Financial data has improved in August, and RMB loans increased by 39 billion yuan year -on -year

Author:21st Century Economic report Time:2022.09.09

21st Century Business Herald reporter Bian Wanli Beijing report

Financial data has improved in August, and the demand for credit in the future is still the focus.

On September 9, the central bank issued August financial statistics. Data show that at the end of August, the broad currency (M2) increased by 12.2%year -on -year, a new high since May 2016; the increase in social financing in August 2022 was 2.43 trillion yuan, which was 557.1 billion yuan less than the same period last year; RMB deposits increased by 128 trillion yuan, an increase of 92.6 billion yuan year -on -year.

Wang Qing, the chief macro analyst of Dongfang Jincheng, analyzed that overall, the credit data was repaired in August, and the internal part of it was obvious. The wide credit process mainly relied on policy promotion, and the market spontaneous financing demand was still weak.

He said that looking forward to the future, under economic restoration and policy efforts, financial data will be further recovered in September. Among them, the growth rate of various loans is expected to rise from decrease to rise, which is a sign of continued to advance wide credit. Next, macro policies will continue to increase the demand for credit, and policy tools, including fiscal discounts, have a large space.

M2 continues to rise year -on -year growth rate

At the end of August, the balance of the broad currency (M2) was 2.5951 trillion yuan, an increase of 12.2%year -on -year, and the growth rate was 0.2 and 4 percentage points higher than the same period last month and the same period last year. Since March 2022, the growth rate of M2 has been showing a tendency to grow, which has been a sixth consecutive rise. Among them, the growth rates in February, March, April, May, June, and July were 9.2%, 9.7%, 10.5%, 11.1%, 11.4%, 12%, respectively. At the same time, the growth rate of 12%in August hit a new high since May 2016, second only to the growth rate of 12.8%in April 2016.

Zhou Maohua, a macro researcher at the Everbright Bank Financial Market Department, said, "M2 maintained a high of 12.2%year -on -year, mainly to reflect domestic active financial and monetary policies, increase the basis of basic currency, and drive the increase in residents and corporate deposits; The growth rate of speed with nominal GDP is basically matched, showing that the domestic currency supply is in a reasonable range, and it continues to provide strong support for the real economy recovery. "

Generally, M2 is composed of M1+quasi -currency (regular deposits+residential savings deposits+other deposits); M1 consists of M0+corporate current deposit. Data show that in August, RMB deposits increased by 1.28 trillion yuan, an increase of 92.6 billion yuan year -on -year. Among them, residents 'deposits increased by 828.6 billion yuan, non -financial corporate deposits increased by 955.1 billion yuan, fiscal deposits decreased by 257.2 billion yuan, and non -bank financial institutions' deposits decreased by 435.3 billion yuan.

In Wang Qing's opinion, there are two main reasons for the year -on -year growth rate of M2 M2: First, the large -scale retention of tax refund in August continues to advance, and the tax refund funds directly reach the corporate account, which will directly increase corporate deposits and increase the growth rate of M2 growth rate. Essence The second is the current investment in infrastructure, and fiscal expenditure has increased. It can be seen that in August, fiscal deposits decreased by nearly 430 billion yuan year -on -year. It is worth noting that the recent growth rate of residents' deposits has continued to be at a high level, showing that the current consumption confidence in residents is weak and the savings tendency is strong. This shows that the future consumer demand needs to be further boosted.

The balance of narrow currency (M1) was 6.646 trillion yuan, an increase of 6.1%year -on -year, and the growth rate was 0.6 percentage points lower than the end of the last month, 1.9 percentage points higher than the same period last year; %. The monthly net cash was put in cash of 72.2 billion yuan. Wang Qing believes that the growth rate of M1 in August declined slightly from the previous month, and continued to be at a low level. The main reason was that the current property market is still to be boosted, and the short -term deposit of enterprises has been greatly affected; in addition, the lower M1 growth rate also means The current active activity of the real economy is still insufficient.

