Drawing on real estate and mobile Internet to see new energy!Haitong strategy: high heat may continue

Author:Broker China Time:2022.09.12

Source: Stock Market Xunye ID: xunyugen

Core conclusion: ① Industrial cycle: The population age structure determines the real estate cycle, and the penetration rate of smartphones determines the mobile internet cycle. At present, the penetration rate of new energy vehicles is only 25%, photovoltaic wind power generation accounts for 11%, and the new energy industry cycle has not yet been completed. ② Profit valuation: During the high growth stage of real estate and mobile internet, the PEG center of the related industrial chain is around 1. At present, the new energy vehicle PEG is around 0.5, and the valuation is not high. ③ Configuration and transaction: At present, the configuration and transaction popularity of the new energy industry chain fund is high, but as long as the prosperity of real estate and mobile interconnection is referred to, as long as the prosperity is still there, the high heat has maintained a long time.

The value sector has performed well in the past week, whether the style will be switched, and whether the new energy sector can continue the previous good performance is the focus of market attention. The short -term fluctuations in the market style are normal, and the focus is on the analysis of the mid- and long -term trends. This report draws on history, compares the three dimensions of industrial cycle, corporate profitability, transaction and allocation, and compares and analyzes this round of new energy cycle and previous real estate cycles and mobile Internet cycles.

1. Industrial cycle: new energy is still in the fast penetration stage

From the perspective of the industrial development cycle, we sort out the driving factors and iconic characteristics behind the three-wheeled stock market cycle of the real estate cycle of 05-10, the 10-15-year mobile Internet cycle, and the new energy cycle from 19 to the present.

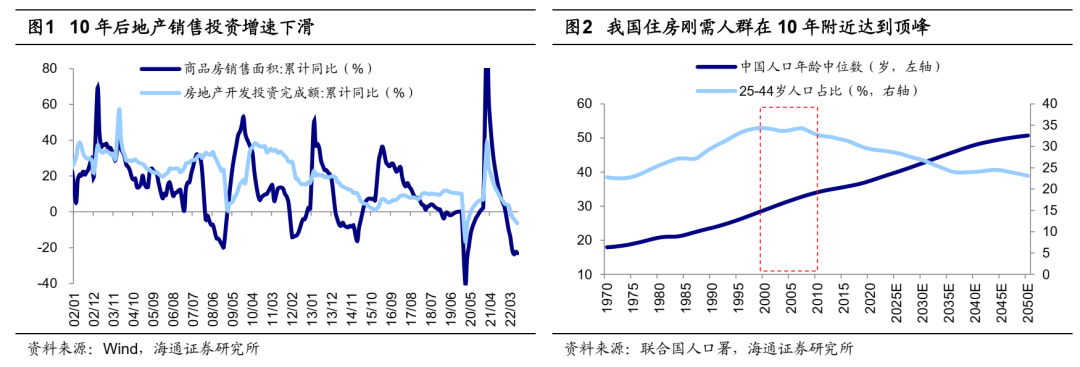

The age structure of the population determines the real estate cycle. In 2005-10, high growth and 11 years began to slow. Under the promotion of population and policy factors, the real estate cycle kicked off, and the rise of real estate and related industries. In July 1998, the State Council issued the "Notice on Further Deepening the Reform of the Urban Housing System and Accelerating Housing Construction" to comprehensively end the distribution of real housing objects. process. At the same time, the people aged 25-44 in my country have just reached the peak of the stage, and the urbanization rate rose from 36%in 2000 to 50%in 2010. The demand for residential housing was released. During 2000-10, the average annual growth rate of commercial housing sales reached 18%, and it was 44%in 2009. After 2010, my country's industrial transformation and upgrading kicked off, and the leading industry shifted from real estate -based to consumption and technology. In addition, the proportion of population between 25-44 years in my country has decreased from 32.7%in 10 years to 29.2%of 21 years. The changes in the population structure have also caused residents' rigid configuration to decline in real estate. Under the influence of changes in the industrial structure and population structure, the trend of the real estate industry has ended, the center of real estate sales and investment growth has declined significantly, the average annual growth rate of real estate sales has decreased from 18%between 00-10 years to 5%from 11 years and to the present. The speed average value also decreased from 25%to 11%, a decrease of a decrease of annual growth rate of manufacturing investment in the same period.

