Dialogue Professor Tsinghua: Everyone invests in wealth management. Why are you always losing money?

Author:One Time:2022.06.20

From ancient times to the present,

"Investment loss" is almost the fate of all investors.

Why are personal investors always lose money?

Why do women perform better than male investment?

When the economic situation is not good,

What do people tend to do, and how do they actually do it better?

An interview with the deputy dean of the National Financial Research Institute of Tsinghua University,

Financial columnist Zhu Ning,

His teacher Robert Schiller, the winner of the Nobel Prize in Economics in 2013,

One of the core research themes is:

How does economic and human behavior affect each other?

He said that outside a variety of models,

What the economy is finally returning is the issue of human nature.

He hopes to study through "behavioral finance",

Help everyone understand their investment behavior,

Deep reasons behind behavior,

So as to establish the correct investment concept and habits.

"I want ordinary people not to lose money that should not be lost."

Edit: Zhou Tiancheng

Responsible editor: Chen Ziwen

One: Your research field is "behavioral finance". Why is this direction?

Zhu Ning: I studied undergraduate at Peking University before. At that time, the more orthodox Western Economics Society assumed that people were rational, and then made the optimized calculation on the basis of rationality.

Later, I went to Yale to study for a doctorate and was fortunate to contact a big database about investment. After research, it was found that

Structural distribution of stock market investors

First, individual investors are roughly lost money;

Second, everyone always repeats some misconduct, not completely rational, so it will always lose money inexplicably.

I think this is very interesting, and I have studied all the way to the present.

Two weeks before an interview, Zhu Ning just participated in the 2022 Davos Economic Forum. Prior to this, Zhu Ning has also been invited to speak at the Davos World Economic Forum many times (the picture is 2020)

One: How much does a personal investor lose about a total of about a total of about a total of?

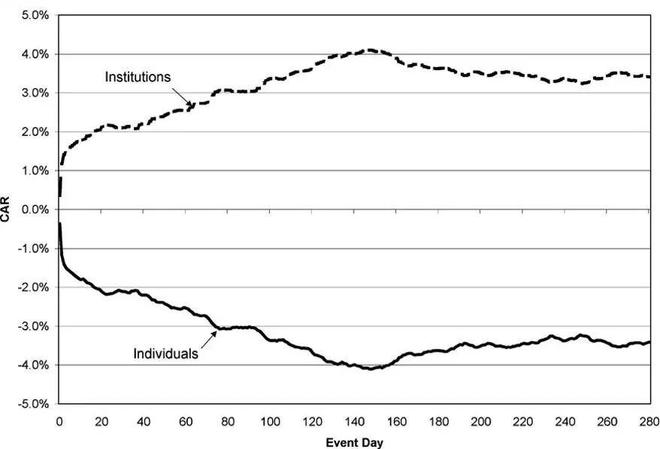

Zhu Ning: The market has been changing, so it is difficult to give accurate answers. But we can refer to a data in Taiwan, China. After six years of follow -up research on investors in Taiwan, it has been found that investors in the Chinese market in China are about 2%each year.

At present, the total amount of our stock market is about 50-6.6 billion. Based on 2%of the losses, the annual amount of A-share retail investors should be tens of trillion.

The differences between the performance of individual investors in Taiwan (curve below) and institutional performance (curve above), you can see that individual investors are mostly losing money

There is also a data, my colleague in Tsinghua, a study in the first two years, paying attention to the 2015 stock disaster. They found that investors with the smallest account amount (that is, Xiaobai retail investor), who had the largest amount of accounts, delivered about 200 billion yuan of wealth.

I often say that everyone is actually the most important charity in China. The collection of retail investors is much more wealth contributed to the market than any individual.

One: Where did these individual investors lose? Why can't I run the market?

Zhu Ning: I have a saying that politics is not correct, called "retail investors make money. This is not good, but in fact it is.

If individual investors can objectively compare themselves and institutions, what can they do, they should have not speculated stocks.

For example, in high -frequency transactions, the millisecond speed is particularly important. Investment institutions will spend millions to laid a optical cable, open roads and meet the water bridge, just for those millisecond trading advantages. How could ordinary people run to win this infrastructure?

