Every time it is traded (evening edition) 丨 north to the funds to be optimistic about the net outflow of the market for 14.7 billion; the northbound funds to the bottom of the Moutai pass through 900 million;

Author:Daily Economic News Time:2022.09.09

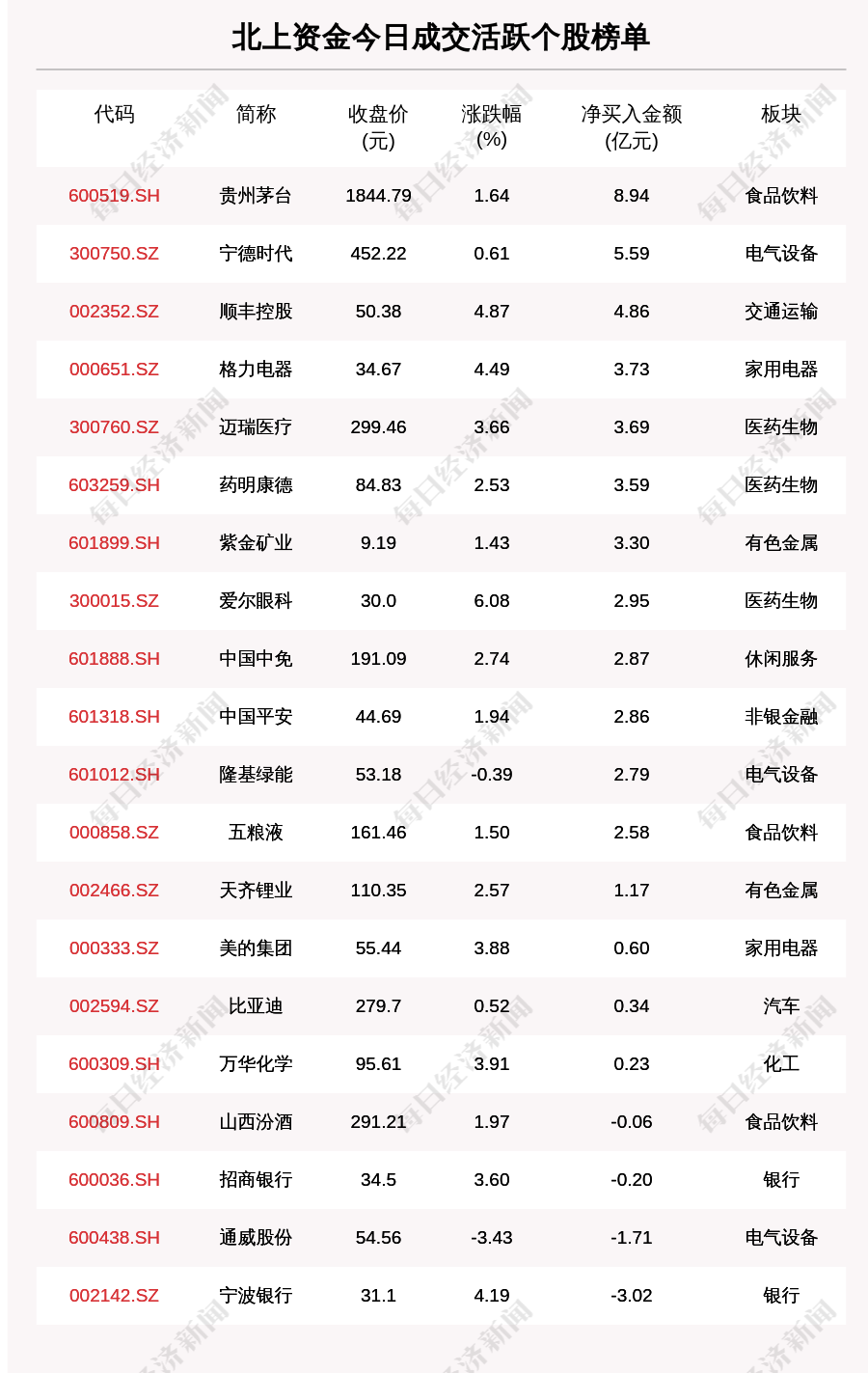

On September 9, the Shanghai Index rose 0.82%. Northern Fund buying a net purchase of 14.754 billion yuan today. Among them, the Shanghai Stock Connect net purchase was 8.317 billion yuan, and the Shenzhen Stock Connect net purchase was 6.437 billion yuan.

