Master of bill trading?Huibai New Material IPO: He has helped the affiliated client to transfer, and the two parties disclosed that the bills were completely inconsistent

Author:Daily Economic News Time:2022.09.07

Recently, Huibai New Materials Technology (Shanghai) Co., Ltd. (hereinafter referred to as "Huibai New Materials") submitted the prospectus and intends to be listed on the GEM.

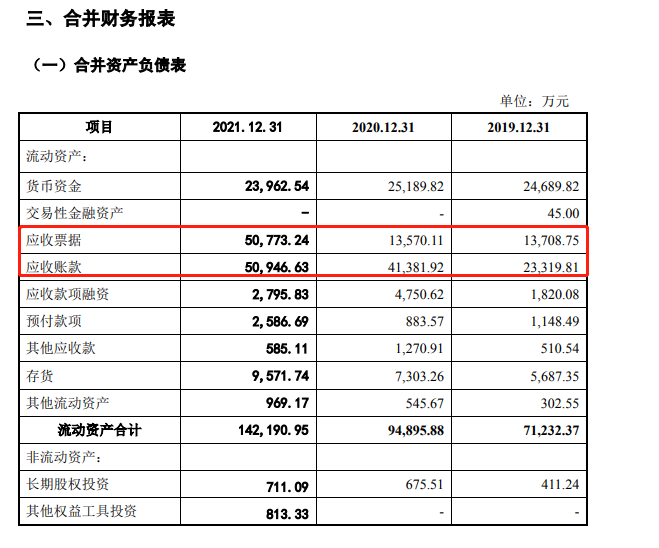

"Daily Economic News" reporter noticed that Huibai's new material receivable was large. As of the end of 2021, Huibai's new materials receivables received approximately 510 million yuan, accounts receivable of about 510 million yuan, and total assets were about 1.62 billion yuan. The total assets and accounts receivables account for about 63%.

While holding 500 million yuan in bills, Huibai New Materials still has 500 million yuan to handle the bills. The company can grant credit through banks, mortgage the bills receivable, and issue a bill to suppliers, thereby completing a closed transaction closed loop. At the same time, when related customers who ranked one of the top five customers lacked funds, Huibai New Materials also used the receivables to assist the affiliated customers to transfer loans.

However, the reporter's investigation found that the receivables disclosed by Huibai New Materials are completely inconsistent with the bills payable disclosed by the related customers.

Continuously receivable items

According to Huibai's new material prospectus, its main products include epoxy resin and electronic electrical insulation packaging for wind power blades, new composite materials, and epoxy resins. The lower reaches are mainly wind power equipment vendors.

From 2019 to 2021, the total receivables and accounts receivables of Huibai New Materials were about 370 million yuan, 550 million yuan, and 1.02 billion yuan, respectively. During the same period, the company's total assets were about 780 million yuan, 1.05 billion yuan, and 1.62 billion yuan, respectively, and the proportion of receivables accounted for about 47%, 52%, and 63%of total assets, respectively.

Image source: Announcement Screenshot

Huibo New Materials said that the continued growth trend of accounts receivable is mainly due to the continuous increase in the company's business scale.

However, it is worth noting that while Huobai's new material holds a large number of bills receivables, its own bills payable and account payable are also large. As of the end of 2021, Huobai's new materials should pay about 510 million yuan, and the account payable was about 330 million yuan.

Large receivables and applications have fluctuated to the cash flow of Huibai's new material.

The prospectus (declaration draft) shows that from 2019 to 2021, the net profit of Huibai's new materials was 22.748 million yuan, 56.493 million yuan, and 67.3104 million yuan, respectively. 10,000 yuan and -102.7391 million yuan. It can be seen that the net cash flow generated by Huibai's new materials fluctuated.