In order to increase the transaction speed of 30 milliseconds, the Canadian telecommunications company ARCTIC FIBRE has spent 1.5 billion US dollars to build a cross -sea optical cable

There are also differences in financial literacy and information.

I offer EMBA courses in Tsinghua. At the class, how many people can tell me what the price -earnings ratio is? About half of the people raised my hands; I said yes, please tell me what the city's net rate is, and put a little bit. Let me ask you again, what is ebida (Earnings Before Interest depreciation and amortization)? The remaining hands are only about 10%to 20%. Moreover, these are the most basic investment market information, and the audience is also high -end net worth investors. They are not so -called "little white".

Coupled with the differences in information and the differences in financial resources, who can make money and who can't make money, and think about it a little rationally, it is easy to get the answer.

One: To tell such a simple truth, why still have a large number of individual investors scramble to enter the market, but continue to lose money but persevere here?

Zhu Ning: Because we are humans. We keep making mistakes in our lives to realize that we are people.

For example, people are over -confident, and everyone feels that they are an expert, not just in the investment field. Before GPS, everyone drove lost, and they would drive very confidently -people always confident that they could find the way.

For example, people have the mentality of ostriches. When making money, you feel that you are a great investor. When you lose money, you choose to forget, pretending that you do n’t lose money at all.

There is an interesting research in the field of economics. When it comes to the bull market, investors have to check their accounts 7 times a week; when the bear market, it is only checked once every 2 weeks. Under these weaknesses, people's views and views on the market are of course biased.

The famous episode "Big Times" with the Hong Kong stock market as the background

One: What factors will be shaped and influenced by the investment decision of ordinary people?

Zhu Ning: Research shows that after a traffic accident, buying stocks will be much more conservative than the original.

One is a traffic accident, and the other is stock investment. It seems that eight -shots can't hit -in fact, how much risk life has experienced, and the views on risks will change.

There are also studies that children born during the depression from 1929 to 1933 have experienced a economic recession when they were young. These people's investment behavior in a lifetime is more conservative than the previous generation.

We think we are rational, but we are all affected and shaped by various factors, and sometimes we do not realize this.

One: You once said that in the investment market, women's performance is generally better than men. why is that?

Zhu Ning: We observed different markets and found that women are not as radical or as paranoid as men. Women are more conservative than men, and it is not easy to have particularly big problems or make particularly wrong mistakes. To a certain extent, women may be better investors than men.

The stock market fluctuates greatly, and women's pressure resistance will be stronger. When she faces market fluctuations, her mentality will be more calm and stable. In contrast

One: In addition to gender factors, between "losing money" and "making money", what are the main differences between investors?

Zhu Ning: The first is how much you know about finance.

It can be said that 80%-90%of individual investors do not know finance at all. I can't figure it out, how do such people think of buying stocks?

No one can endorse you in the stock market. If you lose money, you just lose money. I think supervision should not encourage those who have no financial literacy to enter the market.

The movie "Wolf of Wall Street"

The second is how much time you can spend on investment.

Look at those fund managers, very young, and very good financial literacy. People after 90s or post -95s are already "smart", and their hair is almost gone. In addition to sleeping, they are thinking about these things every day, investigating every week, and meeting, even if he can't win the broader market.

A normal retail investor, even if you are particularly smart and talented, there are full -time work every day, and there are various miscellaneous things. How can you have extra energy? In terms of finance, this is called Limited Attention.

When we return to the issue of women's investment, during the time of the Japanese economic bubble, there is a saying that it is called "Mrs. Watanabe", which means that many families are investing in financial management during that time. The important reason is that many women in Japan are full -time housewives, and they have time to study the market. In the field of investment, this is not missing.

In his later years, Newton lost all his net worth in his investment, and left a famous saying that "I can measure the distance of the celestial body, but cannot estimate the crazyness of the human heart"

One: "Bubble" is one of your main research directions, and it is also closely related to investing in money. So what is "bubble"?

Zhu Ning: What we said earlier is stocks. Now when we talk about bubbles, we may have a greater investment relationship with the property market and cryptocurrency.

In a word, foam is a self -realization expectation.