RMB loans increased by 39 billion yuan year -on -year

It is worth noting that in August, RMB loans increased by 1.25 trillion yuan, a year -on -year increase of 39 billion yuan.

"The loan ring in August was significantly increased, which conforms to the seasonal law, but the increase in the year -on -year increase is related to the further efforts of the policy." Wang Qing said that the interest rate reduction in August, the central bank once again held some financial institutions' currency credit situation. Analysis of the symposium, the implementation of the policy development financial instruments previously launched, and the continuation policies and measures that the State Council's policy of stabilizing the economy will have a certain effect on credit data.

From the perspective of the sub -department, household loans increased by 458 billion yuan, of which short -term loans increased by 192.2 billion yuan, and medium- and long -term loans increased by 265.8 billion yuan. Zhou Maohua said that the consumer demand for residents has recovered, and the decline of residents' medium- and long -term loans has narrowed year -on -year, reflecting that the demand for the property market has recovered.

Wang Qing believes that the performance of residential credit in August is still poor. Although the LPR quotation of more than 5 years of the month was reduced by 15bp again, due to the late low time, the policy was not fully released during the month. Continuing the year -on -year negative increases; August residents' short loans resumed a year -on -year increase, with an increase of 42.6 billion yuan. He judged that the main reason was that the bank credit quota was sufficient, which increased the credit investment of high -quality individual customers. At the same time, the recent downward loan interest rate also boosted the demand for personal loans.

Enterprise (affairs) loans increased by 875 billion yuan, of which short -term loans decreased by 12.1 billion yuan, medium and long -term loans increased by 735.3 billion yuan, and bill financing increased by 159.1 billion yuan; non -bank financial institutions loans decreased by 42.5 billion yuan. From January to August, the cumulative RMB loan increased by 15.61 trillion yuan, an increase of 554 billion yuan year-on-year. Zhou Maohua said that the continuous improvement of the medium and long -term loans of the enterprise has continued to improve, on the one hand, it reflects the gradual release of domestic help from enterprises and the effects of stabilizing investment policies; on the other hand, domestic enterprises' confidence in economic recovery prospects is improving. From the perspective of trends, domestic economic activities are expected to recover steadily, residents' consumption demand has recovered, real estate has gradually bottomed out and stabilized, and key projects such as infrastructure will help drive domestic physical financing demand to gradually improve.

Preliminary statistics, the stock of social financing at the end of August 2022 was 3.3721 trillion yuan, a year -on -year increase of 10.5%, and the growth rate decreased by 2 percentage points from the previous month. Yuan. From January to August, the cumulative increase in social financing was 24.17 trillion yuan, which was 2.31 trillion yuan over the same period last year.

Among the details of the incremental increase in the social integration, the main contributions include RMB loans, entrusted loans, and unspoken bank acceptance bills issued to the real economy, with an increase of 63.1 billion yuan, 157.8 billion yuan, and 335.8 billion yuan year -on -year respectively. In July, the three items increased by 430.3 billion yuan, an increase of 24 billion yuan year -on -year, and a year -on -year decrease of 42.8 billion yuan. Zhou Maohua analyzed that the financing rebound from the inside and outside of the table reflected that some banks were not strong enough to meet the loans and real economy financing needs through bills.

Liang Si, a researcher at the Bank of China Research Institute, said, "The continuousness of future financial data recovery needs to be observed."