Regarding the changes in cash flow, Huibai's new material explained: "During the reporting period, the company is in a period of rapid growth, and the inventory, operating receivable items, and business should be largely changed. The net fluctuations are large. "

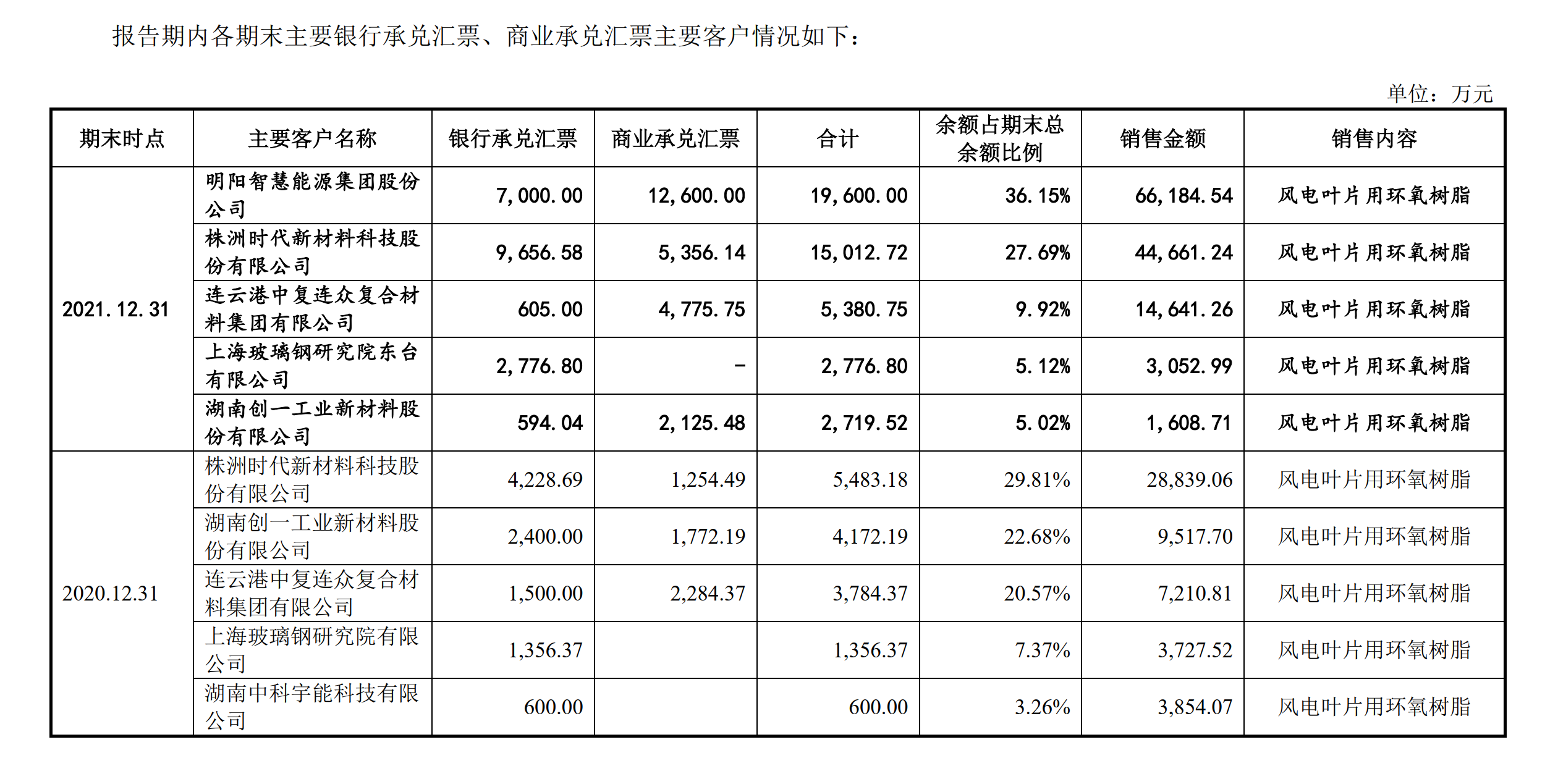

Customer customers' sales atrophic

As of the end of 2021, the top five companies' receivables of Huibo New Materials include Mingyang Smart (SH601615, 28.07, a market value of 63.7 billion yuan), Times New Materials (SH600458, 10.08 yuan, market value of 8.1 billion yuan), and Lianyungang Zhongzhongzhongzhongzhongzhongzhong China. Fu Lianzhong Composite Materials Group Co., Ltd., Shanghai Finerants Research Institute Dongtai Co., Ltd. and Chuangyi New Materials (NQ836703, the stock price is 2.23 yuan, and the market value is 86 million yuan).

Photo source: Screenshot of Huibai New Materials Announcement

Among the above -mentioned enterprises, the new material is the related enterprise of Huibai's new material. Huibai New Materials holds 6.24%of the equity of Chuangyin, and Kang Yaulun, one of the actual controllers of Huibai's new materials, is serving as a director.

