The fund industry staged the survival of the fittest: 135 funds were liquidated, and 1452 struggled on the "life and death line"

Author:Huaxia Times Time:2022.06.20

Huaxia Times Watchmaking

China Times (chinatimes.net.cn) reporter Hu Jinhua, an apprenticeship reporter Geng Qian Shanghai reported

Darwin's "survival of the fittest and the survival of the fittest" not only exists in the biological world, but also applies to the fund industry.

Wind data shows that as of June 19, the fund termination date is the statistical caliber. This year, a total of 135 funds (calculated separated by different shares) funds liquidation, totaling 1452 funds (different share total statistics) of less than 50 million yuan, including some of which The establishment of 345 funds was less than one year, and 135 funds were established in 2022.

In the opinion of Xia Shengyin, the wealth management partner of the private equity network, the cruel "survival of the fittest" law is the root of the long -term development of the fund industry. He believes that some old funds with poor performance and smaller scale are facing liquidation risks, and some institutional investors have high proportion of funds. mud. This is not only the natural process of fund investments in the survival of the fittest, but also an effective protection of the benefits of the investment in the investment. With the development of the equity market, the fund liquidation is gradually normalized. Fund companies must also comply with market choices, respond to regulatory requirements, integrate and optimize their own product lines, and better serve the holders.

135 funds have been cleared

On June 18, BOC Fund issued a contract termination and property liquidation announcement of China Yin Ruifeng's repayment mixed (Class A, C). The announcement shows that starting from June 20, the fund has entered the liquidation procedure and stopped handling services such as purchase, redemption, conversion and regular fixed investment.

For the reasons for the blending of BOC Ruifeng, BOC Fund summarized it as a trigger contract termination terms. The announcement mentioned that as of June 17, the BOC Ruifeng repayment mixed 50 working days in consecutive working days has appeared as assets of less than 50 million yuan. According to the fifth part of the "Fund Contract", the "fund filing" stipulation: "After the" Fund Contract "takes effect, the number of fund shares in 50 working days in a row or less than 200 or 50 million yuan in assets of the fund is less than 50 million yuan. Fund managers should terminate the Fund Contract and liquidate in accordance with the agreed procedure of the Fund Contract. There is no need to hold a fund share holder conference. "

It is worth noting that the BOC Ruifeng returns were mixed in July last year, and it was less than one year from the funds to the liquidation time from the fund to the liquidation time.

However, there are also many funds in the market. Wind data shows that with the fund terminal terminal as the statistical caliber. As of June 19, a total of 135 (share calculation) funds were liquidated this year. The number of funds from the same period from 2019 to 2021 was 111, 72 and 200, respectively.

In terms of fund types, among the 135 funds of this year, the number of medium and long -term pure debt funds is the largest. Data show that there are 31 medium and long -term pure debt funds, 20 flexible configuration funds, 20 passive index funds, 18 passive index bond funds, 13 hybrid bond funds, 13 partial stock hybrid funds , 9 partial debt mixed funds.

In terms of liquidation, the main reason for most of the fund liquidation is that the fund holder conference agrees to terminate and the net value of the fund assets is lower than the contract restriction. Only.

For some fund products that are no longer in line with market demand, starting the fund liquidation process is a virtuous cycle of the industry's survival of the fittest. Xia Shengyin told the reporter of "Huaxia Times" that before May this year, the A -shares fluctuated fiercely and the market sentiment was pessimistic. In such a market environment, the release of new funds dropped to freezing points. Some old funds with poor performance and smaller scale faced The risk of liquidation, and some institutional investors have high -proportion of funds. After a large redemption, they became "mini -based" and eventually caught in a mud. This is not only the natural process of fund investments in the survival of the fittest, but also an effective protection of the benefits of the investment in the investment. With the development of the equity market, the fund liquidation is gradually normalized. Fund companies must also comply with market choices, respond to regulatory requirements, integrate and optimize their own product lines, and better serve the holders.

1452 "Mini Base" is facing liquidation risk

The funds that have been liquidated have continued to increase, and there are still thousands of "mini funds" in the market that are less than 50 million yuan. According to Wind data, as of June 19, a total of 1452 funds (total statistics of different shares) in the market were less than 50 million yuan.

