Where does the funds run?Follow the interim report and policy improvement

Author:Capital state Time:2022.09.05

On September 2nd, A shares showed a reduction in a consolidation pattern, more than 3,500 shares rose, and the small plate theme stocks bounced collectively; Satellite navigation concept stocks have a daily rising tide, and indexes such as chips, industrial gases, 5G, Yuan universe, data centers, consumer electronics, robots, etc. have increased; coal, consumption, medicine, finance, real estate, and lithium battery sectors weaken.

上证指数收涨0.05%报3186.48点,深成指跌0.09%报11702.39点,创业板指跌0.03%报2533.02点,科创50指数涨0.43%报1030.12点,万得全A涨0.25%,万Double innovation rose 0.84%. The market turnover was 747.08 billion yuan, and the new low was once again refreshing; the actual net sales of the northbound capital were 3.783 billion yuan.

Data source: wind

According to the news on September 2, the non -agricultural employment population increased by 315,000 after the U.S. quarter -adjusted quarter, and it was expected to increase by 300,000, but the unemployment rate increased from 3.5%in July to 3.7%. After the data was announced, the major US stock index futures rose. Relevant personnel have raised the benchmark interest rate by 0.75 percentage points at the past two meetings. Earlier officials were considering the same range of interest rate hikes at the September meeting. However, the momentum of the weakening of the labor market will make the interest rate hike slow down.

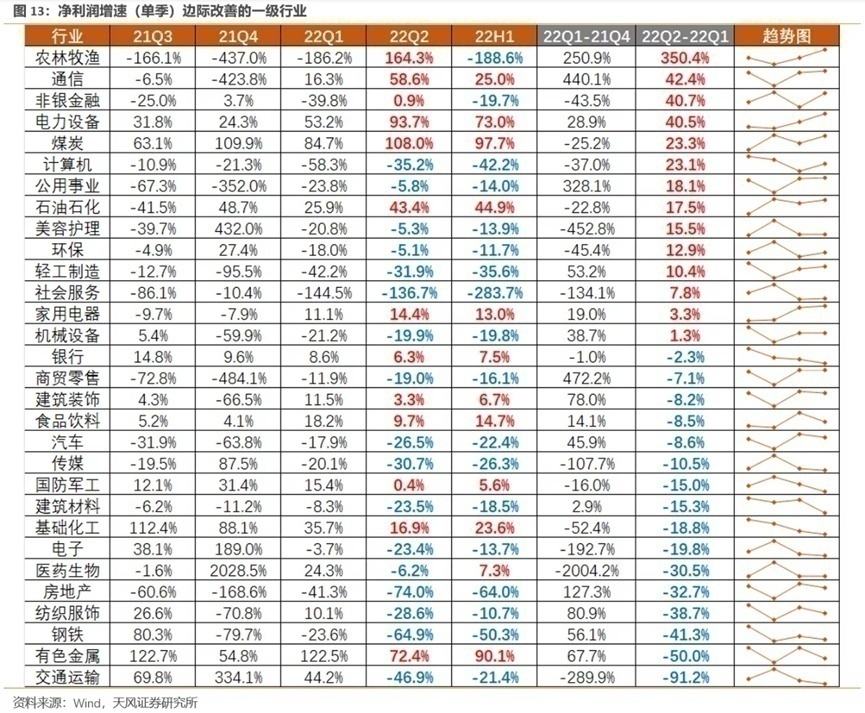

The interim report was released, and the entire A non -financial net profit cumulative was 5.6%year -on -year; the performance of science and technology and entrepreneurship fell significantly; In the second quarter of 22, the total A non -financial net profit was 5.6%year -on -year. 22Q2 net profit growth, Shanghai Stock Exchange 50 (9.6%)> CSI 300 (6.6%)> CSI 500 (-13.7%). The industry -level photovoltaic, communication equipment high prosperity+marginal improvement; the dilemma of the pig cycle reversal; there are also some sectors that the performance is still under pressure, but the policy port recovers, which is expected to drive valuation repair, such as the sub -industry game and film and television of the media industry.

On September 2nd, the game ETF (516010) was under the background of the two consecutive days of the market, and the opening trend was strong, and the increase in the early trading was more than 3%. Point, then closes 3.27%.

