The IPO financing of A shares has reached 464.1 billion during the year, and it is expected to hit a new high throughout the year.

Author:Pole news Time:2022.09.09

Extreme news reporter Xu Wei

Video editing Xu Wei

In 2022, the IPO financing amount of the A -share market is expected to set a new record. Deloitte China ’s Capital Market Service Department issued a report on the“ Review and Prospects of the IPO Market in Mainland China and the Hong Kong IPO Market in the first three quarters of 2022 ”, and predicted the A -share market throughout the year in 2022.

The report shows that according to the current data and estimated figures, according to the financing amount as of September 30, 2022, the Shanghai Stock Exchange and the Shenzhen Stock Exchange will continue to rank the chief and second of the global new stock financing rankings. After completing the listing of two oversized new shares, the Hong Kong Stock Exchange will be ranked fourth.

As of September 30, 2022, 285 new shares will be listed in the A -share market, with a financing of 464.1 billion yuan, compared with 372 new shares in the third quarter of 2021, 369.8 billion yuan, the number decreased by 23%, and the financing amount increased by 26% Essence

China Mobile has become the "Raiders King" in the first three quarters

Source: Deqin

The report shows that in the first three quarters of the global financing amount, 4 companies from the top ten IPOs from the Shanghai Stock Exchange and two companies are from the Hong Kong Stock Exchange.

China Mobile has become the "Raiders" in the first three quarters of A shares with a financing amount of 52 billion yuan, and it is also the world's second largest IPO. The LG ENERGY SOLUTION (financing amount is HK $ 84.3 billion) in the Korean Stock Exchange. China Oil, Lianying Medical, and Haiguang Information are ranked fourth, ninth, and tenth in the global financing list. In addition, the photovoltaic module giant Jingke Energy (688223.SH) raised 10 billion yuan in the science and technology board of science and technology.

Specifically, as of now, a total of 285 new shares have been issued in the A -share market, with a total financing of 464.1 billion yuan. Although the number of IPOs has decreased by 23%compared with the previous year, the financing amount has increased by 26%.

From the perspective of the section, the number of IPOs of the GEM is leading in A shares, a leading financing amount of science and technology boards, and the financing volume of science and technology boards and GEM has exceeded the motherboard. Driven by the science and technology board, the Shanghai Stock Exchange ranked first with 114 new shares and about 296 billion yuan in financing during the year, of which a total of 83 new shares issued a total of 83 new shares, with a total financing of over 180 billion yuan; The amount of financing of 162.7 billion yuan followed, and the 31 new shares of the Bei Stock Exchange financing 5.4 billion yuan. Looking at the branch industry, the amount of financing in the technology, media and telecommunications industries is far ahead, and the manufacturing industry ranks second.

The annual financing amount is expected to reach 660 billion yuan

With the end of the first three quarters, the market pays more attention to the IPO market throughout the year. According to the Deloitte report, as of now, 247 companies have passed but have not been issued, and nearly 900 companies are applying for listing.

Deloitte China Capital Market Service Department stated that the trend of science and technology boards, GEM, and Shanghai and Shenzhen motherboards is expected to continue in the first three quarters of the third quarter. Considering economic stimulus measures, the annual stock financing amount of the A -share market is expected to continue to rise. It may set a new record.

Deloitte expects that in 2022, the science and technology board may be listed by 140 to 160 companies, with a financing amount of 230 billion yuan to 260 billion yuan; the GEM has a new listing of 190 to 210 companies, with a financing amount of 1900 yuan to 2150 100 million yuan; the Shanghai and Shenzhen motherboards are estimated to be about 80 to 100 new shares listed, with a financing of about 1400 to 170 billion yuan. The Bei Stock Exchange will be listed about 50 to 80 new shares, with a financing of about 100 to 15 billion yuan. Generally speaking, the annual financing amount is expected to reach 660 billion yuan.

In terms of the Hong Kong Stock Exchange, the "Duty Free Mao" China has completed H -shares issuance in the near future, with a total fundraising of HK $ 16.2 billion, which is the sixth largest IPO in the world. The stock is expected to become the largest IPO of the Hong Kong Stock Exchange during the year. Tianqi Lithium Industry H shares Raiders 13.5 billion Hong Kong dollars.