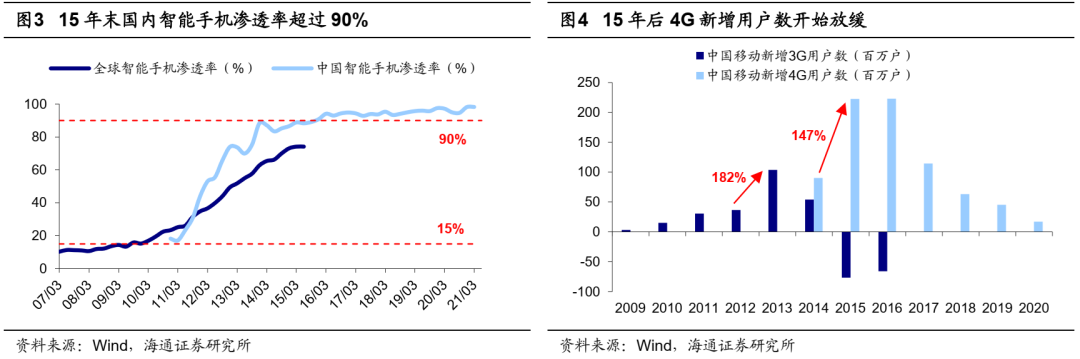

The penetration rate of smart phones determines the mobile internet cycle. In 2010, high growth and 16 years began to slow down. The mobile internet cycle starting in 2010 is the stage where 3G technology matures and transitions to 4G. The Internet officially enters the 4G voice and video era from the 3G picture era. During this period, many powerful macro -support policies and top -level design were introduced. In 2012, the "Twelfth Five -Year Plan" of Broadband Network Infrastructure "made 4G as an important engine of my country's telecommunications industry. In 2014 and 2015, the government work report Emphasize the development of 4G technology and accelerate the promotion of the "Internet+" strategy in various industries. With the support of the policy, the 4G base station was quickly constructed. The annual growth rate of 4G base stations in 13 years was 33%, and 14 years were 95%. Infrastructure construction has laid the foundation for the rapid infiltration of smartphones. Domestic smartphone shipments increased from 90 million units in 2011 to 460 million in 2015, with a compound annual growth rate of 48%. With the rapid penetration of smartphones, the evolution of industrial evolution starts from electronic devices and gradually transmits to software content to scene applications, driving the high prosperity of the entire industry chain. After 15 years, the development of the smartphone industry entered a mature period. At the end of 15 years, the penetration rate of smartphones exceeded 90%. Since then, the sales of smartphones have fallen, and the increase in the penetration rate has begun to slow down or even stagnate. This round of technology industry trends have also ended.

