CXO, the water selling person in innovative medicine rush hot

Author:Value Planet Planet Time:2022.09.06

Author | Liao Yangyong

Edit | Yu Chen

This article is a joint produced by the planet Planet X titanium media

Recently, pharmaceutical -related listed companies have released annual reports, and their performance is also two days of ice and fire.

Innovative drugs have not recovered from the winter, most of the Biotech revenue has narrowed and losses have expanded. Although the revenue of Cinda creatures increased slightly by 15%, the loss increased by 60%year -on -year. Large pharmaceutical companies, such as Baiji Shenzhou, have expanded to more than 6.66 billion yuan in losses.

However, in terms of the performance of the segment sector, the CXO (pharmaceutical outsourcing service) sector has resumed the previous growth momentum. As of August 30, 29 CXO listed companies in A shares have released semi -annual reports, and 21 net profit has increased year -on -year, accounting for more than 70 %. Among them, there are many companies that have doubled revenue profits.

The overall performance of the CXO sector is second only to IVD (in vitro diagnosis) and new crown vaccines in more than ten segmented sections of medical care. Revenue and net profit increase ranked third. In addition, head CXO companies have surpassed the head innovative pharmaceutical companies in terms of market value and revenue.

Why can CXO's performance avoid the impact of the cold winter of innovative medicines, and the momentum of rising all the way? Is it not as good as the Outsourcing Party B?

CXO-industrial refinement division of labor giants

From scratch, an innovative medicine will go through several major links of drug discovery, pre -clinical research, clinical trials, commercial production and sales (see the feast of the last period of the previous period: the rivers and lakes behind the innovative medicine "), and the entire process It costs at least hundreds of millions, which takes several years to ten years. With the intensification of competition, pharmaceutical companies gradually outsourcing some links to other professional institutions. These are the hot CXO companies. According to the industrial chain, the division of labor is divided into:

1. CRO, the research institution responsible for the discovery, preclinical research and clinical trials of the front -end drug is CRO. Generally, it is more advantageous compared with the cost of the project, and it is a typical intellectual -intensive industry compared to pharmaceutical companies. For example, as a major shareholder of the cornerstone pharmaceutical industry, the Department of Pharmaceutical has exported a lot of product pipelines and developed it for it;

2.CMO, pharmaceutical production is strictly standardized. Investment in new pharmaceutical factories is huge pressure for small and medium -sized pharmaceutical companies, so outsourcing for pharmaceutical factories with surplus capacity has become a better choice. This type of foundry plant is similar to OEM and earns foundry fees. For example, Jiuzhou Pharmaceutical is the main raw and pharmaceutical manufacturers of epilepsy drug Kamoxiping and Okasiping, which supplies major pharmaceutical companies at home and abroad;

3.CDMO, many innovative drugs have high requirements for production technology, ordinary CMOs cannot meet, foundry companies also need to develop production technology, formula and dosage forms. This is CDMO. The knowledge of these production processes belongs to foundry enterprises and authorized to use Party A, which is equivalent to ODM. For example, Pharma's recently discussed new crown oral medication Paxlovid, 480 million production orders are said to be handed over to Kailai;

4.CSO, most of the Biotech does not have its own sales network. The self -built channels are spent, and they are not their expertise. Therefore, they will outsourcing sales and promotion to pharmaceutical companies with mature channels. For example, Corning Jerry developed the world's first subcutaneous injection PD-L1, and the commercialization of sales was handed over to the pioneering pharmaceutical industry.

Most of the CSO and CMO are the business extension or transformation of traditional pharmaceutical companies. Strictly speaking, it is not an agency. Therefore, in general, the current CXO is mainly CRO and CDMO.

CXO's charging model is to charge the project and order, and do not bear the risks of subsequent sales. The drug sales are not good, and it is not directly related to it. Therefore, the CXO industry has a stronger cycle capacity. This is similar to selling water for gold rushing customers in the gold rush heat. No matter whether there is a gold mine or not, as long as there is a steady stream of gold rushing customers, the business of selling water will make money.

Therefore, the prosperity of CXO mainly depends on the growth of innovative drugs. As long as the global pharmaceutical research and development enthusiasm is not reduced, the business of CRO/CDMO will become bigger and bigger. In this case, why did it not seriously affect the CXO industry last year?

