Blowing with the 2.5 billion yuan lithium carbonate cooperation project with Ningde Times, Yongxing Materials made 70,000 in 7 and a half months

Author:Red Star News Time:2022.09.07

Yongxing Materials (002756.SZ) and Ningde Times (300750.SZ) 2.5 billion yuan of lithium carbonate cooperation projects were finally blown after 7 and a half months.

On the evening of September 5, Yongxing Materials Announcement announced that the joint venture agreement was terminated with Ningde Times.

Regarding the reasons for the termination of joint ventures, the Ningde Times said that the company and the other party had a friendly negotiation agreement with the other party due to the actual situation and facing the project.

The staff of the Yongxing Materials Securities Department stated to the Red Star Capital Bureau, "There are differences in the views of the two parties on some matters, and the specific situation is not convenient to disclose it." He emphasized that "the termination of cooperation has not lost much to us, and the joint venture company has not yet carried out actual production production. And business operation. "

Busy for 7 and a half months

Yongxing Materials made 70,000 yuan

On January 27, Yongxing Materials Announcement signed a joint venture business agreement with Ningde Times. Lithium projects, the total investment amount of the project does not exceed 2.5 billion yuan, and plans to build an annual output of 50,000 tons of lithium carbonate production capacity projects.

The joint venture company plans to build 6 million tons of mining capacity (mainly part of the mine operations in Ningde Times), 6 million tons of mineral capacity and 50,000 tons of lithium carbonate production capacity projects; of which, the first phase of the project will build 30,000 tons of lithium carbonate smelting capacity, and and and of. Depending on the situation, the construction of corresponding capacity is mining and mineral construction.

↑ Yongxing Materials According to IC Photo

According to the agreement, Jiangxi Yongxing Special Steel New Energy Technology Co., Ltd. (referred to as "Jiangxi Yongxing New Energy") and Ningde Times wholly -owned subsidiary Yichun Times New Energy Resources Co., Ltd. ("Jiangxi Yongxing New Energy") ") The registered capital of the above -mentioned joint ventures was 300 million yuan and 700 million yuan, respectively, holding 30%and 70%, respectively.

After the establishment of the joint venture, the two parties have paid a total of 26 million yuan to the joint venture in accordance with the shareholding ratio, of which 18.2 million yuan was paid in the Yichun period, and Jiangxi Yongxing New Energy paid 7.8 million yuan.

In this cooperation, the Ningde Times supplied raw materials to the joint venture company, and 100%lithium carbonate products of the joint venture company were prioritized to the Ningde Times or its designated party. Yongxing Materials had previously promised that the products in the 20,000 -ton/year lithium salt capacity they built were mainly provided to the Ningde Times or its designated parties. The procurement price gives appropriate discounts based on market prices under certain conditions.

However, 7 and a half months later, the cooperation was blown. On the evening of September 5, Yongxing Materials Announcement, the board of directors reviewed and approved the "Proposal on the Termination Agreement to sign a joint venture business agreement with Ningde Times New Energy Technology Co., Ltd.", and agreed to sign the "termination agreement for joint venture business agreement" with Ningde Times.

Yongxing Materials said that "the actual situation and facing the new situation in the process of project preparation", and "the two parties will seek other cooperation methods according to the actual situation." The staff of the Yongxing Materials Securities Department told the Red Star Capital Bureau, "There are differences in the views of the two parties on some matters, and the specific situation is not convenient to disclose it." He emphasized that "the termination of cooperation has not lost much to us, and the joint venture company has not yet carried out actual production and has not yet launched actual production and has not yet launched actual production and has not yet launched actual production. Business operation. "

↑ Ningde Times According to IC Photo

In response to the question of "why cancel the production cooperation with Yichun's lithium carbonate? Will it affect the development of lithium mines after canceling cooperation?" Ningde Times replied on the interactive platform that the matter would not affect the development of the company's lithium ore development progress. Essence Due to the actual and facing situation of the project preparation process, the company and the other party have a friendly negotiation agreement to ensure the company's Jiangxi lithium carbonate smelting production capacity construction progress. The core of the company's lithium porcelain earth ore development progress depends on the front processes such as mining, not the back -end lithium carbonate smelting production capacity. It will not affect the development of lithium ore due to changes in this matter.

The two parties agree that after the termination of the cooperation, 30%of the equity of the joint venture held by Yongxing Materials will be transferred by the Ningde Times or its designated party. After calculating equity transfer, the consideration of equity is RMB 78.703 million. In other words, it is equivalent to the deposit of Yongxing's materials for 7 and a half months, which receives 70,300 yuan in interest.