Recently, a number of A -share game companies have announced the semi -annual report, and the business volume of many game companies has increased rapidly. Take the largest weight shares of the Animation Game Index of the game ETF (516010) target index as an example: August 31, 2022, Sanqi Interactive Entertainment released the 2022 semi -annual report, 22Q2 revenue of 4.03 billion yuan, year -on -year The increase of 7.58%, the net profit of the deduction of non -returnees was 882 million yuan, a year -on -year increase of 39.11%. In the annual top 52 distributors selected in the first half of 2022, the ranking of Sanqi Mutual Entertainment has made a rapid progress. Under the competition with competitors in Japan, South Korea, Europe, and other places, it ranked 25th in the list. A series of domestic game companies represented by Sanqi Interactive Entertainment contribute significantly in revenue in the business contribution of the overseas business. In the future, domestic game companies' overseas business is expected to contribute potential for the continuous growth of the development of the game industry.

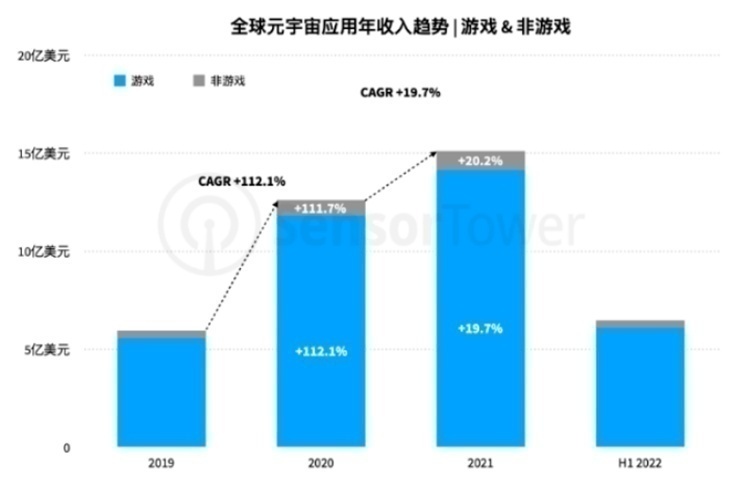

Source: Sensor Tower

The game industry, especially VR games (virtual reality games), as a more convenient way for people to recognize and contact the Yuan universe, the development of the Yuan universe industry is one of the important driving forces for the development of the game industry. Game industry analysis agency Sensor

The "Mobile Game Market Inspecture of the Yuan Universe Concept" released by TOWER shows that in the first half of 2022, the a total of US $ 650 million in the Yuan Universe's application was 650 million US dollars, of which game application revenue accounted for 94%. Recently, various governments have issued relevant measures. For example, on September 1, multi -region governments promoted the development measures of the Yuan universe to provide policy support for the development of the gaming industry. The combination of the Yuan universe and the gaming industry opened up a new growth space for the development of the gaming industry.

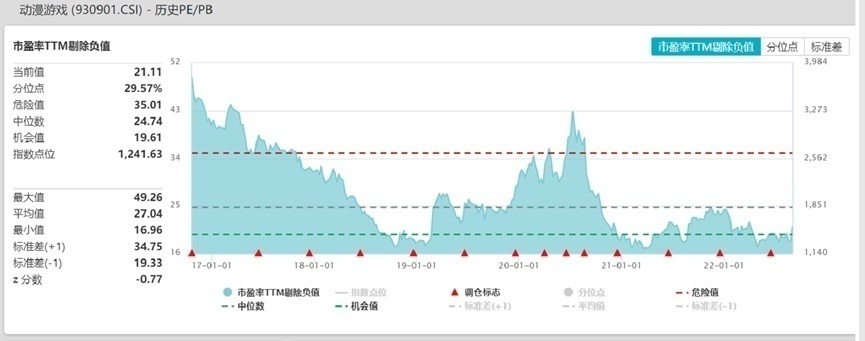

With the launch of the game version number in the second half of 2022, the continuous efforts of domestic game companies' gaming companies to go out of the sea, and the game ETF is expected to usher in new growth space. And the valuation of the game ETF target index has been at a historical low of 29.57%. Interested investors can grasp the development potential of domestic game companies by setting up the game company ETF (516010) and the Shanghai -Hong Kong Shenzhen ETF (517500).

On September 2nd, the opening of the film and television ETF (516620) increased by 2.13%in the early days. Later, the increase in the entire day was stable, and the final closing was 2.46%.

