Unnamed Macro | August 2022 Monetary Financial Comment: Social finance credit is better, and structural restoration is still yet to be exerted

Author:Economic Observer Time:2022.09.12

Key points:

● Social finance has increased less year -on -year, and government bonds and corporate debt composition mainly drag down

● The marginal of credit scale is better, but the department's structure is significantly differentiated

● M2-M1 scissors are widening, and the social meling-M2 continues to widen

● Looking at the future: Short -term social meling credit is still supported, and long -term trend needs to pay attention to epidemic and real estate direction

Summary

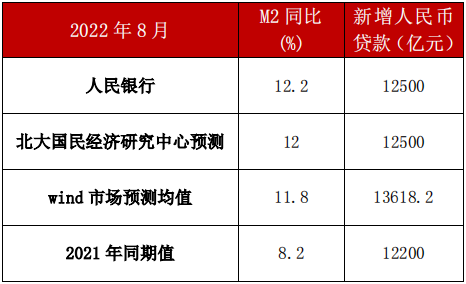

In August 2022, the scale of social financing was 2.43 trillion yuan, an increase of 559.3 billion yuan from the same period last year; the new RMB loan was 1.25 trillion yuan, an increase of 30 billion yuan year -on -year. Although the uncertainty increased by the endless epidemic and the adverse effects of the discontinuation of the out -of -date house suspension on the financing demand of physical enterprises and the consumer demand of residents, the continuous introduction and implementation of the domestic stable growth policy, the overall social merit credit scale has improved. But the department's structure is still to be repaired.

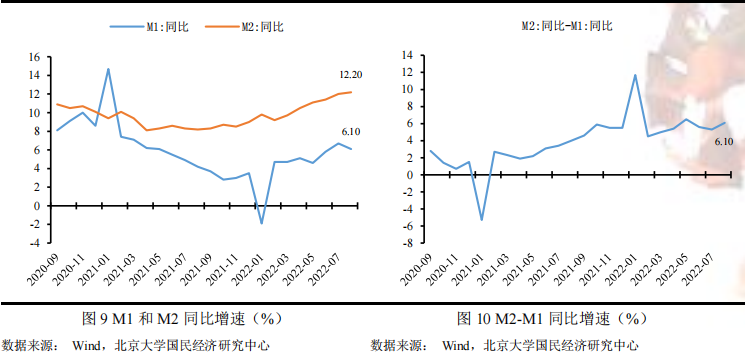

In August 2022, the balance of narrow currency (M1) was 6.646 trillion yuan, an increase of 6.1%year -on -year, and a decrease of 0.6 percentage points from the previous period. Essence Under the role of a series of steady growth policies, the impact of superimposed base effects and misaligned fiscal expenditure this year, M2 runs a high year -on -year growth rate, and on the one hand, the activation of currency deposits has decreased, and the phenomenon of abundant capital liquidity continues on the other hand.

Essay

Social finance has increased less year -on -year, and government bonds and corporate debt compositions are mainly dragged down

In August 2022, the scale of social financing was 2.43 trillion yuan, which was 559.3 billion yuan less than the same period last year, but it was better than market expectations. Among them, foreign currency loans-82.6 billion yuan, an increase of 117.3 billion yuan year-on-year; corporate bond financing was 114.8 billion yuan, an increase of 35.1 billion yuan year-on-year; government bonds were 304.5 billion yuan, an increase of 669.3 billion yuan year-on-year. Increasing 1136.7 billion yuan, a major drag on social integration this month.

Regarding the year -on -year year -on -year increase in foreign currency loans, mainly because the exchange rate fluctuations and the overall growth rate of imports have been weak since this year, resulting in insufficient overall demand for foreign currency loans. The RMB exchange rate fluctuations increase the risk of corporate foreign currency loans, thereby weakening the demand for corporate foreign currency loans. The data shows that the RMB exchange rate depreciated to 6.93 in August, which is about to face the "7" situation. At the same time, the import growth rate has continued to operate at a low level since this year, and the demand for import and remittance is significantly weaker than in previous years, so it has caused insufficient foreign currency loan demand.