We imagine that there is no good news, but suddenly many people in the market tell you that this stock is a good stock. After everyone hear this news, the first reaction is "I want to buy stocks", right Bar?

What will happen to everyone after buying stocks? This stock really rose. People will further strengthen expectations, and more people will be attracted to buy this stock.

People are particularly easy to "chase the rise and fall", which means that it has risen yesterday, and I think it will rise tomorrow.

But in fact, no asset price has always risen. From the perspective of probability, it rose yesterday. The possibility of rising today will only decline and will not rise. But human cognition is a self -enhancement cognition. The idiom is called "Li Ling Zhi Xun", which is human nature.

One: Is it difficult for many people to accept this emotional?

Zhu Ning: Very right. Psychologically saying "5 stages of acceptance", the first is "Denial".

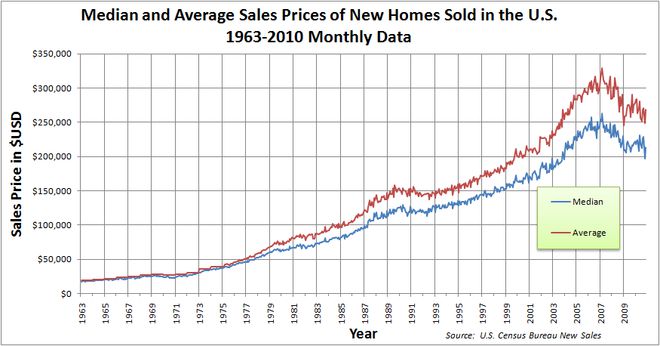

From 2003 to 2008, I taught at the University of California, when California's house prices rose a lot. You and Americans say that house prices may fall, and they will feel how it is, and you have a mind in your brain.

U.S. housing price trend charts can be observed that after the rise in 2007 to a high point, it started to fall sharply

There is a famous book in the field of economics called "This Time is Different" ("This time is different"). When everyone is in a bubble, it is difficult to believe in historical experience. It is easy for people to feel that the current prosperity will not be shattered.

One: Are there some good financial literacy investors around you who used to be in the foam?

Zhu Ning: From 1998 to 2000, the United States was in the bubble of the Internet at the time. I was still studying in the United States at that time. There were some Yale classmates or students from Peking University in the past 20 years old. From time to time, someone would tell me that I was going to retire, because the company I participated in the investment was that I was involved in the investment of the investment. I'm going to go public. Later, the bubble was shattered, and everyone was still working hard to continue working.

Investment Bank Lehman Brothers, founded in 1850, applied for bankruptcy in 2008

I have also worked briefly in Lehman brothers. Some managers who have already achieved very high -level managers are very trustworthy to put almost all of their net assets into Lehman's stock. Later, everyone knew that Lehman announced bankruptcy, and many people have lost their hard work for many years.

One: When it comes to historical experience, what are the famous bubbles in history? How do they all be burst?

Zhu Ning: For example, Newton is a complete net worth in the "South China Sea Bubble".

In 1711, the stocks of the British Nanhai Company were greatly sought after. From half a year, it rose from £ 120 to more than 1,000 pounds. At that time, the people were crazy stocks. Later, the Congress passed the "Bubble Act" restricted, and the stock price plunged back below 190 two months later.

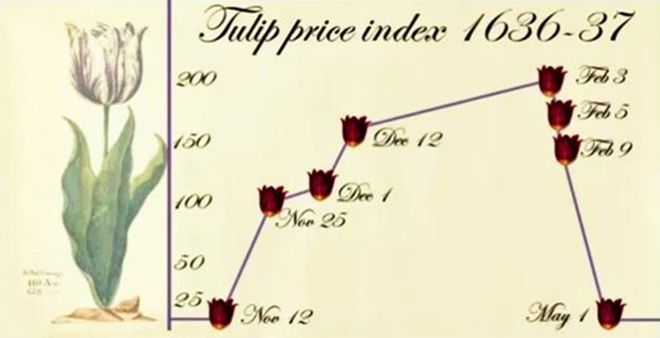

During the Tulip bubble period of the Netherlands, the trend chart of the price of tulip

In history, there are also tulip bubbles in the Netherlands in the 17th century. In the most crazy time, a tulip seed can be replaced by 20 sets of villas in the center of Amsterdam; real estate bubbles in Japan in the 1980s, the land value of the Tokyo Royal Palace at that time, the value of the Tokyo Palace. It is more valuable than Canada's land.