60 % revenue of CXO

14 largest pharmaceutical companies in the world

Many CXO founders have the background of overseas medicine research. For example, Hong Hao, the founders of Kailei, and Lou Bailiang, which are transformed into the into the United States, are researchers who have worked in the United States. And not to mention the Li Ge's husband and wife of the Department of Pharmaceutical and Ming, after graduating from the PhD in Organic Chemistry of Columbia University, they have entered BMS (Belief Schimibao) and PPD (one of the world's largest CROs). A lot of initial orders have been obtained.

These founders are familiar with the FDA's new drug approval standards and processes, as well as the operating model of multinational pharmaceutical companies. Most of today's CXO giants were founded around 2000. At that time, the domestic research and development foundry model has not yet germinated. Therefore, serving overseas pharmaceutical companies has become a natural choice for CXOs.

Yaoming Kant's global layout. Picture source: Yao Ming Kangde

Kang Long turned into a global layout. Picture source: Kang Longcheng

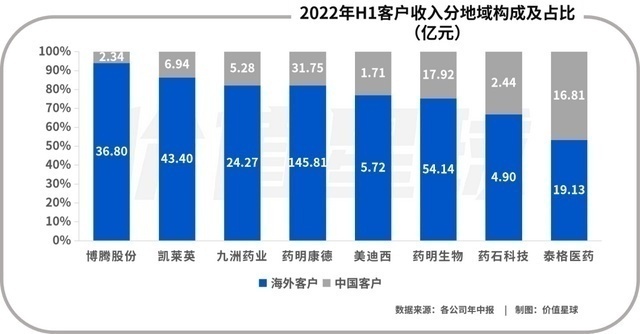

Many CXOs have industrial layout around the world. For example, Tiger Medicine acquired CRO Fangda Pharmaceutical in 2014, and in 2015, it acquired Dreamcis, the largest CRO company in South Korea. 24 subsidiaries, all five continents. Even though domestic innovative drugs have developed rapidly in recent years, the current main revenue of CXO companies still comes from overseas. The industry's average overseas revenue accounted for 70%, while Kailei and Botten shares reached more than 85%. Most of the overseas revenue came from a few global head pharmaceutical companies such as Roche, Pfizer, Merck, and BMS.

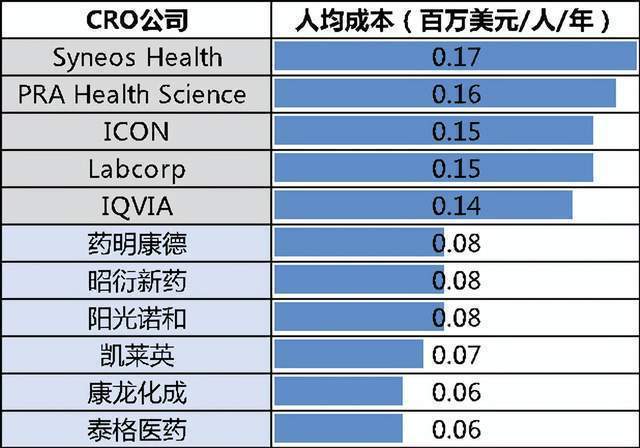

The reason for this situation is very well understood, the low labor cost of China. Domestic graduate students have sufficient supply, rich chemical and medical manpower reserves, forming a dividend of engineers. You know, the main cost of medical research and development is the cost of manpower. Compared with foreign CROs, my country's CRO per capita salary is less than one -third of each other.

Global pharmaceutical companies and CRO per capita costs. Photo source: letter

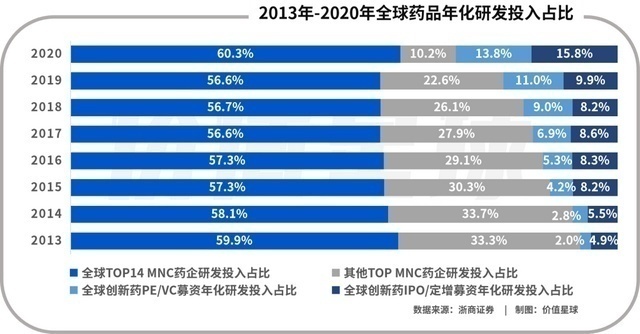

Most of the patent patents in global sales have been concentrated in the past ten years. Therefore, major multinational pharmaceutical companies have increased R & D investment. The world's top 14 pharmaceutical companies have more than $ 5 billion in R & D expenses each year, and it is still steadily rising. The competition is becoming more intense, the profit of the new drug is shorter, and the input -output ratio has been decreasing. Therefore, the efficiency of grabbing time and grabbing has become the key to victory in the development of new drugs. So the relatively unrelated industrial links to a lower -cost China have become the common choice of major multinational pharmaceutical companies.