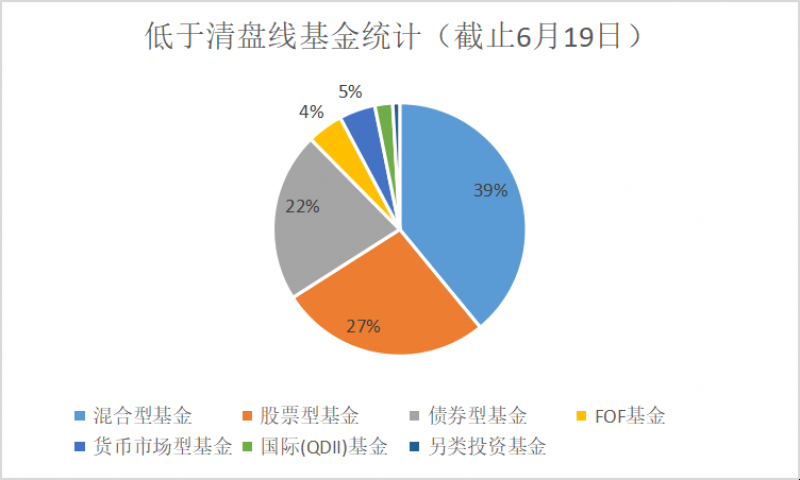

From the perspective of fund types, the most hybrid funds and the least alternative investment funds. Data show that there are 568 hybrid funds, accounting for 39.1%; there are 391 stock funds, accounting for 26.9%; 310 bond funds, accounting for 21.3%.

Judging from the establishment time, the proportion of old funds is more. Data show that among the 1452 funds facing liquidation, the funds that have been established for more than one year are as high as 1,103, accounting for over 75%. Only 349 funds were established less than one year, and 138 funds were established in 2022.

"In the fund industry, due to the combination of various factors such as resources input inertia and channel assessment guidance, the situation of more common existence in the industry in the past. 'Redemption of buying a new'. In this context, after a period of time for the existence of some performance, due to the lack of market funds, it is slowly easily reduced to the general manager of the Fund Fund. Huo Yan said in an interview with the Huaxia Times reporter. However, most of these funds facing liquidation risks will not be liquidated immediately. Fund companies generally choose to hold the holder conference to review the continuous operation and modify the termination terms to try to retain the "mini fund" below 50 million yuan. Xia Shengyin analyzed the reporter of this newspaper: "On the one hand, the fund company has the requirements of maintaining its own brand; on the other hand, considering that this year's complex external reasons such as epidemics, the Russian and Ukraine War, and the US interest rate hikes have caused the fund's poor performance, and the scale changes. Small. But if the fund itself still has competitiveness, the fund company tends to retain and continue to operate. "

The opportunity cost is also an important reason for the fund company to retain the "mini fund". Huo Yan said that because the regulatory agency has clear requirements for the number of public fund products and the scale of existence, when the company has a "mini fund" on the edge of the liquidation, considering the opportunity cost of the newly issued, and the corresponding liquidation work The amount and or some reputation damage, many companies are still willing to choose staged resource investment to maintain the continued survival of the product.

Huo Yan emphasized: "In recent years, the market has gradually opened up the liquidation of the 'mini fund', and it is not very good to judge the company's performance and market impact." Generally speaking, in addition to continuous new products In addition to maintaining the market and channel popularity, as a professional asset management institution, the fund manager should also tilt more energy and resources on the performance polishing and customer companionship of durable products. Only by achieving long -term performance of performance and guiding and matching the reasonable expectations of investors can all parties in the industry win better and longer healthy development.

Editor -in -chief: Xu Yunqian Editor: Gong Peijia

- END -

Shaoyang City carried out special food standard business demonstration store creation activities

Newspaper (Reporter Li Chengjun intern Wen Yu Correspondent Zeng Shaoshi Zhang Donglin) On June 15, the Shaoyang Market Supervision Bureau deployed a special food standardized business demonstration c

What is your hometown in Zhejiang's "Healthy Zhejiang Development Index"?

Zhejiang News Client reporter Chen NingThe reporter learned from the Office of the...