Residents' wealth management style is conservatively conservative bank wealth management geometry in the first half of the year

Author:Economic Observer Time:2022.09.07

Economic Observation Network reporter Hu Qun Listed Bank Report revealed the good development momentum of bank wealth management subsidiaries.

Among them, the scale of net assets of many bank wealth management subsidiaries exceeds 10 billion yuan, and the size of wealth management products exceeds trillions.

Behind this is that the residents' wealth management product configuration preferences are relatively concentrated and relatively conservative.

"For banks, the characteristics of our customer base have obvious characteristics after the exploration of the past few years." Zhang Wenqiao, deputy general manager of Puyin Finance, said that the characteristics first are that customers require high liquidity, which is relatively disgusting period and a disgusting period. Long product; Features that customers want stable benefits and do not like fluctuations. However, the two are conflict. If you want to obtain a stable income in a fluctuating market, you must stretch the investment period, but this does not blame investors. From the perspective of bank wealth management subsidiaries, we must resolve this contradiction. It is necessary to enhance the customer's sense of gain, to improve the ability of asset management, and control the retracement and fluctuations through various technical means.

Financial management semi -annual performance

According to the semi -annual report of the listed bank, as of the end of June 2022, ICBC Financial Management (18.665 billion yuan), Agricultural Bank of China (16.293 billion yuan), BOC Finance (14.544 billion yuan), CCB Finance (19.360 billion yuan), and Bank of Communications Financial management (10.540 billion yuan) and China Post Financial (11.149 billion yuan) of six state -owned banks with large state -owned banks, as well as the net assets of recruiting banking wealth management (15.408 billion yuan) and Xingyin Finance (11.122 billion yuan) exceeded 10 billion yuan Essence

In terms of the scale of wealth management products, as of the end of June 2022, the scale of recruitment of banking (2.88 trillion yuan), CCB Financial (2.05 trillion yuan) products exceeded 2 trillion yuan; Xingyin Finance (1.96 trillion yuan), and workers Silver Financial Management (1.82 trillion yuan), Chinese Bank of China Finance (1.72 trillion yuan), Agricultural Bank of China (1.68 trillion yuan), Xinyin Financial Management (1.65 trillion yuan, CITIC Bank and CITIC Finance), Traffic Bank Finance (1.1999 And Everbright Finance (1.15 trillion yuan) products exceeded trillion yuan.

In terms of net profit, as of the end of June 2022, 18 bank wealth management subsidiaries have received positive income, including 6 state -owned banks (ICBC Finance, RMB Financial Management, China Banking Financial Management, CCB Financial Management, China Banking Financial Management, China Post Financial Management) Wealth Management subsidiary, 6 joint -stock bank wealth management subsidiaries (Xingyin Financial Management, China Merchants Financial Management, Xinyin Financial Management, Ping An Financial Management, Everbright Finance, Huaxia Financial Management), 5 urban commercial bank wealth management subsidiaries (Huiyin Financial Management, Nan Silver wealth management, Hangyin Financial Management, Qingyin Financial Management, Ningyin Financial Management), a wealth management subsidiary of the Rural Commercial Bank (Chongqing Rural Commercial Finance). Among them, Xingyin Finance (2.538 billion yuan), China Merchants Financial Management (2.066 billion yuan), and the net profit of CCB Finance (1.913 billion yuan) ranked among the top three.

To a certain extent, the performance of bank wealth management subsidiaries reflects the development momentum of the bank wealth management market in the first half of the year.

"In the first half of the year, a total of 417.2 billion yuan was created for investors, an increase of 3.4 billion yuan from the first half of last year." As of the end of June 2022, the scale of wealth management products reached 2.915 trillion yuan, an increase of 12.98%year -on -year; the number of investors reached 91.454 million, a year -on -year increase of 49%. Among them, the number of individual investors was 90,616,800, accounting for 99.08%; the number of institutional investors was 837,200, accounting for 0.92%.

Among the individual investors, the largest number of investors with risk preferences is second (stable), accounting for 35.51%; risk preferences are level three (balance type), level 4 (growth) and level 5 (aggressive (aggressive) (aggressive) The proportion of investors in types has declined year -on -year. Investors investment wealth management products are mainly concentrated in the risk levels of first -level (low) and second (low), with a total of more than 90%, and the first -level ratio is 5 percentage points from the beginning of the year.