According to Huibai New Materials, it was established in 2011 and is mainly engaged in the production and sales of blades of wind turbines. In 2015, Chuangyin New Materials and Huibai New Materials New Materials signed a production contract for wind power blades. The two sides formed a commissioned processing cooperative relationship. Times New Materials commissioned the new material to produce wind power leaves.

At the beginning of the cooperation, Chuangyin New Materials According to the requirements of the cooperation, the wind power blades were purchased by the Time New Materials by the Time New Materials and the supplier was directly shipped directly to Chuangyi New Material by the supplier's order.

As a new material of the wind power blades of the Time, Huibai New Materials uses epoxy resin suppliers. According to the requirements of the new materials of the times, from 2015 to 2017, it will deliver the wind power blades to the air -to -air blades from 2015 to 2017. Subsequently, when Chuangyi New Materials purchased raw materials by themselves, Huibai New Materials still sold epoxy resin to him.

According to Huibai New Materials Prospectus, it is the third largest customer in 2019 and 2020. In the past two years, Huibai New Materials sold about 35.84 million yuan and 95.18 million yuan of "wind power blades for epoxy resin" to Chuangyi New Materials.

Hui Bai New Materials said: "Because of the development prospects of the company, the company participated in the subscription of Chuangyin's non -public offering of shares in December 2016, becoming a shareholder of 6.24%of the shares of the new material; in January 2017 , The company's actual controller Kang Yaolun is the director of the new material. The company mainly sells epoxy resin to the new material sales of wind power blades. The transaction price is determined according to the bidding results of the new materials of the times, which is fair. "

In 2021, the sales of Huibai New Materials to Chuangyi New Materials shrunk to about 16.09 million yuan. As for the reasons for the shrinking sales, Huibai's new material explained: "In the first half of 2021, the company intends to adjust the price of epoxy resin to the company due to the increase in the price of basic epoxy resin and curing agent. The rapid rise in prices may lead to more frequent adjustment of the sales price of wind power leaves with epoxy resin, and the cooperation model of new materials and the new materials of the times has been adjusted again. Negotiate procurement prices with suppliers and purchase by themselves, so the company and Chuangyi New Material have not traded since the second quarter of 2021. "Daily Economic News reporters have dropped sharply from Huobai New Materials in 2021, Xiang Chuangyin issued the "Interview Letter", but as of press time, no response was obtained.

