Yang Delong: The central bank has lowered foreign exchange deposits to release positive signals. my country's economic recovery situation remains unchanged

Author:Dahe Cai Cube Time:2022.09.06

Yang Delong | Cube, everyone talks about column authors

Today is September 6th, the recent depreciation of the RMB exchange rate has continued to depreciate. The main reason is that it has been strongly attacked by the US dollar index and broke through the 110 mark. The depreciation is relatively small. In order to stabilize the trend of the RMB, the central bank announced that it reduced the two percentage of foreign exchange deposit reserve rates, which released about $ 19 billion in foreign exchange funds to stabilize the RMB trend. The foreign exchange deposit reserve rate refers to the ratio of the foreign exchange deposit reserve of the Bank of China to the People's Bank of China to the RMB China Bank. According to the financial data released by the central bank, as of the end of July 2022, my country's foreign exchange deposits were $ 953.7 billion. In other words, two percentage points are lowered, which is equivalent to financial institutions that can reduce US $ 19 billion of foreign exchange to the central bank. On the other hand, financial institutions have added $ 19 billion in foreign exchange. This is conducive to boosting the RMB exchange rate trend of.

Yesterday, Liu Guoqiang, the vice president of the People's Bank of China, introduced the continuation policy measures for the State Council's policies in a routine blower in the State Council's policy. He said: "The long -term trend of the RMB should be clear. The degree of recognition will continue to increase, which is a long -term trend. However, two -way fluctuations in the short term are a normal state. There will be no "unilateral cities" with two -way fluctuations, but the point of the exchange rate is not allowed. One point. Reasonable balance and basic stability are what we like to see. We also have the strength to support. I don't think there will be any accidents or an accident. "After the above statement, the central bank has lowered the foreign exchange deposit reserve ratio of financial institutions during the year. The intention of stabilizing the RMB exchange rate is obvious, and the stability of the RMB exchange rate is conducive to boosting the confidence in the market.

Since the beginning of this year, the Fed has raised interest rates four times, and the interest rate hike is mainly to cope with the highest level of inflation in the current 40 years. After half a year of interest rate hikes, the CPI in the United States remained high and did not fall sharply. It is mainly because it is not only the currency phenomenon that promotes the inflation of the United States this time, but also the shortage of supply chain. Affected by the conflict of Russia and Ukraine, the prices of oil and gas have skyrocketed, and the supply of agricultural products has also been affected. Affected by the global epidemic, the supply chain of many industries has been impacted. These have made the United States's high degree of complexity in control, but in order to cope with the main contradictions such as high inflation, the Fed releases a hawk signal. At the previous annual meeting of the Central Bank of Jackson Hall, the Federal Reserve President Powell once again expressed its stance to respond to inflation, which means that the US dollar may continue to strengthen and affect non -US currency.

On August 15th, the central bank of my country lowered the interest rate of LPR interest rates and the interest rate of MLF for medium -term borrowing convenience, mainly to cope with the current slowdown in economic growth. The primary contradiction facing the Fed now is anti -inflation, and the main contradiction we face is steady growth. Therefore, the Sino -US monetary policy has a relatively large deviation, and China -US interest rates have inverted. This is the cause of exchange rate fluctuations, but the short -term exchange rate fluctuations The impact is actually limited, and my country's assets still have a relatively large investment attraction to foreign capital. A number of foreign investment banks have published a report saying that investors can regard the recent low valuations of China's stock market as an opportunity to further increase their positions, and they are optimistic about the performance of the stock market after the economic recovery. In terms of the bond market, foreign capital also inflows in August.

From the perspective of domestic economic growth, the momentum of economic recovery in the second half of the year has gradually formed, but the strength of recovery is not great. In July and August for two consecutive months, PMI was under the 50%glory of the watershed, which shows that the foundation of the economic recovery is still relatively weak and cannot be taken lightly. In the first half of the year, the State Council introduced 33 policies to stimulate economic stimulation, and is now gradually landing. In addition, some time ago, the National Association also introduced 19 continued 19 stimulating economic policies to stabilize the economic recovery. This is to stabilize the economic growth through investment and consumption. Of course, the recent epidemic conditions in some areas have been repeated, the epidemic control measures are relatively strict, and the increase in consumption growth in the second half of the year is not obvious, especially for tourism -related consumption growth rates have decreased significantly. The epidemic should be defended and the economy must be stable. With the gradual implementation of a series of policies that stimulate the economy, economic growth may rise, which may rise, which is an important foundation for the next step of the capital market.

From the perspective of economic growth in recent years, my country's economy is transforming. The growth model that originally relied on investment pulling and export driving has gradually transformed into consumer pulling and technology drive. From increasing the growth model of labor force and capital production factors, gradually shift to the growth model of increasing labor productivity, that is, increasing the added value of the economy. The economic growth rate has declined in ladder in the past ten years, but the economic structure is transforming, and the quality of economic growth must be gradually increased, and the proportion of high value -added products must be gradually increased. In this case, even if the economic growth rate declines as a whole, the quality of our economic growth is increased, which will become an important investment opportunity in the capital market.

From the perspective of economic transformation, new energy and consumption are the two major directions of economic transformation. my country's determination to vigorously develop new energy. Whether it is new energy vehicles or photovoltaic and wind power, the future development space is very large. For example, in terms of new energy vehicles, my country's new energy vehicles are now developing the fastest growth in the world, and sales account for half of the world. From the perspective of the preservation, my country's new energy vehicles have exceeded 10 million units, the world's first. However, compared with my country's car ownership of 300 million, it accounts for only 3%. There is still a lot of room for growth in the future. In terms of photovoltaic and wind power generation, the proportion now has less than 10%. 70%of my country's power generation rely on thermal power. It is planned to increase to 25%in 2030 and increase to 80%in 2060. The development space is still very large. Therefore, we spare no effort to support the development of clean energy. This is a energy revolution, and we must master the autonomy of new energy and gradually get rid of the dependence on imported oil, which is of great significance for our national security strategy.