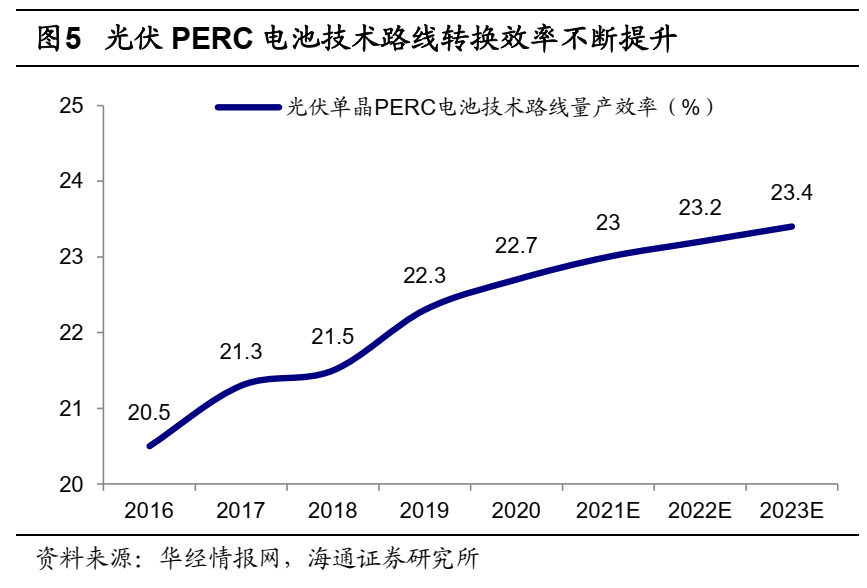

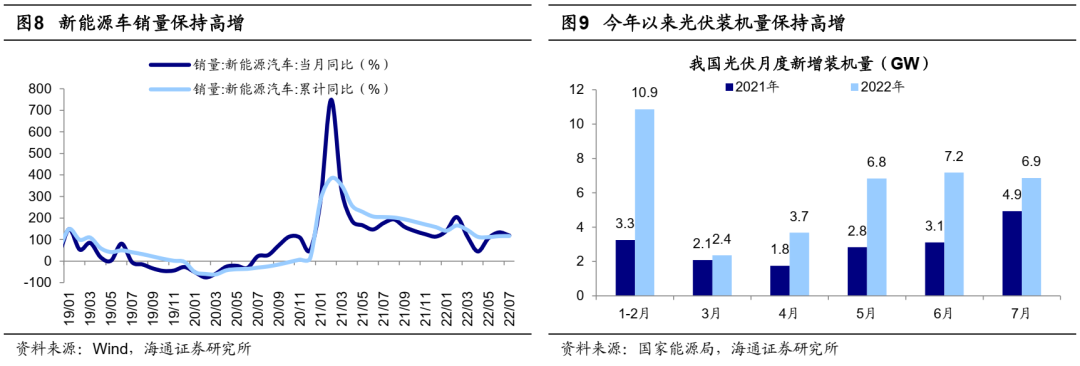

New energy vehicles are still in the fast penetration stage, and the proportion of wind power in the energy field is gradually increasing. Since 2019, the rise of the new energy industry is inseparable from the driver of technological progress. Since 2016, photovoltaic single -crystal PERC battery technology has continuously improved the production conversion efficiency. At present, it is iterating from the PERC route to the higher limit conversion efficiency. The battery life and battery pack energy of the car continued to increase. Technological progress is the basis of the large -scale development and application of new energy, and the support of policy has further accelerated the penetration of the new energy industry.

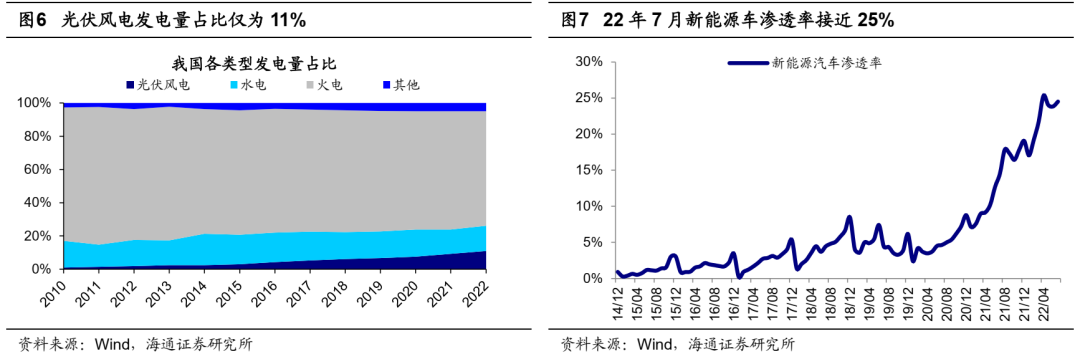

In terms of photovoltaic wind power, the first batch of landscape bases released at the end of 21st in 21st year planned nearly 100GW wind power and photovoltaic installation machines. At present, construction has been fully started. The second batch of wind power and photovoltaic installations exceeded 400GW. The policy support is the rapid volume of wind power installation machines. From January to July this year, the new photovoltaic installation machine increased by 110%compared with the same period last year, and the new installation of wind power increased by 19%. As of July 22, the cumulative installed capacity of photovoltaic wind power was 687GW, and the "Opinions on Completion and accurately implementing the new development concept for the new development concept to do a good job of carbon and carbon neutrality" issued by the State Council in October 21st The installed capacity is 1200GW. From the perspective of power generation, the proportion of wind power photovoltaic power generation from January to July 22nd to 11%, and the notice of the "Two wind power, photovoltaic power generation development related matters issued by the Energy Bureau in April 21 (draft for comments) 》 It is required that the proportion of photovoltaic and wind power in 2025 will reach 16.5%of the power consumption of the whole society. It can be seen that there is a certain gap between the installation of photovoltaic and wind power or power generation. In terms of new energy vehicles, the sales of new energy vehicles have been sold rapidly in 20 years. The monthly penetration rate of new energy vehicles has increased from 2.4%in early 20 years to 24.5%in July 22nd. twenty two%. During the history of the development of smart phones, after entering the rapid development stage after the penetration rate exceeds 15%, the slope of the penetration rate has increased significantly. The industrial evolution starts from electronic devices, gradually transmits to software content to scenario applications. The current new energy vehicle is in this stage, and the penetration rate is accelerating. In the future, with the transformation of new energy vehicles to intelligence and digitalization, the new energy vehicle industry is expected to gradually evolve from hardware manufacturing to software and ecology, and the prosperity trend of the new energy vehicle industry chain has not ended.

