Medical ETF leveraged funds bought 65.24 million yuan in a single day, and the financing balance was innovative for 3 consecutive days.

Author:Capital state Time:2022.09.07

Yesterday (September 6), the CSI Medical Index fell slightly by 0.24%. Recently, the popular ETF -medical ETF (512170) fell 0.4%.

According to the latest data from the Shanghai Stock Exchange, the medical ETF (512170) continued to obtain funds and continued to increase its inflows. Among them, the ETF market share continued to purchase over 380 million copies yesterday, with a net inflow of 187 million yuan! In the past 20 days, a total of over 2.1 billion yuan was purchased. At present, the share of medical ETF (512170) fund shares of 32.455 billion yuan, which is approaching 16 billion yuan!

In terms of the two finances, according to the latest data released by the Shanghai Stock Exchange, the medical ETF (512170) continued to obtain financing customers. Yesterday, the single -day financing purchase amount of medical ETF (512170) was as high as 65 million yuan. The latest financing balance rose to 510 million yuan, a new high on the market for 3 consecutive days, and increased by 50%in the second half of the year!

【Latest View】

Recently, with the disclosure of the interim reporting performance, the performance of A -share listed companies in the first half of the year has emerged. For the continuous adjustment of more than a year of medical and medicine sectors, boots have finally landed. In this regard, Hu Jie, the fund manager of the largest medical ETF (512170) fund manager of the two cities, expressed the latest performance:

At present, the ingredients stocks of the CSI Medical Index have been released in the 2022 half -annual report. Judging from the published data, in the first half of 2022, the overall income and profit level of the medical sector still showed a growth year -on -year. According to the overall method, the main business income of the SCR medical index is 42%, and the net profit growth rate is 45%. More than%; from the expected data of 2022, its annual net profit growth rate is about 46%, which reflects the high growth of the medical sector.

Data source: wind

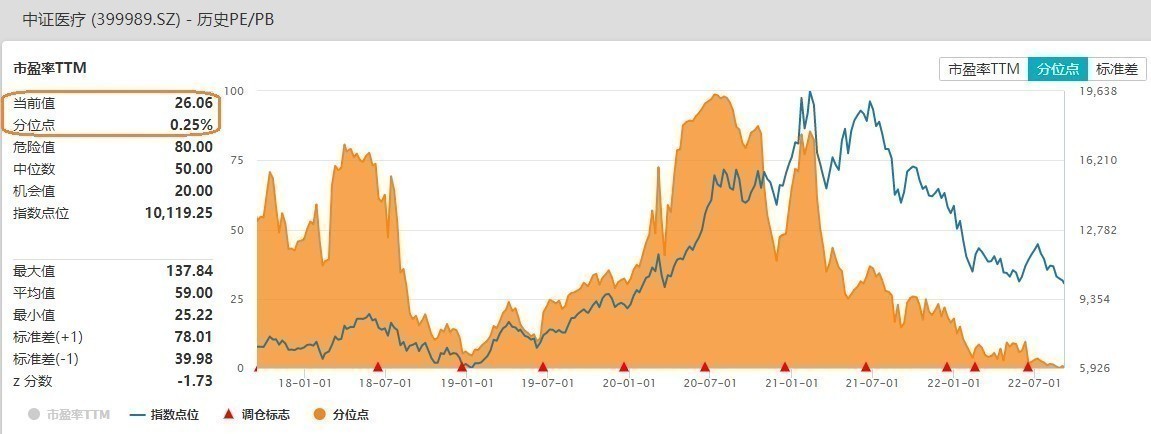

The current CSI Medical Index has reached about 47%since the high point in July 2021. Compared with other growth sectors, the medical sector is currently in a significant overtaking state. From the perspective of valuation, the latest PE valuation of the CSI Medical Index is about 26 times. It is the lowest point in the past 7 years and has a higher cost -effectiveness.