Regarding the increase in corporate bond financing in August, it was mainly affected by the weakened financing demand of physical enterprises. In the first half of the year, government bonds were issued in June, and the corresponding supporting financing demand weakened. In addition, there is still a certain degree of negative impact on corporate bond financing. Regarding August, government bonds increased less year -on -year, mainly due to the misalignment of fiscal preparation this year and last year's fiscal rear. In addition, the non -discounted bank acceptance bill is the main item that supports the scale of social financing in August, mainly due to the increasing uncertainty of the current epidemic, and the increase in short -term financing demand for enterprises.

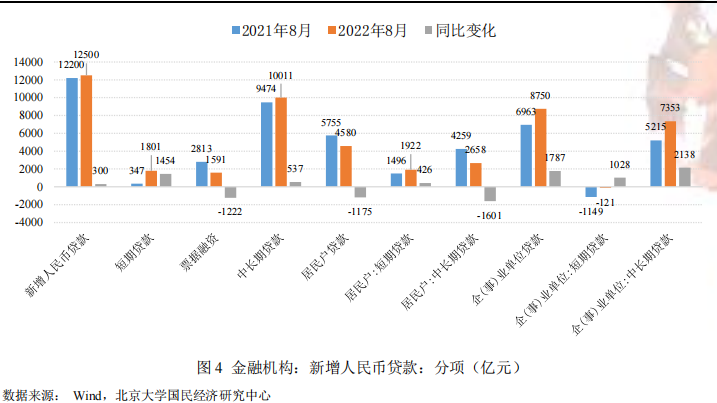

The marginal of credit has improved, but the department's structure is significantly differentiated

In August 2022, a new RMB loan was 1.25 trillion yuan, an increase of 30 billion yuan year -on -year. Among them, short -term loans were 180.1 billion yuan, an increase of 145.4 billion yuan year -on -year; bill financing was 159.1 billion yuan, a year -on -year increase of 1222; medium- and long -term loans of 1001.1 billion yuan, an increase of 53.7 billion yuan year -on -year. It can be seen that short -term loans are the main support of new RMB loans this month, and bill financing has fallen sharply. In addition, the sub -department perspective that the new loan of residents and enterprises and institutions contrasts this month, and the increase in residential household loans to drag new RMB loans this month, and the loans of enterprises and institutions increased more than new RMB this month. Loan provides support.

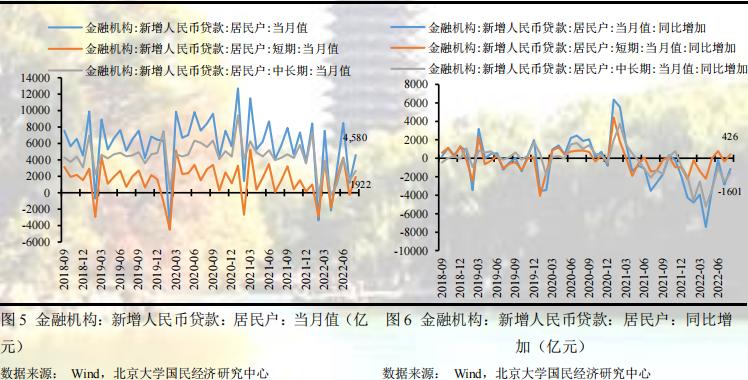

In terms of residential loans, the residential household loan in August was 458 billion yuan, an increase of 117.5 billion yuan year -on -year. Among them, the short -term loans of residents 'households were 192.2 billion yuan, an increase of 42.6 billion yuan year -on -year, and residents' medium- and long -term loans were 265.8 billion yuan, an increase of 160.1 billion yuan year -on -year, indicating that the residential loan structure has not improved, indicating that the real estate market prosperity will still be further boosted. Among them, the increase in short -term loans is mainly due to the impact of various stimulating consumption policies recently issued, and the decrease in medium -to -long -term loans is mainly due to the tide of bad loans in the period in July, which leads to the tentative or temporarily proclaimed house purchase of residents who buy a house. The subsequent development of the plan and the wait -and -see incident has led to the continued decline in the interim loan in August in August.

