Shocking the capital tube circle!After the 80s, the private equity boss served as the general manager of A -share, and also wrote a number of financial novels

Author:China Fund News Time:2022.09.06

China Fund reporter Li Zhi

There were bank presidents who sent takeaways, and later private equity bosses opened Didi. It seems not surprising that the turning around in the financial circle is not surprising. Last night, ST Kaiyuan announced that he would hire a private equity manager to take over as the general manager of the company.

It is worth noting that the general manager understands management and investment, has many years of energy storage battery technology technology investment research background, and was also the general manager of celebrity private equity institutions, and has multiple financial novels. However, many shareholders are puzzled, "The company belongs to the education industry. Why did the general manager change an energy storage expert? Following the company in the near future whether there is a big move."

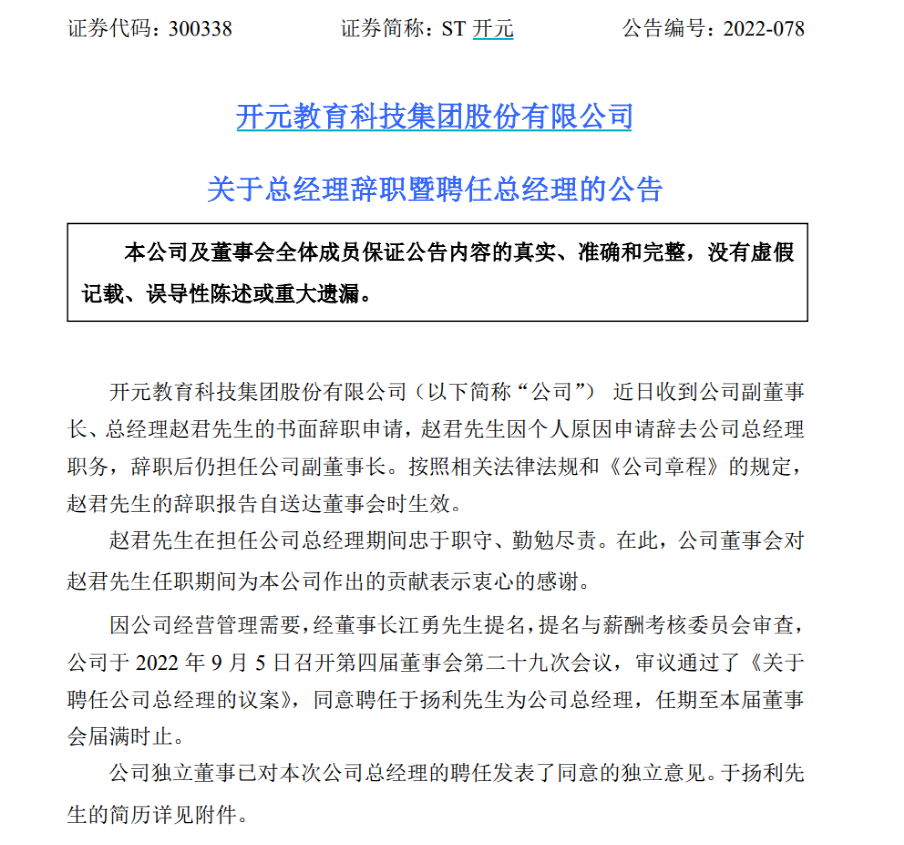

Private equity boss takes over as ST Kaiyuan General Manager

On the evening of September 5, ST Kaiyuan issued an announcement that recently received a written resignation application from the company's vice chairman and general manager, Mr. Zhao Jun. Essence

Due to the company's operating management needs, after the director of the director Changjiang Yong, the nomination and salary assessment committee reviewed it, the company held the 29th meeting of the 4th board of directors on September 5, 2022 to review and approve the "Proposal on the General Manager of the Company's General Manager ", Agree with Mr. Yu Yangli as the general manager of the company, the term of office until the expiration of the current board.

Although the general manager of listed companies is common, the newly appointed general manager's resume is quite promising. For many years, the background of the new energy storage battery technology technology technology investment research and research is the general manager of private equity institutions.

According to the data, Yu Yangli was the "post -80s", graduated from the Metallurgical Department of Central South University, and was also a special instructor of the Innovation and Entrepreneurship Center of Central South University. Negotiations such as "many financial novels. Focus on the research and investment of new materials for energy storage batteries. Former executive chairman of the Hunan University Student Federation, participated in the work of the Hunan Provincial Party Committee of the Chinese Communist Youth League. Since 2004, Yu Yangli has served as the manager of Fujian Nanping Nanfu Battery Co., Ltd.; since 2012, he is the general manager of Changsha Finance Investment Management Co., Ltd.

Investment in the wealth is listed as an operation abnormal institution

According to information disclosed by the China Securities Investment Fund Association, Changsha Finance Investment Management Co., Ltd. (hereinafter referred to as "financial investment") is a private equity and entrepreneurial investment fund manager. The business type is a private equity investment fund.

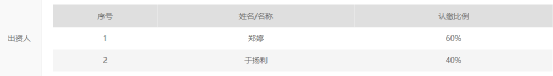

Financial Investment was established in March 2014. The current management scale range is 0.5 billion yuan, and the registered capital is 20 million yuan. In the information of the investor information, Yangli subscribed for 40%, and Zheng Ting's subscription ratio was 60%. The current product information disclosed is only Shenzhen Rongxing's Equity Investment Fund Management Center (limited partnership), but the product has no investor information.

