There are counts | August cash management product return on inventory

Author:Cover news Time:2022.09.12

After more than three years of transition period, the new asset management regulations officially began to implement in 2022. At the same time, the rectification of cash management wealth management products has also been continuously promoted. What is the cash management product income of various institutions in August 2022? According to data disclosed by public channels, the Puyi Standard selected a public offering of public offering of public offering of public offering of public funds for public offering of public funds from August 1st to August 31st, 2022 from August 1st to August 31st, 2022. The average 7 -day annualized return on the month is ranked.

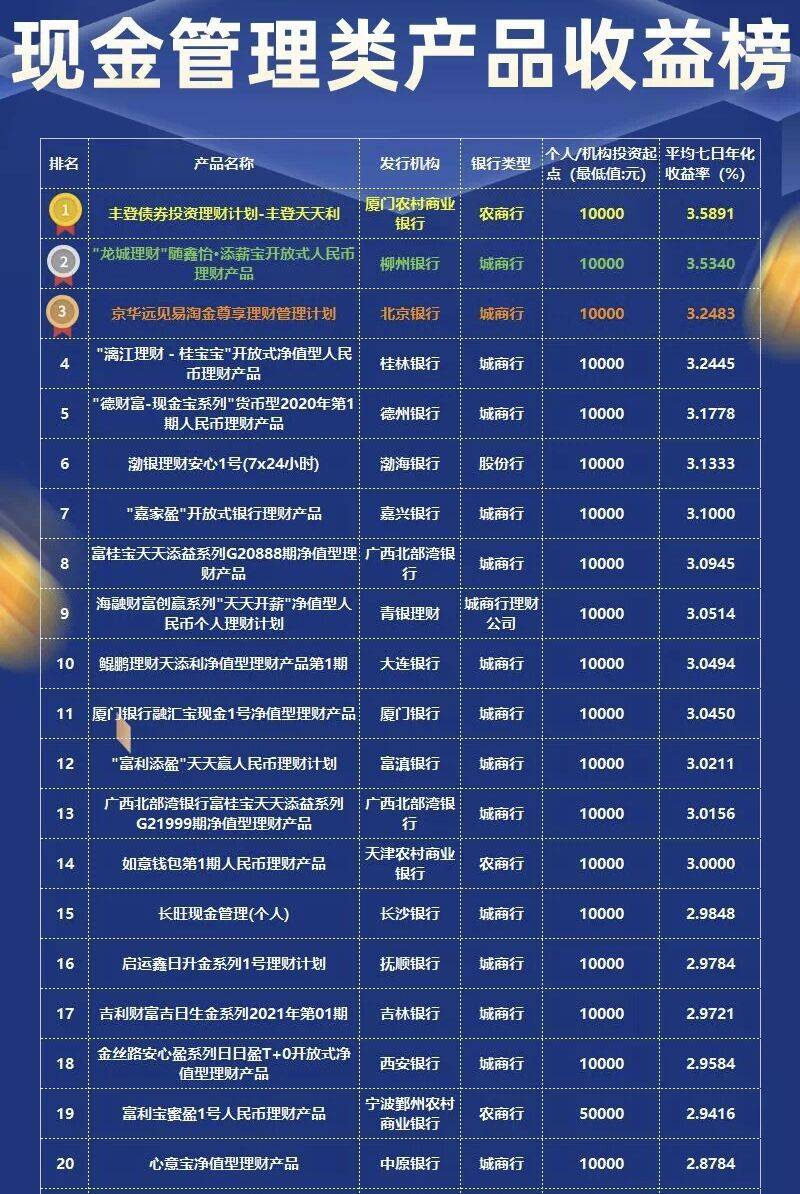

The top 20 of bank wealth management cash management income

In the list of this issue, Fengdeng Bond Investment and Wealth Management Plan-The average 7-day annualized yield of Feng Deng Tiantianli is 3.5891%, winning the crown; The annualized yield is 3.5340%, ranking second; the average annualized return on the 7 -day annualized return of Yijin Gold Enjoyment Financial Management Plan is 3.2483%, ranking third.

Income: The average annualized return on the 7 -day list of all listings was 3.0102%, a slight decrease from the previous period; the average annualized return on the 7 -day product on the list was 2.7828%, a slight decrease from the previous period. In addition, the average annualized return rate of 13 products exceeded the average annualized return on the average 7 -day annualized return of all products, which is the same as the previous period.

Institutional distribution: Among the types of institutions, the number of products in the city commercial banks has the largest number, with a total of 19 products, accounting for 63.33%; followed by Rural Commercial Bank, a total of 3 products, accounting for 10.00%. On the whole, the income of cash management wealth management products in urban commercial banks still dominates.

