HPV expansion, targeting Wantai, Watson, Kangle Guardian, Ruike and Watson have lost their advantages!

Author:Yaizhi.com Time:2022.09.06

HPV expansion is aimed at Wantai, Watson, and Kangle Guardians, and Ruko and Watson have lost their advantages!

Source: Yaozhi.com/智

Previously, the implementation of the HPV vaccine for free, the author once said that high -priced HPV vaccines may be reduced to "chicken ribs".

This is mainly because without being recommended to be repeatedly vaccinated, the "2 price HPV vaccine" in the school -age section will be greatly squeezed to the market where the high -priced HPV vaccine will be greatly squeezed to a certain extent. The age is only 16-26 years old, and the free vaccination stage is not in the age group of 9-price HPV.

But now it ’s different. On August 30th, the State Drug Administration approved the Merhadon 9-valent HPV vaccine to adapt to the population to 9-45 years old. Some groups can also choose to vaccinate the 9 -price HPV vaccine at their own expense. To some extent, the 9 -valent HPV vaccine can be integrated into the free vaccination plan (if the capacity is sufficient).

Without any sales expenditure, can it be priced autonomously. Isn't the sales rising?

Stimulated by the above news, some people predict that without the age expansion, the nine -valent HPV vaccine can be so popular. Now the age expansion is completed. As the only subject of Merck in the country, Zhifei Bio is expected to have the next performance. Facing "take off" directly.

But is this really the case?

The ideal is beautiful, but production capacity is the most realistic issue

If Merck's nine -valent HPV vaccine expands age, the biggest beneficiary is the Chinese agent "Zhifei Bio", which is indeed a fact.

After all, Zhifei Bio has always relying on this "money printing machine" not only to gain a market value of 100 billion yuan, but also grows into one of the leaders of the domestic vaccine industry. +Double -top -top enterprise of self -research.

According to the performance of the first half of the 2022 announced by Zhifei Bio, the number of issuances of the nine -valent vaccine of its agency reached 9.2988 million, a year -on -year growth rate of 379.34%, the largest increase among all vaccines.

So today, the 9 -price HPV expansion is theoretically, how much incremental market will this bring to Zhifei creatures?

Related statistics show that ideal, the 9 -price HPV market after the age expansion, compared with the previous 70 million people, has skyrocketed to more than 300 million today, which has expanded almost 4 times, and the number is amazing.

But this is just the ideal state of data. The key point is "production capacity" if it can be achieved in reality.

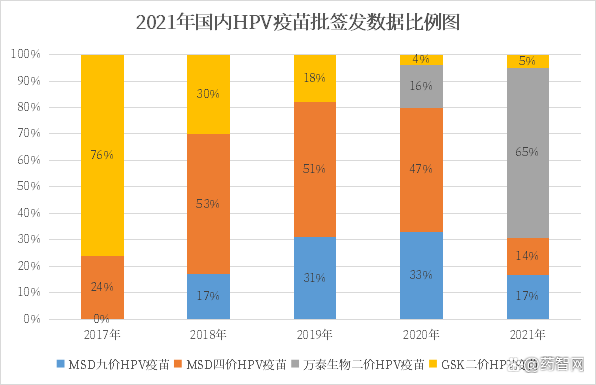

For a long time, Merck has been seeking a balance between market demand and limited vaccine capacity. Even if the supply volume of the 9 -price HPV vaccine in China in 2020 increased by 58%compared to 2020, and in order to achieve the goal of ‘2030 global elimination cervical cancer’, Merida spent billions of expanding production facilities for production facilities and building facilities.

However, at present, Meridon can still only support only 10%of the world's market demand. From a certain perspective, no matter how the age group is expanded, it has not improved in the overall sales of Merck. It is not the problem of "can't make an appointment", but it can only alleviate "can't wait."

The same age expansion is also an dimension of "low -priced HPV" reduction

At present, the main consumer consumer of the two domestic binary HPV vaccines that have been listed is 27 to 45 years old. The respective competition barriers were formed on the top.

But now the latter adapting to the crowd to expand to 9-45 years old, which means that the difference between the age of the two no longer exists. This pair of HPV vaccines with a 2 price HPV vaccine seriously conflict and advantageous advantages and advantages No longer.

In the long run, with the gradual increase of Merck's 9-price HPV production capacity, there is also a listing of domestic HPV vaccines with the same age section (9-45 years old). The current market growth of the two-price HPV may face a lot of challenges.

In addition, with the current trend of the HPV vaccine project, when the company's pursuit of higher -cost vaccine research and development and longer age coverage rate, what is the value of time and effort to be valuable to listed on the 2 -price HPV vaccine?