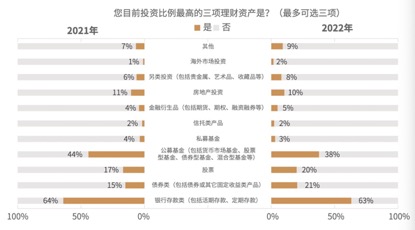

Residents' wealth management yield: Just don't lose money

The "Report on the Investigation and Financial Management Behavior Research Report" (hereinafter referred to as the "Report") jointly released by the China Institute of Finance Research, Shanghai Jiaotong University and the Ant Financial Think Tank jointly concluded: Configuration (stock+public fund+private equity fund) shows a downward trend as a whole. From the perspective of the allocation of the entire investment category, it is more decentralized than last year. The three assets of residents' investment in 2022 are bank deposits, public funds and bonds. Among them, bank deposits accounted for 63%, slightly lower than 1 percentage point in the previous year; public funds accounted for 38%, a decrease of 6 percentage points from the previous year, and the proportion of bond asset allocation was 21%. Compared with the previous one, compared to the previous one 15%of the year rose by 6 percentage points, replacing stocks as one of the three types of assets with the most residents in 2022.

The report passed the Alipay message box in April 2022 for active users over 18 years of age. After 3 weeks, a total of 11,765 valid answers were recovered; among residents participating in the survey, people under 30 accounted for 46%, 30-30- The 40-year-old population is 34%; 78%of the annual income of residents is distributed from 0 to 20,000; 70%of residents' main revenue sources are wages and income; users with investment assets account for more than 60%of users within 300,000.

This population is actually overlapping with the customer group of the bank wealth management subsidiary. "From the perspective of the basic customer base of bank wealth management, the customers we serve are mainly concentrated in the general public. Relatively speaking, the middle layer. Those who can afford the wealth management are about 50,000 yuan customers. We will also serve private customers. Overall, most of them are concentrated in ordinary people. "Zhang Wenqiao said.

Source: "Report on China Residents' Investment and Financial Management Behavior"

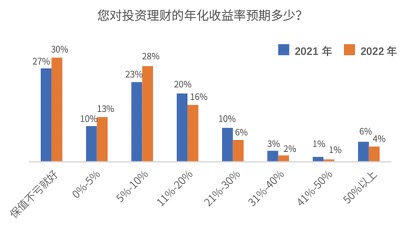

In addition to more conservative investment styles, residents' expectations for investment income also show a decline.

The annualized expected income of the investment last year accounted for 37%of the users who were within 5%(including "not losing"), an increase of 6 percentage points this year to 43%, of which "not loss" is good. The attitude is 30%, an increase of 3%over last year; the proportion of users with 5%-10%last year is 23%, and this year is 28%. %, This year is 16%. In particular, the number of people with high returns has decreased significantly. This year's revenue expects only 13%of users, which is significantly reduced compared to 20%of last year. In fact, the size of more than 10%of the income is also declining, accounting for 40%last year, only 29%this year.

Source: "Report on China Residents' Investment and Financial Management Behavior"

The "Report" believes that this shows that people's income expectations are gradually returning to rationality, and on the other hand, it also reflects the disapproval of market expectations.

In fact, this year, some people still have the yield of wealth management products. On September 7, Beijing White-collar Chen Jie opened the Ant Wealth APP. This year, the yield was -15.53%, more than 2.59%of the national maker. In the past 8 months, positive returns have been realized in February, May, and June, and the remaining 5 months have been negative income.

2022 is the first year of the official implementation of the new regulations for asset management. The net value of 15 banking groups has reached 100%, which has fully completed the transformation of net worth. Bank wealth management cannot guarantee stable earnings. Investors need to re -examine their risk preferences and income expectations, and choose the right product.

"As a stable asset, bank wealth management products are mainly stable and more stable solid -income products, accounting for more than 80%of all types of products. The year's banking wealth management market has entered a new stage of comprehensive net worth management. At the beginning of this year, due to market shocks, bank wealth management products have a large -scale net breakthrough. In addition, since this year, wealth management subsidiaries have terminated the operation of multiple products. Facing In the new market situation, bank wealth management subsidiaries still have shortcomings in terms of equity investment. "CITIC Construction Investment Banking Research Report pointed out.

According to the research report of CITIC Construction Investment Banking, the problems of current equity wealth management products are mainly concentrated in two aspects: product design and risk management. In terms of product design, the investment and research system of some equity wealth management products is not complete, and the product research and development capacity is relatively lacking; in terms of risk management, the risk level of equity wealth management products is relatively high. Effective monitoring of the level. Different from the pursuit of relative income public funds, bank wealth management pursues absolute returns, and bank wealth management subsidiaries must make high risk investment after accumulating sufficient security pads.

- END -

Yaoming Kangde: In the first half of 2022, the net profit of returning mother increased by 73.29% year -on -year

On July 26, 2022, Yaoming Kangde (603259.SH/02359.HK) announced the 2022 semi -ann...

Minister of Industry and Information Technology Miao Wei: "5G+Industrial Internet" is realizing the integrated application

China Economic Net, Beijing, August 31 (Reporter Ma Changyan) The Deputy Director of the Economic Committee of the National Committee of the Chinese People's Political Consultative Conference and form...