From the perspective of production, China is the largest pharmaceutical market in the United States and the largest exporter in the world in the world. The starting point of industrial foundation and talent quality is high. Similarly, as a world factory, China also has a cost advantage in drug production. More importantly, there is a large number of hidden dangers of chemical pollution in the production of raw materials. After years of environmental protection rectification, the remaining domestic pharmaceutical factories left behind after eliminating backward production capacity have established a high barriers to enter, making the industrial concentration higher. Drug production pays attention to the scale effect. Only when the production capacity reaches a certain scale can we bear huge amount of equipment investment and meet the strict standards of domestic GMP and FDA. In short, the domestic pharmaceutical foundry industry has high standards, large scale, and low cost. Overseas pharmaceutical companies naturally tend to transfer drug production to China.

Only 14% of R & D investment from VC financing in 2020

Global drug R & D investment rises every year. At present, there is no decline in the decline, and the industrial transfer is still accelerating. Therefore, the domestic CXO will still be binding with the growth of multinational pharmaceutical companies in the next few years. Global Biotech's R & D expenditure accounts for less than 15%. The sum of annual R & D expenditure of all Biotech has just surpassed the Roche's annual R & D investment. Therefore, changes in the investment and financing environment of innovative drugs cannot be threatened to the survival of CXO.

Why do Chinese pharmaceutical enterprises

Also outsourced to CXO?

However, it is undeniable that for the domestic head CXO, the proportion of revenue contributing to the long -tail customers in China is increasing year by year, and it has become an important source of customers. But in China, the cost advantage of CXO is not as obvious as abroad. Why do domestic customers find outsourcing? In fact, this situation has only evolved rapidly in recent years.

Previously, domestic pharmaceutical companies rarely found the motivation of CXO agent, and there were no conditions. Since 2015, domestic CXO customers have begun to increase, mainly due to the emergence of the MAH (drug listing licensee) system.

In the past, the new drug registration batch number, only enterprises with pharmaceutical factories can apply, and these pharmaceutical factories need to have drug production licenses, that is, the pharmaceutical batch number and the production license number are bound. Therefore, pharmaceutical companies in traditional concepts are self -developed and self -produced pharmaceutical companies.

From the 2016 pilot MAH system, it was formally implemented three years later. The binding between drug production licenses and listing permits was canceled, allowing scientific research institutions with no production capacity to apply for drug batch numbers, and entrusted pharmaceutical factories with production qualifications to produce.

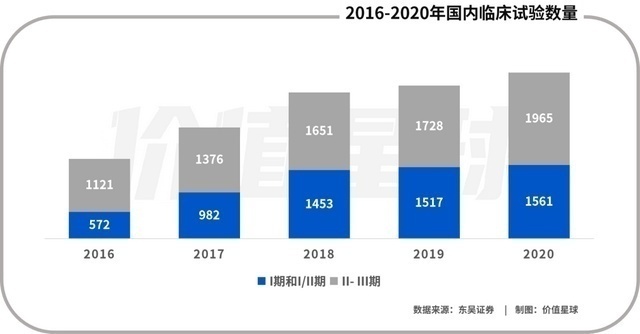

The number of domestic clinical trials has increased in the past five years

This policy was released immediately, and the domestic Biotech was like spring zither after the rain, and increased from zero to more than 1,000 in five years. This also brings huge dividends to CXO, especially the CDMO industry. Biotech is mostly a founding enterprise. The main expertise lies in front -end scientific research. There is no central laboratory that meets GLP, and it is not capable of building a factory. Therefore, almost all Biotech will outsourcing the research and development and production links to CXO.