Yang Delong's management can be managed by the Qianhai Open Source Cleaning Energy Fund for the second quarter report that the new energy vehicle industry chain, photovoltaic, wind power, hydrogen energy and other industries in the new energy vehicle industry chain. In another direction of the benefit of economic transformation, the impact of the short -term epidemic in the short term of consumption has declined, but this is temporary. Once the post -epidemic era, consumption is expected to rise in recovery, and the long -term equity investment value of consumer white horse stocks also It will be higher, Yang Delong believes that it is a better strategy to seize the opportunity of market recovery by layout new energy leaders and consumer white horse stocks. After nearly three months of adjustment, the capital market is also expected to gradually rebound and get out of the bottom area. Therefore, it is recommended to maintain confidence and patience under the current market.

Responsible editor: Shi Jian | Audit: Li Zhen | Director: Wan Junwei

- END -

Line 7 North Extension Line (front Sichuan line) project, Line 16 (Hannan line) starting point adjustment engineering personnel clothing procurement project to win the bid

[Source: Wuhan Metro Group_Nenging Information]Line 7 North Extension Line (front Sichuan line) project, Line 16 (Hannan line) starting point adjustment engineering personnel clothing procurement proj

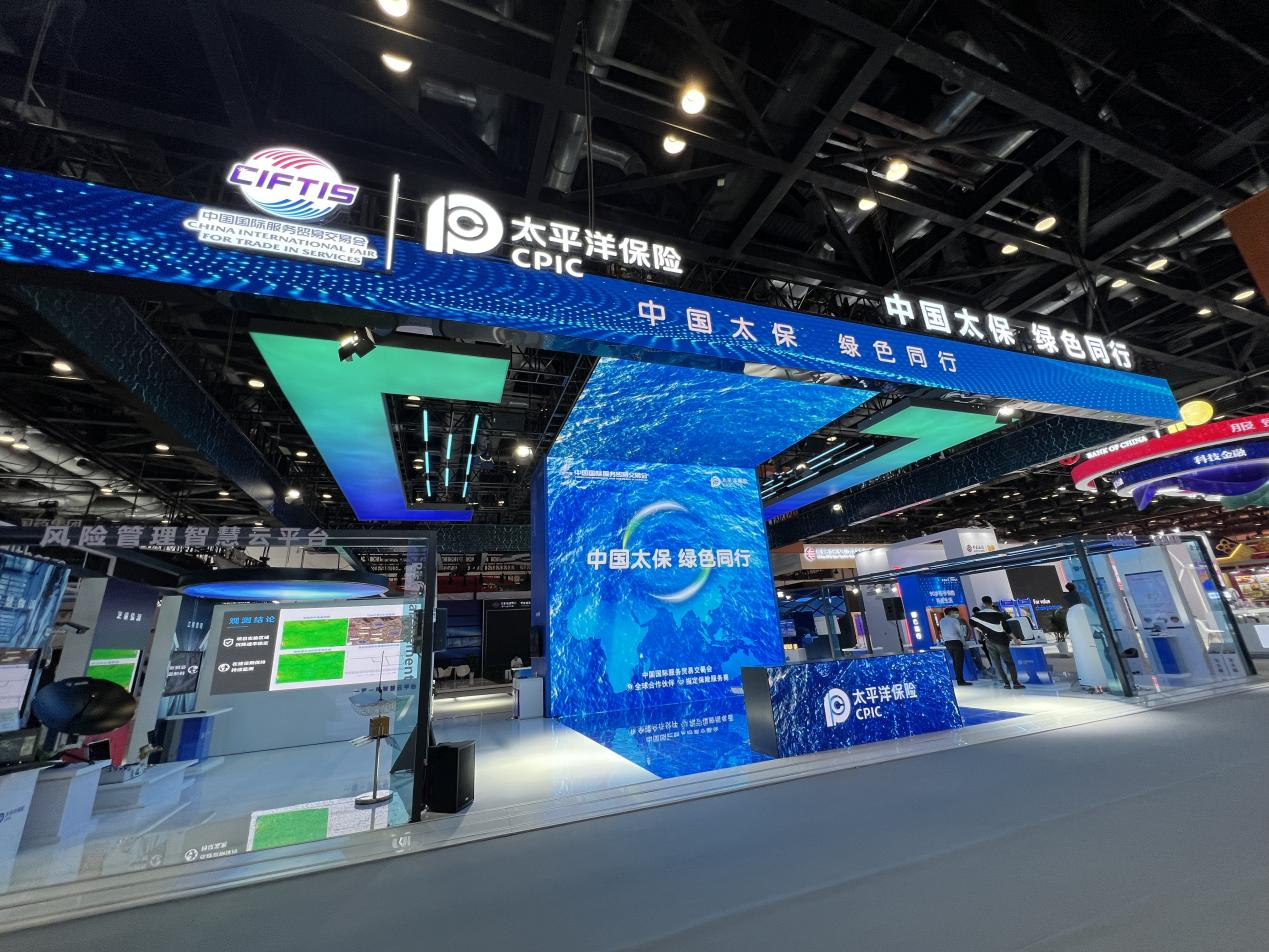

China Taibao appeared at the service trade association!Create a "Taibao Sample" for high -quality development

On August 31, the service of the service trade in 2022 officially kicked off. As a...