Use bills to transfer loans as affiliated customers

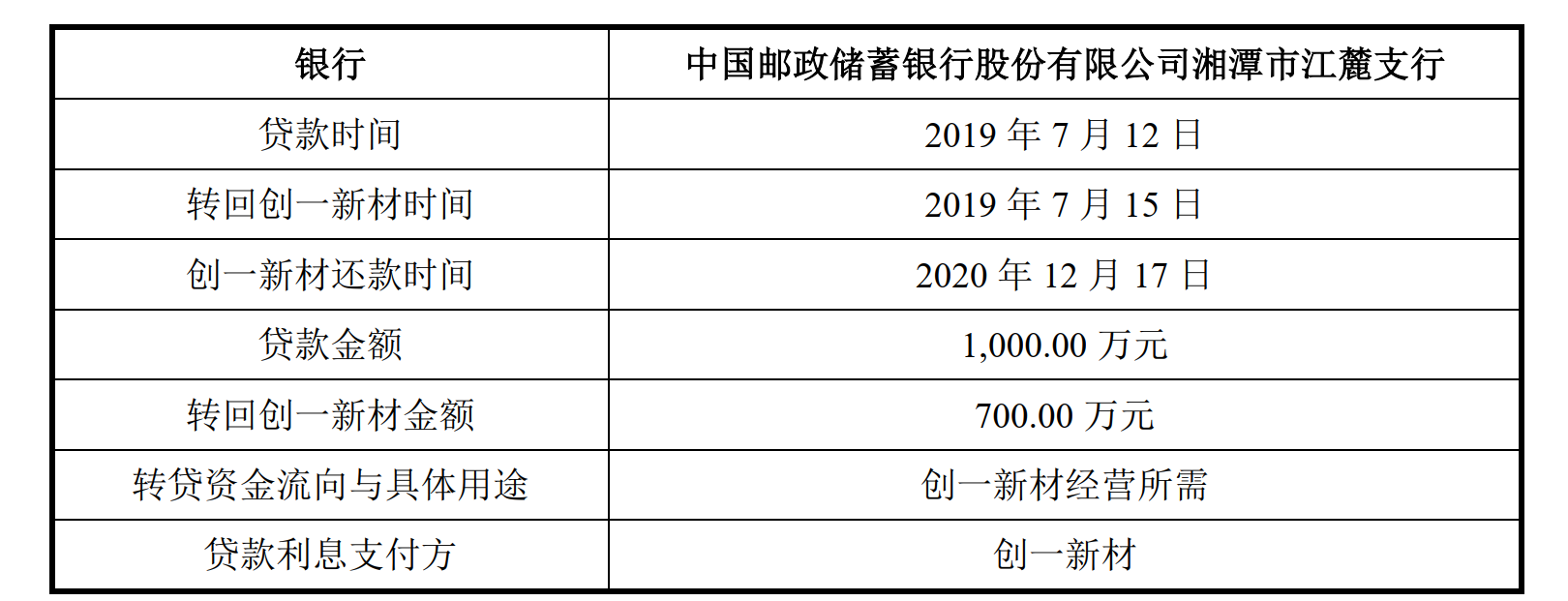

However, in addition to selling related raw materials to Chuangyi New Materials, Huibai New Materials has also used the bill to help Chuangyin's "transfer".

Huibai New Materials stated that it agreed in the contract signed by Chuangyin, and the payment method was settled by 12 months of acceptance or bank transfer within 2 months after the account.

In July 2019, Chuangyi New Materials remitted 10 million yuan in bank credit funds to the Huibai New Materials Bank account for repaying part of the payment owed to Huibai's new materials. Later, due to the tight funding of a new material, he negotiated with Huibai New Materials to replace some bank deposits 7 million yuan into bills for settlement. Therefore, Huibai New Materials returned to Chuangyin 7 million yuan through bank transfers in the month, and the remaining 3 million yuan was used as normal sales repayments to reduce the balance of accounts receivable.

Photo source: Screenshot of Huibai New Materials Announcement

Huibai New Materials said that it was not the borrower under the aforementioned "transfer loan", nor did it seek any economic benefits through the bank's loan funds.

"As of the end of the reporting period, the company's borrowing of banks involved in the transfer of customers has expired and has been repaid in full amount of loan principal and interest. It has not caused losses to relevant loan banks. There is no rectification situation, there is no reality or potential disputes in the loan -loan behavior, and the above -mentioned transfer behavior has no major adverse effects on the company. "Huibai's new material said.

"Daily Economic News" reporters issued the "Interview Letter" to Chuangyi New Materials on whether the two sides still exist in the above -mentioned transactions, but as of press time, they have not received a response.

