The story of the agricultural letter behind the "Gold"

Author:China Agricultural Credit News Time:2022.09.06

The story of the agricultural letter behind the "Gold"

Xue Daomei

A water industry in Lijiang, Yunnan, officially launched barrel water in September 2016 and quickly opened the sales market. Faced with increasingly soaring orders, the gap in the flow of funds was the "block" that blocked the rising period of career. When the company is facing financing difficulties, when it comes to the exhibition, the leadership of the "encounter" Yunnan Ningzhang Rural Commercial Bank will visit the enterprise. Ningzheng Rural Commercial Bank learned that the company has a broad sales market and strong productivity. It is known that the small and micro "financing high" (the financial system of the enterprise is not sound and lacks the mortgage) that has grown from individuals). Only by operating conditions can match the real needs of the enterprise, and according to the needs of the enterprise, it will give the enterprise a credit loan of 500,000 yuan in a timely manner, which will really solve the urgent urgency of the enterprise.

With the support of credit, the company's business is booming, and Lijiang City is the first drinking water production enterprise certified by the international management system (HACCP), and has won "Lijiang Excellent Enterprise", "Yunnan Provincial Science and Technology SMEs", "Integrity Management and Exy Consumption "Demonstration enterprise," The Third Prize of Lijiang Innovation and Entrepreneurship Competition "... The company's person in charge has a greater" ambition ", adding a bottle of water production line to push the brand to the whole country, so the first time I found Ningzheng Rural Commercial Bank Tell the idea of increasing capital and expansion. The bank strongly supports the company's development plan and gives a fixed asset loan of 1.5 million yuan. With Ningzhang Rural Commercial Bank's stable credit support, the company immediately added a bottle water production line with 12,000 bottles per hour. Once the bottle water was launched, the "countless fans" became the designated water for the Lugu Lake International Bicycle Open, and the third "Chenghai Covenant" bicycle race was available in the 3rd "Chenghai Covenant". "Yunpin is out of Yunnan", the product is sold north, Shanghai, Guangzhou.

Faced with the repeated epidemic, the company's sales were blocked and operating income decreased significantly. Ningzheng Rural Commercial Bank fully implements the work deployment of the superiors, the requirements of the benchmarks and tables, adhere to the development of the real economy, implement the policy of "reduction of expenses and benefits", benefiting enterprises and the people, and reducing interest rates for them. It greatly reduced the financing cost of the enterprise, and the real gold and silver helped the enterprise "light up".

"From childhood to big" is the true portrayal of Ningzheng Rural Commercial Bank to serve the company, and it is also the epitome of Lijiang Agricultural Credit Services Small and Micro -Enterprises. Lijiang Agricultural Credit was born in Sri Lanka, grows in Sri Lanka, and serves Sri Lanka. It has a natural fish and water relationship with local small and micro enterprises, becoming the bank of the most "understanding" small and micro enterprises in the county. Lijiang Agricultural Credit adheres to the strategic positioning of the agricultural branch, gives full play to the enthusiasm of serving small and micro enterprises, allows more resources to tilt to small and micro enterprises, and better alleviate the problem of "financing difficulties and expensive financing" of small and micro enterprises, so that benefit enterprises Policies are more "fit", "quenching thirst", and more "feeling". As of the end of August this year, the balance of inclusive micro loans was 6.95 billion yuan, an increase of 18.84%, and the growth rate was higher than 4.76 percentage points of various loans. The "two increases" goals of inclusive small and micro enterprise loans will be given to renewal support for customers who temporarily encounter difficulties, and the principal and interest will be extended to 310 households and 1.827 billion yuan in implementation. , Non -pressure loans, non -delay loans, help small and micro enterprises to resolve the financial crisis through various ways such as turnover loans, interpretation of the circle, and interest rate discounts. In the way of changing space in time, it creates the vitality and confidence of continuous operation for enterprises. Lijiang Agricultural Credit will effectively carry the main responsibility of stabilizing the economic market and helping enterprises to relieve the rescue. Essence

- END -

[Follow] Helping the high -quality development of the manufacturing industry in Yunnan Province!Provincial finance issued special funds of 500 million yuan

recentlyProvincial financeHigh -quality development special funds for manufacturin...

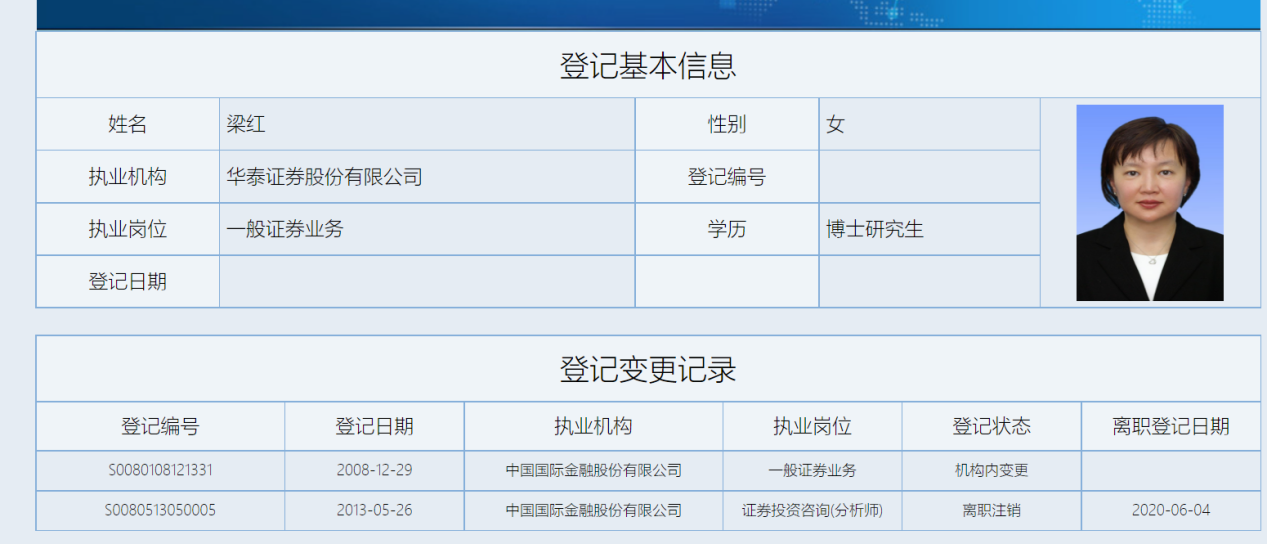

Dr. Liang Hong joined Huatai Securities and was the chief economist of CICC

On the afternoon of July 11, it was reported that Liang Hong had resigned from the...