Fosun's reduction will continue to reduce the holding of COFCO Industry, no more than 6%of the shares

Author:Cover news Time:2022.09.10

Cover Journalist Zhu Ning

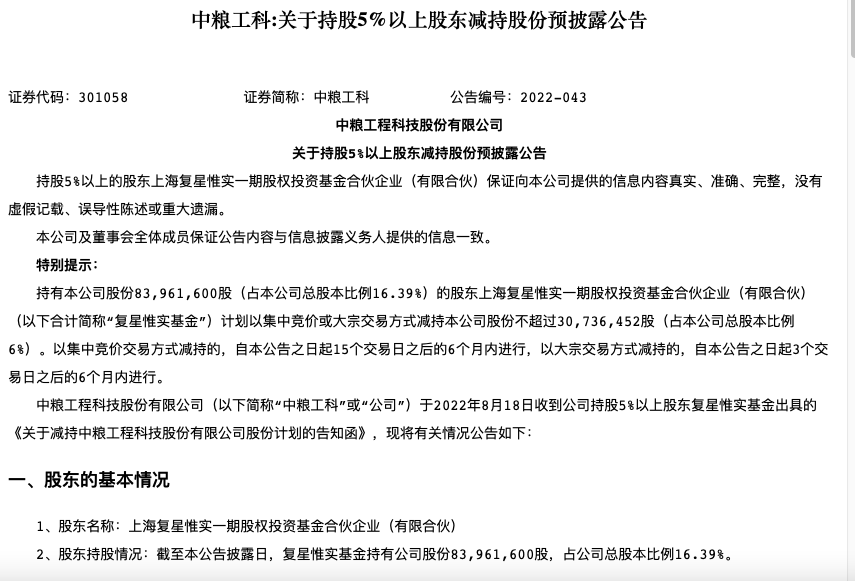

COFCO (301058) announced on the evening of September 9th that the company holding 16.39%of the shareholders Shanghai Fosun Weishi Phase I first phase of the equity investment fund partnership (referred to as "Fosun Weishi Fund") planned to concentrate on bidding or large trading methods. The shares of the company do not exceed 30.7365 million shares (accounting for 6%of the company's total share capital).

As of the close of the day, COFCO Industry reported to 4.62%to 16.52 yuan per share.

Immediately reduce your holdings until the lifting period

According to public information, COFCO is a first -class comprehensive engineering service provider and equipment manufacturer in China in my country. In September 2021, COFCO Land Landing on the GEM.

On the evening of September 5th, the COFCO Institute of Technology announced the announcement of the listing and circulation of the shares of the shares before the first public offering. 101 billion, accounting for 19.8045%of the company's total share capital.

The listing and circulation date of the limited sales shares is September 9, 2022, and the number of shareholders who apply for lift shares is 2. ), The number of shares held was 83.96 million shares and 17.49 million shares, respectively. The sales period promised by the two shareholders was 12 months from the date of the company's first public offering of shares and listing.

As soon as the lifting period arrived, Fosun's only fund rotated immediately. The announcement shows that the reason for the reduction of the Fosun Weishi Fund is its own business needs.

Fosun continues to reduce holdings

It is worth noting that the Recent Fuming system has continued to reduce its holdings. Fosun Pharmaceutical announced on September 3 that the controlling shareholder Shanghai Fosun High Technology (Group) Co., Ltd. intends to reduce its holdings of not more than 80.897 million shares, accounting for 3%of the total share capital ratio. This is also the first time that Fosun Pharmaceutical has been reduced by the controlling shareholder in the past five years. For the reasons for reducing holdings, Fosun Hi -Tech said in the announcement as "its own business plan needs".

On the same day, the Yuyuan shares of Fosun issued an announcement that the company and wholly -owned subsidiaries intend to sell 65.9438 million shares of Jinhui wine through agreement transfer, accounting for 13%of the total shares of Jinhui wine. At the same time, the Yuyuan Co., Ltd. will continue to reduce its holdings of more than 5%in the next six months. In addition, the Fosun has reduced its equity of many companies such as Hainan Mining, Tsingtao Beer, and Zhongshan Public in Hainan.

In this regard, the market analysis pointed out that the large -scale market cash in the Fosuna is actually a normal phenomenon. At present The larger the group, the more the group must maintain the stability of its relatively large -scale capital chain. Now that the capital market itself is relatively large, it is normal to adjust to a certain amount of adjustment at this time.

- END -

Heilongjiang Jiamusi Grain and Oil "Xiajiangnan" is called brand agriculture

A few days ago, Heilongjiang's Jiamusi Good Grain and Oil marketing activities walked into Nanjing, Jiangsu, and handed out Jiamusi Golden Card to add good grain to the table of Nanjing consumers....

Divide the corporate credit risk in four categories of "distinguished treatment", and Wuha

The Yangtze River Daily Da Wuhan Client June 13 (Correspondent Liu Yeqing) The city's corporate credit classification indicators are unified, differentiated supervision measures are clear, and organic...