Exploration of independent legal person direct selling banks: Post -Hui Wanjia Bank started, Baixin Bank ushered in the outbreak of performance?

Author:WEMONEY Research Room Time:2022.09.08

Produced | WEMONEY Research Room

Wen | Liu Shuangxia

Since the launch of the first domestic independent legal person direct -selling bank in 2017, in the past five years, a wholly -owned subsidiary of the postal savings bank has successfully opened.

At the end of June this year, the post -Hui Wanjia Bank officially opened the door to welcome the guests. Baixin Bank's performance broke out in the first half of the year, and net profit increased by more than doubled year -on -year. At the same time, the long -prepared investment topology bank suddenly announced the termination.

In the context of the impact of the epidemic and the stricter of Internet deposit and loan policies, how can the two independent legal person direct sales of direct sales of direct -selling banks deal with the road of differentiated development?

01. At the beginning of the postal savings, the "test field" of the digital transformation of the postal savings bank

Different from the equity structure of Baixin Bank's "Bank+Internet", Post -Huiwan Bank was established by the postal savings bank.

On June 30, 2022, the post -opening meeting held a opening meeting to announce the official opening and launching the first batch of products.

According to the semi -annual report of the Postal Savings Bank, as of the end of June 2022, post -Huiwanjia Bank achieved operating income of 68 million yuan and a net loss of 32 million yuan.

From the preparatory approval in December 2020, in just one and a half years, the post -Huiwan Bank Bank opened smoothly. It shows that the postal savings bank attaches great importance to it. In the layout of the postal savings bank, postal Huilian Bank is the "test field" for the digital transformation of the postal savings bank.

For a long time, the postal savings bank rely on the unique "self -employment+agency" model. The outlets spread throughout the urban and rural areas. It has more than 600 million personal customers "rich mines", but its online transformation process is relatively slow.

Zhang Jinliang, chairman of the Postal Savings Bank, said that direct -selling banks, as an independent legal person bank with a full license, applied for the application of the digital transformation of the postal savings bank or the "test field".

"The biggest difference between the post -Huiwan Bank and other direct sales banks is that there is a huge offline physical network. Online intelligent services and offline face -to -face services are the biggest and core competition of this direct selling bank. "Force." Zhang Jinliang said.

The postal savings bank wants to set up financial services into the production and living scenarios such as merchants, consumers, etc. through the establishment of direct sales banks. Using Internet thinking, it mainly focuses on serving the three farmers and small and micro enterprises, and integrates various scenarios such as industries, government affairs, and people's livelihood with science and technology.

Judging from the products of Zihui Wanjia Bank, it also mainly supports the advantages of the mother bank. As of now, the first batch of products such as Sinochem Loan, Sales and Loan, and Wealth Management Supermarkets, which are officially launched, have been officially launched. Digital rural platforms that focus on rural government scenarios are conducting pilot promotion in some counties.

As a wholly -owned subsidiary of the postal savings bank, post -Huiwanjia Bank will mainly rely on the mother's exhibition industry.

Liang Shidong, chairman of Zhaowei Wanjia Bank, introduced: "From the perspective of marketing, the initial stage of opening is mainly through mother and child collaboration, and the related agreement of mother and child travel has been signed, including channel sharing and business cooperation. OK, now it is mainly training products and business for branches. "

Liang Shidong said that the work in the second half of this year is not eager to expand the scale to achieve profitability. The focus of work will be placed in the business model of running and accumulating basic data, especially consolidating risk control capabilities.

Post -Hui Wanjia Bank is in its infancy, and the focus of the initial stage of opening is to lay the foundation. The "2022 Marketing Activity Equity Service Procurement" obtained by the Wemony Research Office shows that the Yinhui Wanjia Bank is providing them with the integration mall construction and maintenance, integration account management services, equity procurement and distribution, customized marketing tools Such related technologies, operations and after -sales service.

02 and 5 years exploration, Baixin Bank ushered in the period of performance explosion?

As the first direct -selling bank in the form of independent legal persons, Baixin Bank has attracted market attention since its opening.

Baixin Bank officially opened on November 18, 2017, and was established by CITIC Bank and Baidu Company. Its initial registered capital was 2 billion yuan, and the strategic shareholder Canada Pension Fund Investment Company was introduced. As of the end of 2021, the total amount of Baixin Bank's share capital was 5.634 billion yuan. CITIC Bank, Baidu, and Canada's pension funds hold a shareholding ratio of 65.7%, 26.03%, and 8.27%, respectively.

Before 2021, Baixin Bank had been in the stage of exploration and development, and his performance was unstable. From 2017 to 2020, Baixin Bank's operating income was 41.9037 million yuan, 1.295 billion yuan, 2.373 billion yuan, and 1.723 billion yuan, and the net profit attributable to the mother was -293 million yuan, -484 billion yuan, 197.605 million yuan, and 197.64 billion yuan. -388 billion yuan.

