Support to stabilize the economic market Henan banking insurance industry in action 丨 Henan Agricultural Credit Society: Do a good job of "three -character" article benefit the agricultural and profitable enterprises to help the market

Author:Henan Daily Client Time:2022.09.10

Henan Daily client reporter Hu Shutong

Since the beginning of this year, Henan Provincial Agricultural Credit Society has been in mind the "big people of the country" and "province's main", and resolutely implement the decision -making and deployment of the Party Central Committee and the State Council on stabilizing the economic market. The deployment of the Great Strategy, under the guidance of the regulatory authorities, coordinate the development of the epidemic prevention and control and the development of the real economy, and fully support the guarantee of the market to protect the employment and keep the people's livelihood, ensure that internal stability, promoting development, and helping the economy. As of the end of July, the province's loan balance of the province's agricultural credit cooperatives was 1142.3 billion yuan, and the balance of agricultural loan -related loans was 874.5 billion yuan. With a deposit of about 20%of the banking financial institutions in the province, 40%of the province's agricultural loan, 40%of 40% Small and micro enterprise loans, 60%of farmers' loans, and 80%of poverty alleviation small loans have contributed to the province's stable economic market.

Do a good job of "farm" articles around the revitalization of the countryside

Nong is a state, and the Benkin Ning. The province's Agricultural Credit Society keeps in mind the purpose of serving the "agriculture, rural areas, and rural areas", introduced work opinions, single -column credit plans, and launched exclusive products to serve rural revitalization. The first is the implementation of the "Xingnong Hui Nong" plan. It is proposed that in 2022, a total of more than 100 billion yuan in rural revitalization loans is put on the goals of more than 100 billion yuan, and six major areas such as "grain bags", "vegetable baskets" project, agricultural advantageous industrial development, and agricultural industrialization leading enterprises have increased credit investment. As of the end of July, this year, the rural revitalization related loans were 90.5 billion yuan. The second is to actively carry out the "three major actions". Carry out the "in -depth integration of party building and finance" to solve problems such as asymmetric information, lack of pledged goods, and poor loan channels such as pledged substances. Carrying out the "Credit Village Credit" action, and vigorously promoting the rating of farmers and new agricultural business entities, and currently carry out "whole village credit" of 36,400 administrative villages in the province. Carry out service sinking operations, implement rural infrastructure expansion plans, and realize that "basic finance does not leave villages and comprehensive finance cannot be out of the town." The third is to continue to consolidate the results of expanding poverty alleviation. We will conscientiously implement the requirements of the "four non -picking", maintain the existing assistance policies, advance measures, and work intensity, and promote the effective connection of the results of consolidation and expansion of poverty alleviation. As of the end of July, a total of 92 billion yuan of poverty alleviation loans was put in accumulation, with 3.6 billion yuan in that year, with a balance of 17.2 billion yuan.

Focus on the "small" article around the company to help companies

Continue to promote the "increased household expansion" project of small and micro -financial services, try to protect the market entities, and provide solid support for the stability of employment. The first is to vigorously release the "source of living water". Take advanced manufacturing, green environmental protection, scientific and technological innovation small and micro enterprises as supportive priorities, establish and improve the "whitelist" dynamic management system of enterprises, and accurately provide financial services for "one enterprise, one policy". As of the end of July, the balance of private and small and micro -enterprise loans was 764.9 billion yuan, of which the balance of inclusive small and micro enterprise loans was 273.2 billion yuan, the balance of loans of technology -based SMEs was 9 billion yuan, and the loan balance of SME loans of SMEs was 26 100 million yuan. The second is to establish a long -term service mechanism. Formulate the "Implementation Rules for the Effective Mechanism of Small and Micro -Enterprises to Loan the Loan Loan Council", and formulate 28 measures from 7 aspects to comprehensively improve the enthusiasm and endogenous motivation of small and micro enterprises' financial services. Use monetary policy to supplement the sources of funds, implement the reform of small and micro loan franchise institutions, and carry out bank -enterprise docking activities to normalize, and improve the loan capacity and level of small and micro enterprises. The third is to introduce the policy of relieving the enterprise. It is supported by the impact of small and micro -enterprises affected by the epidemic, no loan, no loan, continuous loan, and supporting measures such as renewal of the exhibition period and adjusting the repayment cycle. As of the end of July, a total of 117.3 billion yuan in bailout corporate loans was supported, with a balance of 85.9 billion yuan. Optimized interest rate pricing mechanism and launching preferential interest rate products, the average interest rate of various loans decreased by 0.81 percentage points from the beginning of the year.

Do a good job of "real" article around market demand

Give full play to the positive role of finance in promoting investment, stable growth, and benefiting people's livelihood, and effectively meet the financing needs of key enterprises, important areas, and major projects. The first is to carry out in -depth activities of the "President into Ten Thousand Enterprises". Actively docking the Baolian enterprise and do a good job of "two questions and four delivery" on -site investigations and credit support. At present, 103,000 companies have been conducted on 6,613 companies, and 22.6 billion yuan in credit support to 2,519 companies, of which 1.4 billion yuan of loans to 59 provincial enterprises. The second is to actively support the construction of "three batches". Focus on the "Top Ten Strategy", pay close attention to the province's "three batches" major projects, implement 11 work measures including list management and differentiated credit policy, take the initiative to connect local governments, and broaden the channels for credit release. As of the end of July, the province's "three batches" major project loan balance was 2.3 billion yuan. The third is to do a good job of financial services for new citizens. Promote the "Jinyan Entrepreneurship Loan" products to help migrant workers in the urban family. Taking the online product "Jinyan E loan" as the starting point, focusing on the development of personal business and digital finance, and further enhance the convenience and accessibility of new citizens' financing. To maximize the benefit of the people, avoid the payment of the card of the card, the in -system depository and exchange fees, and the management fee of small accounts, temporarily exempt the online business national and cross -bank transfer fees.

