Commercialization ability PK!Baiji, Cinda, Fuhong Hanlin led, and Jun Shi was weak?How do I survive without profitable BIOTECH?

Author:Pharmaceutical economy Time:2022.09.06

Come and charge "Blue Words" together!

Teng Shengbo Yao recently issued an announcement that Luo Yongqing will resign from the position of executive director, president and general manager of Greater China and the CEO (CEO) of Teng Shenghua, a subsidiary of Teng Shengbo, will take effect on September 15th Essence

The high -level changes of Teng Shengbo are just a microcosm of the market test of Biotech/BioPharma's commercialization recently. After all, for any biopharmaceutical company, it is not the purpose of listing the product. The product can really exchange "real gold and silver" in the market is the true chapters of each family.

In recent years, my country's biopharmaceutical company's innovation capabilities have been increasing, and more and more enterprise innovation products have been approved to be listed one after another. Does the idea of "product curative effect naturally do not worry about selling" mean that the listing of innovative products is necessarily equal to commercialization?

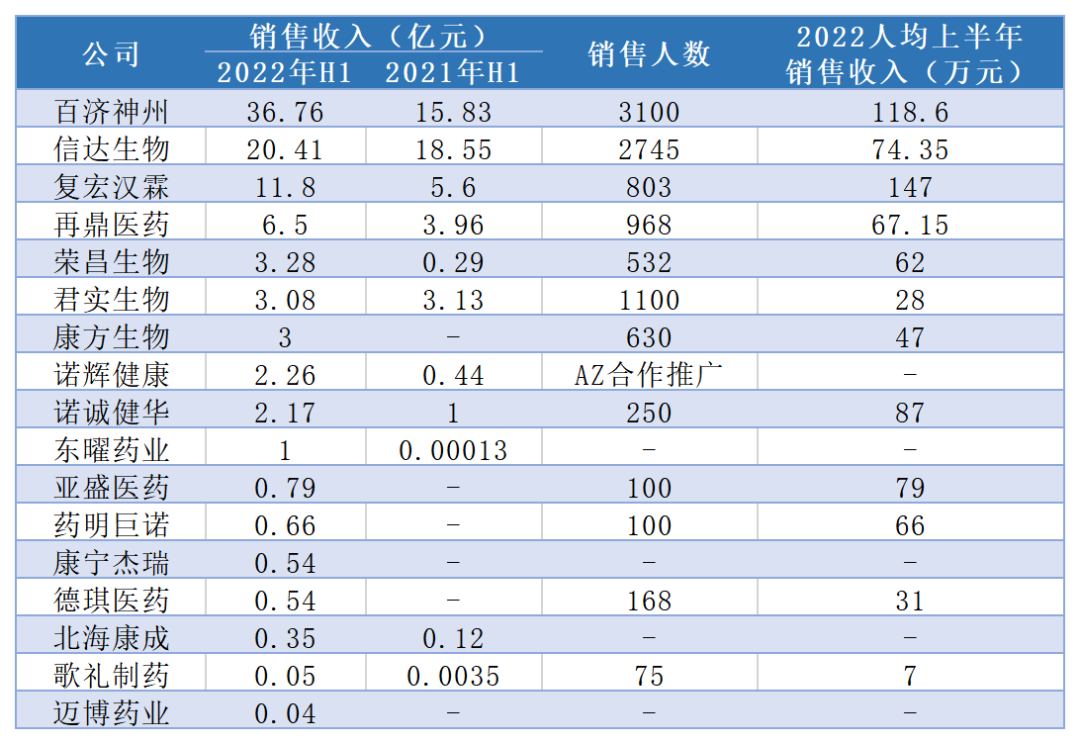

With the recently released the 2022 China Financial Report by various pharmaceutical listed companies, the New Media Center of the Medical Economic News sorted out the sales amount disclosed by the company and the size of the sales team. The differences in commercialization between enterprises.

Industry insiders said that from Biotech to Biopharma, of course, innovative research and development capabilities are of course to measure the "ruler" of a biomedical company. At the same time, in the face of increasingly difficult market tests, the construction of commercial capacity has obviously become a competitiveness that cannot be ignored. Being able to obtain large -scale sales and stable profits is also the core element that enterprises can develop for a long time.

