The central bank and the Banking Regulatory Commission announced!The 19 domestic banks were selected!

Author:Top news Time:2022.09.10

On September 9, the Central Bank and the CBRC released the list of important banks in my country in 2022, and 19 domestic system important banks were selected.

Based by the importance of the system from low to high into five groups:

There are nine groups in the first group, including China Minsheng Bank, China Everbright Bank, Ping An Bank, Huaxia Bank, Ningbo Bank, Guangfa Bank, Bank of Jiangsu, Bank of Shanghai, Bank of Beijing;

3 groups, including CITIC Bank, China Postal Savings Bank, SPD Bank;

The third group, including the Bank of Communications, China Merchants Bank, and Industrial Bank;

Four groups, including Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank of China; the fifth group has not entered.

The list of important banks in my country's systemic important bank this year

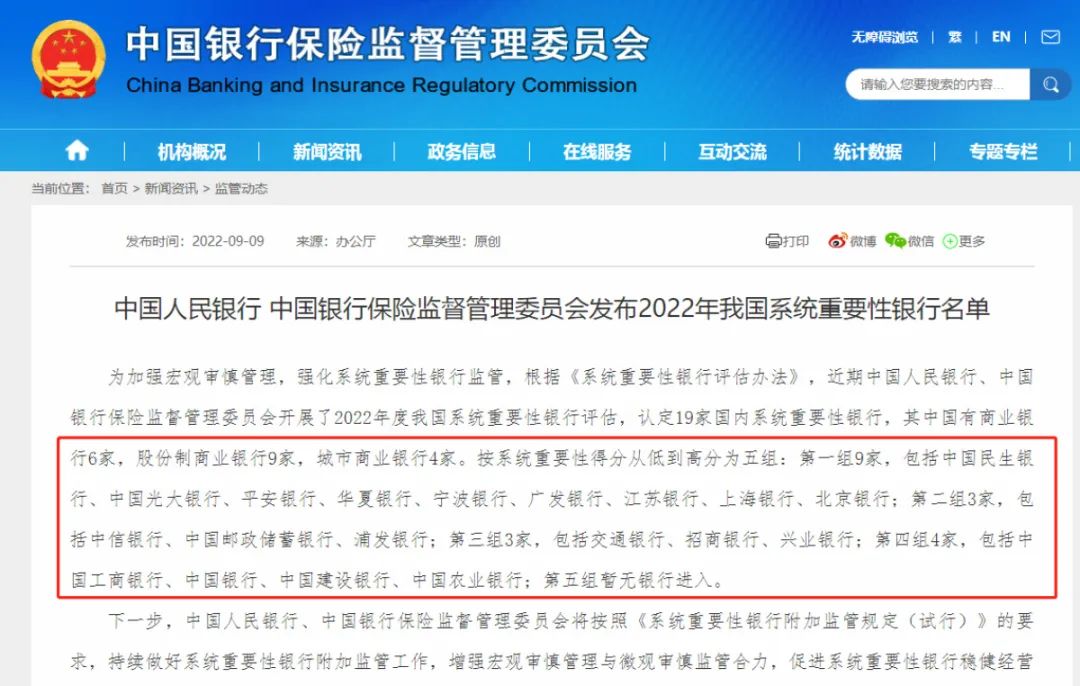

In order to strengthen macro -prudential management and strengthen system importance bank supervision, in accordance with the "System Important Bank Evaluation Measures", the People's Bank of China and the Bank of China Insurance Supervision and Administration Commission have carried out the evaluation of the my country System Important Bank of China in 2022 to identify 19 domestic systems. Important banks, including 6 State Commercial Banks, 9 joint -stock commercial banks, and 4 urban commercial banks.

According to the system importance, scores from low to high into five groups: the first group of 9, including China Minsheng Bank, China Everbright Bank, Ping An Bank, Huaxia Bank, Ningbo Bank, Guangfa Bank, Bank of Jiangsu, Bank of Shanghai, Bank of Beijing; There are 3 groups in the second group, including CITIC Bank, China Postal Savings Bank, and Pudong Development Bank; the third group of 3, including Bank of Communications, China Merchants Bank, and Industrial Bank; Banks, Agricultural Bank of China; no banks enter the fifth group.

In the next step, the People's Bank of China and the Bank of China Insurance Supervision and Administration will continue to do a good job of systematic bank additional supervision in accordance with the requirements of the "System Important Bank Additional Supervision Regulations (Trial)", and strengthen macro -prudential management and micro -prudential supervision. , Promote the stable operation and healthy development of the system.

Release list every year: differentiated supervision and maintenance of financial stability

On December 3, 2020, the "System Important Bank Evaluation Measures" issued by the Central Bank and the Banking Insurance Regulatory Commission (hereinafter referred to as the "Evaluation Measures"), the purpose is to improve the regulatory framework of my country's systematic financial institutions, establish a systemic bank assessment and identification mechanism.

It is understood that the "Evaluation Measures" as one of the "Guiding Opinions on Improving the Supervision of Systems Health Institutions" is one of the basis for the basis of the important bank of my country's systemic banks. The basis for the requirements of the disposal plan and the implementation of the early correction mechanism.

The main content of the "Evaluation Measures" is to clarify the purpose of evaluation. Identify the important banks of systems in my country, issue a list every year, and conduct differentiated supervision of system importance banks according to the list to effectively maintain financial stability. The second is to determine the evaluation method. Calculate the system importance score of the banking bank with quantitative evaluation indicators, and then make supervision judgments based on other quantitative and qualitative information. The third is to clarify the evaluation process. Determine the scope of participating banks every year, collect the data from the banks for calculation, propose the initial list of the system importance banks, combine the supervision judgment, and make necessary adjustments to the initial list.

background

The person in charge of the relevant departments of the Central Bank and the Banking Regulatory Commission responded to the reporter's question on the "Evaluation Measures for System Important Banks", and also mentioned the background of the "Evaluation Measures". High degree, strong correlation with other financial institutions. Once a problem occurs, it may have strong contagiousness on the financial system, and it may also have a great impact on the macroeconomic operation. Therefore, since the international financial crisis, strengthening the supervision and prevention of "big but not down" of systemic financial institutions has become an important part of the global financial supervision reform. In November 2018, with the consent of the Party Central Committee and the State Council, the People's Bank of China, the CBRC, and the Securities Regulatory Commission jointly issued the "Guiding Opinions on Improving the Supervision of System Important Financial Institutions", which clarified the evaluation and identification, additional supervision, and additional supervision of the importance of my country's systemic important financial institutions in China The overall institutional framework of resume disposal. Considering that the banking industry occupies an important position in my country's financial system, four banks including ICBC, Agricultural Bank, Bank of China, and Construction Bank have been selected as a global system important bank list. Subsequent release system importance banks and implementation of additional supervision requirements laid the foundation.

On the basis of the above documents, in order to improve the regulatory framework of the importance of my country's systemic importance and clarify the additional regulatory requirements of system importance banks, on October 15, 2021, the Central Bank and the China Banking Regulatory Commission also issued the "System Important Bank Additional Regulatory Regulations (Trial)" Essence The "Administrative Regulations" draws on the practical experience of international financial supervision, fully consider the actual situation of the banking industry in my country, help improve my country's macro -prudential policy framework, supplement the shortcomings of the bank supervision system of the system, and maintain the stability of the financial system.

———————————————————————

Source: Dahe Daily · Yu Video Reporter Deng Fei

- END -

High -tech development of the main business of building construction is difficult to build a new field of semiconductors. Will it be "dissatisfied"?

Reporter Li Beibei, a reporter from this reporter, reported by BeijingBased on Che...

Rice and fish crab symbiosis realizes one field and three receipts

Tianshan.com reporter Zhang Ting correspondent Dong ShijuIn late August, it was du...