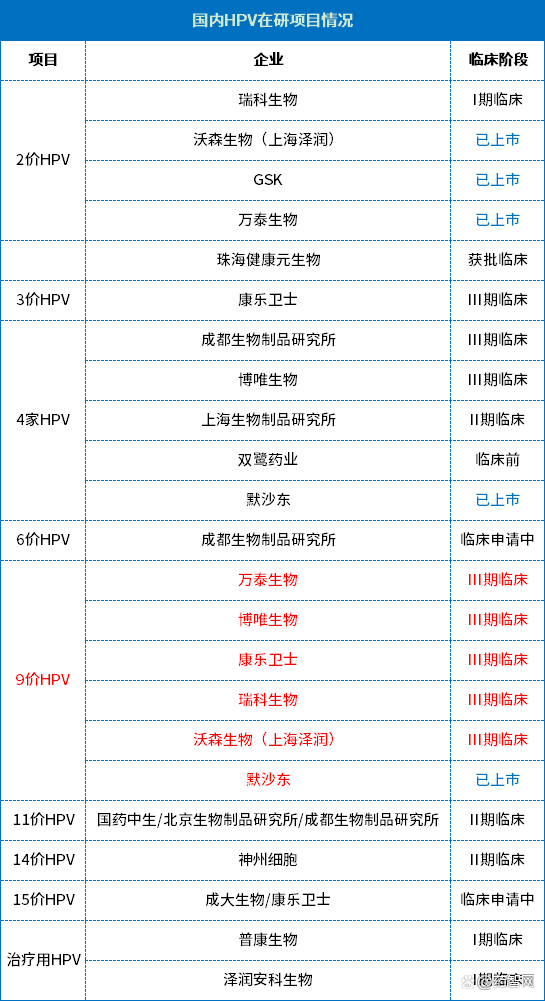

In June of this year, China Pharmaceutical Clinical Test Registration and Information Publication Platform showed that the Sinopharm Institute of Biotechnology, Beijing Biological Products Research Institute, and Chengdu Biological Products Research Institute have launched a three -phase clinical trial to evaluate the 11 -price HPV vaccination vaccination The immune and safety of Chinese women at the age of 18-45.

The 14 -valent HPV vaccine independently developed by Shenzhou cells is conducting phase I/II research at the Jiangsu Disease Prevention and Control Center; the 15 -valent HPV vaccine of Chengda Bio and Kangle Guard seems to have completed clinical applications. It is conceivable that in the future, there must be a higher price HPV vaccine, and the dimension of low -cost vaccines will be increasing.

Expansion affects the competitive advantage of domestic 9 -price HPV

The current status of the industry that is in short supply has attracted countless companies to enter the bureau, and has also increased the competition in the industry.

Today, the 9 -valent HPV vaccine expansion has broken the differentiated competition balance between the original HPV vaccine to a certain extent, and its competitive advantage has increased sharply.

Some people say that the biggest winner of the 9 -valent HPV vaccine of Mer Shadong may be a domestic alternative company. At least for the part that Merhadodo is capable of being able to cover, the domestic 9 price is tantamount to free delivery. But is the fact?

According to relevant data, the current HPV nine -valent vaccines of Watson Biological (Shanghai Zerun), Wantai Biology (Beijing Wantai Biology), Shanghai Boyi, Kangle Guardians, and Ruike have entered the clinical three In the period, it is the most promising role in fighting for the domestic market.

According to the contents of the listing prospectus submitted by Ruico Bio, the nine -valent HPV vaccine RPV vaccine REC603 In comparison of Merck's 9 -price HPV, there are two main advantages:

① Domestic nine -valent HPV vaccine has no successful cases of commercialization. Mer Shadong's nine -valent HPV has insufficient capacity, and Ruico Bio hopes that REC603 will become a domestic alternative to Merck's nine -valent HPV vaccine.

② The applicable population of Murisha East Nine Valsia HPV vaccines is a 16-26-year-old woman. The REC603 of Ruico Bio is more suitable for the age and is expected to cover the 9-45-year-old group.

Nowadays, with Merck's 9 -valent HPV expansion, its applicable age expansion, the two cover the group back again, and the advantage two has disappeared. From this point of view, it seems that Merhadodo expansion is not just the market for low -cost vaccines, but the same is true for some 9 -valent HPV vaccines.

Statistics, the age of the 9 -price HPV subject in China, if the age of the subject is approved by the future product, then it seems that only the two companies of Ryoko and Watson can compare with Merhado. As for other companies, they have already been "chess" in adapting age.

Perhaps the global market of the horse racing circle may be the way out of HPV

As domestic HPV players gradually realize that HPV vaccines are likely to follow PD-1 to become another biological product towards cabbage prices. More and more players have put their attention to overseas markets.

In 2018, WHO called on all countries to take action to eliminate cervical cancer, and by 2020, WHO received the "Accelerating the Elimination of Cervical Cancer Global Strategy" promised by 194 countries. Died with 5 million.

Based on the current in vaccination rate of tens of millions of people in the country and less than 10%of the world, many domestic HPV vaccine R & D companies, if they just play the price war in China, it seems that there is no pattern. Perhaps the road is the most important way.

It is not a big future to be satisfied with the price war in China. It is the way out to run the horse in the vast global market.

At least, Wantai Biological has begun to lay out the strategy of this area. Its independently developed second -cost HPV vaccine has obtained the approval of listing permits from the Ministry of Health and Social Security of Morocco on May 11, 2022. It is believed that the 9 -valent HPV vaccine developed in the future is likely to take the same path.

At that time, He Chou could not adapt to the age of Merhado. Overseas markets were in hand, and the expansion of indications seemed to be complete.

- END -

Chengyang Audit Focus on the management of seedlings of state -owned enterprises

Recently, in the audit of the state -owned enterprises in a certain district, the ...

Hot -view biological disclosure 2022 semi -annual report achieved revenue of 2.046 billion yuan

On August 25, hot -ora -view biological (code: 688068.SH) released the 2022 semi -annual performance report.From January 1, 2022-June 30, 2022, the company realized operating income of 2.046 billion y