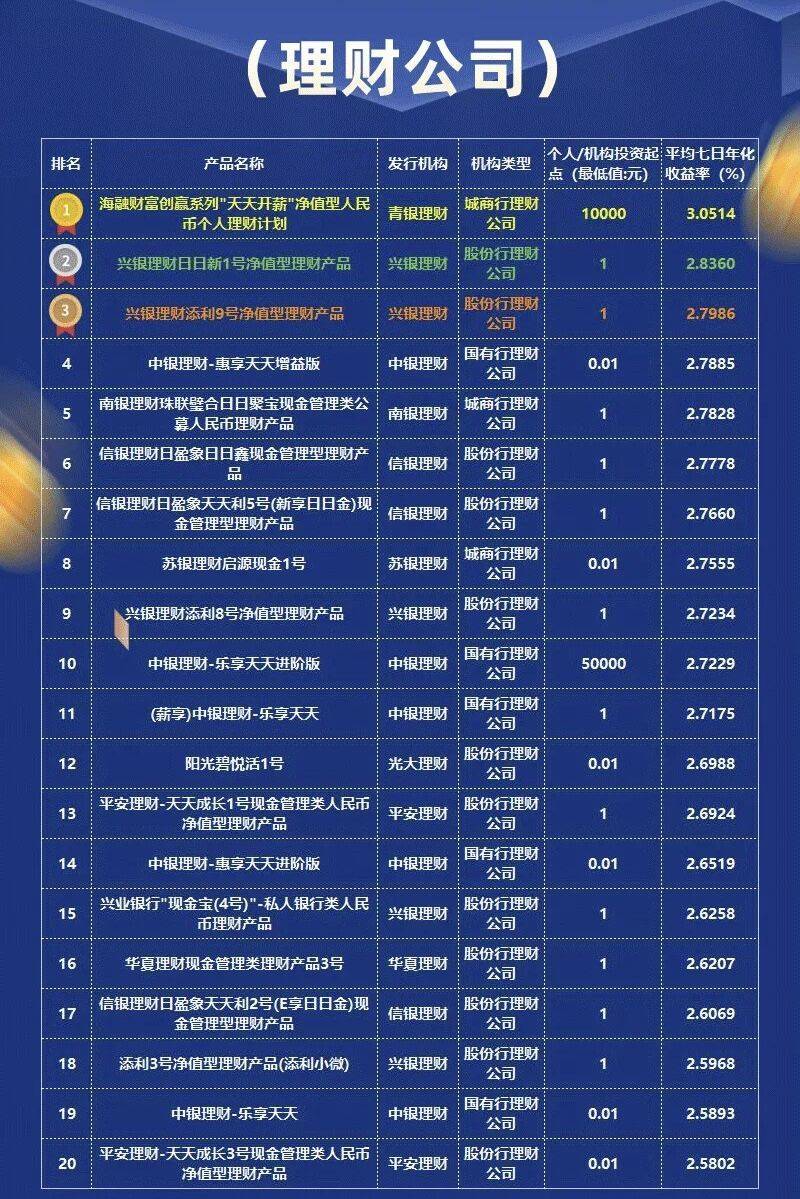

Top 20 cash management income of wealth management companies

In the list of this issue, the average annualized return rate of the net worth personal wealth management plan of Hairong Fortune Winning Series "Daily Paying Salary" is 3.0514%, ranking first; The average 7 -day annualized return rate was 2.8360%, ranking second; Xingyin Financial Management Tim Lya No. 9 net value -based wealth management product average 7 -day annualized return was 2.7986%, ranking third.

Income: The average annualized return on the 7 -day products on the list was 2.7192%, a slight decrease from the previous period; the average annualized return on the 7 -day product on the list was 2.5802%, a slight decrease from the previous period. In addition, the average annualized return rate of 10 products exceeded the average of the average 7 -day annualized return of all products in the list, an increase of 1 model from the previous period.

Institutional distribution: There are 12 products on the shareholders' wealth management company, 5 products on state -owned bank wealth management companies are on the list, and 3 products have 3 products on the list of city commercial bank wealth. Among them, there are 5 products on the list of Xingyin Financial Management; 5 products in BOC Financial Management are on the list.

Cover reporter Dong Tiangang

- END -

From January to May, China's absorption of foreign capital increased by 17.3% year -on -year

According to data from the Ministry of Commerce on the 14th, from January to May this year, the actual amount of foreign investment in the country was 564.2 billion yuan, an increase of 17.3%year -on

The three major index shock and lower the Shanghai and Shenzhen cities with a turnover of 1100 billion yuan.

Our reporter Zhao Ziqiang on August 3, the three major indexes fell after the shoc...