Source: Wind

China Merchants Securities said that the performance of the film and television sector is better around the recovery of film and television content, and Bona's listing brings a large morale to the film and television sector. Judging from the movie box office, TOP10 this week

Most of the weekly box office is Chinese films. New TV series, new variety shows, etc., such as "Ode to Joy 3" and "Cang Lanjue", have brought good response in the market.

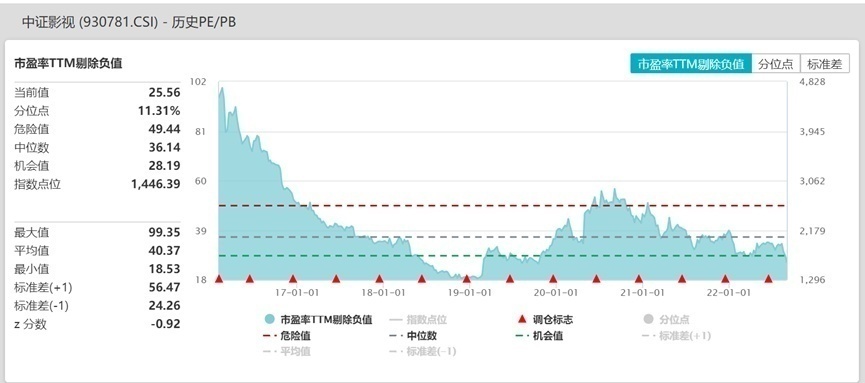

On the one hand, the opportunity for the film and television industry to recover is related to the quality of the film and television industry. On the other hand, it is necessary to pay attention to the reality of the recovery of consumer demand for the entertainment market. Affected by public health incidents, in recent years, the development of the film and television industry has been under great pressure. Combined with the recent domestic economic data, the demand for the entertainment consumer market has been weak. The valuation of the film and television ETF target index is currently at an absolute historical low of 11.31%. In the current time period, the configuration of the film and television ETF has the opportunity to grasp the film and television sector affected by the joint health incident. However, it still needs to be alert to the further tightening of the prevention and control measures of the common health incident, resulting in the risk of unreasonable consumer demand. Gaming and film and television are recently in the low valuation+logic logic. Following the "Opinions on Promoting the Implementation of the National Cultural Digitalization Strategy" on May 22, and on July 21, relevant departments and other 27 ministries and commissions issued the "Opinions on Promoting the High -quality Development of Foreign Cultural Trade".

Data source: wind

The seventh consecutive quarter of the 2022Q2 Media Internet Industry Fund is lower than the standard ratio. Current performance base+emotional bottom+policy bottom, investors can continue to pay attention to adversity film and television ETF (516620), game ETF (516010), and game Shanghai and Hong Kong Shenzhen ETF (517500).

On September 2nd, Huawei Yu Chengdong revealed that Huawei Mate 50 series will have the technology of "breaking the sky upward" in the communication. According to the news from the previous Tianfeng International Analyst, Huawei Mate 50

The series will support satellite communication and provide emergency SMS services.

Source: Huawei

The communication sector is catalyzed by satellite mobile phones. Previously, iPhone13 also had similar expectations but not disclosed. It is expected that satellite communication may be supported on iPhone14. Satellite communication is a supplement to ground communication. The application scenarios are mainly signal coverage in remote areas, the scene of the traffic junction such as shipping aircraft, and emergency disaster relief scenes. This is also a great benefit to the consumer electronics sector. On September 2nd, communication, consumer electronics, and chips rebounded together.

Data source: wind

The technology growth style may be relatively limited, but the short -term may still not dominate. The low valuation of the communication ETF (515880) is a relatively stable choice. As for the chip sector, the short -term demand pressure is still there. Entering the new window of electronic products in the third quarter, the sales data is worthy of continuous attention. The chip delivery time continued to improve in July. The average delivery cycle of the global chip in July was 26.9 weeks, and it fell for three consecutive months. The main problem was significantly improved due to the decline in global consumer electronics demand. Under the trend of domestic replacement, domestic chip companies have a lot of room for development, but for a period of time, the fundamentals will still be affected by the shrinking demand. Long -term can continue to pay attention to the chip ETF (512760). The batch method is layout (for details, see "The chip continues to be shorter).

- END -

Just now, WeChat announced!

Source: WeChat Coral Security Public AccountEdit: Marshmallow | Review: Siyuan

Explosion, technological innovation, and favorable policies, can cold chain logistics seize the opportunity to advance?

No one in more than ten years, in the past two years of popular fried chicken, col...