In the long run, medical care is a long -slope thick snow track variety: the acceleration of the population aging, the medical health of 1.4 billion people, and the solid underlying logic of the long -term high prosperity of the driving medical industry. At present, my country's medical expenditure is not high, and there is still much room for improvement compared to more than 10%of developed countries.

Looking forward to the market outlook, CXO, medical equipment and other sectors will still show high prosperity, and the terminal demand for consumer medical and medical consumables will show a trend of recovery. In addition, from the policy point of view, we see that the medical device sector may usher in the policy turning point.

On September 3, the relevant departments publicly responded to the "innovative medical device incorporated into the green channel of medical insurance charges", which clearly proposed that innovative medical devices will not be purchased for the time being, which reflects the policy's encouragement of innovative medical devices, and the section estimates Value is expected to rise.

Therefore, there is no need to worry about the long -term prosperity of the medical sector in the future. Of course, there is a short -term impact of policy and capital preferences in the short term. From the perspective of the market trend of the medical sector, the annualized volatility of the China Stock Exchange Medical Index in 2021 is about 34%, which has the characteristics of high volatility and high elasticity. From the perspective of valuation and growth, the medical sector currently has a high valuation cost -effectiveness. It is a good time for the left layout. Investors can buy in batches at dual points and have long -term configuration to enjoy the long -term dividends of the medical industry.

The latest weekly report of Xingye Securities stated that the pharmaceutical sector is currently at a strategic bottom and has the characteristics of policy bottom, valuation bottom, and positions. Standing at the current point, we reiterate the point of view of the sector again, optimistic about the drug sector that shows the operating reversal state, the high -speed growth track life sciences, and the consumer medical care about valuation switching.

Debon Securities stated in the latest research report "Innovative pharmaceutical weapon is not included in the collection of collection, and proposed to allocate medicine under the active signal of medical insurance": Under the dual influence of public health prevention and control and policies Optimistic about the pharmaceutical structure of the second half of 22 and 23 years! Medicine has been fully adjusted and valuation is at the bottom. The current full base is seriously low. Non -pharmaceutical -themed funds (that is, full -base) Pharmaceutical positions have decreased from 13.7%of 2020Q2 to 6.6%of 2022Q2, a new low of 5 years. Following the local support of innovative drugs, the state releases positive signals in the policy surface, which is expected to promote the repair of pharmaceutical emotions, superimposed recovery expectations, and valuation switching. We recommend actively configure medicines. Optimistic about the pharmaceutical market in the second half of 22 and 23 years.

Guojin Securities believes that the semi -annual report of the medical sector has been disclosed one after another. Affected by the local public health prevention and control rebounds, some enterprises in the sector are affected by the growth rate of some enterprises in the sector. Considering the steady recovery of the industry operations in 2022Q3, the delayed demand is continuously released, the superimposed valuation switching, the performance base of the medical sector in 2021, the high and low and low performance base, and the expected stability of the control fee policy. The expectation of the medical sector will not change in the second half of the year.

As the performance of the interim report is gradually clear, the market's anxiety of the second quarter performance is terminated. We expect the pharmaceutical and medical sector to usher in the second half of the year to 2023.EssenceData statistics show that after the valuation of the valuation in 2016, the CSI Medical Index has harvested a large -level market of nearly 240%in more than 2 years in the next two years.

Medical ETF (512170) tracking CSI Medical Index (399989) ingredient stocks have comprehensively covered the subdivision leader in the field of medical devices and medical services.It directly benefits from high -growth fields such as population aging, medical consumption upgrades and medical beauty, and has long -term national -level demand growth; at the same time, it covers 8 CXO leading concept stocks.

- END -

ETF Interconnection helps international capital allocation of Chinese assets

5JulWen | Zhang YingOn July 4th, ETF was officially launched in the interconnectio...

57 companies in Texas are on the list!Shandong announced the evaluation results of the harmonious labor relationship in 2021

A few days ago, the Office of the Three -Party Committee of Shandong Province issued a notice issued a notice that 418 enterprises were planned to be Harmonious Enterprise in Shandong Province. Amon