Under the "double carbon" goal, how does Chinese enterprises improve ESG rating?

Author:Economic Observer Time:2022.09.09

Economic Observation Network Cao Yan/Wen "In the past three years, the ESG rating level of Chinese companies has continued to rise."

At the "'Carbon Economy' Scripture" event jointly organized by the Economic Observation Newspaper, the International Green Economic Association, and the World Sustainable Development Industry and Commerce Council, Wang Xiaoshu, director of the Asia -Pacific region of the Ministry of Climate Research, made the above remarks.

According to MSCI statistics, the proportion of ESG rating (rating CCC and B) of the MSCI China Index ingredients decreased from 59%in 2019 to 46%in 2021.

Wang Xiaoshu introduced that the ESG rating of MSCI was constructed by comparative sorting in the industry, and the rating of each industry was basically distributed. If the company wants to be industry leaders, it is about 15%of the global interbank sorting.

However, there is still a certain gap between the overall level of ESG rating of Chinese companies. According to MSCI statistics, as of the end of 2021, 15 companies (2%) of the MSCI China Index are located in ESG leaders.

"The number and proportion of Chinese companies in the tail CCC and B -level companies are relatively large. These companies have more room for improvement in ESG disclosure and practice." Wang Xiaoshu admits that the pressure brought by new ESG regulations, investment institutions and customers And the enhancement of corporate consciousness is promoting ESG concepts to be widely accepted and adopted in China.

ESG's quantitative value

In June 2018, A shares were officially included in the MSCI emerging market index and the MSCI global index. All A -share companies that were included in the MSCI index will accept ESG evaluation.

In 2020, MSCI released the "Principles of Sustainable Investment", calling on the investment community to incorporate ESG factors into investment evaluation decisions to reduce relevant risks and find opportunities in rapid changing global markets.

Wang Xiaoshu said that by observing the data and index performance for more than 10 years, in emerging markets, the ESG leader index of MSCI has greatly won the MSCI emerging market wide -based index. In the ESG consideration in emerging markets, institutions can more comprehensively observe the performance of listed companies and reduce the probability of investing in the ESG -thunder incident company.

A survey of global investors released by MSCI in early 2021 shows that more than 70%of the 200 -global large institutional investor holding about $ 18 trillion in $ 18 trillion hopes to increase ESG investment.

"The ESG rating may be related to the daily operation and financial situation of the enterprise." Wang Xiaoshu explained that it would produce a lot of negative external nature during operation, such as environmental pollution and carbon emissions. These negative externalities may cause enterprises to be punished or even shut down factories, and then internalize the substantive risk of the company's finance.

Wang Yi, CEO of ESG quantitative solutions, provided by the CEO of CEO of CEOCO Technology (Beijing) Co., Ltd., further supplemented that ESG can help enterprises build a new curve of financial growth in the future.

Compared with the 1,859 heads listed on A shares and Hong Kong stocks, Bono Technology found that the trend of stock changes was significantly positively correlated with the ESG rating change. The greater the change of the ESG rating, the more obvious the impact of the stock price changes, and the change of rating changes on the stock price is asymmetry, and the rating raised the booster of the stock price greater.

"At present, some Chinese head companies have used ESG -related financial methods (innovation financing, green bonds, green loans, etc.) to enhance the influence of corporate brand image and ESG in the new financing direction of ESG concepts." Wang Yi Name representation.

How do Chinese companies improve their rating?

At present, the MSCI rating system involves more than 30 ESG issues. According to Wang Xiaoshu, about 40%of the rating systems are disclosed from listed companies, such as annual reports and corporate social responsibility reports. In addition, MSCI also uses a large number of data as supplements, including information obtained from open markets such as regulatory websites.

At the same time, the issues of ESG rating will also be different for different industries and enterprises. Specifically, for company governance-related general issues, MSCI will conduct an overall evaluation of companies in various industries or regions; when involving environmental and social related issues, MSCI will only choose the most related topic assessment in 3-7 industries.

For example, in the mining industry, MSCI believes that important issues include pollutant emissions, biological diversity effects, water resources use, community relations, and employee safety and health; in the Internet industry, MSCI values human resources management, data and privacy protection more. Way.

"We review and adjust the issues of various industries every year. On the one hand, through a large amount of data, the risk and opportunity exposure of the industry in different ESG issues will continue to communicate with global investors and listed companies on the other hand ESG's views, consider and adjust comprehensive consideration. "Wang Xiaoshu said.

Therefore, Wang Xiaoshu believes that enterprises need to integrate the ESG concept into strategic level and operation management, identify the risks and opportunities that affect their long -term sustainable development, and carry out systemic management; at the same time The more the focus of investors' attention.

- END -

The top ten industries depend on Texas | thick planting advantages, cultivate stronger "Made in Texas"

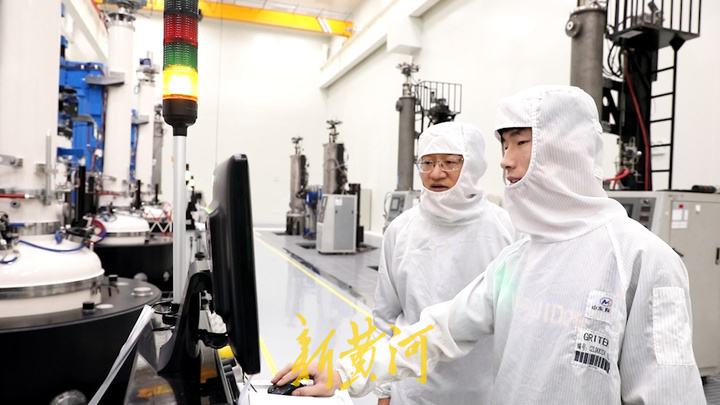

Right now, the major project of Shandong Province, the large silicon wafer project...

Asia Pai Technology Term Terminal IPO before listing is more than 60 million yuan in dividends

Recently, Nanjing Yapai Technology Co., Ltd. (hereinafter referred to as Yapai Technology) took the initiative to withdraw from the GEM listing application.Asian Technology disclosed in its prospectus