On September 9th, in the list of active stocks in the North Shanghai Fund Transaction, a total of 16 net stocks were bought, and the largest amount was Moutai (600519.SH, the closing price: 1844.79 yuan), which bought 894.5 million yuan; net selling There are 4 individual stocks, and the most amounts are Bank of Ningbo (002142.SZ, the closing price: 31.1 yuan), which sells 302.3 million yuan.

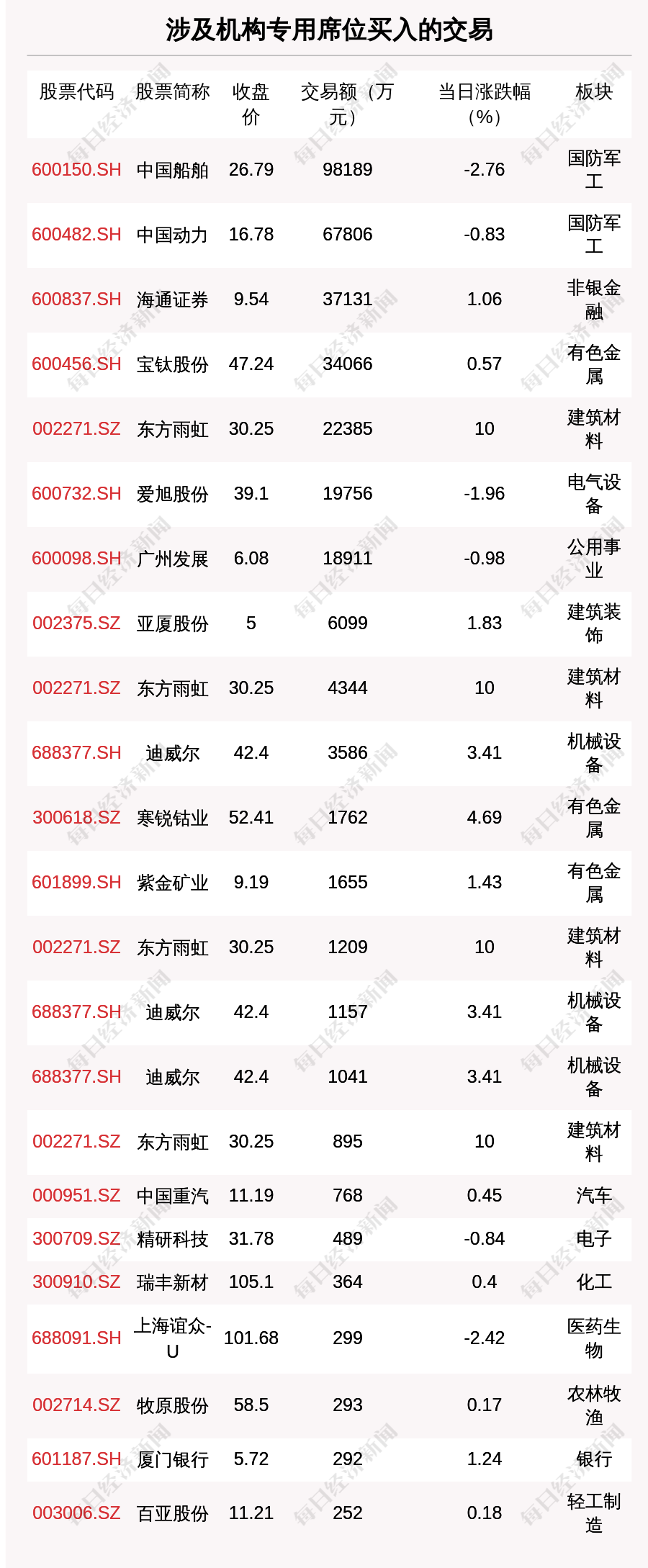

On September 9, 2022, a total of 161 large transactions occurred in the Shanghai and Shenzhen cities, with a total of 5.811 billion yuan, involving 78 listed companies.

On September 9th, a total of 40 stocks were on the list. Rongjie's dragon and tiger list had the largest number of net buyers, reaching 204 million yuan.

In the Dragon and Tiger List, there are 24 individual stocks involving the special seats in the institution. The top three of the net purchase are Sino -Materials International, Jia'ao Environmental Protection, and Ruikang Pharmaceuticals, which are 41.887 million yuan, 16.422 million yuan, and 15.646 million yuan, respectively.