- END -

[Learn and implement the spirit of the 14th Provincial Party Congress] Yumen: New varieties+new technologies leverage new agricultural development

There are fruits and vegetables throughout the year. This is nothing new in Yumen. Nanguei species and benefits bonus. This is even more common in Yumen. All of this benefits from Yumen City to vigoro

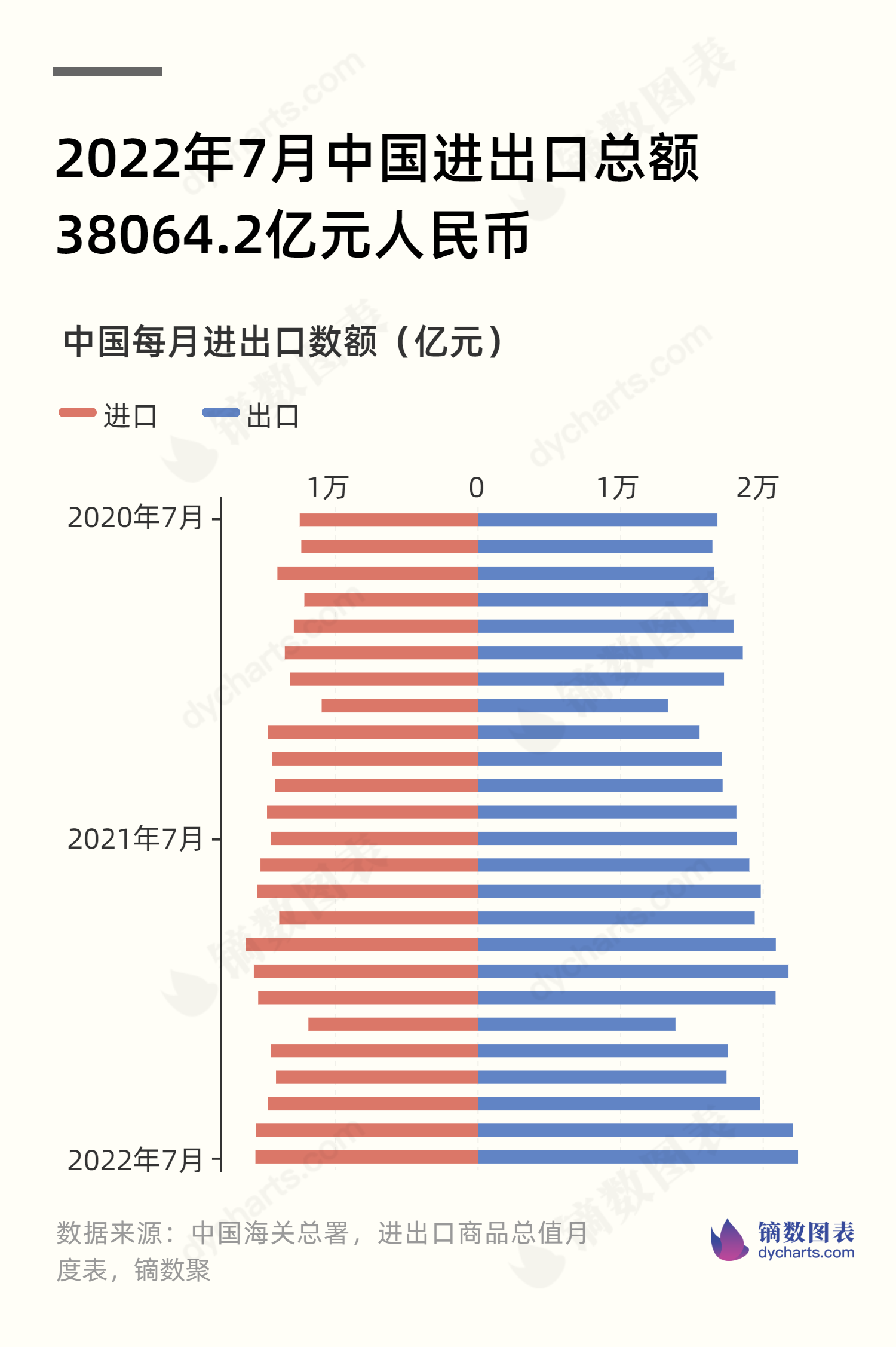

In July 2022, China's total import and export value was 3806.42 billion yuan

In July 2022, China's total imports and exports were 3806.42 billion yuan.Data sou...