Every hot review | Times new shares retrial cases frequently refer to shareholders' return must keep up

Author:Daily Economic News Time:2022.09.06

Since the beginning of this year, the new shares (stocks that have been listed for one year) have set off a re -financing boom. According to statistics, in the first eight months of this year, a total of 35 new shares opened fixed -increase financing. This data has also increased significantly compared with previous years. The author believes that due to the needs of enterprise development, the new shares have launched a re -financing, but the return of shareholders must also be effectively kept up.

The way of re -financing of listed companies includes allocating shares, public issuance, non -public issuance (fixed increase), issuance convertible bonds, etc. Due to the characteristics of simple procedures, low costs, and easy behaviors, it has become one of the favorite when listed companies re -financing. From the perspective of the year -on -year re -financing amount, listed companies tending to increase financing often occupy a large proportion, which is also a major feature of listed companies' re -financing.

Behind the frequent reflection of new shares this year, it also shows very distinctive characteristics. For example, the number of new shares in recent years has been like "high sesame flowers", and one step a year. For the first August, there were 3 in 2018, 4 in 2019, and rose to 17 in 2020. In 2021, it soared to 21. In the first August this year, 35 were entered into the "3" era. The year is more than double the increase.

Not only does the number of increases year by year, the time for the new stocks to start a fixed -increase re -financing is also shortened. Earlier, the new shares were more rare to start financing within six months, and now it has become the norm. For example, the Capital Corporation Co., Ltd. is precise. It was launched on December 27, 2021. The fixed increase plan was released on May 11, 2022, which was 135 days apart. GEM Corporation was listed on September 28, 2021, and a fixed increase plan was released on January 24, 2022. It was only 118 days apart. The data shows that of the above 35 companies, the time interval between the six companies' release plans and the listing of the listing is less than 200 days, which also highlights the hunger of these companies for funds.

In addition, from the perspective of the sectors, the new stocks of science and technology boards and GEM have become the main force. Among them, the new shares of the Science and Technology Board have opened 15 additional financing, and the GEM is also 15. There are 3 main boards on the Shanghai Stock Exchange, and 2 are all 2. All two companies in Beijiao have been on the list, which is worth noting.

Due to the lack of fundraising for the first new shares, in just one year, all IPO financing all invested in fundraising projects. However, many new stock companies have launched re -financing, but there is no reason.

First of all, the insufficient fundraising of IPO is an important factor that cannot be ignored. The issuance price of new shares is affected by many factors, such as policies, markets, and tracks. In the past two years, IPO's lack of fundraising has been the focus of market attention. Among the 35 companies mentioned above, the first raised funds of the 19 companies were not as expected. For example, the Kodak CNC plan raised 976 million yuan, and the actual fundraising was 250 million yuan, which was far lower than expected. It is one of the measures for remedy to make up for the gap of funds.

Secondly, companies on the track need huge amounts of funds for investment. The track company not only is sought after by the market, but its investment projects are often "big conclusions". Like Ningde Times, after nearly 20 billion yuan in financing in 2020, this year, it has once again raised nearly 45 billion yuan in financing. Moreover, even if the start of the track company has a super fundraising, it will also be favored by the institution when it is fixed.

Financing is one of the three major functions of the capital market. The re -financing of new shares has not only exerted the financing function of the capital market, but also an important manifestation of the capital market to support the real economy. However, financing and returns have always been a pair of twin brothers. While the new shares frequently reach out to the capital market in the short term, their future return investors will also need to follow up.

In recent years, the dividends of listed companies have been remarkable. For example, from 2017 to 2021, the total cash dividend of listed companies exceeded 10 trillion yuan for five consecutive years. Not only are there more and more listed companies involved in dividends, the proportion is getting higher and higher, and the total dividends continue to refresh the record. Moreover, mid -term dividends have gradually become a trend. For example, this year, 123 listed companies implemented the annual dividend, involving an amount of more than 220 billion yuan. All of this is undoubtedly worthy of recognition.

The author believes that on the issue of returning shareholders, the new shares must first enhance the awareness of shareholders' return, which is fundamental. Secondly, it is necessary to improve the ability of shareholders, and to improve profitability is the foundation. This requires financing funds to truly play and thicken its performance.

Daily Economic News

- END -

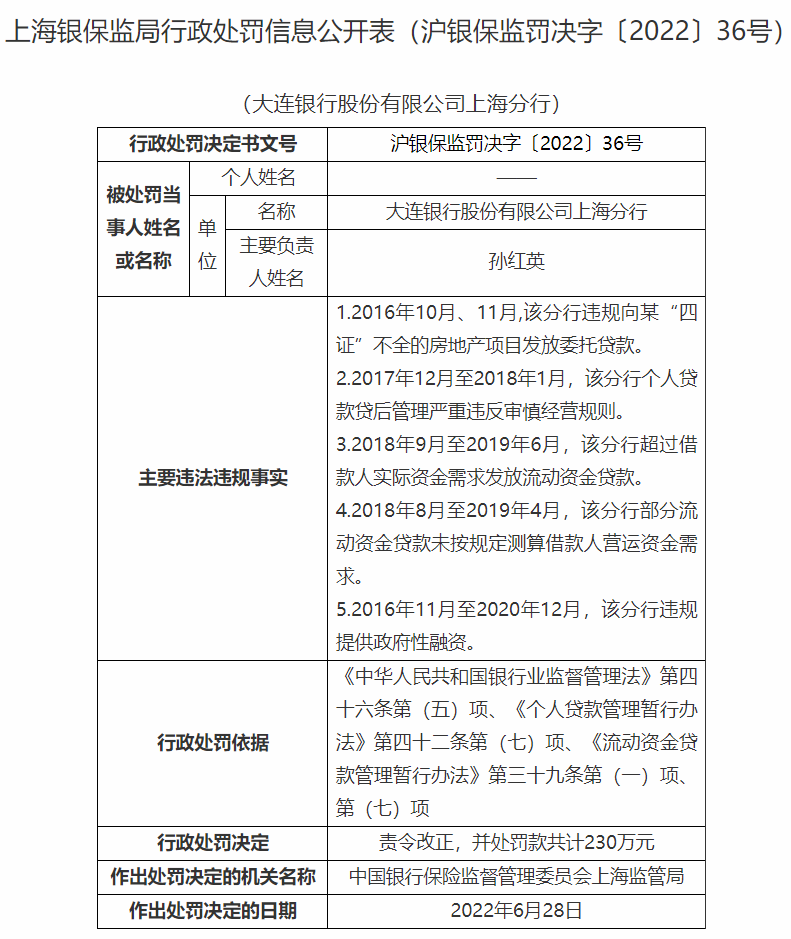

Dalian Bank was fined 4.4 million yuan!Deficiency increase loans and illegal provision of government financing

[Dahecai Cube News] On July 6, the administrative penalty information disclosed by...

Several sayings of Rizhao Development | Tax reduction and fee reduction allows companies to enjoy the "drip irrigation" service

Live Live Rizhao August 13th The fiscal revenue is an important indicator of finan...