Bojie (002975.SZ) said on the investor interactive platform on September 9 that the company currently has a variety of 5G millimeter -wave shielding box products. From the perspective of the function and process of testing, the test demand for 5G millimeter waves will be greater than the 4G test demand, but customers will continuously optimize the test process and develop new test methods, and find better in the quality and efficiency of testing. Balance point.

Tuobang (002139.SZ) said on the investor interactive platform on September 9 that inverter products are widely used in the field of photovoltaic and energy storage. The company's inverter mainly focuses on portable energy storage. The technology and quality are at the leading level in the industry. It has obtained the absolute share of the head customers in the field. The demand for downstream in this field is strong and the business progress is smooth. This year, it is expected to continue to double. The company's micro -inverse products are still progressing.

When Sheng Technology (300073.SZ) said on the investor interactive platform on September 9th, the company used a special microcrystalline front -drive body and material structure regulation to solve the key technical bottleneck of the positive electrode material of sodium batteries, and launched a new generation of sodium electronics materials At present, the process has been completed and sampled to large domestic customers. Product performance indicators are better than similar products in the market.

Ocean Motor (002249.SZ) said on the investor interactive platform on September 9 that a variety of models equipped with the company's hydrogen fuel cell module have been included in the national "New Energy Vehicle Promotion and Application Recommended Model", such as Dongguan Zhongqihong Far -fuel battery urban buses, Dongfeng brand fuel cell city passenger cars, Chengdu Guangtong fuel cell city passenger cars, Zhuhai Guangtong fuel cell bus chassis, etc.

San'an Optoelectronics (600703.SH) said on the investor interactive platform on September 9 that the company's LED business is in the upper reaches of the industrial chain, mainly including LED substrate, extension, chip manufacturing, etc. The circuit business mainly includes the R & D front -end, filter, optical technology, and electronic electronic compound semiconductor research and development and production. The company has built upstream industries extended from the outer chip manufacturing and packaging. The downstream is mainly terminal applied.

De Sheng Technology (002908.SZ) said on the investor interactive platform on September 9 that the company has technical capabilities and typical applications in the blockchain field, such as the company's equity chain application implemented by the company, which is the core of the Beijing Minsheng One Card project. One of the applications, the use of blockchain technology to open up the barriers between various departments is more conducive to realizing cross -departmental information sharing. The application practice has been highly recognized by partners such as Beijing project and Huawei.

Cangzhou Pearl (002108.SZ) said on the investor interactive platform on September 9 that the company's sales volume of lithium -ion battery diaphragm products in the first half of 2022 and 26.13%of the comprehensive gross profit margin. The quality improvement of diaphragm products and customer introduction have currently successfully entered the mainstream battery production enterprises at home and abroad. Subsequent companies will continue to strengthen market development and actively promote customer certification.

Tuo Ri Xinneng (002218.SZ) said on the investor interactive platform on September 9 that the power stations that created direct electricity income for the company were self -operated. rights and interests. The company's self -held photovoltaic power station is mainly centralized; the entire county promotes projects are mainly distributed.

Fengyuan (002805.SZ) said on the investor interactive platform on September 9 that as of the first half of the year, the company's lithium iron phosphate has 10,000 tons of production capacity; Capacity. The company's lithium iron phosphate has 10,000 tons of production capacity. The Zaozhuang base has built a new 40,000 tons of iron phosphate lithium phosphate production line at the end of August. The three yuan production capacity, the Zaozhuang base built a new 8,000 tons of high nickel ternary production line at the end of July into the device debugging stage.