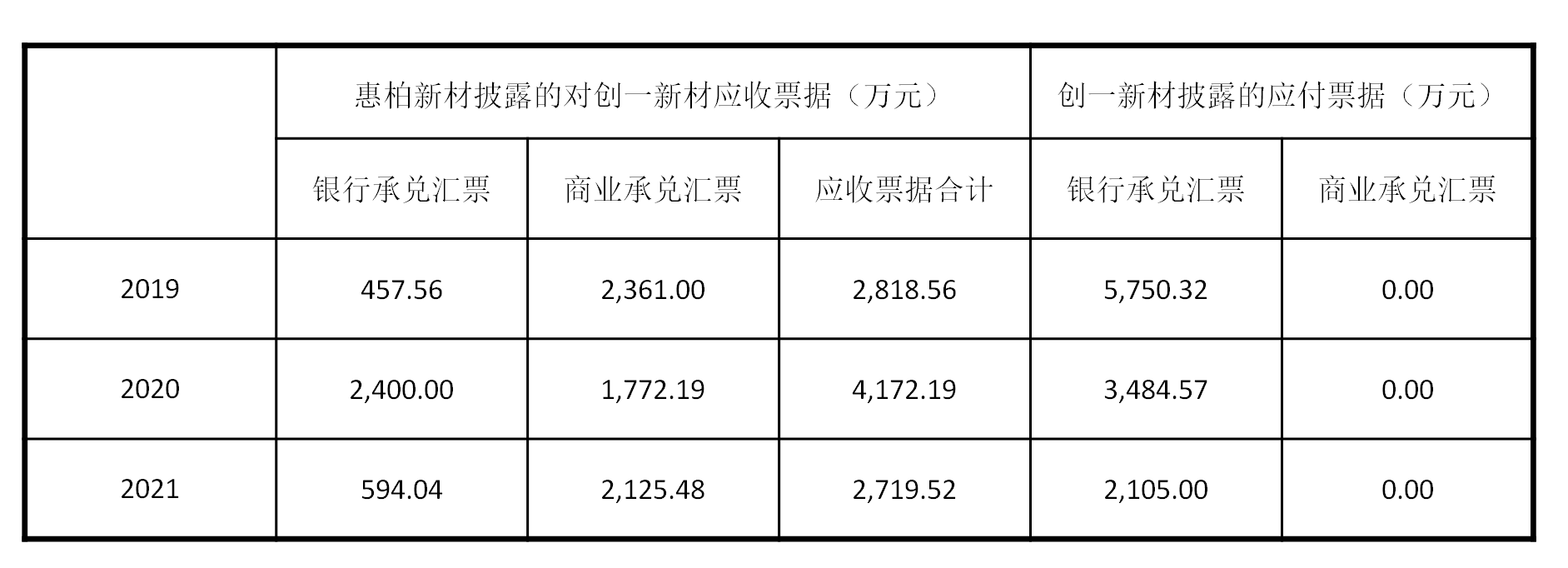

The bill receivable is completely different from the disclosure of related customers

A reporter from the "Daily Economic News" found that the disclosure of Huibai New Materials and Chuangyi New Materials was completely different.

It is worth noting that the reason why Huibai's new material has formed a large amount of receivables and handling is because Huibai's new material can directly issue a commercial acceptance bill to the bank to pledge the bills.

Hui Bai's new material said: "In 2019, the company's new bank credit can use commercial acceptance bills to pledge the bills to pledge the bills and accept more commercial acceptance bills as the settlement method of receivables. At the end of the year The balance of commercial acceptance bills receivables of Hechuang Yinyi New Materials is 40.7885 million yuan and 23.61 million yuan, which has led to a significant increase in the balance of the company's commercial acceptance bill at the end of 2019. "

According to Huibai New Materials, at the end of 2019, at the end of 2020 and at the end of 2021, the balance of the receipt of the new materials of Huibai's new materials was 28.1856 million yuan, 41.721 million yuan, and 27.1952 million yuan, respectively.

The composition of the above -mentioned Huibai New Materials for the receipt of the new material is: at the end of 2019, the balance of the bank acceptance bill was 4.5756 million yuan, and the balance of the commercial acceptance bill was 23.61 million yuan; at the end of 2020, the balance of the bank acceptance bill was 24 million yuan The balance of commercial acceptance bills was 17.7219 million yuan; at the end of 2021, the balance of bank acceptance bills was 5.94 million yuan, and the balance of commercial acceptance bills was 212.548 million yuan.

However, the information disclosed by the new material is completely inconsistent with the information disclosed by the above -mentioned Huibai New Materials. According to the 2019 report, the 2019 report, the 2020 and 2021 reports, the balance of its bills should be 57.503 million yuan, 34.847 million yuan, and 21.05 million yuan, respectively.

Data source: Huobai New Materials Prospectus, Annual Report of Chuangyi New Material

In other words, at the end of 2020 and at the end of 2021, the total amount of bills of payables disclosed in a new material were smaller than the balance of the new material bills disclosed by Huibai's new material.

In addition, from the composition of the bills disclosed by Chuangyi New Materials, it is also different from the great disclosure of Huibai's new material. The annual reports of Chuangyi New Materials in 2019, 2020 and 2021 show that their bills payable are bank acceptance bills, and the amount of commercial acceptance bills is 0.

"Daily Economic News" reporter caused the differences between the two sides to disclose the data, and issued the "Interview Letter" to Huibai New Materials and Chuangyi New Materials, but as of the press time, they did not get a response from the two parties.

Cover picture source: Photo Network-500850476

Daily Economic News

- END -

Research Report on China Sharing Economic Regulation: In the past five years, online car proceedings have increased year by year, and the judicial focus has gradually shifted

21st Century Economic Herald Profile Reporter Zhong Yuxin Beijing ReportingAlthough my country's development in the field of sharing economy has achieved certain results, whether it is a format model...

"Little Chrysanthemum" has become a "big industry"

In recent years, Chadian Town, Linzhou has adhered to the development model of coo...