2. Profit valuation: new energy basic upward, the valuation is not high

The industrial cycle determines the fundamentals of the stock market. From the perspective of the real estate cycle of 2005-10 and the 10-15-year mobile Internet cycle, when the industrial prosperity is up, the relevant industry's fundamentals are up and the valuation center has risen. After the industrial cycle is over, the fundamentals of related industries have begun to fall and the valuation center decreases.

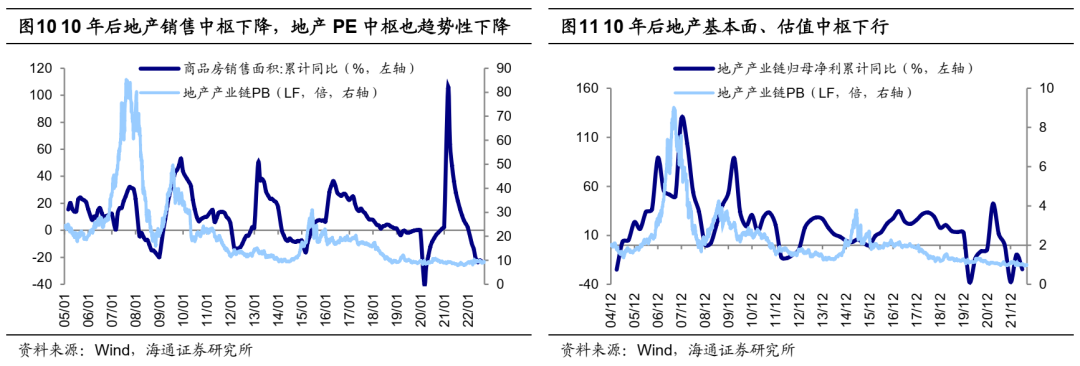

After the 2011 real estate cycle ended, the profit growth rate of the industrial chain fell and the valuation center moved down. The real estate industry chain chain is very long, including upstream building materials, steel, non -colored, midstream real estate and building construction, and downstream home appliances, light industry and other industries. Essence From 2005-1010, real estate sales maintained a high speed, and the fundamentals of related industries were upward. The real estate industry chain (including real estate, building materials, and building decorations three-one-level industry, the same below) ROE (TTM, overall method, the same below) from 05 from 05 At about 3%of the year rose to 14%in 2010. With the decline in the real estate sales growth center after 2010, the fundamentals of the real estate industry chain began to fall, and the ROE of the real estate industry chain began to fluctuate. 10%of the year to the present (as of 22/09/09, the same below). The real estate industry chain PE (PB) center has decreased from 34.6 times (3.3 times) in 05-10 to 13.6 times (1.7 times) from 11 years to the present. We calculate the PEG with the growth rate of the net profit of the real estate industry chain and the valuation center. Due to the decline in the decline in the profit growth center of the real estate industry chain, the PEG has risen from 0.9 between 05-10 to 11 years to 1.4 to the present to the present. Essence