One: Is there any common law of the bubble?

Zhu Ning: I think there may be a few necessary non -sufficient conditions. There are often these conditions when bubbles occur, but it is not guaranteed that these conditions must be a bubble.

First, economic prosperity and wealth have sufficient liquidity. For example, the Dutch bubble occurred in the era of great navigation, and the United States was a short -term prosperity after the war.

Second, new concepts, new products, new business models.

For example, how much should I buy soap, I probably know. But if you see something you haven't seen before, you don't know how to price it. Coupled with the weakness of human nature, it will definitely tend to pricing at a high place.

The last point is the government's support, because after the rise in asset prices, it has a role in promoting economic development, consumption, and taxation. At the beginning, the government was often supported.

I often joke and say that bubbles have no harm, as long as it is not broken. But how can there be no broken bubble?

One: Is it difficult for ordinary people to make money in a bubble market?

Zhu Ning: I think it is a bit similar to gamblers who go to the casino. Once you make money, you will feel so easy to make money. My hands are so good, and it is difficult for you to really be relieved from it.

People who make money in the foam are not without, but they often have strong self -control or strong ability to judge. Most people are difficult to overcome the weaknesses.

One: In history, what will happen to the economic situation after the foam of the market is crushed? From the social level to the personal level, what kind of problems may be faced?

Zhu Ning: First of all, people may make some changes, but this change is often not correct.

Assuming that 10 million bought houses fall to 5 million, investors may not feel that they want to sell the house to control the risk, but it is very likely to buy another fell house.

Human behavior changes are very slow. He has made money in the property market in the past 20 years, so he firmly believes that one day it will rise (the reality is often unsatisfactory).

From the late 1970s to the mid -1980s, the people were in a state of carnival in a positive pleasure. But then the bubble was burst and the economy stagnated, and it was called "lost ten years".

In addition, the impact of economic bubbles is covered at all levels. The willingness to invest, the willingness to work, and the willingness to accept more education will have a particularly profound impact.

There are research on economics. During the Great Depression after the bubble, the suicide rate increased significantly and the crime rate would rise significantly.

Society and economy are interactive. During the rise of bubbles, everyone's emotions are very high, and they are expected to be optimistic, so everyone is willing to work overtime and invest in investment. After the foam is crushed, it is found that the "volume is useless" may produce a state of "low desire".

One: Many people are not particularly optimistic about the current economic situation, so they will have panic and feel insecure. Is there a period of reference in history? What can we do?

Zhu Ning: Actually, many things we have experienced now have happened 30 years ago in Japan and South Korea 20 years ago. After the miracle of rapid economic and fast flying, a downward trend has occurred, which has happened many times in history.

We have lived in a very lucky era in the past three or forty years, but it will not continue. Either changes in the epidemic and some economic changes. I think everyone must be prepared, and it will not be lost.

Accepting changes is a process of maturity and growth of a person, and a process of maturity and growth of a country.

In the past few years, we have seen many investors, many entrepreneurs and industrialists. In the past two or three decades, we have made money by luck. In the past few years, we have lost their own strength and ability.From the perspective of investment, you must know what the bottom line you can accept, and then keep your bottom line.

I often say to young students, saying "the art is not crushed", you don't know what will happen tomorrow, all you can do is to make your own ability stronger and stronger, the value in the market canpromote.

Although it sounds old -fashioned, many things you can't control yourself. When the environment is not good enough, the only suggestion is to be a better self.

- END -

Xinjiang: When the scientific and technological innovation "shifting speed -up" is carried out

Reporter Xie HuizhouThe role of scientific and technological innovation in Xinjian...

"My robot friend" What should I do if your rock board furniture has radiation?Don't be afraid, the robot has finished checking it early!

Jinyun News: Will our daily life come into contact with nuclear radiation? I belie...