Yunmu lithium lifting faucet has increased in the first half of the year

Lithium resources in 2023 are greater than request

Yongxing Materials is the development of special steel new materials business and lithium battery new energy business. It is the leading company of China's stainless steel rod line and Yunmu lithium bonus. The second in the country.

Public information shows that Yongxing Materials has deployed lithium battery new energy business since 2017. Jiangxi Yichun Yifeng plans to build a 30,000 -ton battery -grade lithium carbonate production capacity, of which the annual production capacity of 10,000 tons has been reached in July 2020. In February 2021, the company launched the construction of 20,000 tons of battery -grade lithium carbonate production capacity. Article 1 production line is close to full production. Article 2 production line is also in the climbing stage of the capacity. It is expected that lithium carbonate production will be 22,000 tons. In September 2021, the Ningde Times announced that it intends to spend 13.5 billion yuan in Yichun, Jiangxi, investing in the construction of a new lithium battery manufacturing base project.

↑ Lithium battery According to IC Photo

As the price of lithium salt continues to high, the volume and price of Yongxing material lithium salt products has risen, and the business profit is greatly released.

In the first half of 2022, Yongxing Materials realized operating income of 6.414 billion yuan, an increase of 110.51%year -on -year; the net profit attributable to shareholders of listed companies was 2.263 billion yuan, an increase of 647.64%year -on -year; net profit after deducting non -recurring profit and loss was 2.183 billion yuan, which A year -on -year increase of 798.59%. Regarding the reasons for the increase in performance in the first half of the year, the half -year report stated that during the reporting period, the company's lithium carbonate products rose and the price of lithium carbonate products rose neatly, cost control in a reasonable range, and the profitability was greatly improved. It was the main source of net profit of the company's half -year. From January to June 2022, the company achieved 7380 tons of lithium carbonate, an increase of 35.46%year-on-year. This business achieved operating income of 3.021 billion yuan, an increase of 685.41%year -on -year; net profit of home mother was 2.102 billion yuan, an increase of 1846.05%year -on -year.

Yongxing Materials produces lithium porcelain stones in its own mine as the main raw material to produce battery -level lithium carbonate. At the end of 2022, the company's mineral selection capacity reached 3.6 million tons, and 6.6 million tons were planned in the future.

Compared with the lithium battery material business, the special steel new material business of Yongxing Materials has encountered the adverse effects of unexpected sudden factors such as the sharp fluctuation of international raw materials in the first half of the year, and the domestic epidemic is out of place. During the reporting period, the business income of Special Steel's new material business achieved 3.393 billion yuan, an increase of 27.44%year -on -year; the net profit attributable to shareholders of listed companies was 161 million yuan, a year -on -year decrease of 17.13%. Essence

Some people in the industry believe that high lithium carbonate prices promote the union of Yongxing Materials and Ningde Times. However, the short -term lithium price is due to the mismatch of the volume, and the actual production capacity is not in short supply.

Yu Yahuan, an analyst of Lithium Industry of Antaike Information Co., Ltd. to Hongxing Capital Bureau that as the resource end continues to release, lithium prices will return, and will fall to about 300,000 yuan/ton in the next 2-3 years.

"The 2023 meeting is a time point for the centralized release of resources, because according to the three -year investment cycle of mineral products, the rapid callback of lithium prices in the second half of 2020 stimulates the investment in upstream. In the year of growth, the projects here have risen with the hot valuation of lithium, and there are also increased lithium targets. The overall industrial impact has expanded. 2023. We believe that the probability of 2023 is obviously more than requested. "

According to data from Shanghai Steel Union, the battery -grade lithium carbonate rose 3900 yuan/ton on September 2, with an average price of 497,400 yuan/ton.

Red Star News reporter Wu Danruo

Editor Yu Dongmei Intern editor Zhu Jieying

- END -

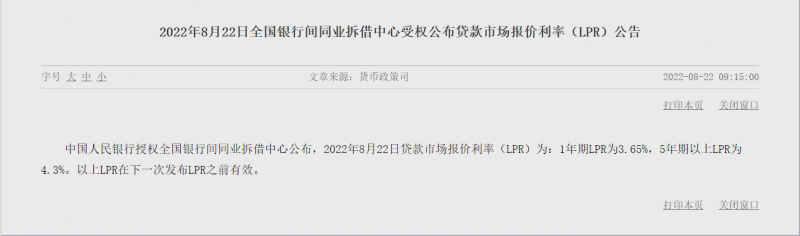

Reduce the first year of the real economy financing cost and the second time the year of the LPR year.

Text/Liu JiaOn August 22, the People's Bank of China authorized the National Bank ...

Chuanyi Technology 7 consecutive boards have soared by nearly 100%, and the environmental protection industry rises against the market. Maybe the style of July will switch?

Wen | Zhang YingOn Friday (July 1), the three major A -share indexes fell, and the...