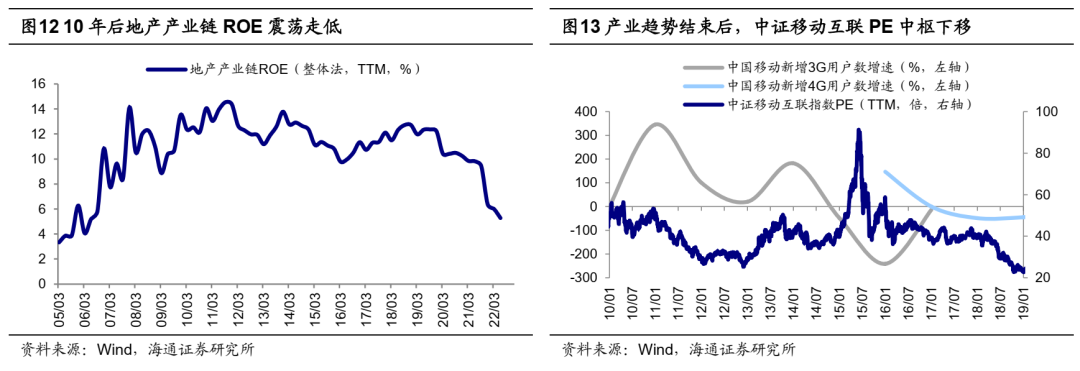

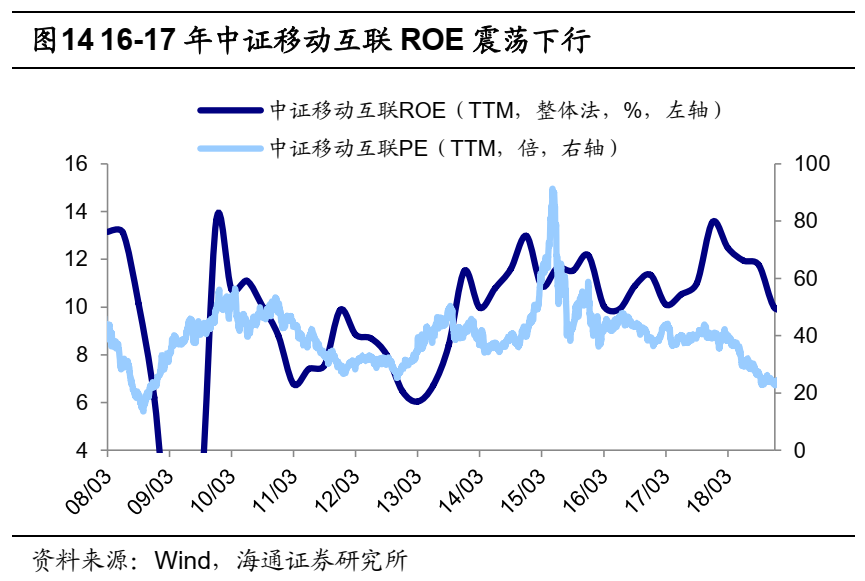

After the mobile internet cycle ended in 2016, the profit growth rate of the industrial chain fell and the valuation center moved down. The smartphone industry chain leading the mobile Internet wave is long, the market size is huge, and the global division of labor. For example, the Apple industry chain includes mid -ups and upstream components (chips, display, cameras, etc.), downstream machinery and service providers (mobile phone brands, operators, channel vendors, etc.). During the mobile Internet cycle in 2010-15, the penetration rate of smartphones was rapidly increased to promote the high prosperity of the mobile Internet industry chain. The CSI mobile internet index ROE rose from 6.9%of 11Q1 to 12.2%of 15Q4. With the penetration rate of smartphones at the end of 15 years exceeded 90%, the mobile internet industry cycle ended, and the CSI mobile internet index ROE dropped from 12.2%of 15Q4 to 9.9%of 18Q4; The cumulative year-on-year average decreased from 63%in 10-15 years to 15%between 16-18 years; its PE center decreased from 42 times between 10-15 years to 38 times in 16-18 years. After 16 years, the profit growth rate of the mobile internet industry chain decreased rapidly, so the PE center decreased slightly. The PEG center of the China Securities Mobile Internet Index also increased from 0.7 between 10-15 years to 2.5 in 16-18 years.