MAH plus factors such as the reform and drug review system reform quickly brought innovative drugs. Two or three scientists can get financing (VC) with the concept of a drug (IP), and all outsourcing (CXO) of R & D, production and sales, and then go to Hong Kong stock IPO. Even if there is no revenue or profit, it will be Can be available through 18A rules. This is often referred to as VIC (venture capital+knowledge power+outsourcing) model.

This is a light asset model. The prescription can purchase authorization or directly acquire startups from foreign companies, develop it to CRO, produce it to CDMO, and sell it to domestic pharmaceutical companies. Part of the work is outsourced out of the investor's money. These companies generally introduce the pipelines of mature categories, so they are pursuing the speed of R & D and listing. After all, they get the drug batch number earlier than the competitors, and the valuation is better. Zaiding Pharmaceutical is the first typical Biotech in China to adopt VIC model. It was listed in Nasdaq three years in Nasdaq three years. The three products that have been listed on Ding Ding Pharmaceuticals are bought from overseas waist pharmaceutical companies and have obtained the exclusive development and sales right of Greater China. At present, more than ten product pipelines they have studied are almost all introduced through authorization. Essence In addition to cooperating with pharmaceutical companies, Ding will also give research and production to CXOs such as Tiger Medicine and Kailei, and are more like a commercial incubation platform of intellectual property rights.

In fact, the Venture Capital Fund Yucheng Capital established by the Department of Pharmaceutical is promoting the VIC model. The Department of Pharmaceutical was originally a good discovery of drugs. You can sell some improved medicines to the founding team, and let the other party outsourcing the R & D to Yaoming Kant, producing outsourcing to Hequan Pharmaceutical or Yaoming creatures, and then finding a pharmaceutical company customer customers Just take the sales.

Of course, most BIOTECH has certain independent research and development capabilities, and will only give some research work such as clinical trial site management and drug safety evaluation to CRO. Compared with CRO, Biotech has a higher degree of dependence on CDMO. After all, the small and medium Biotech is unwilling to take the road to build a plant with a heavy asset.

In addition to BIOTECH, there are some small and medium -sized pharmaceutical companies that originally depended on generic drugs. They have no mature R & D teams, but they must also conduct imitation efficiency consistency evaluations, so they have to outsubine the consistency evaluation to CXO. For example, CROs such as Sunshine Nuohe, New Leading and Warwick Medicine focus on the research and development and consistency evaluation of generic drugs. However, after the mix of generic drugs, the profit compression is not much left, so the cost of the project that can be given is not high. For CXO, it is a business with less money, not the main source of its revenue.

And large pharmaceutical companies such as Hengrui and Baiji Shenzhou have a huge R & D team, mature GMP pharmaceutical factory and sales channels that have been cultivated for many years. Choosing outsourcing is not necessarily more cost -effective than self -developed and self -developed costs. Low. Except for this type of major pharmaceutical companies, other pharmaceutical -related companies, if you want to do innovative medicines, it seems unlikely to bypass CXO.

Figure above: Global CRO market scale (one billion US dollars) Below: China's CRO market size. Picture source: Tiger Medicine Recruitment Book

With the promotion of the above types of customers, the domestic pharmaceutical outsourcing rate has continued to increase. At present, the CXO market penetration rate has reached about 37%. Compared with the penetration rate of about 50%of the United States, there is still a lot of room for growth. Although China's CXO currently has a global market share of less than 12%, the industry's leading size cannot be underestimated. In 2021, the revenue scale of the Department of Pharmaceutical (Yaoming Kant+Yaoming Bio) has ranked among the top five in the world's CXO. Moreover, according to Ferris Santhalin, the annual compound annual growth rate of domestic CXO in the next five years is expected to be between 25%-35%, which is far higher than the average global level. In the near future, with the development of BIOTECH more outsourcing, domestic CXO will become an important player in global innovative drugs.

CXO is concentrated on the two ends of the industrial chain with higher value

According to incomplete statistics, there are nearly 300 CXOs across the country, most of which focus on a certain segment business. This is because the pharmaceutical research and development process is complicated, and there are certain entry barriers between each link. Nor is he unwilling to concentrate the development of the development to a company.

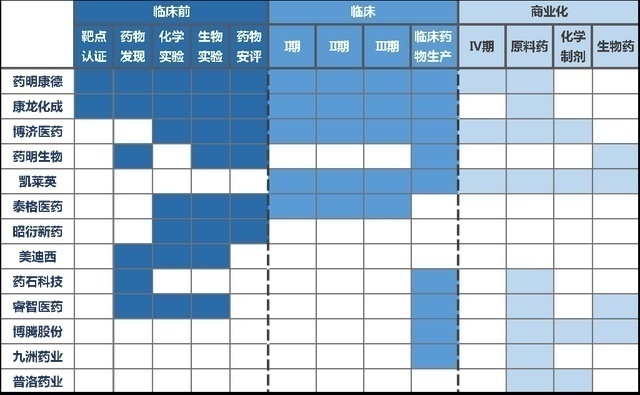

The business layout carried out by each CXO

Most CXOs have their own strengths in the subdivided field, but more CXO is concentrated in clinical and production. For example, Zhao Yan's new drug is a domestic drug safety evaluation leader. Like Midi and Chengdu, it focuses on pre -clinical services; Botten Co., Ltd. focuses on chemical CDMO, and the advantage of pharmaceutical creatures is biopharmaceutical CDMO. Only Tiger Pharmaceuticals focusing on clinical CROs.

Judging from the main business gross profit margin of major CXOs, the gross profit margin of CRO and CDMO prevailable clinical CRO and CDMO is more than 40%, while clinical CRO is slightly lower, about 30%. This can also be roughly regarded as the value of various industries.

Clinical CRO: In the middle of clinical trials, the most technical content is the formulation of treatment plans and experimental methods. The rest is the hard work of volunteers recruiting and follow -up, data finishing and analysis. Generally speaking, it is a labor output, and the value -added is not high.

Clinical CRO: Animal experiments pre -clinical animal experiments are an important part of evaluating the safety and effectiveness of a drug. It can understand the metabolic process and mechanism of drug absorption. The ratio and dosage of the effect often have great commercial potential. In addition, there is a certain threshold to build a laboratory that meets the international GLP standards. There are only a dozen pharmaceutical laboratories that have passed OECD (OECD) GLP certification. Therefore, the industrial value of this link is high.

CDMO: The commercial production of the back end is not a simple foundry concept. The threshold is relatively high. Domestic CDMO is concentrated in the production of raw medicines, with more than 90 % of the revenue. CDMO companies should participate in the research and development of drugs, and study the appropriate compound formula, form, and dosage form. They often need to customize production processes to ensure the stability of large -scale production. These are highly technical content. In particular, the stability of biopharmaceuticals is low, and even the products of each batch will be different, and the production process is higher. And it is not easy to pass CGMP certification and the National EIA. Whether it is the investment of factory equipment or the development of production patents, it is not that ordinary small and medium -sized pharmaceutical companies can bear it. For example, the Pfizer Hangzhou factory recently acquired by Yaoming Bio has a total investment of 350 million US dollars. Kailei also announced this year to obtain nearly 100 acres of land in Fengxian in Shanghai, and will invest 3 billion yuan to build a biopharmaceutical production base.

The larger the factory, the more capable of investing in more advanced production lines, and better production technology, the more you can attract large orders, dilute the cost of solidarity, and have more profits to expand production capacity. This has formed a positive direction. cycle. Therefore, production capacity is the industry barrier, which is easy to move towards the stronger situation, and ensure the gross profit margin of CDMO from the side.

From the value analysis of the above three links, we can understand why only a few CXO focuses on clinical CROs, and most of the other CXOs are focused on clinical or production end.

Of course, the industry's head players have been integrated with the entire industry chain.

Industrial integration provides the foundation for true innovative drugs

In recent years, the innovative pharmaceutical industry has attracted more attention. Party B. The CXO represented by Yaoming Kangde, Kang Longcheng and Kai Laiying has become a heavyweight player in the pharmaceutical industry. Leader Ming Kangde's revenue in the first half of the year was 17.8 billion, and he had far away from the head pharmaceutical company Hengrui Medicine. Kang Longhua's revenue is also equal to Baiji Shenzhou. However, these giants are not satisfied with a single CRO or CDMO. They have gradually deployed vertical integration to achieve end -to -end services from drug discovery to production. In addition to sales, these companies have the prototype of large pharmaceutical companies.

