It took 623 million, 23 -year -old girl "bought" a listed company!There are many companies in her name, and their identity is still a mystery

Author:Daily Economic News Time:2022.09.09

On the evening of September 7, the Daqian Ecology (SH603955, a stock price of 21.78 yuan, and a market value of 2.956 billion yuan) issued an announcement. Source Technology) signed the "Share Transfer Agreement", and Daqian Investment intends to transfer 26.8506 million shares of Daqian Ecology to the Express Technology Agreement (accounting for 19.78%of the total number of shares of Daqian Ecology). The equity transfer price is 23.21 yuan/share, and the total price of the target shares is 623 million yuan.

According to the Daqian Ecological Announcement, the changes in the rights and interests do not touch the acquisition of the offer. After the transaction is completed, the controlling shareholder of the listed company and the actual controller will change, and the "new" actual controller Jin Yingying was born in 1999 and is only 23 years old this year.

Photo source: Photo.com -id: 500472207 (unrelated graphic)

The 23 -year -old female rich enters the listed company

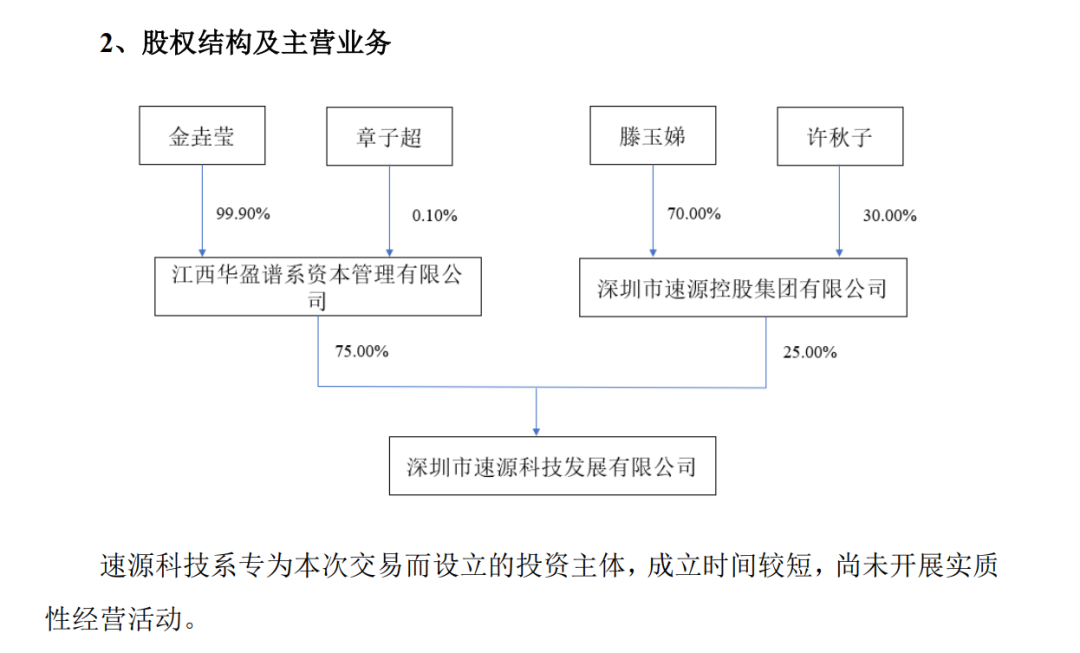

The announcement shows that Suduan Technology was established on August 30, 2022. The registered capital is 300 million yuan. It is an investment entity set up for this transaction. The establishment time is short and has not yet carried out substantial business activities.

The Suduan Technology holds 75%of the shares of the Jiangxi Huaying spectrum Capital Management Co., Ltd. (hereinafter referred to as Jiangxi Huaying), and the shares of Shenzhen Suduan Holdings Group Co., Ltd. (hereinafter referred to as the Suoyuan Holdings) hold a 25%of the shares. Jiangxi Huaying held 99.9%and 0.1%of Zhang Zichao and Zhang Zichao, respectively, and Shiguan Holdings held 70%and 30%of the shares by Teng Yudi and Xu Qiuzi.

Therefore, if the transaction is completed, the controlling shareholder of Daqian Ecology will be changed from Daqian Investment to Suduan Technology, and the actual controller will change from the couple of Luan Jianhong and Fan Heyi to Jin Yingying. Data show that Jin Yingying was born in January 1999 and is currently the legal representative, executive director and general manager of Jiangxi Huaying.

Daqian ecology said that the transaction will not affect the company's normal production and operation. The company will maintain the stability of the core management team, ensure the company's business management and normal development, and ensure the smooth transition of the change of control.

At present, equity transfer has been initially determined, and Daqian ecological stocks have also resumed trading on the 8th, and finally closed up 3.03%.

The Daqian Ecological Announcement stated that it was established on August 30 this this August 30, with a registered capital of 300 million yuan. It was set up for this transaction and has not yet carried out substantial business activities. From the perspective of the equity structure, the controlling shareholder of Suduan Technology is Jiangxi Huaying spectrum Capital Management Co., Ltd., holding 75%of Suduan Technology. Qixinbao showed that Jiangxi Huaying was established at the end of March this year.

