Just now, Pan Shiyi resigned

Author:Arai Telescope Time:2022.09.07

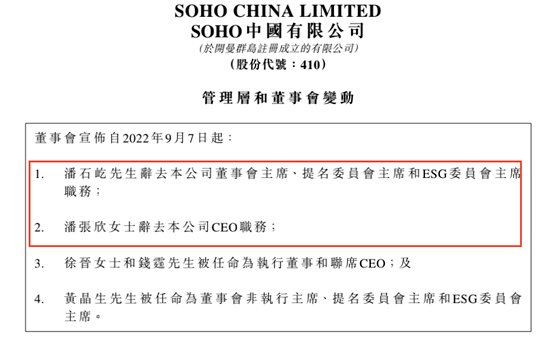

At noon today, SOHO China issued an announcement saying that Pan Shiyi had resigned from the chairman of the board of directors, and Pan Zhangxin had resigned as the CEO.

Affected by this news, in the afternoon, SOHO China's stock price rose rapidly, which once rose by more than 17%. As of press time, SOHO China's stock price rose 11.76%to HK $ 1.52/share, with a market value of HK $ 7.9 billion.

Soho China: Pan Shiyi has resigned as the chairman of the board of directors

Pan Zhangxin has resigned from the CEO

At noon on September 7, SOHO China announced at the Hong Kong Stock Exchange that Pan Shiyi had resigned from the position of the chairman of the board of directors, the chairman of the nomination committee and the chairman of the ESG committee to focus on supporting art and charity; Ms. Pan Zhangxin has resigned as the company's Chief Executive (CEO) Position to focus on supporting art and charity.

According to the announcement, the above two people will continue to serve as executive directors. On the same day, Huang Jing, an independent non -executive director, was appointed as the chairman of the board of directors, the chairman of the nomination committee, and the chairman of the ESG Committee; and Xu Jin and Qian Ting were appointed as executive directors and joint CEOs.

According to the announcement of the announcement, Xu Jin, 50 years old, was previously the vice president of SOHO China, responsible for assets and property management. He joined the company in February 2001 and served as the director of the Personnel Administration, the director of the procurement department, and the vice president. In 1994, he obtained a bachelor's degree in engineering management in Beijing Materials Institute, and has more than 20 years of relevant experience in the real estate development industry.

Qian Ting, 45 years old, previously served as Vice President of SOHO China, responsible for property rental and sales. He joined the company in October 2002 and was the company's rental market director and deputy president. In 2000, he obtained a bachelor's degree in trade economy at Renmin University of China, and has 20 years of experience in Chinese real estate sales and leasing.

The term of office of the two is 3 years from September 7, and it can be terminated by any party not less than 3 months. Each year's basic remuneration is RMB 1.5 million, and the board of directors is RMB 264,000 according to its performance.

Pan Shiyi and Zhang Xin are still members of the board of directors of SOHO.

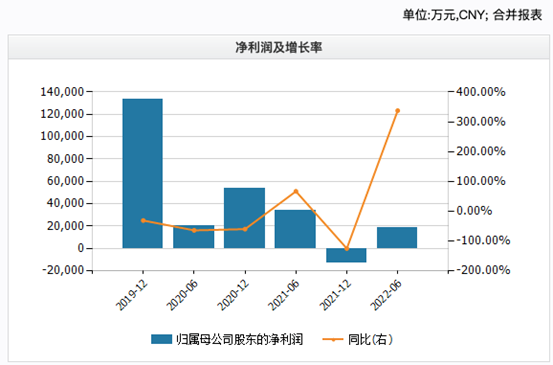

In the first half of this year, net profit was 191 million yuan, an increase of 63% year -on -year

Recently, "Soho China" issued the 2022 mid -term performance announcement. The announcement shows that in the first half of 2022, SOHO China achieved revenue of 896 million yuan, an increase of 11%year -on -year; SOHO China belonged to the parent company's net profit of 191 million yuan, an increase of 63%year -on -year, and the same period of 2021.

However, due to the influence of the new crown epidemic, SOHO's leasing market in Beijing and Shanghai's office building under pressure. As of June 30, 2022, the average rental rate of investment properties dropped to about 80%. At the same time, the lease rate of Lize SOHO, who entered the city in early 2020, has reached about 82%.

Public information shows that Pan Shiyi cooperated with others in 1992 to establish Beijing Wantong Responsibility Co., Ltd., and in 1995, he and his wife Zhang Xin founded SOHO China Co., Ltd., and Pan Shiyi served as chairman and Zhang Xin of SOHO China as CEO. The company develops and holds high -end commercial real estate in Beijing and Shanghai Urban Center, and the development projects have become milestones in urban construction. At present, SOHO China has become the largest office building developer in Beijing and Shanghai, with a total development of 5 million square meters.

Picture from: SOHO China official website

On October 8, 2007, SOHO China was successfully listed on the Hong Kong Stock Exchange (stock code: 410), financing 1.9 billion US dollars, and created IPOs in Asia's largest commercial real estate company. Since 2006, SOHO China has selected the "Most praised Chinese company" All -Star List selected by SOHO China 6 times.