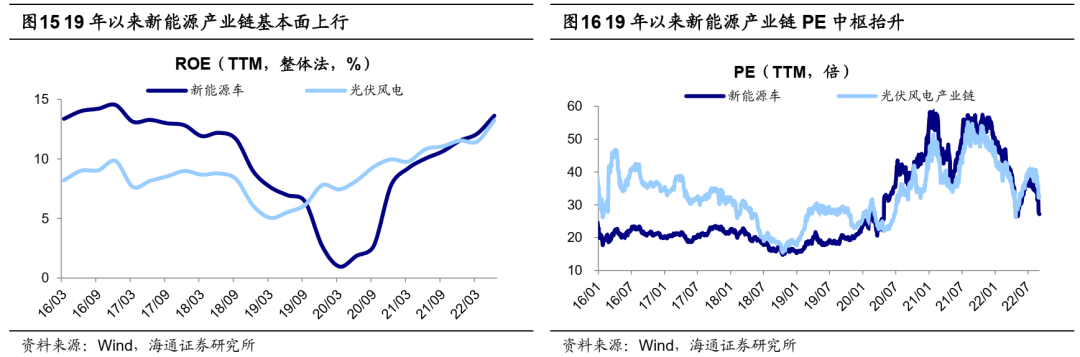

The new energy industry chain is basically good, and the valuation pressure is not great.新能源领域中,新能源车包括上游原材料(锂、隔膜、电解液等)、中游零部件(电池、电控、电机等)以及下游整车制造和服务;光伏包括上游原材料(硅片、银Purgatory and other components and batteries and downstream photovoltaic power generation applications. In the new energy cycle since 19 years, new energy vehicles (including salt lake lithium, lithium ore, lithium battery positive electrode, lithium battery negative, lithium battery electrolyte, lithium battery diaphragm, power battery, charging pile, new energy index of new energy vehicles, new energy vehicles, new energy vehicles, 9 WIND concept indexs, new energy vehicles, and new energy indexes of new energy vehicles. The same below) ROE at the bottom of 20Q1 is 1.1%, 22Q2 has risen to 13.6%, and the cumulative net profit of the mother has increased from -29%of 19Q1 to 84%of 22Q2.光伏风电(包括硅料、电池组件、光伏设备、光伏辅材、光伏加工、逆变器、风电零部件、风电整机、风力发电9个板块,下同)ROE从19Q1的4%左右上升到At 13.2%of 22Q2, the cumulative net profit of returning to the mother increased from -6%to 70%year-on-year. It can be seen that 22Q2 new energy vehicles and photovoltaic wind power industry chains have a significant year -on -year growth rate of 3.3%of all A shares. Looking forward, the trend of the new energy industry has not ended, and the penetration rate of domestic new energy vehicles is still in the rapid climbing stage. It is expected that the sales volume of new energy vehicles will reach 6.5 million vehicles throughout the year. It is expected that the growth rate of new photovoltaic installations in 22 years is close to 100%. This will promote the continuous increase in profitability of new energy industry chain companies. According to Wind unanimous expectations, the net profit growth rate of new energy vehicles in 22 years will reach 68%, and the net profit growth rate of photovoltaic wind power will reach 69%. Since the 19th year of the new energy cycle, the phased high point of the PE valuation of new energy vehicles and photovoltaic wind power sectors appeared in August 21st. At that time, the PE of the new energy vehicle was 57 times and the photovoltaic wind power sector PE was 55 times. Since then, the new energy industry will be The high increase in chain profit has promoted the continuous digestion of valuation. The current new energy vehicle PE is 28 times and the photovoltaic wind power PE is 34 times. Based on the 22 -year net profit growth rate forecast, the new energy vehicle PEG is only 0.4, and the photovoltaic air power is only 0.49. Essence

3. Configuration and transaction: The high heat of the new energy may continue

At present, the new energy cycle has lasted for more than three years, and some investors are worried that the relevant industrial chain funds are too high and the transaction is crowded. From the two dimensions of fund configuration and transaction popularity, we compare and analyze the new energy cycle and the previous real estate cycle and the mobile Internet cycle. First look at the fund configuration:

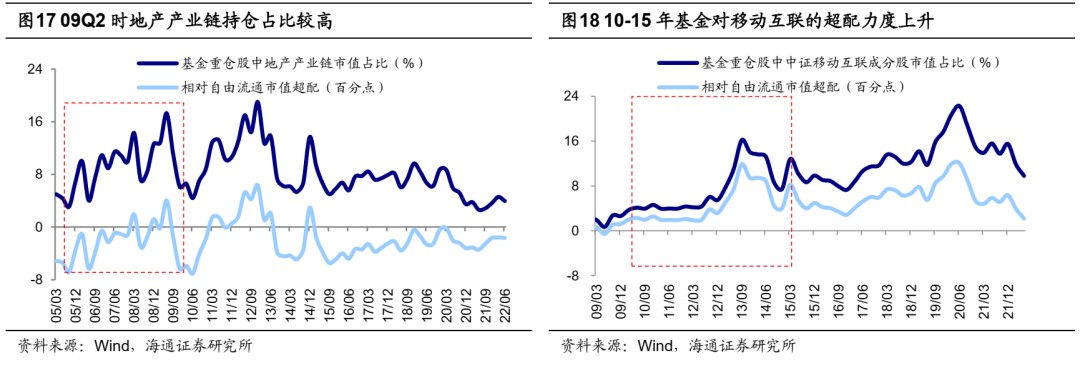

During the real estate cycle from 05-10, the fund has greatly allocated real estate allocation. The market value of the real estate industry chain in the Fund's heavy stocks accounted for 17.3%from 5%of 05Q1 to 09Q2, and the super -match ratio of the relatively free market value reached 4 percentage points; taking the real estate industry in the real estate industry chain as an example, at 09Q2, The fund's configuration of the fund industry is at the highest level of history. Real estate accounts for 15%of the fund's heavy positions, and the relatively free market value is 5 percentage points. With the end of the real estate cycle, the proportion of the real estate industry chain in the heavy positions of the fund has declined, and the relatively free circulation market value continues to be in a low state.

