificat...