A number of trust companies have been transferred; Shaanxi Investment has ushered in the new chairman; Anxin Trust has lost contact | Trust Weekly Report (Issue 28)

Author:21st Century Economic report Time:2022.09.04

21st Century Business Herald reporter Zhu Yingzi Beijing report

【policy】

On September 1, the Sichuan Banking Insurance Regulatory Bureau and the Chongqing Banking Insurance Regulatory Bureau jointly issued the "Opinions on Promoting the High -quality Development of Chongqing Banking Insurance Industry in Chongqing City in Sichuan Province". The opinion mentioned: encourages financial institutions to develop pension financial products such as payment, savings, wealth management, trust, and insurance that conforms to the characteristics of the elderly.

In terms of promoting the integration of the financial market, opinions point out that encouraging bank insurance institutions to establish and improve a targeted cross -regional collaborative development and cooperation mechanism in accordance with their own development characteristics, strengthen communication and docking and strategic cooperation with foreign bank insurance institutions, establish normalized contacts Mechanisms, focusing on the construction of the construction of the Shuangcheng Economic Circle in Chengdu -Chongqing region to carry out in -depth investigations and cooperation and exchanges related to important measures, major measures, and important matters to promote the formation of a sound regional credit market, insurance market, trust market, and financial leasing market to promote the region The financial market interconnection and balanced development.

【Equity Transfer】

100%equity in the new era of trust is listed on the Beijing Stock Exchange to transfer the reserve price of 2.314 billion yuan

On September 1st, the 21st Century Business Herald reporter found on the Beijing Property Exchange (hereinafter referred to as the "Beijing Stock Exchange"). The official website of the Beijing Stock Exchange found that the 6 billion shares (100%equity) project in the new era has begun to be listed. The transferor is the New Era Vision (Beijing) Investment Co., Ltd. (58.54%of the shares), Shanghai Renguang Industrial Development Co., Ltd. (holding 24.39%), Weifang Kewei Investment Co., Ltd. Trade Co., Ltd. (2.44%of the shares), the transfer price of 2.314 billion yuan, disclosure from September 01, 2022 to October 18, 2022.

Shanghai Qian'an and Bank of China took over 15.54%of the equity of Anxin Trust

On August 31, 2022, Anxin Trust announced that recently received the "Crude Supervision Compulsory Measures Decisions" issued by the Shanghai Banking Regulatory Bureau. Development Co., Ltd. (hereinafter referred to as "Guozhijie") has all shared equity of Anxin Trust held within one month from the date of receiving prudent supervision and compulsory measures.

In this regard, on August 30, Shanghai Qian'an Investment Management Co., Ltd. (hereinafter referred to as "Shanghai Qianan") and Bank of China signed a share transfer agreement with Guozhijie, respectively. %Of the shares, 5.00%shares held by the Bank of China to the Jie of the Bank of China.

On August 31, the Shanghai Banking and Insurance Bureau conducted approval and approval of the above equity changes. The transfer of transfer registration has been completed at China Securities Registration and Settlement Co., Ltd.

19.99%of the equity of Berry Trust is intended to be publicly listed for transfer

On August 30, Electricity Investment Industry (000958.SZ) issued an announcement disclosed that Berry Trust Foreign Stocks Jpmorgan Chaseco. Essence State Power Investment Group Capital Holdings Co., Ltd., a wholly -owned subsidiary of Electricity Investment and Rong, holds 50.24%of Berry Trust and has the priority purchase right of this equity transfer, but decided to abandon the right.

As of June 30, 2022, the owner of the Berry Trust was 11.393 billion yuan (unaudited), and the equity corresponding to the 19.99%equity of Morgan Chase was 2.277 billion yuan.

3.89%of the Northern Trust's equity is listed on the Beijing Stock Exchange to transfer the reserve price of 265 million yuan

On August 29, the Northern Trust 3889.2019 million shares (3.89%of the total share capital) were transferred to the North Stock Exchange. The transfer price was 265 million yuan. From August 29th to September 26, 2022.

【business】

The chairman of Shaanxi Investment is approved by the former president Yao Weidong to be promoted by the former president

On September 2nd, Shaanxi Investment issued an announcement saying that the Shaanxi Banking Regulatory Bureau was received on the same day, the "Approval of Yao Weidong's qualifications to qualify" (Shaanxi Banking Regulatory Supervision [2022] No. 263). Shaanxi Banking Regulatory Bureau has approved Yao Weidong's qualification to serve as chairman of Shaanxi Investment.

Public information shows that Yao Weidong was born in July 1971. He is a master of philosophy (Ph.D.), a senior economist, and a senior registered professional manager in China. He has successively served as deputy director of the Shaanxi Investment Office, director of the party committee work department, general manager of the human resources department, member of the party committee, secretary of the board of directors, and vice president. Essence

Anke Innovation: Licenses on the extension of AVIC's wealth management products

On September 2nd, Anke Innovation (300866.SZ) announced that it subscribed for the "AVIC Trust Trust [2019] Changsha No. 651, Changsha, Changsha, Changsha, Changsha Branch of Changsha Branch of Changsha on June 21, 2021. The subscription amount is RMB 100 million, the source of funds is its own funds, and the period of holding is from June 21, 2021 to June 12, 2022. The corresponding performance comparison benchmark is 5.5%.

As of the expiration of the holding period, Anke Innovation has not received the principal and some financial income of AVIC 651 trust wealth management products. Anke Innovation has sued AVIC Trust to Nanchang Intermediate People's Court for the above trust disputes, and recently received the "Notice of Acceptance" issued by the court (2022) Gan 01 No. 443. As of the date of this announcement, the case has been accepted and the trial has not yet begun. The cumulative cumulative record of charitable trusts 934 Single -recorded property reached 4.251 billion

On September 1, the "2022 Charity Trust Research Report" released by Zhongcheng Trust Charity Trust Studio showed that according to the public data of the Ministry of Civil Affairs Charity China Information Platform, the number of charitable trusts in accordance with the cumulative number of charitable trusts in the past six years has reached 934 orders. The scale of property reached 4.251 billion yuan. From the perspective of cumulative charitable trusts in various provinces, the top two in Zhejiang and Guangdong Province reached 1.154 billion and 800 billion, respectively. There are 8 provinces and cities with a cumulative scale of charitable trusts exceeding 100 million yuan.

Western trust landing housing enterprise risk disposal trust service trust scale exceeds 23 billion

On September 1, the official news of the Western Trust, the company landed in June 2022 a single Guangdong -Hong Kong -Macao Greater Bay Area market -oriented restructuring service trust project. The project was more than 23 billion, with a term of 7 years.

Specifically, the project takes multiple dilemma assets (equity and creditor's rights) under the real estate enterprise as the trust property, set up a service trust for the purpose of repayment of debt to corporate creditors, and assist the introduction of third -party reorganization investors to activate to activate the activity Problem assets.

The largest -themed charitable trust in the country is established in Ningbo

On September 1, the official news of Kunlun Trust, Ningbo Charity Federation and Kunlun Trust signed the "Tzu Chi Siming Medical Development Charity Trust" on the same day. The trust was initiated by the Ningbo Charity Federation. The establishment scale is 20 million yuan, which can be added in the future. Trust property will be used to promote the development of grassroots medicine and medical services in Ningbo City, district and district levels.

Kunlun Trust said that the trust project is the largest -themed charitable trust in China to date, and as of September 1, the largest single charity trust in Zhejiang Province this year.

Anxin Trust has a senior management loss of contact, and the guarantee is promised to be 2.07 billion yuan

On August 30, Anxin Trust's semi -annual report released by Anxin Trust showed that Anxin Trust realized revenue of 26.6888 million yuan, a decrease of 76.74%from the same period last year; net profit of returning home was 886 million yuan in net profit. As of the end of June this year, the net assets of Anxin Trust were negative, and the equity of the owner of the parent company was -636 million yuan.

Anxin Trust said in the semi -annual report that because of the work needs to contact the Director Ms. Ms. Ms. Ms. Ms. Ms. Ms., they could not contact them. As of the announcement of the announcement of this report, the company still could not determine the reason for the negligence of the Directors.

According to the public information, the daughter of Gao Tianguo, the actual controller of the Senior Trust Trust, has obtained the residence rights of other countries or regions. It is Canadian citizenship. Gao Tianguo died of illness on April 4, 2022.

