Keep updated the prospectus: 417 million revenue in the first quarter, and a net loss of 155 million

Author:Economic Observer Time:2022.09.06

Economic Observation Network reporter Zheng Yixin updated the prospectus on September 6 (hereinafter referred to as "Keep"). On August 26, Keep's IPO application status turned to "failure".

A foreign investment banker told reporters that after the company submitted the prospectus, the time to wait for the listing report was limited to the audit report, and the application status would be displayed into failure. According to the regulations of the Hong Kong Stock Exchange, the planned company (issuer) completed the update of financial data within three months after the application of the original six months, that is, the reconstruction of the prospectus, all of which are the continuation of the original application.

The prospectus updated by Keep shows that in the first quarter of 2022, Keep achieved revenue of 417 million yuan, an increase of 37.6%year -on -year. In the first quarter of 2022, the net loss was 155 million yuan under the measurement of non -international financial report standards. 237 million yuan.

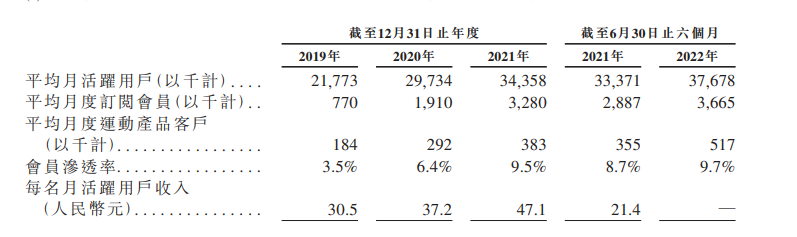

The prospectus shows that the revenue of revenue is the growth of their own brand sports products and membership subscriptions and online payment content. In the six months of June 30, 2022, the average monthly active user of the Keep platform was 37.7 million, and the membership penetration rate was 9.7%.

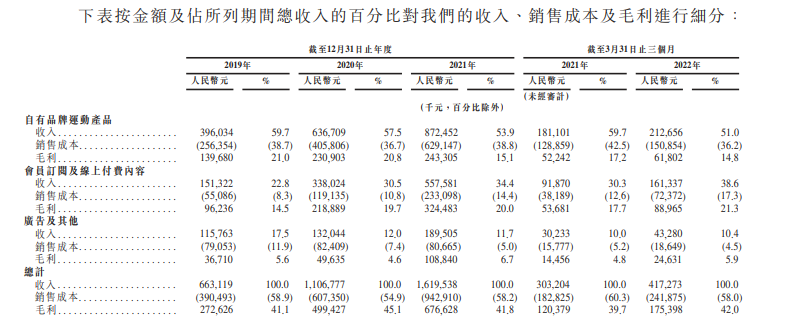

In the three months as of March 30, 2022, in the revenue structure of Keep, its own brand products (consumer goods) business accounted for the largest proportion, with revenue of 213 million yuan, accounting for 51%. The proportion of its own brand products has declined. His brand products include KEEP smart bicycles, bracelets, weight scale, treadmills, etc., as well as the income of related supporting sports products. As of June 30, 2022, Keep has sold approximately 108,000 KEEP smart bicycles, 1.5 million Keep bracelets, 1 million KEEP smart scale, and 197,000 treadmills.

Keep's second largest business segment is member subscription and online payment content, with revenue of 161 million yuan, accounting for 38.6%, which is increased compared to 2021. In addition, advertising and other services contributed 43.3 million yuan, accounting for 10.4%.

Keep's funds will be used for research and development to improve technical capabilities and promote product innovation, development and diversification of fitness content, brand promotion and promotion, and general enterprise use and operating funds.

Regarding the issue of how Keep turned his losses in the future, Keep told reporters that it is based on the publicity information of the prospectus and no further explanation.

- END -

"I do practical things for the masses": The issuance of consumer coupons is a benefit of the people, and it is also a "add firewood and fire" for the market to warn the market.

Elephant News commentator Chen SiIn recent years, consumption has gradually increased its economic increase effect, and slowly has become the main driving force for the steady recovery of the national

Alibaba's "Hot Land Plan" continues to promote the first digital project of the first agricultural link to settle in the west

Due to the influence of rain and low temperatures, the main Litchi production area...