Zhang Wenkui: To deal with the decline in economic growth, marketization reform is very important

Author:China News Weekly Time:2022.09.04

I am worried that many people think that the economic growth is declining now

It is entirely affected by the epidemic, which takes steady growth as

Eliminate the temporary economic downturn caused by epidemic control

Stimulating policies, in fact, market -oriented reform policy is more important

Affected by multiple factors such as the distribution of the domestic new crown epidemic, policy formulation and implementation, and geopolitical factors fermentation, China's economy has undulating since the second quarter of this year, and its economic growth has a large wave. According to the recently released economic data released by the National Bureau of Statistics, China's major economic growth indicators fell from June in July and failed to continue the strong recovery momentum in June. Judging from quarterly data, China's economy in the second quarter of this year was only 0.4 % year -on -year, significantly lower than the growth rate of 4.8 % in the first quarter.

Under the influence of the epidemic, China's service industry and consumption recovery occurred in staggering. In addition, the real estate industry is still under the influence of "expected weakness", and the downward pressure on real estate investment is prominent. The role of infrastructure investment steady economy needs to be further released.

At present, the pressure of "steady growth" in China's economy is still not small, and economic growth is the basis for promoting employment and improving people's livelihood. How to take into account the short -term and long -term stability of China's economy and economy? In this regard, "China News Weekly" recently interviewed Zhang Wenkui, deputy director of the Institute of Enterprise Research Center of the Development Research Center of the State Council. It is understood that his new "Steady Growth: Basic China Economy" is about to be launched in the near future.

China News Weekly: Since the second quarter of this year, the monthly volatility of Chinese economic data is relatively large. The latest release of economic data in July has not continued the recovery momentum in June. What are the main reasons?

Zhang Wenkui: The volatility between month and quarterly data is increased. I personally think that the accuracy of China's short -term data is actually increasing. The data in July is not as good as expected. This is likely to indicate that the market expectations have biased. Our grasp of the actual situation of economic operation is actually not so accurate. Faced with the constant outbreak, the control of the epidemic will continue, and some places even increase the layers. Therefore, the uncertainty of economic growth is greater, and it is more difficult to predict.

At the end of May this year, the central government released 33 stable economic measures, and a large part of them depended on investment. Investment means that there must be funds to invest, but some local governments are currently under great financial pressure. This will make it not enough to engage in infrastructure investment for a while. Especially in recent years, real estate is downturn, and a very important government fund income of local governments -the revenue of state -owned land use right transfer income has fallen sharply this year, resulting in a lot of supporting funds for local infrastructure construction. If it wasn't for the good foreign trade data in July, I estimated that the growth data would be worse. Therefore, the quarterly and monthly volatility of China's economic indicators is greater than in the past. On the one hand, it is because of the disturbance of the epidemic. On the other hand, it may show that the effect of the irritating policy is not as high as market expectations.

China News Weekly: Do you think real estate has a particularly great impact on July?

Zhang Wenkui: Since the beginning of this year, especially since the second quarter, the impact of real estate on the economy has really had a great impact. Real estate sales have fallen seriously this year -of course, real estate sales declined last year, but real estate investment is still growing. But this year, real estate investment is also declining, more serious than sales declines, which is essentially a lagging response. As soon as the real estate company is still not good at sales this year, they will choose to reduce investment or even not invest. In fact, there is no money to invest. Real estate investment is one of the three pillars of China's fixed asset investment. It accounts for about 20 % of fixed asset investment. This large pillar is gone, which will obviously have a great impact on the economy.

China News Weekly: So, will China's investment grow well this year?

Zhang Wenkui: In the third quarter of this year, some central key infrastructure investment will keep up, which will make up for the shortcomings of investment in the investment to a certain extent. Why does infrastructure investment come up in the third quarter? Because some of the special investment projects of the central government, including environmental assessment, feasibility demonstration, etc., they need to perform strict procedures. It takes a long time. Many large projects may still be in the process. In the third quarter Essence

China News Weekly: Since 2020, China's quarterly growth rate has increased. In your opinion, the sharp fluctuation of quarterly growth rate reflects that although Chinese economic activities still have some toughness, the fragility is also increasing. What are these vulnerable performances?

Zhang Wenkui: The main manifestation of the endogenous growth momentum of the Chinese economy is not strong before. The weakening of endogenous growth in the economy must rely on external forces to promote economic growth. For example, a car's engine is insufficient, and it is only to push by external forces. This external thrust is policy stimulation. If the external policy stimulus can not keep up, economic growth will come down. In May this year, the state introduced 33 steady growth measures, which promoted economic growth in June, but by July, the policy of local stable investment could not keep up, and the economic growth rate came down. Therefore, in the case of lack of vitality in economic growth, once the policy stimulus cannot keep up, its volatility will be revealed.

China News Weekly: How do you think the toughness of the Chinese economy can be played?

Zhang Wenkui: On the one hand, it depends on how to scientifically and efficiently coordinate the prevention and control of the epidemic and the development of the economic development, and grasp the balance between the two. The endogenous power of the economy is actually a market -oriented driving force. Many markets have been frozen during the epidemic, including the tourism market, catering industry food and other contact consumption, which are greatly suppressed. On the other hand, from a deeper reason, the market -oriented reform of China must continue to advance, and implement what the central document said "make the market a decisive role in the allocation of resources." Now this is not enough.

In fact, China has market demand in many aspects, but the market cannot play a role. For example, the lack of electricity is relatively powerful now. Sichuan, Chongqing and other places are missing. Some factories in these places have to be controlled. Last summer, a large area of electricity limits also appeared in the country. The highest level of the central government attaches great importance to this. If it is only occasionally in some places, it is also understandable that the generality of general power is not kept up to keep up with the supply side of China's power system, and market -oriented reforms are lacking. For example, the price formation mechanism of coal and electricity, cross -regional scheduling of electricity. More importantly, the investment in this industry is very strict, and it is difficult to enter new enterprises. In fact, virtual power plants have developed very fast abroad, and China has a lot of room for these areas.

If market -oriented reforms in some areas can keep up, it can not only promote private investment, but also increase supply, enhance market toughness and vitality, and then promote economic growth.

China News Weekly: In your opinion, for the policy spirit of preventing singles and one -size -fits -all by the central government, all localities should focus on the service industry and small and medium -sized enterprises, study and implement some supporting measures to promote business activities. What should these supporting measures include?

Zhang Wenkui: For the large enterprises in the manufacturing industry (including some large enterprises in the power industry), they are relatively large, have the importance of industry, and some are state -owned. They can often be on the list. As long as you enter the whitelist, you can get the logistics license to unblock the economic cycle of the enterprise. However, many small and medium -sized enterprises with large and extensive service industries are people's livelihood. Many people in their families rely on a small and micro enterprise engaged in the service industry to maintain their livelihoods. Once the epidemic affects these enterprises strictly controlled, people's livelihood will be affected. This will also cause domestic demand to be unable to come up. In the end, economic growth can only be invested, but investment is actually difficult to support.

How to change this situation? I don't think it can be divided into black and white lists. Only companies entering the whitelist have a pass. This control is wrong and must be changed. As long as the enterprise meets the epidemic prevention regulations and has green codes and other requirements, normal production and operation should be allowed. The black and white list looks very good, it is actually a discriminatory policy. When the epidemic is very serious this year, some companies have included some companies in the short term, but they cannot have a long -term policy. In addition, local epidemic prevention measures cannot be increased layer by layer. Local governments should focus on helping the people's livelihood, small and micro enterprises, blocking their respective major epidemic prevention vulnerabilities according to the characteristics of different industries, and then trying to let them operate normally.

China News Weekly: Do you agree that China still needs to maintain a relatively high economic growth rate. What is the reason?

Zhang Wenkui: First of all, it depends on the potential growth rate of China's economy. Whether China can grow around potential growth. Studies by most economists believe that the potential growth rate of China's economy is about 6 %, and some even think that it is higher, and some think it is 5.5 % or 5 %. At present, the growth of China's economy has not actually reached the potential growth rate. The problem is that if the economy deviates too much growth, it means that the economic potential has not been played, which is a pity. In other words, the economy is suppressed, and these inhibitory factors need to be lifted and let the economic potential truly play.

Secondly, at present, China is at the intersection of the first century -old struggle goal and the second century -old struggle goal. It may need to reach about $ 30,000. At present, China's per capita GDP is only less than $ 13,000, which is far from medium -developed countries. Therefore, in order to achieve the development goals in 2035, economic potential must be fully released rather than suppressed.

Therefore, in terms of growth potential, or from the perspective of national rejuvenation, China needs a relatively high growth rate. Recently, former US Treasury Secretary Smes said that the scale of China's economy will exceed the predictions of the United States, and now it is not so affirmative. Perhaps he was too pessimistic about the prospect of China's economy, but we must have a sense of worry and cheer.

China News Weekly: In your opinion, in 2023 and the entire "Fourteenth Five -Year Plan" period, even longer, China has faced a lot of challenges. In the future, steady growth needs to be achieved through market -oriented reforms. Why is it so important to adhere to the direction of market -oriented reform? What market -oriented reform should China be accelerated?

Zhang Wenkui: I am worried that many people think that the economic growth is declining, and it is completely affected by the epidemic. It takes the stable growth as a temporary policy of economic downturn caused by the control of the epidemic. I want to emphasize that this is not the case, although the epidemic factors are also important.

Even if the epidemic has passed, China's stable growth mission may still be very heavy, because China's marketization reform is not as fast as expected. If the market -oriented reform is not in place, the potential of China's economy cannot be fully exerted. Whether it is a domestic cycle or an international cycle, there is a block. Therefore, it is necessary to accelerate market -oriented reforms to stimulate entrepreneurial spirit and stimulate market vitality. Practice has proved that China's reform and opening up has risen sharply due to market -oriented reforms. In fact, as long as many industries are open to private enterprises and the threshold for industry entry will be broken, they can find the growth space you can't imagine. Of course, the reform of state -owned enterprises must continue to be promoted. The country has been talking about the basic position of establishing a competitive policy and not achieving fair competition, it is difficult to have a real market economy, and the reform space in this area is still very large. In addition, we must continue to increase the opening of the outside world and follow the road of globalization. Send 2022.8.29 Total Issue 1058 "China News Weekly" magazine

Magazine title: Zhang Wenkui: Coperly decline in economic growth, market -oriented reform policies are crucial

Reporter: Wang Xiaoxia

Operation editor: Xiao Ran

- END -

These companies in Xiamen do not affect credit reporting and free penalties!Details →

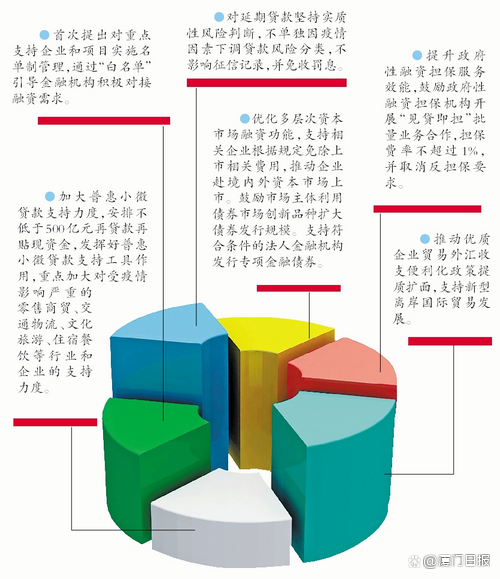

Xiamen City issued \Several Measures for Financial Supporting Economic Insurance...

200 million yuan Agricultural Development Infrastructure Fund supports the heart of the heating pipe network heating people.

200 million yuan Agricultural Development Infrastructure Fund supports the heart o...