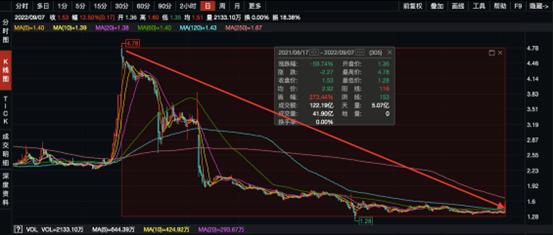

In March 2020, it was reported that Blackstone Group wanted to acquire SOHO China with a quotation of 6 Hong Kong dollars per share, and intentionally made SOHO China directly privatize the market. In June 2021, SOHO China issued an announcement that the U.S. Blackstone Group had issued a full acquisition offer to SOHO China. 91%of SOHO China will be sold to the Black Market, with a transaction price of about HK $ 23.657 billion. After the transaction is completed, SOHO China will continue to be listed on the Hong Kong Stock Exchange. However, in the end, the transaction was not reached. After the plan was blown, SOHO China's stock price plummeted all the way, with a cumulative decline of nearly 60%.

Earlier CFO was suspected of insider transactions being investigated

This year SOHO China is "a little annoying".

At the beginning of July this year, SOHO China (0410.HK) also reported that CFO was investigated by insider transactions.

At that time, SOHO China urgently issued a clarification announcement on the Hong Kong Stock Exchange stating that it was known that the chief financial officer Ni Kwai Yang was under investigation due to the inside story of the company's stock. However, the announcement did not indicate the internal transactions it involved. The company also said that both directors and other executives did not know that they were suspected of insider transactions and were not investigated.

SOHO China said that the company's directors and other executives do not know that they are suspected of insider transactions and have not been investigated, but they fully cooperate about the information provided by the relevant authorities. It is reported that before the investigation was completed, SOHO China temporarily transferred Ni Kuyang's duties to the company's financial director. The company also said that the investigation has no major adverse effects on the operation of the group's business.

However, this time SOHO China did not refer to the insider transaction involved in Ni Kwai Yang.However, some media reported in the report that Ni Kuyang used the known insider to use the stock cash in the SOHO China case.In addition, in March this year, the website of the Beijing Market Supervision Bureau shows that Beijing Souhou Property Management Co., Ltd. Chaoyangmen Second Branch, Haidian Huangzhuang Branch, Qianmen Branch, Sanlitun Branch, Wangjing Branch and other 15 branchesIt was punished and fined by the Beijing Multi -District Market Supervision and Administration Bureau. Because of the existence of increasing the price to the end user, charging electricity fees, charging the active increase in the end user in the name of the power transformation service fee, violating the "Electricity Law of the People's Republic of China" relatedIt stipulates that 15 branches have been fined more than 115 million yuan.

According to industrial and commercial information, Beijing Souhou Property Management Co., Ltd. is a SOHO China subsidiary and is responsible for operating property management of SOHO Chinese business -write projects.

Reporter | Wen Jing

Edit on duty | Fry

- END -

my country is the largest in operating machines!Liaoning Hongfang River Nuclear Power Station fully put into operation

China Guang Nuclear Group Co., Ltd. reported on the evening of the 23rd that at 21:35 on the same day, with the 168 -hour trial operation test, the Liaoning Hongfang River Nuclear Power Station No. 6

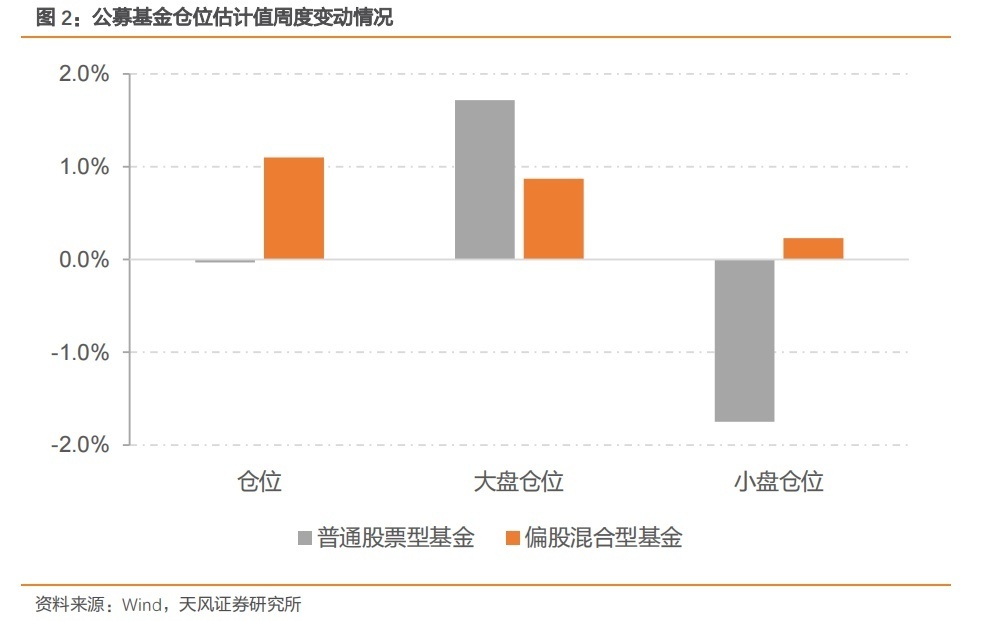

Public -private equity fund positions have rebounded, fund manager confidence index recovers

On July 6, Capital State learned that since April's round of rebound, some public ...