Biopharma commercialization test

What is the per capita sales performance?

Innovation ability is the key to whether a Biotech can sustainable, but the commercialization ability is also irreplaceable.

Throughout the world, there are only a handful of companies that have transformed from Biotech to Biopharma. For most BIOTECH companies, the best destination may only be acquired at high prices, and it is evident that it is difficult to commercialize.

Looking back at the domestic market, taking some biomedical companies listed on the "18A" of Hong Kong stocks as an example, it also faces the same problem. "Product sales" and "product energy sales" obviously have two completely different contexts. What are the differences between enterprises between commercial products listing and commercial market promotion capabilities? According to the enterprise's release data for 2022, data comparison was performed.

(Incantance statistics)

Among them, the number of Junshi biological business team reached 1,100, with sales revenue of 310 million yuan, and the per capita sales revenue was 280,000 yuan in the first half of the year. Judging from the total sales performance in the first half of the year, the sales revenue of Rongchang Bio and Kangfang Biological was 328 million yuan and 300 million yuan, respectively. The income between several companies seemed to be equal. Only 532 and 630 were only 620,000 yuan and 470,000 yuan in the first half of the year. The commercial efficiency was obviously higher.

Junshi Bio has successful, and its PD-1 product Tripley is officially launched in February 2019. It brought 774 million yuan in sales to Junshi creatures in the year. In 2020, sales reached 1.003 billion yuan In 2021, the cliff -type decline was only 412 million yuan. Now in the first half of 2022, Tripley monoclonal sales were 298 million yuan. The commercialization situation improved, but it was still difficult to reach the market competition pressure.

Market sources commented that if a biomedical company compares to a "carriage", the innovation ability is the horse that leads the way, and the commercialization ability is to ensure that the carriage continues to move forward. Neither of them should be ignored, especially for a one for a one For companies that are developing. "Among the current domestic biomedical companies, the R & D and commercialization of Baiji Shenzhou and Cinda Bio seems to be more balanced."

The market divides the Baiji Shenzhou and Cinda Bio into a "unique file" different from other biomedical companies, which is not basically basically not basically nothing to do. In addition to their perfect commercial team, there are more than one product that can achieve large -scale sales in their hands. This also allows companies to decline in the price of medical insurance negotiations in the face of products and have more space.

Taking Baiji Shenzhou as an example, under the superposition of the significant price reduction of medical insurance negotiations and market turmoil, its income and profits have not been greatly impacted. Thanks to its global market layout, this is commercialized. Power manifestation. In the first half of 2022, even if the price of PD-1 medical insurance negotiations also declined, the total sales revenue was 3.676 billion yuan. The "self -hematopoietic", the per capita sales revenue exceeds one million in the first half of the year.

The commercialization capacity of Cinda Bio has been proven by the market. In the previous 2021 annual report, Cinda Bio has more than 4 billion product sales revenue and the growth of PD-1 products. Price and conversion of medical insurance negotiations allowed the sales of Xindili monoclonal anti -resistance to unprecedented pressure in 2022, but the commercial team still retains the resources of the terminal channel. From the data, it can be seen that the per capita sales revenue exceeded 740,000 in the first half of the year. Yuan, always ranked among the forefront of commercialization; in addition, Sanofi cooperation with Cinda creatures also saw the advantages of the Cinda commercial team.

In addition, from the above data information, we can see that among biomedical companies that have now realized product commercialization, companies such as pharmaceuticals, Nuo Chengjian, and Yasheng Pharmaceutical are worthy of attention in terms of commercial efficiency. According to market analysts, from the long run of enterprise development, blood transfusion in the capital market is only a way to solve the source of corporate funds. Only by forming large -scale sales, relying on the commercial team independently, and undertaking the cost of the full cycle of research and development and sales. In order to form a virtuous circle, so that enough profits can make companies run smoother.