Zhenhua New Materials (688707.SH) said on the investor interactive platform on September 9 that the company's positive electrode material production capacity is at a low level in the same industry. At present The production capacity of Yuanzhengji material is 26,000 tons (comprehensive compatible with medium nickel and medium -high nickel series products). The production capacity is expected to reach 76,000 tons at the end of 2022, and 82,000 tons in the first quarter of next year. With the construction of Yilong III projects, the company's overall production capacity will reach 182,200 tons in 2025, providing support for the rapid development of the company's positive pole material business. Langzi (SZ 002612, closing price: 25.24 yuan) issued an announcement on the evening of September 9, saying that on September 9, 2022, Beijing Langzi Medical Management Co., Ltd. and Wuhu Bichen, a wholly -owned subsidiary of Langzi Co., Ltd. No. 5 Equity Investment Partnership (Limited Partnership) signed the "Equity Transfer Agreement", and Beijing Langzi Medical Management intends to acquire 75%equity of Kunming Hanchen Medical Beauty Hospital Co., Ltd. held by Bochen 5 in cash. According to the assessment report issued by the appraisal agency hired by this transaction, Kunming Hanchen used the income method to evaluate the value of the shareholders' entire equity of about 211 million yuan (that is, the results of the 100%equity evaluation of the Kunming Hanchen was about 211 million yuan), and The corresponding evaluation value is about 158 million yuan. Based on the results of the above evaluation, the price transfer price of the target equity is about 158 million yuan after negotiation.

Longteng Optoelectronics (SH 688055, closing price: 4.87 yuan) issued an announcement on the evening of September 9th that on September 9, 2022, the company received the shareholders 'shareholders' shareholding plan for the shareholders of Kunshan Longteng Optoelectronics Co., Ltd. "Information letter", as of September 8, 2022, Longteng Holdings has reduced its holdings of about 3.75 million shares through a collection of bidding, accounting for 0.11%of the company's total share capital. The plan has not yet been implemented.

Carbon Yuan Technology (SH 603133, closing price: 10.12 yuan) issued an announcement on the evening of September 9th that as of the date of this announcement, the shareholder of Carbon Yuan Technology Co., Ltd. Thousands of shares, accounting for 7.7%of the company's total share capital. Jinfuyuan plans to reduce its holdings by concentrating bidding transactions or community transactions in the next two months, which will not exceed about 6.28 million shares, that is, the total reduction ratio will not exceed 3%of the company's total share capital.

Cambrian (SH 688256, closing price: 72 yuan) announced on the evening of September 9 that due About 10.26 million shares. Ningbo Hangao plans to reduce the total holdings of Cambrian by centralized bidding and transaction methods. The SDIC and Entrepreneurship Fund plans to reduce the total holdings of Cambrian shares by centralized bidding and transaction methods.

Yongguan New Material (SH 603681, closing price: 26.07 yuan) issued an announcement on the evening of September 9th that as of the disclosure of this announcement, the company's shareholders Lang Duo (Shanghai) Enterprise Management Consulting Partnership (Limited Partnership) holding a company shares contract contract contract contract contract 5.59 million shares, accounting for 2.93%of the company's total share capital; 垚 Er (Shanghai) Enterprise Management Consultation Partnership (Limited Partnership) holds about 3.34 million shares of the company; There are 3 million shares of the company. Due to its own funds, the company's shareholders, the company,,,, intends to reduce the company's shares through centralized bidding and large transaction methods, the total reduction of not more than 11.47 million shares, accounting for no more than 6%of the company's share capital.

Hua Railway Emergency (SH 603300, closing price: 7.39 yuan) issued an announcement on the evening of September 9 that Zhejiang Huagi Emergency Equipment Technology Co., Ltd. recently received the "Approval of Zhejiang Huagi Emergency Equipment" issued by the China Securities Regulatory Commission recently Approval of Technology Co., Ltd. non -public offering of shares ": Approve your company's non -public offering of no more than 125 million new shares.

Tianghe Guangneng (SH 688599, closing price: 72.5 yuan) issued an announcement on the evening of September 9th that as of the disclosure of this announcement, Beijing Hongyu Technology Partnership (Limited Partnership) directly held Tiantuang Energy Co., Ltd. for the first time for the first time Before the public offering, about 105 million shares were issued. Due to the "Tianhe Convertible Bonds" conversion of the "Tianhe Convertible Bonds", about 5.31 million new shares were added, and a total of about 111 million shares held by the company's shares, accounting for 5.11%of the company's total share capital. Among them, the shares held before the first public offering have been listed on June 10, 2021. Due to its own development and funding needs, Beijing Hongyu plans to announce the reduction of the holdings through the market price through the market price within three months from the date of three months from the date of this reduction plan. 2%of the stocks, about 4.335 million shares.

Taiping Bird (SH 603877, closing price: 18.12 yuan) issued an announcement on the evening of September 9 that on September 8, 2022, the company completed the repurchase, and the company had actually repurchased the company's shares of about 3.35 million shares, accounting for 0.7% of the company's total share capital , The highest price of the repurchase is 22.4 yuan/share, the minimum price of the repurchase is 17.33 yuan/share, the average repurchase price is 19.63 yuan/share, and the total amount pays is about 65.82 million yuan.

Boruo Biological (SH 688767, closing price: 53.47 yuan) issued an announcement on the evening of September 9th that as of the disclosure of this announcement, Hangzhou Botuo Biotechnology Co., Ltd. Li Qifu, Wu Haijiang, Zheng Gangwu, Li Yan, and Li Honghe held each other. The company's shares of 6 million shares, 800,000 shares, 480,000 shares, 360,000 shares, and 360,000 shares. The shares obtained will be lifted and circulated after -sales on September 8, 2022. Due to the demand for shareholders' funds, Li Qifu, Wu Haijiang, Zheng Gangwu, Li Yan, and Li Honghe intends to reduce their holdings by concentrated bidding and transaction methods of the community, which does not exceed 3.18 million shares, accounting for no more than 2.98%of the company's total shares.

Kehua Data (SZ 002335, closing price: 38.99 yuan) issued an announcement on the evening of September 9 that some directors, supervisors, and senior management of the company voluntarily increased their holdings of the company's share plan. Based on the confidence in the future development prospects of the company and the confidence The company's value is highly recognized. It is planned to increase the company's shares by concentrating the bidding of the secondary market within 6 months from the date of the disclosure of this announcement.

International Industry (SZ000159, closing price: 9.02 yuan) issued an announcement on the evening of September 9 that as the assets of the revitalization company, according to the company's strategic development needs, on September 9, 2022, Xinjiang International Industrial Co., Ltd. The Co., Ltd. signed the "Equity Transfer Contract", which intends to transfer 100%equity of Xinjiang International Land Real Estate Development Co., Ltd., Xinjiang International Land Real Estate Development Co., Ltd. The transfer price is 254 million yuan.

The first entrepreneurial (SZ 002797, closed price: 5.98 yuan) issued an announcement on the evening of September 9 that the First Venture Securities Co., Ltd. received the company's largest shareholder Beijing Capital Entrepreneurs Group Co., Ltd. on September 8, 2022 The letter was notified to inform Shouchuang Group and Beijing State -owned Capital Operation Management Co., Ltd. to sign the "Region Transfer Agreement on the First Entrepreneurship Securities Co., Ltd.". Unlimited sales shares of about 465 million shares (11.0576%of the company's total share capital).

Jin Rong Tianyu (SZ 300988, closing price: 23.59 yuan) issued an announcement on the evening of September 9 that the related matters related to the issuance of shares to specific objects this time have been implemented by the company's 2021 shareholders' meeting. The 29th meeting of the second board of directors of the company has been reviewed and approved. There are no more than 35 issues. The number of shares issued this time does not exceed 7.95 million shares (including the number), and does not exceed 30%of the total share capital of the company before the issuance. The issuance price is not lower than the price of the company's stock transactions in 20 trading days. This issue is proposed to raise no more than 159 million yuan. After deducting the issuance costs, all of them are used in the smart manufacturing base of Zhejiang Jinrong Precision Products.

Tuori Xinneng (SZ 002218, closing price: 5.98 yuan) issued an announcement on the evening of September 9th that about 134 million shares holding Shenzhen Tuori New Energy Technology Co., Ltd. (accounting for 9.52%of the company's total share capital) The shareholder of Kashi Dongfang Hexin Technology Co., Ltd. plans to use a concentrated bidding trading method within 6 months after the disclosure of this announcement or from the date of the disclosure of this announcement within 6 months. The total transaction method has reduced the company's shares of less than 14.13 million shares (the proportion of the company's total shares does not exceed 1%).

Hongrun Construction (SZ 002062, closing price: 5.98 yuan) issued an announcement on the evening of September 9th that Hongrun Construction Group Co., Ltd. recently received a notice from the Ningbo Public Resources Trading Platform, Shaojiadu Bridge and Wiring Engineering and Yao Yao The first phase of the Jiangxin District Comprehensive Pipe Corridor (Shadu Road) (II bidding) civil construction project was under construction projects in the project, and the price of the project was about 275 million yuan.

