V Guan Finance Report | Light Media is notified to criticize: the disclosure of the disclosure of the preview of the preview is inaccurate

Author:Zhongxin Jingwei Time:2022.09.07

Zhongxin Jingwei, September 7th. Due to the inaccurate disclosure of the performance forecast, Beijing Light Media Co., Ltd. (hereinafter referred to as Light Media) and the company's chairman and financial leader were notified by the Shenzhen Stock Exchange.

The "Decision on the Criticism of Beijing Light Media Co., Ltd. and related parties" released by the Shenzhen Stock Exchange on the 7th shows that after being found out, the following violations of Light Media and related parties:

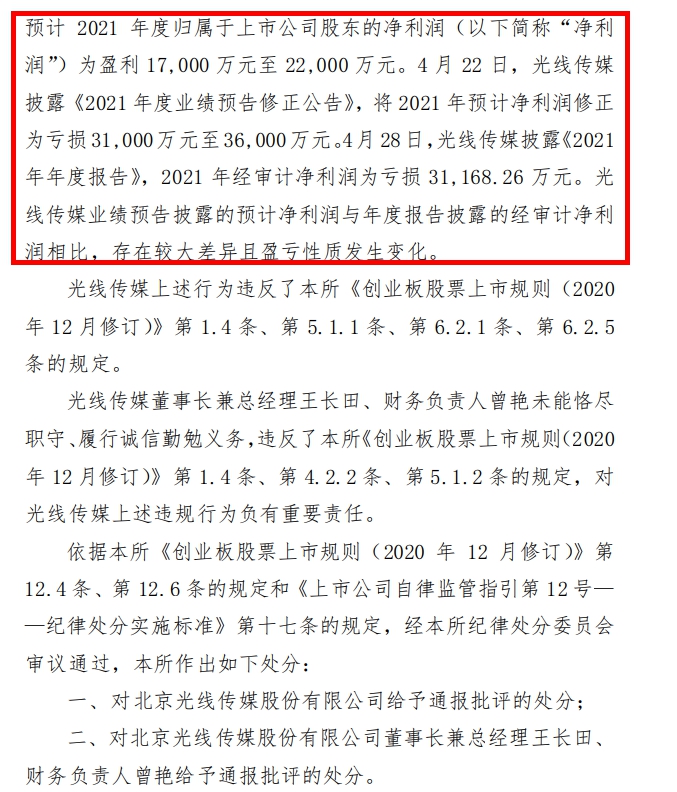

On January 28, 2022, Light Media disclosed the "2021 Annual Performance Trailer". It is expected that the net profit attributable to shareholders of listed companies in 2021 (hereinafter referred to as "net profit") is a profit of 170 million yuan to 220 million yuan. On April 22, Light Media disclosed the "Amendment to the 2021 Annual Propaganda Trailer", which will amend the expected net profit in 2021 to a loss of 310 million yuan to 360 million yuan. On April 28, Light Media disclosed the "Annual Report of 2021", and the net profit of the audited in 2021 was a loss of 311,682,600 yuan. Compared with the audited net profit disclosed by the annual report, the net profit disclosed by the Light Media Performance Preview has a large difference and changes in the nature of profit and loss.

Source: "Decision on the Decision of Beijing Light Media Co., Ltd. and related parties to report criticism"

The Shenzhen Stock Exchange pointed out that the above -mentioned behavior of Light Media's above -mentioned behavior violated the "GEM Stock Listing Rules (Amended in December 2020)" Article 1.4, Article 5.1.1, 6.2.1, and Article 6.2.5.

Wang Changtian, chairman and general manager of Light Media, and Zeng Yan, the head of finance, failed to fulfill his duties and fulfill his integrity and diligence. The provisions of Article 5.1.2 have important responsibilities for the above -mentioned violations of Light Media.

According to the relevant provisions of the Shenzhen Stock Exchange's "GEM Stock Listing Rules (Amended in December 2020)" and "Guidelines for Self -Regulatory Supervision of Listed Companies -Implementation Standards for Disciplinary Action", the Shenzhen Stock Exchange made the following sanctions:

1. A punishment for criticism of Beijing Light Media Co., Ltd.;

2. Wang Changtian, chairman and general manager of Beijing Light Media Co., Ltd., and Zeng Yan, the head of finance Zeng Yan.

For Beijing Optical Media Co., Ltd. and related parties, the above -mentioned violations and the punishment given by the Shenzhen Stock Exchange will be recorded in the integrity file of the listed company and open to the society.

Public information shows that Light Media was established in 1998 and was listed in the Shenzhen Stock Exchange in 2011. It is China's largest private media and entertainment group. After listing, from 2013 to 2019, the revenue of light media rose from 900 million yuan to 2.829 billion yuan, an increase of 2.14 times, and net profit increased from 328 million yuan to 948 million yuan, an increase of 1.89 times. Among them, the income increase in 2019 will not increase. In 2020, the performance of the light media was cut, but it remained profitable.

According to the 2021 annual report, revenue was 1.168 billion yuan during the reporting period of the optical media; net loss and deduction of non -net losses were 312 million yuan and 445 million yuan, respectively, a year -on -year decrease of 207%and 289.4%, respectively.

The 2022 semi -annual report shows that the light media business is mainly investment, production, and distribution of film and television drama projects. The main products are film and television dramas and related derivatives that meet the needs of popular spiritual and cultural needs. Anime, music, literature, artist agent, real -life entertainment, industrial investment and other fields.

In terms of performance, Light Media achieved operating income of 583 million yuan in the first half of 2022, a year -on -year decrease of 22.78%; net profit of home mother was 200 million yuan, a year -on -year decrease of 58.67%; and basic earnings per share was 0.07 yuan.

Light Media explained that in the first half of 2022, the film industry continued to be seriously affected by the epidemic, and the industry still faced huge difficulties and challenges, which also caused the company's performance to be directly affected.

In the secondary market, as of the closing of the 7th, the light media reported 9.03 yuan/share, a decrease of 0.55%. According to the same flower of the same flower, the stock price of Light Media has fallen by nearly 30 % during the year, and the company's total market value is 26.49 billion yuan. (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Qingdao another full process digital approval service scenarios are online

Qingdao Daily/Guanhai News, September 9th, on September 8th, the Municipal Administrative Examination and Approval Bureau launched the full process of digital approval service scenarios for the Sanit

The contribution rate of foreign trade data from Zhejiang from January to August continued to rank first in the country

The reporter learned from Hangzhou Customs today that from January to August, the ...