In the next step, the province's agricultural credit cooperatives will continue to conscientiously implement the spirit of stabilizing the national market telephone conference, implement the work arrangements of the provincial party committee and provincial government, fully serve the real economy, increase loans, and strive to increase the annual net increase of 90 billion yuanAt the or above, the steady stream has continuously injecting financial water into the economic continuous recovery and steadily.

- END -

Xinxian: Create seed seedlings industrial clusters to help agricultural high -quality development

Seed safety is related to national security. Xinxian has given full play to the advantages of the agricultural industry, focusing on the research and development and application of technologies such a

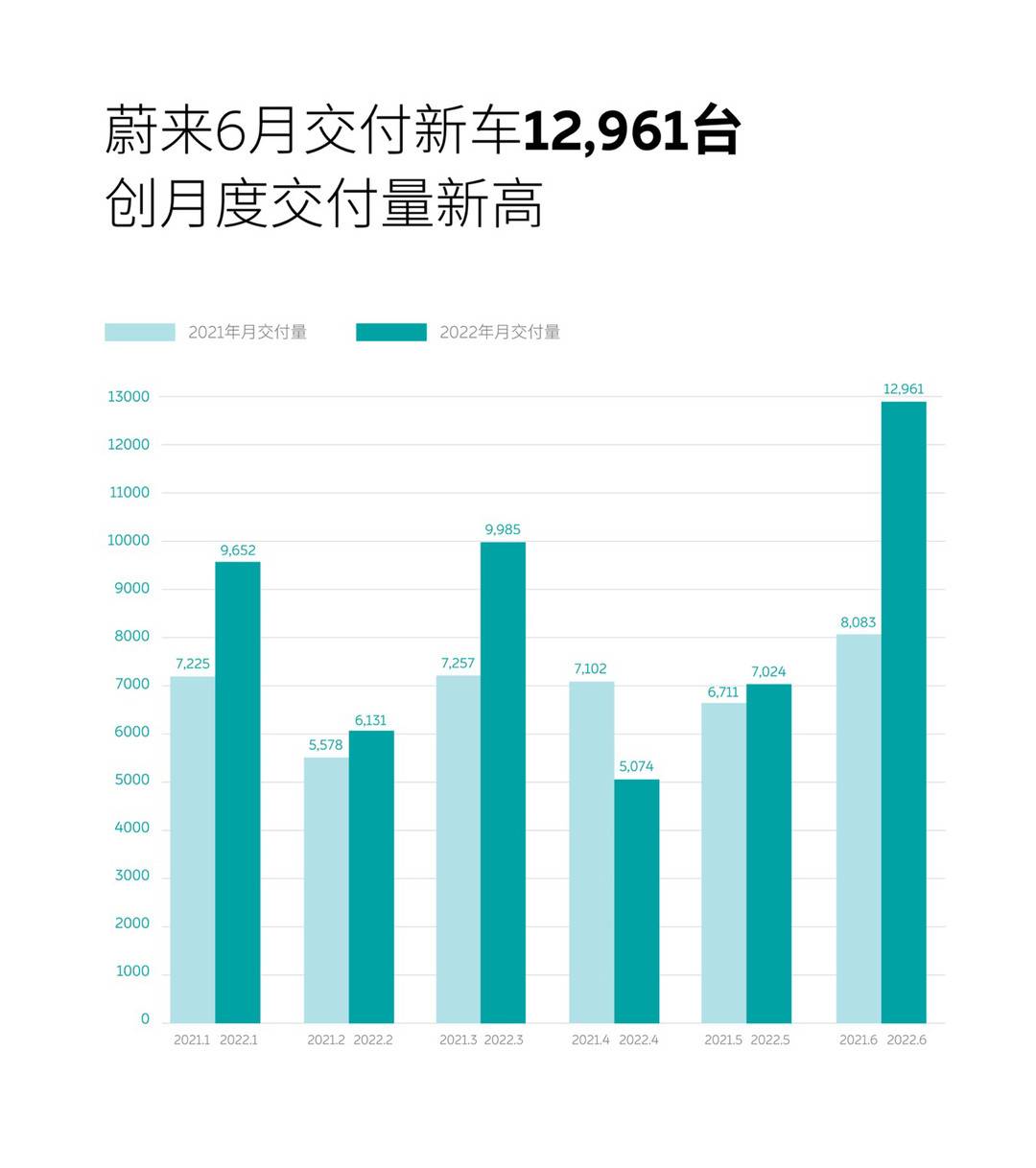

The semi-annual report of the auto market | January-June year-on-year increased by 21.1%!Weilai, who was "shorted" by the Grizzlies, responded with the transcript of the middle school entrance examination

Cover news reporter Zhang FuchaoOn July 1, Weilai announced its June sales data, w...