In addition, Anxin Trust disclosed that under the guidance of relevant departments, after full negotiation, a large number of guarantees promised that the holder reached a reconciliation with the company. In the first half of this year, the guarantee commitment to the case was withdrawn of 6 cases; Anxin Trust had eliminated the guarantee of 73.269 billion yuan, and Shangyu Baoxue promised to be 2.07 billion yuan.

China Shipping Trust single monthly supply chain financial financing scale exceeds 100 million yuan

On August 30, the official news of China Shipping Trust, the scale of China Shipbon's supply chain financial business achieved rapid development. In August 2022, the first monthly loan scale of Zhonghai Trust exceeded 100 million yuan. Essence

It is reported that China Shipping Trust has provided financing services for suppliers such as CNOOC (China) Co., Ltd., Ocean Petroleum Engineering Co., Ltd., Zhonghai Oilfield Service Co., Ltd., CNOOC Energy Development Co., Ltd., etc. The credit scale of home suppliers exceeds 2.5 billion yuan, and the scale of lending exceeds 600 million yuan.

Tianjin Trust established Tianjin Municipal Group Xin Sheng No. 1 service trust scale of 79.4 billion yuan

On August 30, the official website of the Tianjin Banking Regulatory Bureau disclosed that the bureau guided the trust companies in their jurisdiction to actively use the independence of trust property and the advantages of the trust system in debt reorganization to provide trust services for Tianjin's state -owned enterprise market -oriented reorganization. Recently, Tianjin Trust established Tianjin Municipal Group Xin Sheng No. 1 service trust with a trust scale of 79.4 billion yuan.

The Tianjin Bureau said that the establishment of the service trust has achieved a win -win situation for enterprises and trust companies. Trust has created the first single business in the field of market -oriented reorganization service trusts and accumulated experience. In the next step, the Tianjin Banking Insurance Regulatory Bureau will continue to guide and support trust companies within their jurisdiction to actively carry out source businesses such as service trusts, charity trusts, and continuously promote their transformation and development.

Shaanxi Investment in the first half of the year's trust assets rose 1.64% of the exhibition area more concentrated

On August 29, the 2022 semi -annual report released by Shaanxi Investment showed that in the first half of this year, Shaanxi Investment achieved operating income of 971 million yuan, an increase of 3.32%over the same period last year; net profit was 466 million yuan, an increase of 6.05%year -on -year.As of the end of June 2022, Shaanxi Investment's assets were 202.604 billion yuan, an increase of 1.64%over the beginning of the year.It can be seen from the annual report that compared with the same period last year, Shaanxi Investment's operating income became more and more concentrated in the Northwest region.In the first half of this year, Shaanxi Investment achieved revenue of 742 million yuan in Northwest China, accounting for 76.57%of the company's total revenue, an increase of 6.42 percentage points from the same period last year.

- END -

Release the market advantage to work together and win -win -from the 2022 service and trade meeting achievement exhibition, look at the new leapfrogging of China's service trade development

Xinhua Full Media+丨 Release market advantages and cooperate with win -win -see the new leap from the 2022 service trade exhibitionXinhua News Agency, Beijing, September 3rd: Release market advantages...

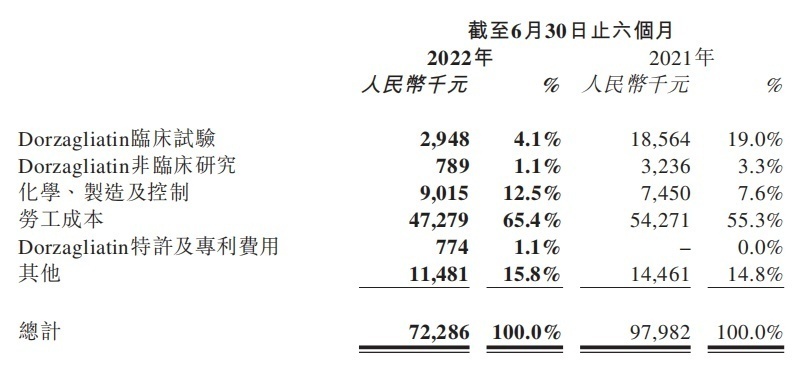

Huaguan Pharmaceutical-B mid-term R & D 2022 decreased by 26.2% year-on-year

On August 25, 2022, the Hong Kong stock listed company Huagong Pharmaceutical-B (0...