During the 10-15 mobile internet cycle, the fund continued to surpass the mobile Internet. The market value of the China Stock Exchange Mobile Interconnection ingredients in China ’s heavy positions increased from 3.7%of 10Q1 to the highest 16%at 13Q3. Under the free circulation of market value, the over -assignment increased from 2 percentage points to 11.9 percentage points. As the penetration rate of smartphones see the top, the fund has begun to decrease on the China Securities Mobile Internet configuration.

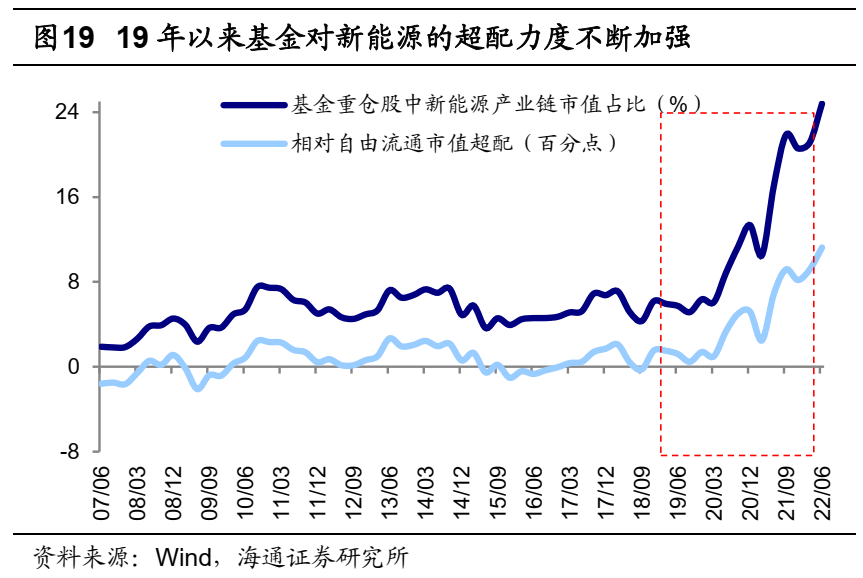

Observing the new energy cycle of this round, the fund's configuration of the new energy industry chain is also continuously strengthened. The proportion of the new energy industry chain (new energy vehicle+photovoltaic air power) in the fund stocks of the fund accounted for from 5.9%of 19Q1 to 24.8%of 22Q2, and the relatively free market value of the relative free circulation reached 11.3 percentage points, an increase of nearly 10 from 19Q1 o'clock in 19Q1 percentage point.