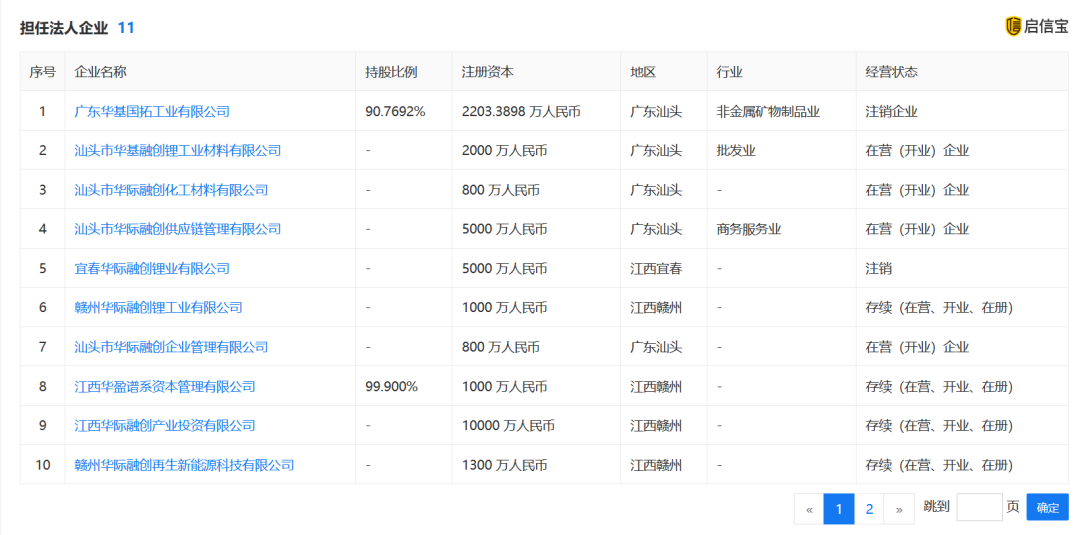

Jin Yingying, female, born in January 1999, Chinese nationality, without permanent residence abroad. He is currently the legal representative, executive director, and general manager of Jiangxi Huaying. Qixinbao shows that the 23 -year -old young man is already a legal representative of 8 continued enterprises, such as Ganzhou Huaji Sunac Lithium Industry Co., Ltd. and Jiangxi Hua Pingchuang Lithium Co., Ltd.. These companies are mostly distributed in Ganzhou and Yichun, Jiangxi, as well as Shantou. The earliest Shantou Huayi Sunac Lithium Industrial Materials Co., Ltd. was established in November 2019. The registered capital of Jiangxi Huaji Sunac Industrial Investment Co., Ltd., the largest registered capital, Yuan.

On September 8th, the reporter of "Daily Economic News" dialed Zhang Zichao. The other party did not deny that he was Zhang Zichao, but after the reporter expressed his willingness to interview, the other party said Essence No one answered the latest annual report phone call in Suduan Holdings.

The staff of the Daqian Ecological Securities Department said that everything is based on the announcement, and the information disclosed has been disclosed, and the announcement of the follow -up company is concerned. As far as the market was "surprised" for the age of the new practical controller of listed companies, the staff member said: "We do not evaluate."

"Early" daily limit of the stock price

As of now, Daqian Investment holds 41.7798 million shares of listed companies with a shareholding ratio of 30.78%. After the equity transfer is completed, the number of shares will be reduced to 14.929 million shares, with a shareholding ratio of 11%.

Due to the planning of equity transfer, Daqian Ecology issued a suspension announcement on the evening of September 5. But on September 5, the trend of the stock price of Daqian Ecology was quite strong. After the opening of the day, the stock price went up the way, and at 10 am, the daily limit was closed, and it did not open.

The transfer of the shares of listed companies this time or the decline in the performance of listed companies. The main business of Daqian Ecology is the planning, design, construction, operation, seedling cultivation, planting, and sales of ecological landscapes, and involves business tourism, indoor ecological environment optimization, ecological environment repair and governance.

In 2021, Daqian Ecology realized operating income of 556 million yuan, a decrease of 41.07%over the same period last year; the net profit attributable to shareholders of listed companies was 58.6177 million yuan, a decrease of 42.58%from the same period last year. Daqian ecology said that the decline in operating income was mainly caused by the decline in the project during the reporting period.

In the first half of 2022, Daqian Ecology achieved operating income of 159 million yuan, a year -on -year decrease of 39.85%, and net profit attributable to shareholders of listed companies was 25.2575 million yuan, a year -on -year decrease of 34.34%. Essence Daqian ecology also said that the decline in operating income and non -net profit deduction is mainly due to the reduction of engineering construction during the reporting period.

In the analysis of the operational situation of the semi -annual report, Daqian ecology stated that due to the impact of the macroeconomic, coupled with the repeated crown epidemic, the overall restrictions on the movement of the personnel, the project bidding, and the business communication with customers were blocked, resulting in a decrease in the number of foreign project expansion; project labor labor; project laborThe transportation of labor flow and engineering construction materials is limited, and the project progress has slowed down. At the same time, labor use and materials are scarce, and market prices have risen, which has also increased project costs.(This article does not constitute investment suggestions, the risk of operation according to this)

"Guessing 'Too Nights Stocks', downloading the Daily Economic News APP Gourd Ten thousand yuan cash rewards" is currently underway, clicking here to participate in the link here.

Reporter | Editor Cheng Ya | Liang Yan Sun Zhicheng Du Hengfeng

School pair | Lu Xiangyong

| Daily Economic News nbdnews original article |

Daily Economic News

- END -

Two years ago, 2020 Yabuli China Entrepreneurs Forum · Wuhan Special Summit was held | Wuhan Calendar

Coordinated | Chen Chang Chen Zhi Design | Ma Yilin Intern | Wang Yaun【Edit: Zhang J...

Chengdu Jinniu District Industry "Founding Delivery Strong Chain" series theme activities held in Xiamen | Go all out to fight for the economy to build

Shi Xiu cover news reporter Xie Ran'anOn September 9th, the cover reporter learned...