(Baixin Bank's net profit data, originated from the Enterprise Early Warning APP)

The official website information shows that Baixin Bank's business mainly has three major sections: wealth management, consumer finance, small and micro finance. Establishing dependence, Baixin Bank has released digital financial products such as good meeting, wallet PLUS, Baidu Flash Card, Baiqi Loan, Baixing Loan, Baixing Loan, Baixing Loan, and other digital financial products.

In the early stage of the exhibition industry, Baixin Bank cooperated with iQiyi, Du Xiaoman and other Internet platforms to expand the deposit business. However, with the stricter of the supervision of the Internet deposit, regulatory requirements must not carry out regular deposits and other businesses through non -self -operated network platforms. For Baixin Bank relying on the online exhibition industry, the efficiency of granting storage has been greatly affected.

Data show that in 2020 and 2021, the scale of savings deposits of Baixin Bank continued to decline. From 2019 to the end of 2021, Baixin Bank's savings deposits were 22.714 billion yuan, 17.156 billion yuan, and 12.196 billion yuan, respectively. It is understood that of Baixin Bank's four Internet deposit products launched by Baixin Bank, "Zhi Huicun", "Xinbao" and "Zhicunbao", "Plus" has been removed from the shelves due to the adjustment of channel cooperation activities; "Zhihui Huihui The products ", Xinbao", and "Zhicunbao" have also been adjusted or removed, and the balance of the stock business has continued to shrink.

In 2021, Baixin Bank's performance turned over and achieved a net profit of 263 million yuan. Market participants pointed out that Baixin Bank, as the first direct -selling bank that was operated independently, was the business itself crossed the river. In the early stage of fintech investment, it was mainly for business exploration. As the business lines gradually became clear, the profit began to have something to do. improvement.

In the first half of this year, Baixin Bank realized net income of 1.937 billion yuan, an increase of 46.95%year -on -year; net profit was 338 million yuan, a year -on -year increase of 225.47%.

At present, Baixin Bank has entered a new stage of strategic development and focuses on the main channel of industrial digital finance.

However, compared with the Internet Business Bank and Weizhong Bank, which is also an Internet bank, Baixin Bank's performance is still a lot. In addition, the United Credit Rating Report also pointed out that the profitability of Baixin Bank needs to be paid attention to. Large -scale business and management fees and credit impairment losses have led to a weak profitability of Baixin Bank, and the future profitability needs to be paid attention to.

Baixin Bank's credit business customer base is mainly young white -collar workers and newcomers in the workplace. The joint credit rating report believes that the source of income and income levels of such customers is unstable. Under the extreme situation of the downward cycle of economic and rising unemployment rates, such customers may have a large area of default. Risk management capabilities need to be tested.

In addition, in the first half of this year, the board of directors of Baixin Bank ushered in great blood change, which will inevitably have a certain impact on business development.

In March of this year, Li Qingping, chairman and chairman of the Strategic Development Committee of Baixin Bank and Li Qingping, chairman and member of the Strategic Development Committee of the Board, Wang Haifeng, a member of the Non -Executive Director and Member of the Audit and Related Transaction Control Committee of the board of directors. Member of the Management and Consumer Rights Protection Commission and the nomination of the board of directors Jin Li submitted his resignation. At the same time, the board of directors elected Lu Tiangui as the chairman, supplemented Liu Yuezhen and Li Xiaoyang as candidates for non -executive directors, and added Renfei as an independent non -executive director candidate.

At present, Lu Tiangui, the proposed chairman of Baixin Bank, is in the stage of regulatory approval. Lu Tiangui is the vice president of CITIC Bank. He has worked at the CITIC Bank Credit Card Center, the private banking department, the head office retail bank, and the Bank of China Co., Ltd. (departments). He has rich experience and management experience in the financial industry.

- END -

Great Wall Securities: The financing balance decreased by 0.17%compared to the previous day, and the securities margin balance increased by 0.22%over the previous day.

002939 Great Wall Securities As of August 16, 2022, the financing balance was 1016.2 million yuan, a decrease of 0.17%over the previous day, and the financing balance ranked 339th among the two bids;,

Sanlian!Four consecutive!

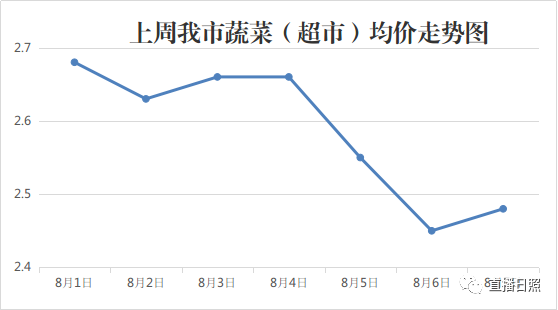

The market price of consumer goods in our city is decliningPork prices decreased f...