Wang Zengwu: Is it the future trend of private banks?

Author:Zhongxin Jingwei Time:2022.09.06

Zhongxin Jingwei, September 6th: Is it the future trend of private banks?

Author Wang Zengwu, Director of the Wealth Management Research Center of the Institute of Finance Management of the Institute of Finance of the Chinese Academy of Social Sciences

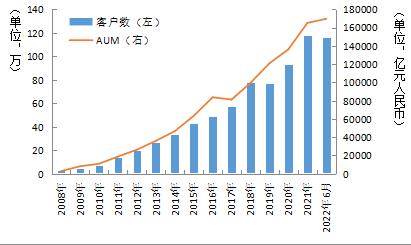

In 2008, the number of customers in the domestic private banking industry and the scale of asset management (AUM, Asset Under Managment) were only 27,200 and 292.6 billion yuan, respectively, and the corresponding data of June 2022 were 11.582 million and 16.97 trillion. Yuan (Figure 1), the latter is 43 times and 58 times the former, the development speed is amazing.

An important indicator of the competitiveness of the per capita AUM or the competitiveness of private banking institutions is not obvious in terms of the increase of dozens of times the increase in the previous dozens of times. It is 140.165 million yuan/per person.

Figure 1 Source of the number of private bank customers and asset management scale Source: The author organizes and draws

In fact, in the past fifteen years, the organizational structure, business model, service system, risk control system, and system construction of the domestic private banking industry have also become more improved in fluctuations. As far as the organizational structure is concerned, after the alternation of the large retail and business division, most institutions still return to the large retail model.

Since entering 2022, an incident worthy of attention is that Xingye Bank and Hengfeng Bank have obtained a private banking license issued by the Shanghai Banking Regulatory Bureau. Does this mean that specialized agencies are the future trend?

As far as the business model is concerned, there are mainly consultants and sales service models. The corresponding profit models are consultant fees and sales commission fees. At present, most private banks have adopted a sales service model or a large platform model.

As far as the service system is concerned, it is nothing more than the integration of financial and non -financial services and the integration of public and private business. The importance of the latter may be higher than the former. The refinement and intimateization of non -financial services focusing on the topic worthy of attention.

As far as the risk control system is concerned, as a senior industry person is concerned, this is currently a blank, and this blank filling seems to be a bit difficult, because private bank customers have more potential uncertainty, such as assets at home and abroad With personal security and the prevention of financial market risks, all these are not a simple risk control system.

As far as system construction is concerned, this or the top priority of the private banking industry should include at least the asset allocation system and customer relationship management system. This should also be cooperated with the aforementioned financial or non -financial services. When investigating the Bank of Longao, they said that their asset management system covered the economic cycle for more than two hundred years. In the event of the impact of the 2008 financial crisis, their system can automatically adjust the asset allocation strategy. If a customer comes to check his asset allocation, only a cup of coffee. This is the direction of the domestic private banking system construction.

Table 1: In June 2022, the source of data related to the domestic private banking industry source: The author organizes and draws

Organizational structure, business model, service system, risk control system and system construction have not changed special changes in the semi -annual report of 2022. Below, we focus on the three dimensions of customers, AUM, and business innovation briefly analyzed the development of private banking business in the half -year report of 2022.

On the one hand, as of the end of June 2022, the number of customers in the private banking industry that has been published in China and AUMs was 1.1582 million and 1.997 trillion yuan (Table 1), respectively (Table 1). The top three AUMs are China Merchants Bank, ICBC and China Bank, and the top three per capita AUM are investment promotion, Ping An and Pudong Development. Among them, China Merchants Bank's AUM and AUM per capita AUM are far ahead of domestic peers.

On the other hand, from the semi -annual report of 2022, we also saw some highlights of business innovation.

First, effort entrepreneur service. For example, ICBC establishes 228 "Entrepreneurs Gas Station" and the Bank of China has launched the "Entrepreneur Office" construction.

Second, deepen digital transformation. For example, Everbright Bank launched the “Data Guide+Scenario Cassens+Full Journal Companion” (DSC) customer group business model and “mobile banking+video investment advisory+offline team” (OVO) omni -channel collaborative service model. For another example, online and systematic management of the family office of Industrial Bank.

Third, deepen public and private linkage services. For example, China Merchants Bank proposed a "customer -private integration service model" in the semi -annual report.

Fourth, study and promote business development. In the transformation of wealth management, securities companies have always worked hard to transform their research capabilities into customer service capabilities, such as "macro -market -research -product" transformation. At present, private banking institutions on heads It is also a kind of "soft power" creation of weekends, monthly reports, quarterly reports, and annual reports. (Zhongxin Jingwei APP)

This article was selected by the Sino -Singapore Jingwei Research Institute. The copy of the work produced by the selected work, the copyright of the work, is not authorized by any unit or individual. The views involved in the selected content only represent the original author and do not represent the view of the Sino -Singapore Jingwei.

Editor in charge: Wang Lei

- END -

Strong and strong, jointly build Shanxi Tongfeng Technician College

On the morning of September 2nd, Yang Wenyue, chairman of the three -dimensional g...

92 funds under the Nuoan Fund disclosed the half -annual report of 2022

On August 31, 2022, the latest semi-annual report of Nuoan Fund Management Co., Ltd. disclosed the latest semi-annual report (January 1, 2022-June 30, 2022).According to the data, Nuoan Fund Managemen