The official website of the China -Foundation Association shows that there are many current problems in the financial investment, and it is prompted to submit an exception. According to the "Notice on Strengthening the Management of Self -discipline Management of operating abnormal institutions" (Zhongji Xiezi [2022] No. 37), the investment in the financial investment is listed as an operating abnormal institution and is required to submit a special legal opinion.

In addition, the investment in Caizhong was also adopted by the Hunan Securities Regulatory Bureau to take the administrative supervision measures with alert letter. During the special inspection of private equity funds in 2020, the Hunan Securities Regulatory Bureau found that there were 8 violations of investment in the financial investment, including the failure to change the executive information in time; the two fund products were not filed in the association; Rongxing "fund property is engaged in investment activities.

Fortune investment was "star institution"

It is worth noting that the investment in the financial market was very active in the capital market. It has interspersed with many listed companies such as Rongyu Group, Yuguang Technology, Mengjie, and Kaiyuan Co., Ltd.

In July 2019, Mengjie announced that it invested in the establishment of Ganzhou Yujie M & A investment management partnerships with Changsha Finance. Investment in the financial investment as an ordinary partner, the capital contributed RMB 100 million and the shareholding ratio was 50%.

In February 2018, Yaoguang Technology and Changsha Finance Investment signed a strategic cooperation framework agreement to jointly establish a 1 billion yuan integrated circuit industry merger and acquisition fund. The investment field of the mergers and acquisitions is mainly based on the main industry and related upstream and downstream industries, namely integrated circuits, 5G communication fields, communication equipment suppliers, and 5G microwave devices.

The investment in Changsha Finance, which was a star institution at that time, was included in the list of suspected loss in 2019. It was impossible to contact the company through the company's telephone and mailboxes left by the company's comprehensive submission of the asset management business.

According to previous reports of the Sanxiang Metropolitan Daily, the general manager Yu Yangli responded to the above matters, "This is mainly caused by the negligence of the company's work, and failed to receive the call in time. As the risk of losing losses in private equity is increasing, the operation of the company's management funds is not optimistic. It is liquidating fund business and cancellation of private equity fund managers' licenses, so it ignores the connection with the association.

Many shareholders expressed doubts

In response to the above situations, many ST Kaiyuan shareholders expressed their questions, "The company belongs to the education industry. Why did the general manager change a energy storage expert? Following the company's recent big moves." Only by using it. "

ST Kaiyuan's high -level changes frequently

Recently, ST Kaiyuan's high -level turbulence has changed frequently. On August 31, Li Bochao, deputy general manager of ST Kaiyuan, applied for resignation of the company's deputy general manager for personal reasons. After resigning, he still served as the general manager of Shanghai Tianhu Education Training Co., Ltd., the company's Sun company.

On August 19, Cheng Dengke, deputy general manager of ST Kaiyuan, applied for resignation of the company's deputy general manager due to personal reasons. After resignation, he no longer held any position of the company. On September 6, ST Kaiyuan reviewed and approved the "Proposal on the Secretary of the Board of Directors of the Company", and agreed to appoint Mr. Li Jun as the secretary of the company's board of directors. After Li Jun served as the secretary of the board of directors, the company's chairman Jiang Yong no longer duties the secretary of the board of directors.

The company's director Changjiang Yong has recently reduced his holding letter due to violations of regulations. The Hunan Securities Regulatory Bureau stated that after investigation, Jiang Yong reduced the company's shares of 1.5 million shares through the major transaction on May 27, 2022, with a transaction value of 3.6 million yuan. The above -mentioned reduction of holdings constituted illegal and reduced its holdings. The Hunan Securities Regulatory Bureau decided to adopt administrative supervision measures with alert letter to Jiang Yong and recorded the integrity file of the securities futures market.

According to the data, ST Kaiyuan was previously a technology company specializing in the research and development, production and sales of coal detection instruments and equipment. In 2017, the company acquired 100%of the equity of Evergrande Education and 70%of the equity of China University of Britain. Since then, the company's main business has gradually transferred to the field of vocational education. At present, Kaiyuan Education's product research and development scope of product research and development spans the two major fields of "skill -type products, test -type products", and has been involved in more than 80 categories such as financial accounting, art design, construction, fire protection, social workers, medical examinations, and education. Realize the comprehensive coverage of core products and the education system for the lifelong vocational education system and personalized learning.

The interim report shows that the company achieved a total operating income of 306 million yuan in the first half of the year, a year -on -year decrease of 43.11%, of which online education and training revenue reached 126 million yuan, a year -on -year decrease of 31.58%, accounting for 41.28%of the company's total revenue. The net profit realized -687,877,500 yuan, a loss of 44.17%from the same period last year.

In today's market, ST Kaiyuan once rose more than 8%. As of now, the stock reported 3.64 yuan, with a total market value of 1.24 billion yuan.

A big news! The 8 trillion tracks skyrocketed, more than a dozen A -share daily limit!

Just now, Beijing notified! A university added 5 newly sieve positive! Terminate cooperation, trillion giants have plummeted!

Edit: Captain

- END -

The transaction value is 45.8 million yuan!The first seven months of Texas completed 99 property trading projects

Relying on the Internet+Public Resources Trading model, the Texas Public Resources Trading Center adheres to the principles of enrollment, unified standards, openness and transparency, and efficient

Guanlan Pavilion 丨 Deepen Shandong's kinetic energy conversion, why is "2027" and "2035" two time nodes

□ Zhou XuezeOn September 2nd, the Chinese Government Network issued the Opinions ...