The size of the foreign reserves in August was 3054.9 billion US dollars: In the long run, the size of the foreign reserves will rise

Author:Daily Economic News Time:2022.09.07

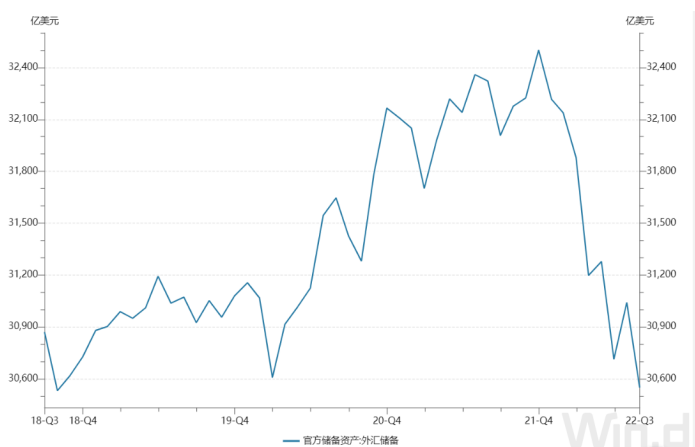

On September 7, the State Administration of Foreign Exchange released data showed that as of the end of August 2022, my country's foreign exchange reserve scale was US $ 3054.9 billion, a decrease of US $ 49.2 billion from the end of July, a decrease of 1.58%.

"Daily Economic News" reporter noticed that since the beginning of this year, the size of the foreign reserves has picked up twice in May and July, and has been shocking down. In addition, at the end of August, the scale of foreign reserves hit a new low since November 2018.

Data source: Wind

Talking about the reasons for the decline in the scale of foreign reserves in August, Wang Chunying, deputy director and spokesman of the State Administration of Foreign Exchange, said that in the international financial market, affected by factors such as monetary policy and macroeconomic data in major countries, the US dollar index rose, global financial assets The price declines overall. Factors such as exchange rate converts and asset price changes have comprehensive effects, and the scale of foreign exchange reserves in the month has declined.

The size of the foreign reserves in August was $ 3054.9 billion

Data show that as of the end of August 2022, the scale of foreign exchange reserves in my country was US $ 3054.9 billion, a decrease of US $ 49.2 billion from the end of July, a decrease of 1.58%. The reporter found that the scale of foreign reserves hit a new low since November 2018.