"Jiu Xiang is afraid of deep alleys"

Innovation is not equal to commercial success

For most innovative R & D companies, although there are capital injection and no profit requirements in the short term, these are just temporary. The capital market still needs to speak with performance. In the end, the only consideration standard will only be commercialization capabilities. The product officially enters the market. The transformation of BIOTECH to Biopharma is worthy of joy. The next commercial transformation is a new level that needs to be overcome.

"Use innovative drugs to meet the unsatisfactory clinical clinical, and achieve huge commercialization." The logic closed loop is rigorous. However, the successful research and development of innovative products is not equivalent to the success of commercialization; It does not necessarily mean commercial failure.

The most typical case is Fu Hong Hanlin. Earlier, the biological similar drugs were considered to be unparalleled by the market. However, in the past two years, with the phased results reached by commercialized attempts, only Tushuzhu has sold 800 million yuan in half a year. The market like the "Red Sea" made a sense of heavy innovation medicine. Although the market speculates that the results of commercialization are inseparable from the global resource support of the Portage system, Fuhong Hanlin has proved that even if it is a biological medicine, it can still make money. The efficiency of commercialization also makes the capital market look forward to its future commercialization potential.

Obviously, regardless of research, development, access or commercialization, any link may form competition barriers. Biotech transforms Biopharma is endlessly attractive. If Biotech does not have the ability to successfully commercialize its own products and turns gorgeous, will it continue to persist?

In recent years, many pharmaceutical companies have continued to increase product width, build factories, improve the level of production and manufacturing, and form a commercial team. However, comprehensively examining the "self -hematopoietic" ability of the enterprise can "sell" products, not that the product can bring sales, but that the product can form a large -scale market sales, and even eliminate various costs. After that, he can truly bring profitability to the enterprise.

Throughout the market, there are still many Biotech companies focusing on research and development, regardless of "market". For example, the industry is well known BIONTECH, Regeneron, etc. These companies have continuously innovated and authorized products, and then they fame in the industry. Finally, they reached the big trees. The alternative transformation made the product successfully commercialized.

Analysis of industry insiders pointed out that the founders of domestic innovative pharmaceutical companies are often technical backgrounds of scientists. In the early days of their establishment, they rely on their research and development technology and knowledge reserves to superimize capital investment in rapid development; People have the ability to transform and move towards commercialization.

This is also doomed that the difficult process of corporate transformation, between corporate management, between R & D and commercialization, may have a difference in strategic ideas. Whether it was the person in charge of the business in the past many times, or the Teng Shengbo medicine mentioned at the beginning of this article, the position of the person in charge or general manager of the commercialization was replaced, which also caused the capital market's guessing of the commercialization of the enterprise.

At the same time, in the cold winter of the capital market, some companies are forced to be under pressure, and they are also looking for opportunities for short -term monetization. Not long ago, Genting Xinyao issued an announcement, signed an agreement with the wholly-owned subsidiary of Geely Germany, and the core of TRODELVY, the core of the core TROP-2 ADC drug introduced from Immunomedics in the Greater China, South Korea, and some Southeast Asian countries, which was previously introduced from Immunomedics. The exclusive rights were returned to Immunomedics; then, Dr. Bo Kerui, the company's CEO (CEO), announced his resignation, further triggering the market's concerns about the commercial transformation of BIOTECH.

Jiu Xiang is also afraid of deep alleys, and success has a diversified definition. Not every company must pursue commercialization. Focusing on unsatisfactory clinical needs, consolidating original high -end technology, and building a research and development platform for independent intellectual property rights, biomedical companies can also gain a foothold in the cycle of the industrial chain.

Faced with the cold winter of the capital market, after considering the transformation, the process may be smoother after standing firmly.

Edit: Yu Chenglin

- END -

Hot -view biological disclosure 2022 semi -annual report achieved revenue of 2.046 billion yuan

On August 25, hot -ora -view biological (code: 688068.SH) released the 2022 semi -annual performance report.From January 1, 2022-June 30, 2022, the company realized operating income of 2.046 billion y

[Jingwei afternoon tea] From September 1st, Beijing rental needs to be signed for contracts

【Hot spots and news】The price of pork on the festival is stable! National Development and Reform Commission: Increased reserves and launch in SeptemberRecently, the Price Department of the National...