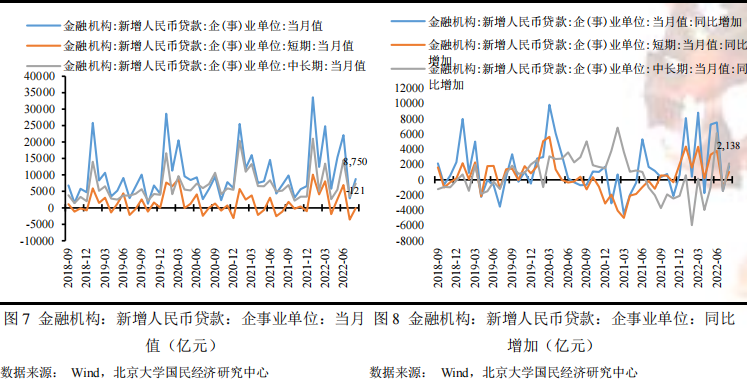

In terms of loans of enterprises and institutions, in August, enterprise institutions loaned 875 billion yuan, an increase of 178.7 billion yuan year -on -year. Among them, the short-term loan of enterprises and institutions was 12.1 billion yuan, a year-on-year decrease of 102.8 billion yuan. The medium- and long-term loans of enterprises and institutions was 735.3 billion yuan, an increase of 213.8 billion yuan year-on-year, indicating that the loan structure of enterprises and institutions was repaired. On August 24th, the State will propose to increase the amount of more than 300 billion or more on the basis of 300 billion policy development financial instruments, and stated that it will use more than 500 billion yuan in special debt deposit limit. loan.

M2-M1 scissors are widen

At the end of August 2022, the balance of narrow currency (M1) was 6.646 trillion yuan, an increase of 6.1%year -on -year, and a decrease of 0.6 percentage points from the previous period; the balance of the general currency (M2) was 25.951 trillion yuan, an increase of 12.2%year -on -year, an increase of 0.2 percentage points from the previous period of the previous period. It is a new high since April 2016. The year -on -year growth rate of M2, which is higher this month, was because the year -on -year growth rate of M2 last August last year was 8.2%, which was the lowest year -on -year, and the low base effect increased the year -on -year growth rate of this month. Compared with last year, a large number of fiscal deposits were converted to M2. For example, in August, fiscal deposits decreased by 2572, a decrease of 429.6 billion yuan over the same period last year, and the year -on -year growth rate of M2. We predict that August M2 increased by 12%year -on -year, lower than the actual results of 0.2 percentage points. The prediction error was mainly to underestimate the intensity of this year's fiscal expenditure. From the perspective of the growth rate of M2-M1, the year-on-year growth rate of M2-M1 at the end of August was 6.1%. The growth rate of scissors increased by 0.8 percentage points compared with the previous period, indicating that the activation of currency deposits in August decreased, indicating that the impact of uncertainty on the demand side still still has still the impact of demand. Large. On the one hand, the scale of tax refund has been reserved since April this year, providing a large number of short -term liquidity for enterprises; on the other hand, bill financing has increased significantly compared with last year, and bill discount has increased the activity deposit of the enterprise sector.

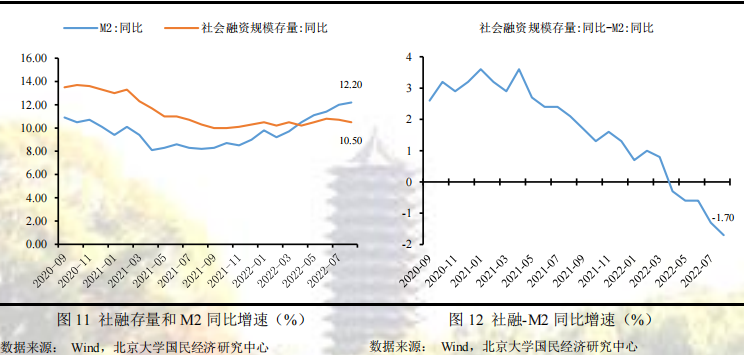

From the perspective of the growth rate of Social Rong-M2, the year-on-year year-on-year growth rate of Social Rong-M2 was -1.7%, which was further expanded by 0.4 percentage points from the previous period, indicating that the speed of social integration and expansion was significantly weaker than the speed of currency expansion. It will continue, indicating that there is a certain mismatch with credit demand and currency looseness. The short -term funds in the financial market have not improved, and interest rates are expected to continue to maintain a low level.