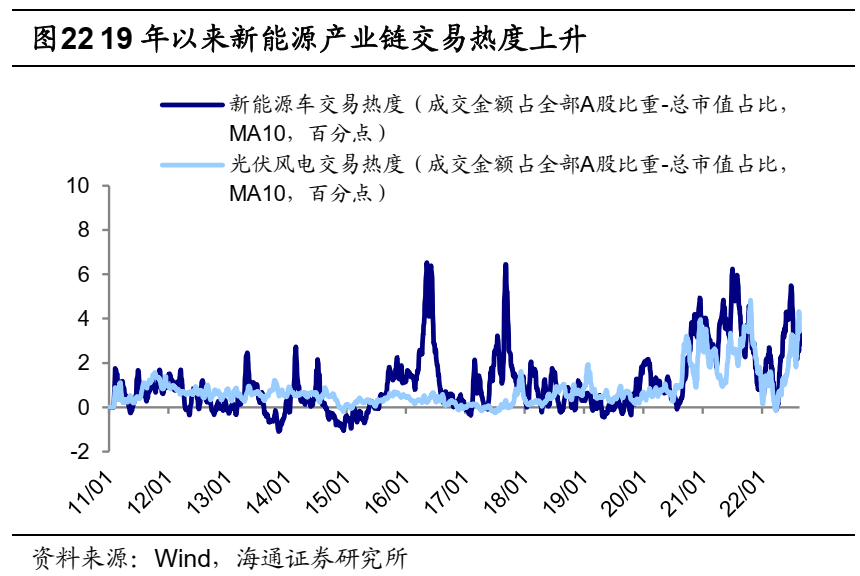

In terms of transaction popularity, the transaction popularity measured by transactions has not excluded the impact of market value changes on the turnover, and the data results may be relatively distorted. Therefore, we calculate the impact of the "proportion of turnover-total market value" to eliminate the changes in market value to measure the transaction popularity of the relevant industrial chain. It can be found that:

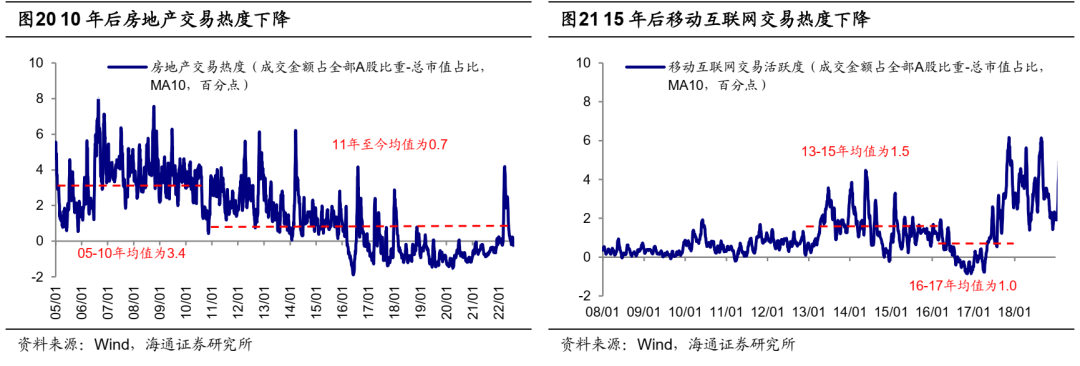

The high heat of real estate chain transactions in 05-10 continued. After eliminating the impact of changes in market value, we can find that the transaction popularity of the real estate industry chain is very different before and after the real estate cycle. The average value of 3.4 percentage points in 05-10 years, that is, the proportion of transactions in the real estate industry chain exceeds 3.4 percentage points; and and of. After the real estate cycle is over, the average transaction heat has dropped to 0.7 percentage points from 11 years.

From 13-15, mobile Internet transactions have been high. The mobile internet cycle in 10-12 is in the beginning, and the popularity of the China Securities Mobile Interconnection Index is not high. As the related industrial chain entered the outbreak period in 13-15 years, the transaction popularity rose and maintained at a high level. During the period, the average transaction popularity rose to 1.5 percentage points. After 16 years, the popularity of China Securities Mobile Interconnection began to decline, and the average transaction popularity between 16-17 decreased to 1.0 percentage points.

Observing the new energy cycle of this round, the popularity of the new energy industry chain transaction has risen significantly in 20 years.The average transaction popularity of new energy vehicles (photovoltaic wind power) in 16-19 was 1.0 percentage points (0.4 percentage points). With the rapid increase of the penetration rate of the new energy industry chain, the transaction popularity of the new energy industry chain has increased and maintained from relative to relative to the present 20 years to the present.High -level, new energy vehicles are 2.4 percentage points, and photovoltaic wind power is 1.8 percentage points.In summary, the current energy industry chain fund configuration and transaction popularity is at a relatively high level. The history of the evolution of the real estate and mobile internet industry chain is drawn. When the prosperity cycle has not ended, the fund configuration and transaction popularity of the relevant industrial chain will continue to be in high levels for a long time.Essence

Risk reminder: History table does not represent the future.

Editor -in -chief: Wang Lulu

School pair: Wang Wei

- END -

News analysis: What do you think of fiscal revenue and expenditure data in the first 5 months?

Xinhua News Agency, Beijing, June 16th News Analysis: What do you think of fiscal ...

Jingyuan Technology: The loss of 529,600 yuan in the first half of 2022, a loss of 84.47% year -on -year loss

On August 31, Jingyuan Technology (code: 836674.NQ) released the performance report of the 2022 Half -Annual Report.From January 1, 2022-June 30, 2022, the company realized operating income of 18.9178