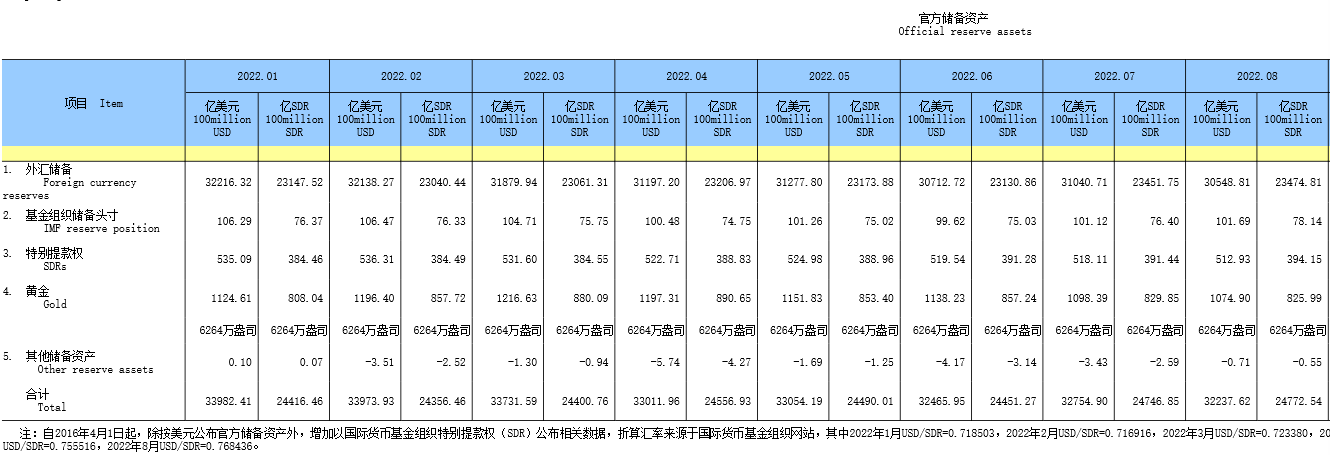

Source: official website of the State Administration of Foreign Exchange

Talking about the reasons for the decline in the scale of foreign reserves in August, Wang Chunying believes that "the comprehensive effect of exchange rate converts and asset price changes, the scale of foreign exchange reserves in the month of the month fell." She believes that in August 2022 The supply and demand remains basically balanced. In the international financial market, affected by factors such as the expected and macroeconomic data of major countries, the US dollar index rose, and the global financial asset prices fell.

Specifically, in terms of currency, as of the end of August, the US dollar exchange rate index (DXY) rose 2.69%year -on -year to 108.7; among non -US dollar currencies, the euro fell 1.68%, the pound fell 4.54%, and the yen fell 4.13%.

In terms of asset prices, as of the end of August, the US dollar price had fallen by 2.6%of the global bond indexes; the S & P 500 stock index fell 4.2%, the Stock 50 index in the euro zone fell 5.1%, and the Nikkei 225 index rose 1.0%.

"The main factors that currently affect the fluctuations in my country's foreign exchange reserves are still the exchange rate factor and asset price change factors. Promoting factors such as interest rate hike expectations have risen from the end of July. In non -US dollar currencies, euro, pounds, and yen have all fallen. In summary, the exchange rate factor has caused a large discount on the non -US dollar part of foreign exchange reserves.

From the perspective of asset price factors, the Federal Reserve ’s interest rate hike expects to rise in mid -August, causing the global market to shift from recession transactions to tightening transactions. The change in asset prices in both equity and bonds caused a decline in asset valuation corresponding to foreign exchange reserves, and the superposition of exchange rate factors is the main factor that caused foreign exchange reserves to fall from the previous month.

Xie Yaxuan, the person in charge of the Strategic Research Department of China Merchants Securities Research and Development Center, said in an interview with a reporter's WeChat interview that the scale of foreign reserves fell by more than 49 billion US dollars in August. There are two main reasons. The euro -to -yen has risen significantly, which has led to a reduction in the book due to exchange rate converts.

"In addition, it is also affected by the fluctuation of asset prices. In August, due to the further strengthening of the Fed's expectations of interest rate hikes, the global financial market has a situation of double male and debt, and it will also have a certain impact on the asset price." Xie Yaxuan said.

Experts: The scale of foreign reserves will rise for a long time

Wen Bin believes that after eliminating the exchange rate and asset price factors, the foreign reserves caused by international revenue and expenditure have a small change, which indicates that the foreign exchange market in my country was generally stable in August, and domestic foreign exchange supply and demand remained basically balanced. The August import and export trade surplus announced by the General Administration of Customs was US $ 79.39 billion, a decrease of US $ 21.88 billion from July, but still expanded by 34.1%year -on -year. From the absolute value, the surplus of nearly $ 80 billion in a single month is still high. Under the financial item, it is expected that direct investment will continue to continue net inflow, and together with the trade surplus of goods, it will provide strong support for the balance of payments in international revenue and expenditure.

Source: official website of the General Administration of Customs

Looking forward to the next stage of the foreign reserves, Wang Chunying said that the current external environment is more complicated and severe, the global economy has increased pressure, and the international financial market fluctuates violently. However, my country efficiently coordinate the prevention and control of the epidemic and economic and social development, implement the policy of stabilizing the economy, and maintain economic operation in a reasonable range, which is conducive to the overall stability of foreign exchange reserves.

Xie Yaxuan believes: "In the short term, it is expected that the US dollar will remain strong, and even fall after rushing, which will lead to a converter factors in the exchange rate. Re -rising, because the US dollar will fall high, in this case, which leads to changes in reserve balances, it is mainly the factors of exchange rate converts, rather than real transactions that cause foreign reserves to increase or decrease. "

Daily Economic News

- END -

Experts offering rope network industry: pull the length through scientific and technological innovation

Jacking a rope into a net, this is the characteristic and advantageous industry of...

Foreign exchange finance needs to be cautious, beware of unknown income!

Foreign exchange financial fraud is essentially a kind of financial fraud. It is a...