- END -

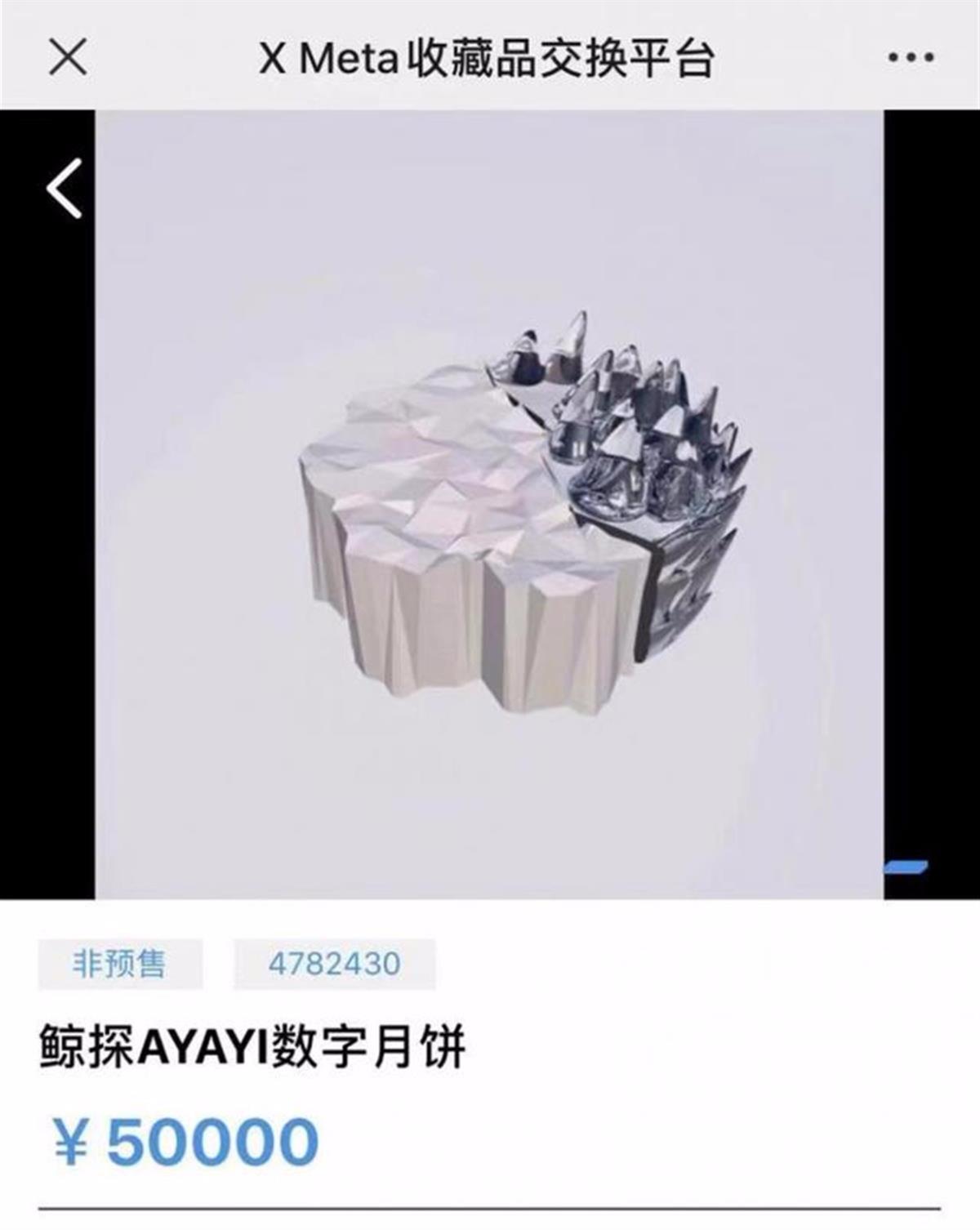

Extreme review | "Digital Moon Cake" is called tens of thousands of yuan, and the "leek flavor" of this moon cake is too rushing

Ji Mu News commentator Qu JingThe Mid -Autumn Festival is approaching, and the com...

Ministry of Industry and Information Technology: In the first half of the year, the output of lithium ion batteries in the first half of the year increased by 150% year -on -year

Zhongxin Jingwei, August 3rd. According to the WeChat public account of the Industry Information WeChat on the 3rd, in the first half of 2022, driven by the leading and strong demand of carbon peak