OPEC+conference unexpectedly announced that the future price reduction of international crude oil rose by more than 2%

Author:Securities daily Time:2022.09.06

Our reporter Xie Ruolin was seen reporter Han Yu. According to Xinhua Finance, on the evening of September 5, Beijing time, OPEC+(Organization of Petroleum Exporting Countries and his partners) held the 32nd Ministerial Meeting and decided to reduce crude oil production by 100,000 in October in October Barrel/day. Earlier, OPEC+agreed to increase the output in September by 100,000 barrels per day, setting the minimum production increase in the history of the alliance. The decision to reduce production also offset the previous increase. Before the meeting, most of the market expects OPEC+to maintain the output quota in October. Although only 100,000 barrels per day were reduced in the end, many analysts said that the production reduction measures released OPEC+intention to stabilize global oil prices in the near future. After the production decision was announced, international oil prices also suspended the decline and rose collectively. WTI crude oil futures and cloth oil futures have increased by more than 2%. In fact, since June of this year, international crude oil prices have changed the trend of high in the first half of the year and continued to fluctuate down. Wind data shows that after the settlement price of oil futures reaching a phased high at $ 123.58/barrel on June 8, it has fallen by about 22.5%, and it was reported at $ 95.74/barrel on September 5. Regarding the recent situation of international crude oil prices, Wang Youxin, a senior researcher at the Bank of China Research Institute, told the reporter of the Securities Daily that the rapid rise in crude oil prices in the first half of the year was mainly affected by the speculation of speculation under international geopolitical conflict. After the impact, with the tightening of global liquidity and the retreat of financial investment capital, crude oil prices have gradually returned to the fundamental impact of supply and demand. At present, major developed economies such as Europe and the United States are facing a large economic downward risk, industrial production and related consumer activities are weak, and global crude oil demand has gradually declined, making international oil prices pressure. Zheng Houcheng, director of the Institute of British Securities Research Institute, also expressed similar views in an interview with the Securities Daily reporter, and analyzed that in August, Morgan Chase's global manufacturing PMI new order index recorded 48.20, which was located on the Rongbai Line for 2 consecutive months for 2 consecutive months. Below, it is also reflected in the situation that the European and American economies are facing a large economic downturn risk. The global market demand is relatively weak, and it has also put greater pressure on international oil prices on the demand side. In addition, Wang Youxin also believes that driven by Fed's accelerated interest rate hike process and risk aversion emotions, the US dollar index has risen strongly. The crude oil prices priced in the US dollar are usually negatively related to the US dollar trend. Essence Although OPEC+slightly reduced production decision to increase international oil prices, the experts interviewed said that the macroex and air factors that suppressed international oil prices still exist. Zheng Houcheng believes that the current US macro economy has entered a stage of passive replenishment, and the Fed will continue to raise great interest rates to tighten liquidity. It is expected that its economic growth rate will continue to undergo pressure in the future. The developed economies of Europe and the United States faced similar problems. Even if OPEC+releasing signal reduction signals in the later period, although international oil prices have risen due to supply and demand, the trend of international oil prices is still suppressed under the weakened global demand. Continue to fall. "From the perspective of demand, global liquidity and economic growth of developed economies in Europe and the United States have fallen further. The crude oil price center will decline significantly compared with the first half of the year." Wang Youxin also said.

Picture | Site Cool Hero Bao Map.com

Recommended reading

Experts forecast: August of the year -on -year increase of CPIs in CPI will maintain a decline in the year -on -year increase in PPI

The central bank has recently continued to carry out 2 billion yuan reverse repurchase this month to reduce OMO and MLF interest rates low

- END -

The "retreat" and "advance" of multinational cosmetics giants

China Business Daily (Reporter Ma Jiawen/Picture) In the first half of this year, ...

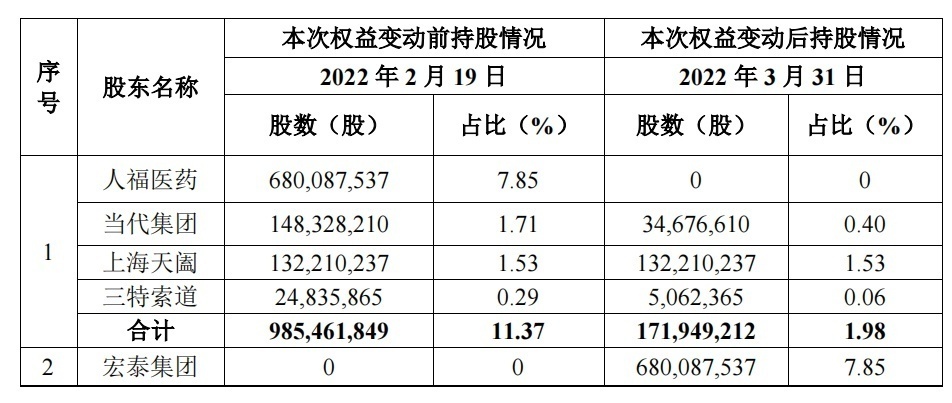

Tianfeng Securities: The board of directors of Hubei Hongtai Group has agreed to acquire 7.85%equity of the company held by Renfu Pharmaceutical

On July 25, 2022, Tianfeng Securities (601162.SH) issued an announcement of the co...