Shu Tai Shen (SZ 300204, closing price: 11.22 yuan) issued an announcement on the evening of September 9 that the number of shares issued this time was not more than 37.5 million shares (including the number), which did not exceed 30% of the total share capital of the company's total share capital before the issuance. The issuance price is not lower than the price of the company's stock transactions in 20 trading days. This issue is planned to raise no more than 300 million yuan. The raised funds are used for the following uses: innovative drug research and development projects, with a total investment of about 381 million yuan, and intended to invest 300 million yuan.

Tianli Technology (SZ 300399, closing price: 10.24 yuan) issued an announcement on the evening of September 9 that the company's shareholders Qian Yongyao and Tianjin Zhihui reduced their holdings of 4.8869 million shares, and the shareholding shares accounted for 2.47% of the company's total shares of 2.47% Essence The number of reductions in this reduction plan has been reduced by half. From January to June 2022, Tianli Technology's operating income composed of 59.86%of insurance product services and 40.14%of mobile information services.

COFCO (SZ 301058, closing price: 16.52 yuan) issued an announcement on the evening of September 9th that about 83.96 million shares (accounting for 16.39%of the company's total shares) of the company Fund partnership (limited partnership) plans to reduce the company's shares with a concentrated bidding or large transaction method of not more than 30.74 million shares (accounting for 6%of the company's total share capital). If the holdings are reduced by concentrated bidding trading methods, within 6 months after the date of this announcement, if the holdings are reduced by a large transaction method, the 6 months after the date of this announcement will be Do it internally. Aikang Technology (SZ 002610, closing price: 3.63 yuan) issued an announcement on the evening of September 9 that Jiangsu Aikang Technology Co., Ltd. received the company's controlling shareholder Jiangsu Aikang Industrial Group Co., Ltd. on September 9, 2022, 2022 The notice letter is that from June 10, 2022 to September 8, 2022, Aikang Industry has reduced its holdings of about 45.51 million shares through the major transaction method, accounting for 1.02%of the company's total share capital.

① As of press time, the Dow has risen by 1.46%, the S & P 500 index futures rose 1.53%, and the Nasda Index futures rose 1.59%.

② The hydrogen energy giant Pragener (PLUG, a stock price of 29.12 US dollars, a market value of 16.852 billion US dollars) rose nearly 2%before the market, and Prager Energy has obtained the largest multi -site electrolytic groove order in Europe to date.

② The American Aluminum Corporation (AA, a stock price of $ 48.86, a market value of US $ 8.791 billion) rose 4.34%before the market to $ 50.98. Due to the tide of shutdown in the European metal smelting industry and the decline of the US dollar index, Lun Aluminum rebounded after several consecutive transactions, and rebounded 1.6%yesterday, and now returned to the top of 2,300 US dollars, an increase of 1.4%.

④ Buckingham Palace in the United Kingdom announced that King Charles III will officially swore to the throne at 10 am local time at 10 am.

⑤ The Norwegian sovereign wealth fund purchased 86%of Paris Lafayette's shares, and the wholly -owned subsidiary of Voltair, a wholly -owned subsidiary of Airbus (EPA: Air, 96.90 euros, and a market value of 76.634 billion euros).

⑥ According to Bloomberg, Bain Capital (BCSF, a stock price of $ 14.67, a market value of US $ 947 million) considers the sale of human resources software developer WORKS HUMAN Intelligence for $ 2 billion to consider the overall or partial sale of the company's shares.

⑦ As of press time, the US dollar index has fallen by more than 1%within the day, and currently reported at 108.49. The pound rose 1%within the day of the dollar. The Australian dollar rose 1.5%within the day of the dollar.

⑧ As of press time, WTI crude oil rose 3%within the day, and now reported to $ 85.21/barrel; Brent crude oil rose 2.85%to $ 90.92/barrel.

委 The European Central Bank Management Commission Muller: To respond to the fast upward inflation requires strong response measures. It is necessary to raise interest rates sharply to prevent swelling.

, 22:00 Beijing time, the final value of the U.S. wholesale inventory in July (previous value: 0.8%, forecast value: 0.8%).

Daily Economic News

- END -

Liancheng: "Chain Long" and "Chain Lord" dual -chain driver Pei Youyu strong three major industries

Liancheng: Chain Long and Chain Lord dual -chain driver Pei Youyu strong three major industries□ Yellow ShuilinOn August 10th, in the industrial concentration area of Pengkou Town, Liancheng

Agricultural technology goes to the countryside to promote the technical solution problem

The wheat is in harmony with the granary, and the Sanxia corn has been sowing, and...