Future Outlook: Short -term social finance credit is still supported, and long -term trends need to pay attention to epidemic and real estate trends

In the future, with the further implementation of policy development financial instruments, the use of more than 500 billion yuan of special debt deposits and the gradual emergence of LPR reduction effects are expected to be continuously supported in September and October. The rhythm of government bond issuance and the restoration of the real estate market will still be affected. In addition, the epidemic will still be a key external factors that affect social finance credit in the future. How to eliminate this uncertainty will strongly support the medium -term financing needs of enterprises and residents.

Introduction to the National Economic Research Center of Peking University:

The National Economic Research Center of Peking University was established in 2004. At the School of Economics, Peking University. Relying on Peking University, key research areas include China's economic fluctuations and economic growth, macro -control theory and practice, economics theory, Chinese economic reform practice, derailment economic theory and practical forefront topics, political economics, western economics teaching research, etc. At the same time, the center closely tracks the major changes in macroeconomic and policies, incorporate short -term fluctuations and long -term growth into a comprehensive theoretical research framework, interpret it with a unique observation perspective, grasp the macro trend, analyze data changes, understand the original intention of policy, pre -pre -pre -pre -pre -pre -pre -mind Judgment policy effect.

The research of the center has achieved significant results and has a greater impact on China's macroeconomic policy. The most representative results are: (1) the adjustment of China's population policy. Professor Su Jian, director of the center, has called on China since 2006 to immediately completely abandon the family planning policy and instead encourages fertility. (2) Research on the macro -control system: The center proposes a three -dimensional macro -control system including market -oriented reform, supply management and demand management policies. (3) Research on macro -control intensity: In July 2017, the center pointed out that China's macro -control should strictly prevent excessive force. This proposal was instructed by the main leaders of the State Council. The "macro -control" view proposed is exactly the same. (4) The results of China's economic goals growth. In 2013, after careful analysis and calculation of Liu Wei and Su Jian, it was believed that China could ensure employment as long as 6.5%of the economic growth rate of each year. Soon after that, this growth rate has become the benchmark goal of the Chinese government's economic growth rate. In recent years, the practice of Chinese economy has also proved the accuracy of their calculation results. (5) Supply -side research. Professor Liu Wei and Su Jian are the earliest scholars in the country to study the supply side. They started academic papers on supply management in magazines such as "Economic Research" in 2007. (6) New normal research. The papers collaborated by Liu Wei and Su Jian "China Macro Regulation in the New Normal" ("Economic Science" 2014 Issue 4) is the first academic paper to study the new normal of China's economy. Su Jian and Lin Weibin also studied the new normal of developed countries. (7) "The Chinese Economy Seeking to Breakthrough" edited by Liu Wei and Su Jian was translated into five types of texts in English, Korean, Russian, Japanese, and India. (8) Research on the subsidy mechanism of Beijing Metro. In 2008, this research team was commissioned by the Beijing Municipal Finance Bureau to design a subsidy mechanism for the Beijing Metro operation. The mechanism has been used since January 1, 2009 until now.

The central publications include: (1) "Yuanfu" magazine. "Yuanfu" is a monthly electronic journal, sponsored by the National Economic Research Center of Peking University, with the purpose of presented the main macroeconomic events at home and abroad in the most timely, most professional and comprehensive way this month and professional interpretation of key events. (2) "China Economic Growth Report" (annual report). The report mainly analyzes the medium and long -term issues existing in China's economic operation. It has been published for 14 consecutive periods since 2003. It is the longest continuous publishing period in related annual reports. (3) Analysis and prediction reports of macroeconomic operations. This center regularly releases a series of analysis and prediction reports on China's macroeconomic operation, especially the forecast report of the center in the forecast accuracy in the country. Exempt statement

The National Economic Research Center of Peking University is an academic institution. This report is for academic exchanges only. In any case, the information or views expressed in this report are for reference only, nor do they use any content in this report. Any losses caused by any losses.

The copyright of this report is only owned by this research center. Without a written permission, no institution or individual may be replicated, replicated, published or cited in any form.

- END -

License densely distributed electronic cigarette companies enthusiastic "embrace" national standards

Zhao Tong, co -founder of Shenzhen Two Fortune Technology Co., Ltd., said in an in...

Weihai Business Bank 丨 Certificate of Certificate Reminder, Enterprise Management

Hello, I am a staff member of the Administrative Examination and Approval Service ...