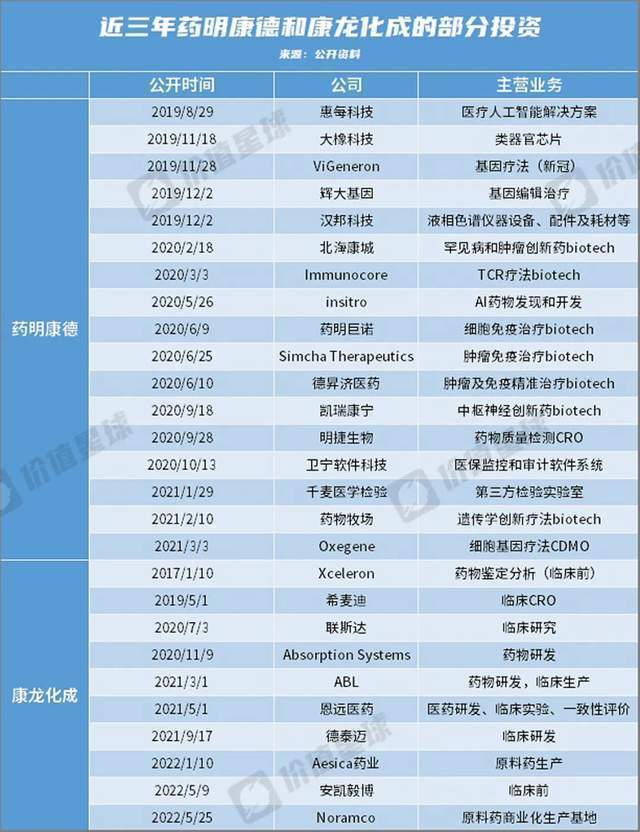

For example, the Department of Yinming, which is constantly “buying, buying”, has invested and acquired more than 30 domestic and foreign enterprises in recent years, forming two main investment strategic lines. On the one hand, through small and decentralized investment, it has the right to speak for emerging Biotech. The main purpose is to expand long -tail customers and let the investing companies hand over R & D and production to themselves. On the other hand, through the holding, the complete layout of the industrial chain, middle and downstream, and fully involved the major segmentation of medicines related to medicines, and earlier emerging areas such as AI drug discovery and cytotherapy, to maintain the basis of leading advantages.

However, in the final analysis, CXO is the product of the professional division of labor in the industrial chain, because multinational pharmaceutical companies actively abandon the layout of the entire industrial chain and concentrate on both ends of the most valuable industrial chain -cutting -edge scientific research and academic promotion, which is commonly known as commonly known as Smile curve. With Apple mobile phones as analogy, the most valuable chip research and development and overall product design, and sales services are firmly in their own hands, and the development, production and assembly of components are outsourced to the global industrial chain. CXO is still downstream in the industrial value chain. Drug profits still belong to European and American head pharmaceutical companies that master core technologies. They cannot really solve the status quo of my country's pharmaceutical technology.

The distance between my country's pharmaceutical industry has led global innovation, and there is still a long way to go, but in recent years, the development of Biotech in China in recent years has changed the current status of only introduction and improved medicines. The first micro -innovation such as dosage forms, as well as joint development of the world's first pioneering medicine, and other pleasing breakthroughs. The gap between the domestic pharmaceutical industry and foreign peers is closer.

CXO has contributed in this process. As the concentration of the industry continues to increase, the head CXO to improve the industrial integration layout can provide better end -to -end services for BIOTECH. The cost is lower and the efficiency is higher. You can focus on the discovery of front -end drugs, research on new targets and new therapies, and even promote cutting -edge scientific research to innovate in the fields of cell gene engineering, biological chips, and biological information technology. In this way, CXO's industrial integration layout provides the foundation for China's real innovation medicine.

*This article is based on public information, which is only used as information exchange, and does not constitute any investment suggestions

- END -

Qingdao Jiaozhou: The most beautiful "background" in the revitalization of the countryside

In the first half of 2022, Jiaozhou anchored the goal of building a very ecological village Qilu Model Demonstration Zone, adhere to the party building leadership to improve its execution, and coo

Focus on the end of the physical retail digital micro -alliance number creation retail contest

The reasoning reality show that simulates the real business operation scene throug...