Growth stocks add hedge tools, CSI 500, GEM ETF options come!Industry: It will help the development of related index products

Author:Daily Economic News Time:2022.09.05

On September 2nd, the CSRC issued a news that the listing of three ETF options was launched, and it will approve the Shanghai Stock Exchange to list the CSI 500ETF options according to the procedures.

The derivatives in the previous venue could not achieve accurate hedging of growth stocks, but this situation has changed this year. In July this year, the CSRC approved the China Financial Futures Exchange to carry out 1,000 stock index futures and options transactions. In the future, the listing of GEM ETF options and CSI 500ETF options will further enrich the hedging toolbox of growth stocks.

In addition, CICC's latest research report pointed out that the listing of GEM and CSI 500ETF options will promote the development of related index products from multiple aspects.

3 ETF option varieties Listing work launched

Picture source: Screenshot of the official website of the Securities and Futures Commission

On September 2nd, the CSRC announced on the official website that the listing of three ETF options was launched, and it will approve the Shanghai Stock Exchange to list the CSI 500ETF options according to the procedure.

The CSRC said that ETF options are basic risk management tools in the stock market. The listing of three options this time is an important measure to comprehensively deepen the capital market reform and make up for the shortcomings of the multi -level capital market system. Risk management needs.

Regarding the launch of the three ETF options species mentioned above, the latest research report released by CICC states that "we believe that the release of this batch of ETF options products on the one hand responds to the" Futures and Derivatives of the People's Republic of China and derivatives passed in April this year. "Methods" for the construction of a healthy, orderly, and international derivative market; on the other hand, it is expected to further enrich the types of financial derivatives, improve pricing efficiency, and provide richer three -dimensional financial finance for risk management, asset allocation and product innovation tool."

FIA data shows that in 2021, the derivatives market in the global field accounted for more than 80%, of which the equity index category options accounted for more than half of the financial derivatives, and the proportion of derivatives in financial venues still increased year by year. Wind shows that financial derivatives in my country only account for less than 20%of the total derivatives in the field, which still shows the great growth potential.

Earlier, the derivative market tool system in the A -shares, one is the stock index futures: the CSI CSI 50, the CSI 300, the CSI 500, and the CSI 1,000 stock index futures; 1,000 stock index options; third, ETF options: Shanghai Stock Exchange 50ETF options and 300ETF options, Shenzhen Stock Exchange 300ETF options.

Before the official listing of 1,000 stock index futures and options in July this year, the A -share market lacks the hedge tool for the market for growth stocks. With this year, the CSI 1,000 stock index futures options such as the options of the growth stock index are in the market. After being approved one after another, growth stocks have gradually entered the era of effective hedging.

A securities company gold worker analyst told reporters today that in the early years, the market news about the CSI 500 and GEM ETF options were launched, but it has not been approved. It belongs to the expected landing. In his opinion, the launch of these ETF options will be favorable for hedging.

It helps enrich the product system of GEM and CSI 500 Index

In addition to providing more hedge tools for the quantitative industry, the listing of these ETF options can also usher in the opportunity of development. CICC believes that the listing of GEM and CSI 500ETF options will mainly promote the development of related index products from three aspects:

First of all, the scale of related products and transactions have risen. After the stock index derivatives were listed in history, the scale and transaction volume of the ETFs of the relevant index were raised. The listing of related ETF options will not only provide more effective hedge tools for the market, but also bring richer investment strategies. The emergence of GEM ETF options has also expanded the existing market value -style stock index derivative market. After the GEM and CSI 500ETF options are listed, related products will also benefit from these two dimensions.

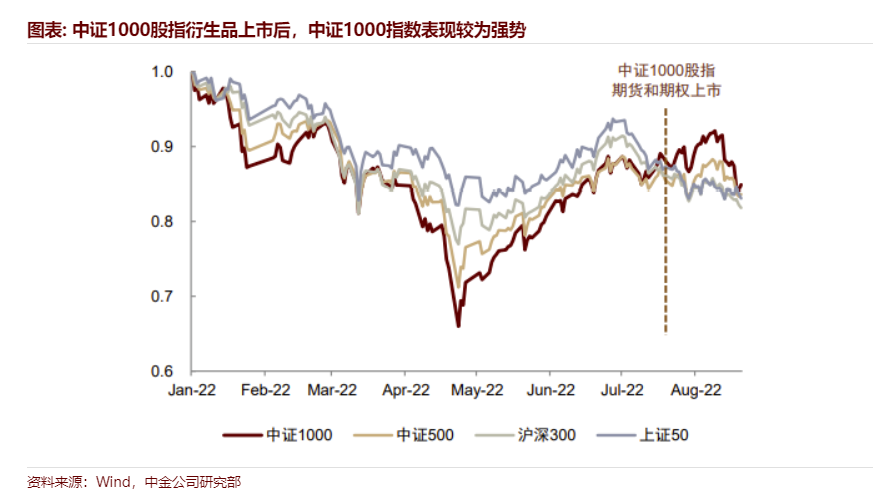

Secondly, under the rise of demand, the index performance is boosted. Looking back on the listing of stock index derivatives in history, the relevant index performance is stronger. We believe that the demand for the listing of GEM and CSI 500ETF options and the inflow of funds may promote the recent performance of the index to a certain extent.

Finally, the development of the index or the improvement of product richness. According to statistics, there are 81 funds that follow the CSI 500 index and 27 funds that follow the GEM index. These include 55 CSI 500 enhanced funds and 14 GEM enhanced funds. CICC believes that with the listing of GEM and CSI 500ETF options, the continuous improvement of transactions and arbitrage strategies of related index support, the declaration and distribution of related products in the future will further enrich the product spectrum of the two indexes, bringing investors to investors Rich options.

It is worth mentioning that CICC pointed out that after the listing of the CSI 1000 index derivatives in July this year, the overall performance of the small plate in August was better than other indexes.Looking back at other stock index derivatives, similar features can also be observed.It is expected that the listing of GEM and CSI 500ETF options, the increase in demand and capital inflows may promote the recent performance of the index.Daily Economic News

- END -

The three major indexes have risen, chip stocks and new energy vehicle stocks rise sharply

On July 7, Eastern Time, the three major indexes of US stocks opened high. As of the close, the three major indexes have risen. The Dow rose by 346.87 points, an increase of 1.12%, to 31384.55 points;

[Praise] This national list, Yunnan is planned to be selected!

recentlyDepartment of Seed Industry Management of the Ministry of Agriculture and ...